Carmine Market Size, Share, Trends and Forecast by Form, Application, End User, and Region, 2025-2033

Carmine Market Size and Share:

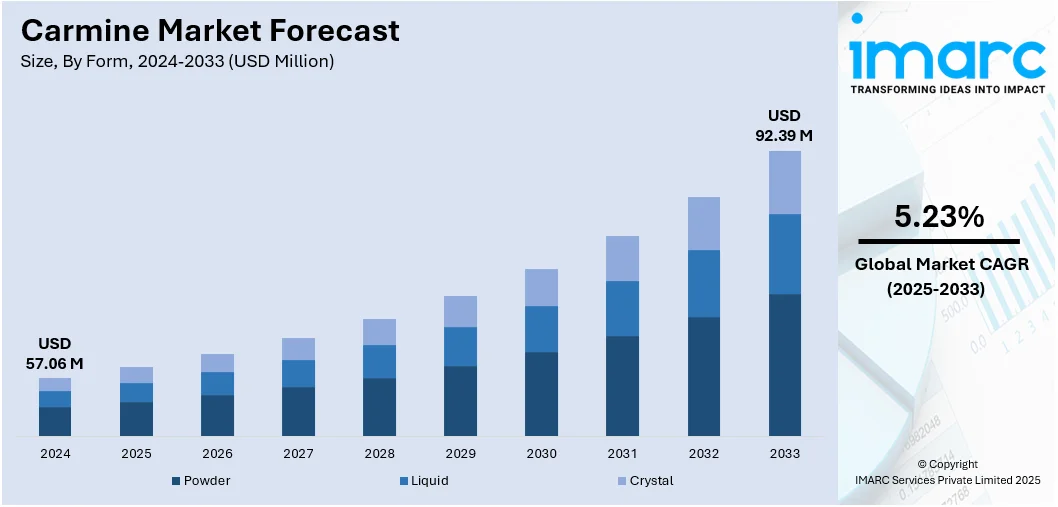

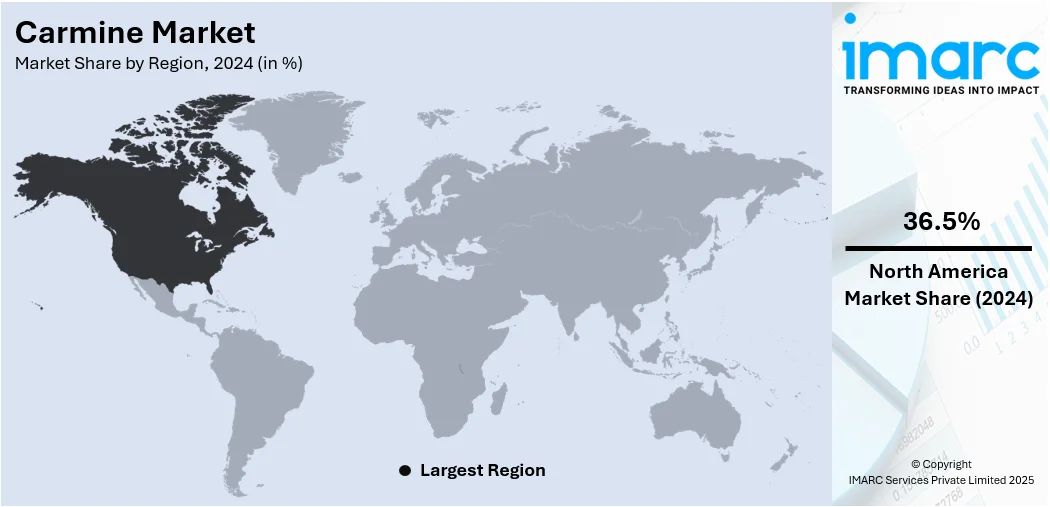

The global carmine market size was valued at USD 57.06 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 92.39 Million by 2033, exhibiting a CAGR of 5.23% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.5% in 2024. The heightened demand for sustainable food coloring options to maintain the nutritional content of consumables, increasing use of makeup products containing safe and natural ingredients, and rising focus on employing naturally procured ingredients in the production of nutraceutical products are boosting the carmine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 57.06 Million |

|

Market Forecast in 2033

|

USD 92.39 Million |

| Market Growth Rate 2025-2033 | 5.23% |

The market is increasingly shaped by sustainability concerns and ethical sourcing practices. As carmine is derived from cochineal insects, companies are under pressure to demonstrate transparency and responsibility across the supply chain. Brands are working to improve sourcing methods, ensure eco-friendly practices, and provide traceability to meet consumer expectations. Ethical considerations, particularly related to animal welfare, are prompting some companies to adopt certification and labeling measures. By positioning carmine as both natural and responsibly sourced, manufacturers can strengthen brand credibility and cater to rising consumer demand for products that align with health, environmental, and ethical values. This focus on sustainability is becoming a decisive factor in differentiating carmine-based products across food, cosmetics, and pharmaceuticals.

To get more information on this market, Request Sample

The United States has become a critical growth region for the carmine industry, supported by shifting consumer preferences toward natural ingredients. Heightened awareness of health risks linked to synthetic dyes has accelerated the transition to natural alternatives like carmine. The clean-label movement in the U.S. has further reinforced demand, with consumers actively seeking products that highlight natural, transparent formulations. Food, beverage, and cosmetic companies are increasingly reformulating products to align with these expectations. At the same time, regulatory emphasis on safe, approved colorants has encouraged manufacturers to adopt carmine in product development. These dynamics position the U.S. as a leading consumer market where natural colorants continue to gain preference, shaping broader adoption trends across industries.

Carmine Market Trends:

Growing Demand for Natural Food Colorants

The worldwide carmine market is going through tremendous growth with the increasing demand for natural food colorants. People are turning health-conscious and going for products free of artificial additives due to associated health hazards and ill-conceived notions. Dairy manufacturers are following this movement by substituting synthetic dyes with natural ones like carmine, which is extracted from cochineal insects and is giving a rich red color. This trend is especially dominant in the bakery, confectionery, dairy, and beverage industries where natural ingredients are becoming popular. Regulatory pressures across different countries are also promoting the use of natural additives, further driving this demand. Since clean-label products are emerging as a key purchasing driver among customers, the function of natural food colorants like carmine in product development is becoming more essential, thus contributing to the growth of the market. In 2024, The Food Safety and Quality Department of Karnataka released a directive regarding the usage of food colorants and chemical additives. The order was issued after the department examined nearly 40 kebab samples from different parts of the city. The examinations in the state-operated labs showed that the levels of artificial colors were so elevated that they were considered hazardous for consumption. It's not only kebabs; the state also took action against the use of these colors in pani puri, cotton candy, and gobi Manchurian.

Growth of the Cosmetics and Personal Care Market

The cosmetics and personal care sector is constantly growing, and this directly contributes to the demand for carmine as a natural pigment. Customers are increasingly looking towards products with natural and sustainable ingredients, prompting cosmetic companies to reformulate product lines using clean-label and environment friendly alternatives. Carmine is finding widespread usage in lipsticks, blushes, and eye shadows owing to its stability, long color life, and safety profile over synthetic dyes. Furthermore, high-end and organic beauty brands are also focusing on natural pigments in their marketing strategies to deliver on consumer demands for authenticity and openness. This trend is especially prevalent in mature markets, but emerging economies are also playing an increasingly important role in driving the market. The growing demand for cruelty-free and ethically sourced ingredients is leading companies to increase transparency in procurement practices. IMARC Group predicts that the global beauty and personal care products market is projected to attain USD 802.6 Billion by 2033.

Growing Demand for Clean-Label Products

The growing demand for clean-label products is constantly remodelling buying habits and is emerging as a key driver for the carmine market. People are actively looking for products with fewer ingredients, familiar names, and natural origins. Here, carmine is being identified as a reliable ingredient that belongs to the category of clean-label movement. Food and cosmetics companies are also promoting the usage of natural colorants in the labeling and marketing process in order to win customer confidence and loyalty. Clean-label qualification and compliance are also becoming key to getting into premium retail channels, especially in emerging markets. This change is generating steady demand for natural ingredients such as carmine in food, beverage, and personal care markets. With growing awareness about synthetic dye scandals ongoing, the dependency on clean-label options is gaining momentum. A report published by the NPD Group in 2024 state that 68% of individuals actively look for skincare products integrated with clean ingredients.

Carmine Market Growth Drivers:

Regulatory Support for Natural Ingredients

Government policies and global food safety organizations are constantly promoting the use of natural additives as opposed to synthetic ones, thus establishing a conducive market situation for carmine. Government regulations on synthetic dyes, especially in Europe and North America, are leading to the growth in the use of natural colorants in a variety of industries. Carmine is gradually being known as a safe and approved food and cosmetic additive, thereby instilling confidence in producers about compliance and marketability. Governments are also encouraging labeling openness, mandating more explicit labeling of artificial ingredients, further deterring their usage. With changing regulatory regimes in the emerging markets, such limitations are being brought forth, thus expanding carmine usage opportunities. Harmonization of global safety standards is facilitating the use of carmine uniformly by multinational brands across markets. This consistent regulatory backing is supporting the shift towards natural ingredients and is vigorously pushing long-term demand for carmine.

Increased Use of Premium and Artisanal Food Products

Increased use of premium and artisanal food products is continuously driving carmine's use as a natural colorant. People are demonstrating a powerful preference for products that highlight authenticity, quality, and craftsmanship, particularly in premium categories like confectionery, dairy, bakery, and beverages. Carmine is extensively applied within these premium segments due to its capacity to offer vibrant, stable, and natural coloring that enhances product appeal. Artisanal brands are taking advantage of natural ingredients as a point of differentiation, with people willing to pay more for food made with natural ingredients over mass-produced counterparts. The gourmet and specialty foods trend is particularly prevalent in mature markets but is also making inroads in the urban areas of emerging economies. With both visual attractiveness and compliance with health-focused values, carmine is being added to premium food success.

Growing Emerging Markets and Increased Disposable Incomes

Emerging markets are continually growing with fast urbanization, growing disposable incomes, and altering lifestyle patterns, all of which are stimulating expanding demand for carmine. As middle-class populations across countries continue to increase, expenditure on packaged food, drinks, and cosmetics is heightening substantially. Shoppers in these markets are increasingly aware of the advantages of using natural ingredients, which translates to increased acceptance of products containing carmine. Global companies are seizing the moment by increasing their presence and introducing natural ingredient-based ranges. Domestic players are also making an entry with formulations that include carmine to cater to changing consumer demands. This increased economic capacity is also driving greater demand for premium and organic items, both of which often depend on natural additives. The widening reach of developing markets is thus playing an important part in catalyzing global demand for carmine.

Carmine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carmine market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on form, application, and end user.

Analysis by Form:

- Powder

- Liquid

- Crystal

As per the carmine market outlook, in 2024, powder segment led the market accounted for the market share of 48.7%. Carmine in powder form provides considerable edge in terms of convenience, extended shelf life and reproducible & homogenous colors, which accounts for its high demand. Powder carmine is used in F&B industry, providing color for the confectionery, dairy products, beverages and meat products. According to the latest report by IMARC Group, the market size of meat snacks will reach USD 18.0 Billion in 2032.

The fact that carmine can dissolve easily and uniformly in formulations helps manufacturers reach the perfect color without sacrificing the quality or safety of their products. In addition to that, powder carmine is stable in various processing environments including heat and pH fluctuations, making it a dependable option for manufacturers, thereby driving carmine market demand.

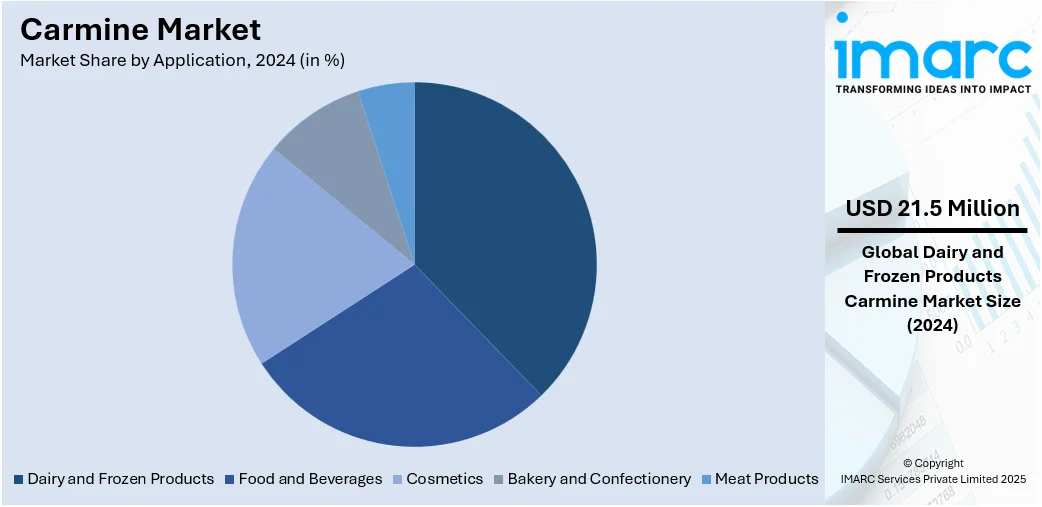

Analysis by Application:

- Dairy and Frozen Products

- Food and Beverages

- Cosmetics

- Bakery and Confectionery

- Meat Products

As per the carmine market forecast, in 2024, the dairy and frozen products led the carmine market accounted for the market share of 37.6%. The dairy and frozen products are dominant due to its high penetration and consumer preference for food items with visually attractive appearance. In dairy products, carmine is used extensively for its color properties in dairy products such as yogurt, ice cream, and cheese. The bright red color, coupled with the process stability in the face of different processing conditions, makes it an excellent candidate for manufacturers, who are seeking aesthetic uplift in their products while ensuring top quality and safety. Besides that, carmine is also used to improve the visual aspect of sorbets, ice creams for batch freezing, and fruit preparation mixtures. This makes carmine an attractive option for manufacturers because it can hold its color without freezing. Moreover, the rising trend of premium or artisanal frozen products containing natural and premium quality content, will establish a positive outlook on carmine market industry statistics. According to a report by IMARC Group, the global dairy market is expected to touch USD 1459.3 Billion by 2032.

Analysis by End User:

- Food Processing Companies

- Beverage Industry

- Catering Industry

- Cosmetics and Pharmaceutical Industry

Carmine is one of the key ingredients utilized by food processing companies. It is used as a coloring agent for manufactured meat products, confectionery, dairy, and bakery. Moreover, the need for natural food colorings is increasing the demand for carmine, which is correlated with the heightened consciousness and inclination towards clean label ingredients among the consumers.

The beverage also utilizes carmine to color a range of beverages, such as fruit juices, alcoholic drinks, smoothies, and flavored waters. The natural origin of Carmine appeals to health-conscious consumers who seek beverages free from artificial additives.

In the catering industry, carmine is used to improve the presentation of food served in restaurants, hotels, and event catering. The use of natural colorings like carmine aligns with the industry's focus on high quality, visually appealing dishes that meet consumer expectations for health and safety.

Carmine is widely utilized in the cosmetics and pharmaceutical industry owing to its vibrant color and natural properties. In cosmetics, carmine is a key ingredient in products like lipsticks, blushes, and eye shadows, providing a desirable red color that is both stable and safe to use on the skin. In the pharmaceutical industry, carmine is employed as a colorant in tablets in capsules and syrups, thereby representing one of the key carmine market growth factors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the carmine market accounted for the market share of 36.5%. The North American market is driven by increasing consumer preferences for natural and clean-label products. As awareness about the potential health risks associated with synthetic additives grows, consumers are increasingly opting for products made with natural ingredients. This trend is particularly evident in the F&B industry, where manufacturers are reformulating products to include natural colorants like carmine to meet consumer demand and comply with regulatory standards. The expanding application of carmine in the cosmetics and personal care sector is also a significant trend. Consumers in North America are becoming more conscious of the ingredients in their beauty products, leading to a higher demand for natural and organic cosmetics. Carmine's stable and vibrant color makes it a preferred choice for high-quality cosmetic formulations. According to an article published in 2023 by YouGov, most women in the United States wear makeup for at least some occasions.

Key Regional Takeaways:

United States Carmine Market Analysis

United States is experiencing a steady surge in carmine adoption due to rising demand for meat products across diverse consumer segments. For instance, per capita consumption of beef is also forecast to increase 2.7% by 2025, outpacing growth in consumption of broilers (2.3 %) and pork (1.7%). USDA expects this will increase the total amount of meat consumed per person in the US from 211 pounds in 2015 to nearly 219 pounds by 2025. As meat products continue to dominate dietary preferences, manufacturers are increasingly turning to natural colorants like carmine to enhance visual appeal and meet clean label requirements. The shift away from synthetic additives, combined with growing consumer awareness of ingredient transparency, is pushing food producers to reformulate their offerings. Carmine, with its stable color properties and natural origin, is gaining traction in meat processing applications including sausages, deli items, and cured meats. Regulatory support for natural additives and innovation in formulation techniques further accelerate the adoption.

Asia Pacific Carmine Market Analysis

Asia-Pacific is witnessing increasing adoption of carmine fueled by the growth of the pharmaceutical industry across developing and developed economies. For instance, the pharmaceutical export from India stood at USD 50 Billion in 2025. Pharmaceutical companies are prioritizing the use of natural colorants like carmine in tablet coatings, capsules, and syrups to comply with evolving regulatory frameworks and consumer preferences for clean-label ingredients. As the pharmaceutical industry diversifies its product lines and expands production capacities, carmine offers a viable alternative to synthetic dyes due to its biocompatibility and non-toxic profile. This growth is supported by the rising aging population and increasing demand for over-the-counter drugs and nutraceuticals.

Europe Carmine Market Analysis

Europe is seeing a notable increase in carmine utilization, primarily due to the expansion of food processing companies aiming to align with natural and sustainable ingredient trends. For instance, in 2025, there are 3,731 food processing startups in Europe which include Novozymes, Butternut Box, Bella and Duke, Lesaffre, Greencore. Out of these, 998 startups are funded, with 645 having secured Series A+ funding. These companies are embracing carmine as a reliable natural pigment for its vibrant red hue and stability in various food matrices. With consumer awareness intensifying around food safety and artificial additives, food processing companies are reformulating products such as confectionery, bakery items, and ready meals with carmine to meet clean-label demands. Regulatory support and certifications promoting natural ingredients enhance the credibility of carmine in processed foods.

Latin America Carmine Market Analysis

Latin America is experiencing increased carmine adoption as demand for dairy and frozen products rises in tandem with growing disposable income. For instance, as of 2025, the average annual salary in Brazil is approximately BRL 40,200, which translates to around USD 7,025.63 per year. As consumers seek premium quality and aesthetically appealing dairy and frozen offerings, manufacturers are opting for carmine to naturally enhance product color. Rising middle-class consumption and interest in indulgent foods are reinforcing the use of natural additives in regional product development.

Middle East and Africa Carmine Market Analysis

Middle East and Africa are witnessing increased carmine use spurred by the expansion of food outlets catering to diverse consumer palates. For instance, the UAE is home to over 30,000 food outlets, and Dubai alone accounts for an estimated 60% of that total, making it one of the most densely saturated foodservice cities in the region. As restaurants, cafes, and quick-service chains broaden their offerings, demand for natural colorants in sauces, desserts, and beverages is intensifying. Carmine supports these food outlets in achieving vibrant presentations without resorting to artificial additives.

Competitive Landscape:

Companies in the carmine market are adopting strategies to respond to shifting consumer preferences, stricter regulatory standards, and rising demand for natural colorants. Businesses are leveraging advanced extraction methods and digital platforms to enhance production efficiency, shorten development cycles, and improve product quality. Automation is being introduced across manufacturing to optimize yield, ensure consistent pigment stability, and meet large-scale demand. Investments in sustainable sourcing and unified supply chain systems are enabling better management of compliance, traceability, and quality assurance, supporting quicker approvals and market readiness. These strategies strengthen adaptability to customer requirements and help deliver reliable, scalable, and regulation-compliant carmine solutions in a competitive, regulation-driven market.

The report provides a comprehensive analysis of the competitive landscape in the carmine market with detailed profiles of all major companies, including:

- Amerilure

- BioconColors

- Colormaker Inc.

- Givaudan Sense Colour

- GNT Group

- Imbarex

- Neelikon Food Dyes And Chemicals Limited

- Proquimac Pfc Sa

- Vinayak Ingredients (INDIA) Pvt. Ltd.

Latest News and Developments:

- March 2025: Debut, a US-based biotech firm, launched a breakthrough biotech version of carmine after four years of R&D, marking a major shift from beetle-derived pigment. It also partnered with L'Oréal last July to co-develop over a dozen bio-identical ingredients for use across its beauty product lines.

- February 2025: Debut launched a bio-based carmine pigment as a beetle-free alternative replicating the vibrant red shade used in lipsticks. The biosynthetic carmine, free from irritant proteins, offered antioxidant and anti-inflammatory benefits and was made scalable through cell-free biomanufacturing.

Carmine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Carmine Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Powder, Liquid, Crystal |

| Applications Covered | Dairy and Frozen Products, Food and Beverages, Cosmetics, Bakery and Confectionery, Meat Products |

| End Users Covered | Food Processing Companies, Beverage Industry, Catering Industry, Cosmetics and Pharmaceutical Industry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amerilure, BioconColors, Colormaker Inc., Givaudan Sense Colour, GNT Group, Imbarex, Neelikon Food Dyes And Chemicals Limited, Proquimac Pfc Sa, Vinayak Ingredients (INDIA) Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carmine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carmine industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carmine market was valued at USD 57.06 Million in 2024.

The carmine market is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 92.39 Million by 2033.

The carmine market is driven by rising demand for natural food colorants, increasing consumer preference for clean-label products, expanding applications in cosmetics and pharmaceuticals, and stricter regulations limiting synthetic dyes. Sustainable sourcing practices and technological advancements in extraction also support industry growth.

In 2024, North America dominated the carmine market, accounted for the market share of 36.5%, driven by strong demand in processed foods, beverages, and cosmetics. Regulatory emphasis on natural additives, coupled with consumer health awareness and clean-label trends, further supported carmine adoption across the region.

Some of the major players in the global carmine market include Amerilure, BioconColors, Colormaker Inc., Givaudan Sense Colour, GNT Group, Imbarex, Neelikon Food Dyes And Chemicals Limited, Proquimac Pfc Sa, Vinayak Ingredients (INDIA) Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)