Carrier Screening Market Size, Share, Trends and Forecast by Type, Medical Condition, Technology, End User, and Region, 2025-2033

Carrier Screening Market 2024, Size and Share:

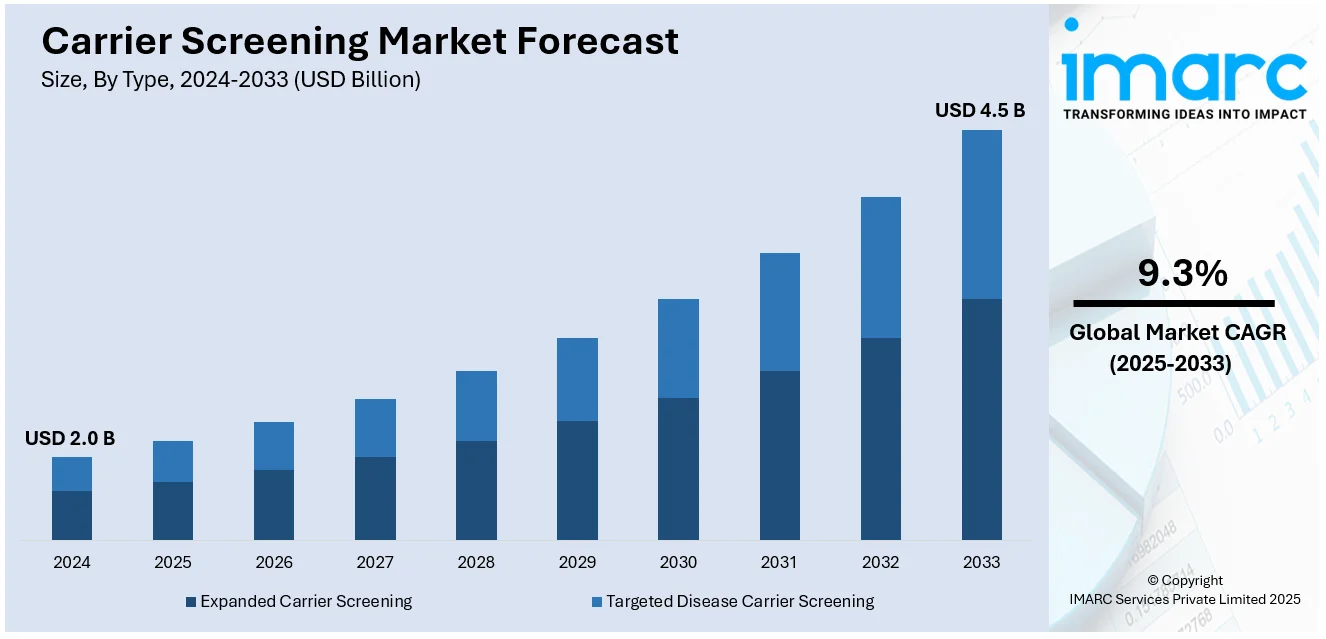

The global carrier screening market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.3% during 2025-2033. North America currently dominates the market, holding a significant share of 40%. This dominance can be attributed to advanced healthcare infrastructure, widespread adoption of genetic testing technologies, and increasing awareness of inherited genetic conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 9.3% |

A significant driver of the carrier screening market is the growing emphasis on early detection and prevention of genetic disorders. Advances in genomics and molecular diagnostics have enhanced the accuracy and accessibility of carrier screening, enabling the identification of potential genetic risks before or during pregnancy. Increasing awareness among healthcare professionals and patients about the importance of proactive genetic counseling has further fueled demand. Additionally, the rising prevalence of inherited disorders and supportive governmental policies advocating for reproductive health have bolstered market growth. For instance, in November 2024, a couple-based genetic carrier screening program in Australia tested 10,038 couples for over 1,281 genes before or early in pregnancy. Of these, 90.7% completed screening, with 1.9% identified as having a higher risk of passing on genetic conditions tied to 90 genes, mainly autosomal recessive. Among high-risk couples, 76.6% pursued or planned reproductive interventions within three months. This shift highlights a growing dedication to tailored healthcare approaches and reducing the potential impact of genetic health concerns.

The United States plays a pivotal role in advancing the carrier screening market through robust healthcare infrastructure and cutting-edge technological innovation. Leading biotechnology firms and diagnostic laboratories in the US are spearheading the development of highly accurate and efficient genetic testing solutions. For instance, in 2024, LGC Clinical Diagnostics introduced the Seraseq Carrier Screening DNA Mix, featuring 54 key genetic variants across 48 genes, supporting clinical labs in validating NGS-based expanded carrier screening assays for genetic risk assessment. Favorable regulatory frameworks, combined with substantial investments in research and development, have accelerated the adoption of carrier screening across diverse healthcare settings. Additionally, initiatives to increase public awareness about genetic health and widespread integration of advanced screening technologies into routine healthcare have further strengthened the US’s position as a global leader in the carrier screening market.

Carrier Screening Market Trends:

Continual Advancements in Genetic Technology

Emerging innovations in genetic technology are supporting the carrier screening market growth. Advancements in molecular diagnostic testing have led to the development of newer and better methods, such as the next-generation sequencing (NGS) for screening several genetic disorders at once. These technological developments and improvements have not only contributed to the lowering of the cost of genetic testing, but also to its accessibility to the public. Healthcare providers are thus able to provide improved and accurate carrier screening, with numerous developments in the knowledge of genetic disorders to grow along with the enhancements in screening instruments contributing to the progress of the market for carrier screening. Among the advances in genetic technology are Whole Genome Sequencing and CRISPR-Cas9. When it comes to genome editing, CRISPR can reach up to 90% accuracy when compared to previous technologies like ZFNs or TALENs. Basic kits for CRISPR-based studies can now be purchased for as little as USD65 to USD200, marking a considerable decrease in cost.

Rising Awareness and Demand

The carrier screening market outlook is positive due to the rising demand for early genetic disorders detection. Carrier screening tests are also on the rise as more individuals and couples want to be protected from such inherited conditions. Increased education programs by health bodies and incorporating genetic counseling into standard healthcare services are supporting the growth of the market. Furthermore, as there is increasing awareness of genetic diseases, coupled with the shift for early detection of diseases and prevention, individuals are opting for carrier screening. This trend is expected to continue in the future, and maintain the market’s upward trend, as timely detection enhances the quality of life and reproductive choices. Forty-seven percent (n=245) of patients were aware of genetic carrier screening (GCS), according to a survey study that examines patients' attitudes and awareness of the technique, concentrating on their comprehension, opinions, and acceptance of it. It draws attention to a patient awareness gap regarding GCS and stresses the significance of improved counselling and education.

Government Roles and Reimbursements

The carrier screening industry is propelled by governmental policies and actions, as well as a positive trend in reimbursement policies. Health and government policy makers are beginning to understand that pre-natal screenings are essential in preventing the spread of genetic disorders. In a study conducted by government researchers utilizing next-generation sequencing (NGS) to assess carrier frequency and identify pathogenic variants of prevalent genetic disorders within the North Indian population, 52 out of 200 participants (26%) were identified as carriers of at least one disorder. Consequently, there are measures to introduce carrier screening into the list of mandatory services provided within the framework of state health care programs and insurance policies. These tests are growing popular as reimbursement policies have made them cheaper and thus more accessible to clients. Also, there is an increase in government funding that supports research and development in genetic screening technologies and therefore the expansion occurring in the industry. Such supportive measures are valuable as they help to facilitate the increased use of carrier screening, which in turn strengthens the industry.

Carrier Screening Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carrier screening market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, medical condition, technology, and end user.

Analysis by Type:

- Expanded Carrier Screening

- Customized Panel Testing

- Predesigned Panel Testing

- Targeted Disease Carrier Screening

Expanded carrier screening leads the market in 2024. Expanded carrier screening provides added information as to various conditions including rare ones, due to which it is a preferred option both by healthcare providers as well as the patients. Its ability to offer comprehensive results of an individual’s carrier status for multiple disorders in a single test has propelled its popularity. It also helps to provide better diagnostic accuracy and assists in making better decisions as to family planning and management. The increasing focus on the genetic health of both parents-to-be and the accessibility of new and more sophisticated carrier detection methods add to the continued popularity of more extensive carrier screening, which cements the leading position of the market.

Analysis by Medical Condition:

- Pulmonary Conditions

- Hematological Conditions

- Neurological Conditions

- Others

Pulmonary conditions leads the market in 2024. Pulmonary conditions represents the largest market segment in the market. Diseases, including cystic fibrosis are more prevalent with serious effects on health, therefore, screening should be done early and correctly to contain the consequences. Current opinions regarding the importance of carrier screening for pulmonary conditions are also worth considering, as the timely identification of the potential carriers and the development of an effective treatment plan can ultimately save the patient’s life and improve their quality of living. Reliable screening tests and focus on the research aspect in the carrier field also play a key role in significant market share being dominated by the pulmonary conditions screening. The focus on disease prevention and genetic testing also bolster the centrality of pulmonary disorders in the sector more widely.

Analysis by Technology:

- DNA Sequencing

- Polymerase Chain Reaction

- Microarrays

- Others

DNA sequencing lead the market with around 40.1% of market share in 2024. Carrier testing by DNA sequencing has been identified to be the most dominant segment within the market by technology. This enhanced science helps in the characterization of DNA materials by finding possible mutations that may determine the carrier status of such inherited ailments. Advancements in DNA sequencing such as high precision, efficiency in generating sequence data and the reduced cost compared to other methods have made DNA sequencing the carrier screening technique of choice. The need to make early provisions in cases of genetic disorders and diseases makes it instrumental in offering adequate and accurate genetic information. With the advancement in sequencing technology, carrier screening has been through more depth and spectrum in genetic analysis.

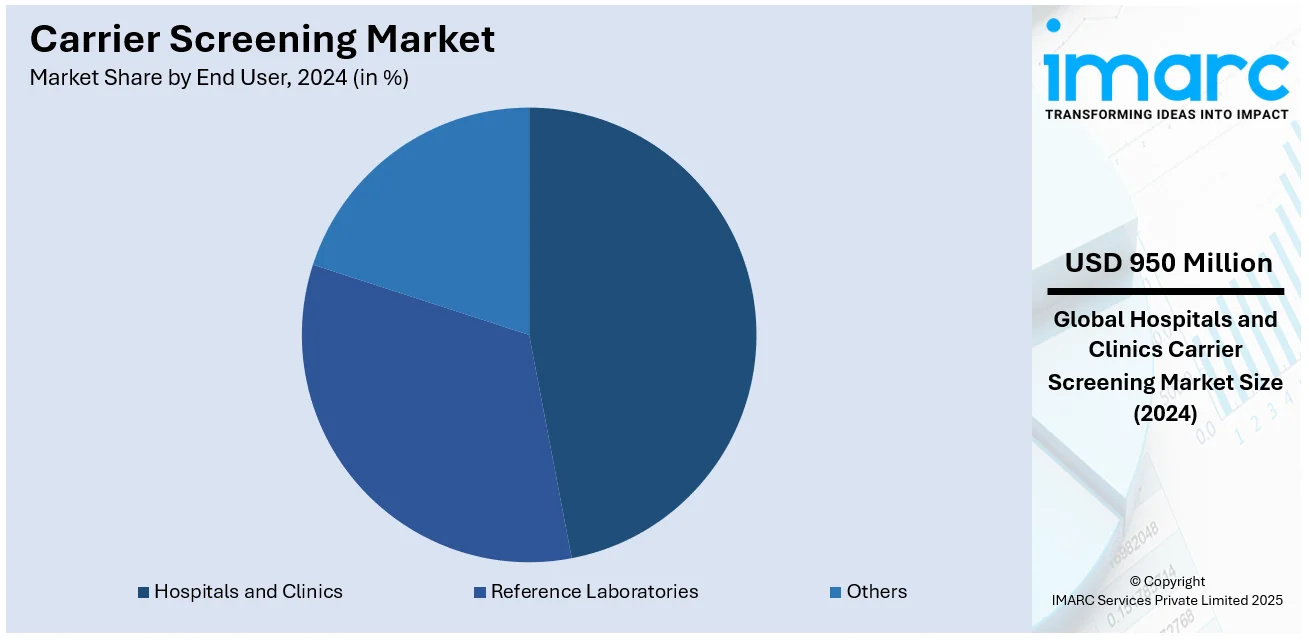

Analysis by End User:

- Hospitals and Clinics

- Reference Laboratories

- Others

Hospitals and clinics leads the market with around 47% of market share in 2024. These are the typical medical facilities where clients can get access to genetic diagnostics. Carrier testing involves the performance of exhaustive screening tests and subsequent counseling- an aspect that hospitals and clinics are well equipped to handle through their necessary infrastructure, personnel, and equipment. These services are translated to make access to carrier screening widespread since the facilities offering prenatal and preconception care incorporate this service. Also, the trust and credibility that are attributed to hospitals and clinics push more individuals into selecting carrier screening. With the existing expansion of genetic testing across these healthcare institutions, the market fundamentals are strengthened behind the key players, which positively contributes to the promotion of carrier screening services.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40%. According to the report, North America represents the largest regional market for carrier screening. North America is the largest market share due to better healthcare facilities, increased awareness levels, and supportive government laws to carry out such genetic tests. The availability of all major genetic testing companies and the on-going research regarding genetics also play a role in placing the area at the top. In North America, there is a relatively greater focus on the prevention of diseases, and usage of carrier screenings is also relatively high. Moreover, the access to desirable insurance coverage for genetic tests creates additional demand for the market. The increased consumer interest in carrier screenings, especially in personalized medication and early disease diagnosis, and North America’s advanced healthcare industry as well as its active approach to genetic screening will continue to foster its growth in the global market.

Key Regional Takeaways:

United States Carrier screening Market Analysis

US accounts for 90% share of the market in North America. Rising cases of genetic disorders and an increased awareness toward early diagnosis drive the United States carrier screening industry. It has been estimated by the Office of Disease Prevention and Health Promotion that nearly 3% of 4 million babies born each year in the United States have birth defects or genetic disorders, making this an area worth carrying out screening on. Key growth drivers in this industry are the expanded carrier screening that tests for more than 400 genetic disorders, as the data of Repromed Fertility Specialists would show, and technological developments within next-generation sequencing (NGS). The country has more than 7,000 genetic counsellors, as per the data from National Institute of Health, ensuring a sound health system for guidance to the expecting parents. The market is also driven by government support for newborn screening programs and mandates for coverage under health insurance policies.

High participation rates in reproductive treatments, such as IVF, accounting for 2.5% of all births in 2022, based on the SART Clinic-specific ART data published by the Society for Assisted Reproductive Technology, further increase the urgency for carrier screening as part of pre-implantation genetic testing. Additionally, screening is becoming more widely available and reasonably priced because to the growing awareness of personalised medicine and the growth of direct-to-consumer genetic testing companies like 23andMe and Invitae.

Europe Carrier screening Market Analysis

Growing awareness of genetic disorders and government-supported healthcare programs are driving the carrier screening industry in Europe. According to an industrial report, with nearly 3.5 million births per year in the region, the demand for genetic testing, including carrier screening, is growing rapidly to prevent inherited diseases such as cystic fibrosis, which is reported to affect about 1 in 2,500 babies. Due to their comprehensive insurance coverage and strong healthcare systems, countries like the UK, Germany, and France are leading the way in the adoption of modern genetic testing. To encourage early detection and informed reproductive decisions, the European Society of Human Genetics has also emphasized the importance of population-based carrier screening. The presence of reliable biotechnology companies and research centers enhances the availability of state-of-the-art carrier screening technologies. The industry is also being driven by improvements in the accessibility and accuracy of screening tests brought about by increased funding for genetic research and partnerships between academic institutions and healthcare providers.

Asia Pacific Carrier Screening Market Analysis

The market for carrier screening is expanding significantly in the Asia-Pacific area due to growing healthcare awareness and a greater emphasis on mother and child health. Having nearly 9 million (in 2023) and 25 million births a year (UNICEF stats), respectively, China and India are a hub of massive scope for carrier screening programs. Increased prevalence of congenital disorders such as thalassemia, sometimes affecting considerable sections of the populations in certain geographical regions, provides a rationale to conduct testing for these conditions. Vietnam accounted for the greatest percentage, having 51.5% with thalassemia while Cambodia 39.5%, Laos 26.8%, Thailand 20.1%, and Malaysia 17.3%, as per reports. Another stimulus for the sector is governmental measures: thus, thalassaemia-screening programs that are compulsory throughout India have fostered growth for the sector. Advances in genetics testing technology boost usage. Emergence of more regional screening operations offering competitive rates also adds fuel to this engine. Another factor for the region includes the increasing requirement for medical tourism in countries like Malaysia and Thailand, which have been known for their low cost genetic testing provision.

Latin America Carrier Screening Market Analysis

Improving maternal health and reducing incidence of inherited disorders are the increasing concerns that lead to the increasing market for carrier screening in Latin America. The two countries that use genetic screening the most in the region is Brazil with 2.5 million births annually, according to an industrial report. Programs targeting illnesses that are more prevalent in particular areas increase the need for carrier screening, such as sickle cell anaemia and cystic fibrosis. Public health initiatives such as newborn screening programs in Brazil support early diagnosis of genetic disorders. Other factors, which are responsible for market expansion, include middle-class people who have better awareness of genetic issues and growing demand for private medical services. There is also co-operation between regional health facilities and foreign genetic testing companies that improve accessability.

Middle East and Africa Carrier Screening Market Analysis

Due to the high rate of consanguineous marriages, which raise the risk of genetic illnesses, the Middle East and Africa region is seeing a surge in demand for carrier screening. Consanguineous marriages make up more than half of all unions in several Middle Eastern nations, which increases the prevalence of hereditary diseases including thalassaemia and sickle cell anaemia. To avoid genetic disorders, national programs such as the premarital screening program of Saudi Arabia are carrier screening dependent, which in turn drives market growth significantly. Carrier screening is in greater demand in Africa because of increased efforts in treating sickle cell disease, which affects up to 3% of births, as per reports. The availability of advanced genetic testing options in the region is also enhanced by increased investments in health infrastructure and collaboration with foreign bodies.

Competitive Landscape:

Career screening companies are rapidly increasing their technological advancement and market coverage. Various other genetic testing companies are also committing resources to the improvement of sensitivity and expanding the list of diseases amenable to detection through genetic testing. They are also entering into various affiliations and service agreements with healthcare service providers and facilities to diversify their service delivery portfolios. For instance, in 2024, Invitae sold reproductive health assets, including carrier and non-invasive prenatal screening, to Natera for $52.5 million, transferring customers and sales representatives to Natera for seamless service continuity. These players are looking to adopt revolutionary technologies such as NGS that will enable them to make their carrier screening more accurate and inclusive. Also, they are to increase awareness efforts in promoting the use of carrier screening among the populace. Key strategies of the market identified as the improvement of accessibility by making prices more competitive, as well as the expansion of the territory, make certain critical players strengthen their positions and promote the development of the market.

The report provides a comprehensive analysis of the competitive landscape in the carrier screening market with detailed profiles of all major companies, including:

- Fulgent Genetics

- Gene By Gene Ltd. (MyDNA)

- Illumina Inc.

- Invitae Corporation

- MedGenome Labs Ltd.

- Myriad Genetics Inc.

- Natera Inc.

- OPKO Health Inc.

- Quest Diagnostics

- Sema4

- Thermo Fisher Scientific Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- November 2024: Bio-Techne is set to showcase its innovative solutions for cancer and carrier screening at the AMP 2024 Annual Meeting & Expo. Among the highlights are cutting-edge diagnostic tools designed to increase the accuracy of genetic analysis and illness identification. These products demonstrate Bio-Techne's dedication to enhancing patient outcomes and developing personalised medicine.

- October 2024: Blueprint Genetics has launched six new reproductive carrier screening tests, now including FMR1 repeat expansion analysis. This improvement makes it possible to identify genetic disease carriers, offering a more thorough method of risk assessment and planning for reproductive health.

- September 2023: Devyser and Thermo Fisher Scientific collaborated to promote laboratory services to advance pharmaceutical research. The goal was to support their development projects utilizing Devyser’s unique assays in its CLIA-certified laboratory.

- July 2023: Quest diagnostics launched its first consumer-focused genetic test, genetic insights. The new service help individuals to understand their risk of developing inheritable medical conditions. The service also includes personalized health reports and access to genetic counselling.

- March 2023: Illumina Inc. and Myriad Genetics Inc. announced the expansion of a strategic partnership to broaden access to and availability of oncology homologous recombination deficiency (HRD) testing.

Carrier Screening Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Medical Conditions Covered | Pulmonary Conditions, Hematological Conditions, Neurological Conditions, Others |

| Technologies Covered | DNA Sequencing, Polymerase Chain Reaction, Microarrays, Others |

| End Users Covered | Hospitals and Clinics, Reference Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fulgent Genetics, Gene By Gene Ltd. (MyDNA), Illumina Inc., Invitae Corporation, MedGenome Labs Ltd., Myriad Genetics Inc., Natera Inc., OPKO Health Inc., Quest Diagnostics, Sema4, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carrier screening market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global carrier screening market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carrier screening industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carrier screening market was valued at USD 2.0 Billion in 2024.

IMARC estimates the carrier screening market to reach USD 4.5 Billion by 2033, exhibiting a CAGR of 9.3% during 2025-2033.

Key factors driving the carrier screening market include advancements in genetic testing technologies, rising awareness about inherited genetic disorders, increasing demand for personalized medicine, and growing adoption of next-generation sequencing (NGS). Supportive government policies, coupled with expanding applications in reproductive health and early disease detection, further fuel market growth.

North America currently dominates the market, accounting for a share exceeding 40% in 2024. The dominance is fueled by advanced healthcare systems, widespread genetic testing adoption, and strong awareness of hereditary conditions. Favorable regulations, government support, and insurance coverage further boost demand. High genetic disorder prevalence and R&D investments enhance test accuracy and accessibility, reinforcing the region’s dominance.

Some of the major players in the carrier screening market include Fulgent Genetics, Gene By Gene Ltd. (MyDNA), Illumina Inc., Invitae Corporation, MedGenome Labs Ltd., Myriad Genetics Inc., Natera Inc., OPKO Health Inc., Quest Diagnostics, Sema4, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)