Care Management Solutions Market Size, Share, Trends and Forecast by Type, Delivery Mode, Application, End User, and Region, 2025-2033

Care Management Solutions Market Size and Share:

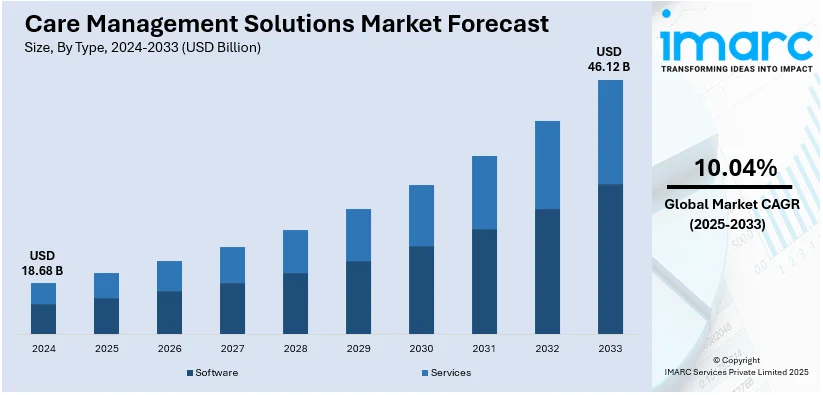

The global care management solutions market size was valued at USD 18.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.12 Billion by 2033, exhibiting a CAGR of 10.04% from 2025-2033. North America currently dominates the market, holding a market share of over 88.90% in 2024. The market is driven by the growing prevalence of chronic diseases, the development of advanced healthcare infrastructure, and the rising demand for cost-effective healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.68 Billion |

|

Market Forecast in 2033

|

USD 46.12 Billion |

| Market Growth Rate 2025-2033 | 10.04% |

The growing prevalence of chronic diseases, which requires continuous monitoring, is creating the need for integrated care management solutions that help manage patient care effectively and reduce hospital readmissions. Additionally, the increasing aging population, with older adults having complex healthcare needs that require personalized care plans, is impelling the market growth. Besides this, the rising shift towards value-based care, where healthcare providers are incentivized to focus on improving patient outcomes, is encouraging the adoption of care management solutions to enhance coordination. Apart from this, technological advancements, such as the integration of artificial intelligence (AI), machine learning (ML), and data analytics, are improving decision-making, predictive modeling, and patient engagement. Furthermore, government initiatives that promote the use of digital health tools are supporting the market growth. Moreover, the rising need for remote patient monitoring and telehealth services is catalyzing the demand for care management solutions.

The United States has emerged as a major region in the market owing to many factors. The growing prevalence of chronic diseases, such as diabetes and obesity, which necessitate ongoing care coordination and management, is propelling the market growth. Besides this, the growing awareness among the masses about the benefits of value-based care models is encouraging healthcare providers to prioritize patient outcomes, making care management solutions essential for improving patient engagement. In addition, innovations in healthcare technology, such as telemedicine and remote patient monitoring, enable real-time monitoring and more personalized care plans. Furthermore, with the rising number of cancer patients and high healthcare expenditure, effective care management solutions are essential for ensuring seamless communication between healthcare providers and improving patient treatment. According to the data published on the official website of the U.S. Centers for Disease Control and Prevention, the cost of cancer care continues to rise and is expected to reach more than $240 billion by 2030.

Care Management Solutions Market Trends:

Rising Prevalence of Chronic Diseases

The need for care management solutions has increased majorly because of the high incidence of chronic illnesses like diabetes, heart disease, and cancer. The World Health Organisation estimates that 422 million people around the world suffer from diabetes and that number continues to grow. A huge portion of both developed and developing countries makes up these figures. According to the Centers for Disease Control and Prevention (CDC), 37.3 million people in the United States alone or about 11.3% of the population have diabetes. Care management solutions help with the continuous care coordination and management that chronic illnesses frequently require, combining patient data, enabling predictive analytics, and enhancing treatment adherence. This increase in chronic disease cases is forcing medical practitioners to apply advanced treatments in the hopes of improving patient outcomes.

Implementation of Value-Based Care Models

Value-based care models, which focus on more effective and cost-effective treatment of patients, are rapidly replacing fee-for-service models in the health sector. According to the US Centres for Medicare & Medicaid Services (CMS) report 2024, out-of-pocket spending increased by 7.2% in 2023 to USD 505.7 Billion, or 10 percent of total national health expenditure. This has placed value-based care as an encouragement for health practitioners to mainly focus on prevention, coordination in care provision, and efficient utilization of resources, all of which find support through the functionalities presented by care management systems. This additional assistance from these systems encourages the adoption of value-based care models by healthcare institutions.

Advancements in healthcare information technology (IT) and digitalization

The adoption of care management solutions has been improved through the rising healthcare IT expenditure as well as digitization within the healthcare system. As of 2023, with more than 90% of US hospitals having implemented electronic health records (EHR) systems, the foundation for the care management solution has been in place. The improvements in the healthcare IT industry are stimulated by data analytics, ML, and AI. These technologies enable care management platforms to enhance patient involvement, personalize care plans, and provide predictive insights, thereby improving healthcare delivery overall. Governmental agencies’ efforts towards digitizing healthcare, such as India's Ayushman Bharat Digital Mission and the European Union's eHealth Action Plan, are also supporting the market growth.

Care Management Solutions Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global care management solutions market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, delivery mode, application, and end user.

Analysis by Type:

- Software

- Services

Software leads the market with 58.9% of market share in 2024. Software exhibits a clear dominance in the type category due to its ability to provide scalable, efficient, and customizable solutions for managing complex healthcare needs. Advanced care management software integrates features like EHR, patient data analytics, and remote monitoring tools, enabling healthcare providers to streamline workflows and improve care coordination. Moreover, as hospitals shift towards value-based care, where providers focus on enhancing patient outcomes and reducing costs, the demand for care management solutions rises. Software solutions also offer real-time data sharing and predictive analytics, helping healthcare teams to make informed decisions and implement proactive interventions. Additionally, software provides flexibility through cloud-based platforms and ensures seamless integration with existing healthcare systems and accessibility across devices. This section remains a preferred choice for optimizing care delivery and addressing the dynamic needs of modern healthcare systems.

Analysis by Delivery Mode:

- Cloud-based and Web-based

- On-premises

Cloud-based and web-based leads the market with 39.5% of the market share in 2024. Cloud-based and web-based delivery modes represent the largest segment owing to their flexibility, scalability, and cost-efficiency. These platforms enable healthcare providers to access data and tools from anywhere. This facility assists in improving care coordination across geographically dispersed teams. Cloud-based solutions reduce the need for on-site infrastructure, lower initial setup costs and allow seamless integration with existing systems. They also support real-time data sharing, enhancing decision-making and patient monitoring. The scalability of cloud-based systems allows organizations to adapt to the growing patient populations and evolving healthcare needs. Additionally, these platforms are regularly updated with the latest features and security protocols to ensure compliance with healthcare regulations and safeguard sensitive patient information. They also offer the connectivity and interoperability required for modern healthcare systems. Their ability to improve operational efficiency and patient outcomes promotes their use.

Analysis by Application:

- Chronic Care Management

- Disease Management

- Utilization Management

The chronic care management focuses on streamlining care for individuals with long-term health conditions like diabetes, hypertension, and arthritis. These solutions are used to enable better monitoring, regular follow-ups, and personalized care plans to keep chronic conditions in check. They help to reduce hospital visits, improve patient adherence to treatments, and ensure overall better health outcomes.

The disease management helps patients and healthcare providers to tackle specific illnesses effectively. These tools provide actionable insights and reminders to ensure that medications and therapies are followed as prescribed. They also assist in monitoring disease progression and identifying potential complications early. They also reduce healthcare costs by preventing severe outcomes and promoting proactive intervention.

The utilization management optimizes the use of healthcare services and helps to ensure that patients receive appropriate and cost-effective treatments while avoiding unnecessary procedures or hospital stays. These tools analyze patient data and recommend the best care pathways by balancing quality and affordability. They are particularly useful for insurers and healthcare providers aiming to deliver better care without inflating costs. Utilization management promotes smarter healthcare delivery and improves resource allocation across the system.

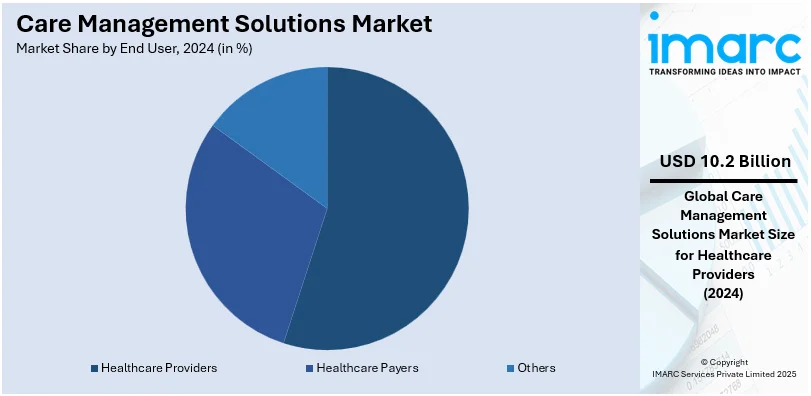

Analysis by End User:

- Healthcare Payers

- Healthcare Providers

- Others

Healthcare providers lead the market with 54.7% of the market share in 2024. Healthcare providers hold the biggest market share by end user, as they play a central role in delivering patient care and improving treatment coordination and outcomes. Providers, including hospitals, clinics, and specialty care centers, seek to manage chronic diseases, reduce hospital readmissions, and transition to value-based care models. Care management solutions enable them to streamline workflows, create personalized treatment plans, and enhance patient engagement by directly addressing these challenges. Apart from this, healthcare providers adopt care management solutions to comply with regulatory requirements, such as meaningful use of EHRs and quality reporting standards. These solutions integrate seamlessly with EHR systems and provide real-time data for informed decision-making. Moreover, the growing emphasis on patient-centered care and the increasing complexity of healthcare demands make these tools important for improving efficiency, reducing costs, and achieving better health outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounts for 51.0% of the market share in 2024. North America enjoys the leading position in the market due to the region's advanced healthcare infrastructure, high adoption of technology, and strong focus on value-based care. Healthcare providers in North America prioritize care coordination to manage chronic diseases and improve patient outcomes, aligning with the objectives of care management solutions. They utilize advanced tools like data analytics, AI, and remote patient monitoring to offer personalized care, reduce hospital readmissions, and optimize resource utilization. Additionally, government initiatives to encourage the adoption of value-based care, which emphasizes patient outcomes over service volume, are fueling the market growth in the region. Moreover, the high number of major technology companies and healthcare solution providers in North America ensures continuous innovation and availability of efficient care management tools. The United States, in particular, is noted for implementing care management solutions owing to its widespread use of EHRs, robust regulatory frameworks, and significant investments in healthcare IT. In December 2024, the US Department of Veterans Affairs revealed that it is starting preliminary planning to implement the Federal EHR system at four facilities in Michigan- Ann Arbor, Battle Creek, Detroit, and Saginaw, targeting mid-2026. The new EHR system incorporates software that maintains health records and monitors every element of patient care.

Key Regional Takeaways:

United States Care Management Solutions Market Analysis

The United States hold 88.90% share in North America. The increasing prevalence of chronic diseases, along with the rising adoption of value-based care models is driving the demand for care management systems in the US. According to an industrial report, as over 40% of American adults suffer from at least one chronic disease, including diabetes, heart disease, or cancer, it is crucial to have effective care management systems that will hasten the care process for patients. This has been driven by the increasing adoption of value-based care models in the US healthcare system, focusing on better results and lower costs. The need for data-integrated and efficiently coordinated solutions is also promoted by government initiatives like Medicare Advantage, which served more than 31 million members in 2023.

According to the data from the National Institute of Health, around 95% of US hospitals use EHR, which makes it easier to implement care management systems and enhance the monitoring and interoperability of patients. Besides this, the increasing adoption of telehealth systems supports remote care coordination, growing 38-fold since 2020, according to reports. Investments in AI and ML technology further improve care management system capabilities to predict and make possible individualized treatment plans. The demand for such solutions is increasing due to the rising emphasis on healthcare inequities and better patient participation.

Europe Care Management Solutions Market Analysis

An aging population, increasing cases of chronic illnesses, and government efforts to support the digitalization of healthcare systems are propelling the market growth in Europe. Since 20 percent of Europeans are 65 years of age or older, there is greater demand for solutions that make it easier to coordinate long-term care. Since chronic diseases, such as diabetes and cardiovascular disease are responsible for approximately 70%-80% of the health care costs in the region, according to industry reports, solutions that enhance care efficiency have been adopted. The European Union's Digital Health and Care Strategy has been a catalyst for the use of care management platforms, as it promotes data exchange and interoperability among healthcare providers. With Germany's Digital Health Act (DVG) encouraging the use of creative care solutions, nations like Germany and the UK are at the forefront of the adoption of digital healthcare instruments. Furthermore, telemedicine's growth, which saw consultations throughout Europe is expanding at a double-digit rate, which allows for remote patient monitoring and care coordination.

Asia-Pacific Care Management Solutions Market Analysis

The increasing chronic disease rates, rising development of healthcare infrastructure, and quick uptake of digital health technology are impelling the market growth in the Asia-Pacific region. According to data presented in a research paper published by the National Institute of Health, over 60% of all people with diabetes reside in this region, which necessitates tools for efficient care coordination and disease control. Government agencies in countries like China and India are investing heavily in the digitization of healthcare. India's Ayushman Bharat Digital Mission aims to build a single health interface. According to an industry report, by June 2023, 364 million of the 1.079 billion internet users in China have been using online medical services, with more than 3,000 internet hospitals. This increasing reliance on telemedicine is creating the need for care management systems. The need for long-term care management is encouraged by the large population aged 65 years or older across the region, with a share of over 28% of the population in Japan alone. Additionally, improved patient monitoring and involvement are made possible by rising smartphone usage and developments in mobile health apps. Apart from this, partnerships between the public and private sectors help to increase access to healthcare.

Latin America Care Management Solutions Market Analysis

The growing rates of chronic illness, rising healthcare costs, and government-led digital health efforts are positively influencing the market in Latin America. According to an industry report, more than 50% of the adults in the region have chronic illnesses, such as diabetes and hypertension, requiring proper systems for care management. Therefore, to enhance health delivery and long-distance care, most government agencies, especially in countries like Brazil and Mexico, are implementing national eHealth) strategies, such as Brazil's telemedicine network. Mobile-based care management systems are also promoted by the growing smartphone penetration rate, which in 2023 reportedly reached nearly 80% of the population. Investments in public healthcare infrastructure, especially in urban areas, are catalyzing the demand for interoperable care solutions. The region's focus on improving access to healthcare and reducing inequities also supports the implementation of integrated care management platforms.

Middle East and Africa Care Management Solutions Market Analysis

The rising healthcare infrastructure investments, increasing chronic disease prevalence, and digital health services are driving the demand for care management systems in the Middle East and Africa region. An estimated 15% of people suffering from chronic illnesses like diabetes existed among adults in GCC countries per the data from the National Institute of Health. Hence the need for good and effective care-coordinating solutions is critical. To modernize the healthcare sector, GCC governments are significantly investing in interoperability and digitization, including Saudi Arabia's Vision 2030. Since 2020, there has been a drastic increase in telemedicine adoption in the region, helping to manage patients remotely. In addition, the adoption of advanced care management solutions in this area is facilitated by the increasing cooperation between government agencies and corporate entities about the implementation of digital health systems.

Competitive Landscape:

Key players in the market are developing innovative technologies and platforms that streamline patient care coordination. Leading companies are investing in creating advanced tools like EHR, remote patient monitoring, telemedicine, and data analytics to enhance healthcare delivery. They are providing scalable solutions that improve patient engagement, reduce healthcare costs, and optimize care workflows. Additionally, they are collaborating with healthcare organizations and payers, which allows them to expand their reach and offer integrated solutions. They are supporting research and development (R&D) activities and emphasizing user-friendly interfaces that enhance the adoption and effectiveness of care management solutions across the healthcare system. For instance, in October 2024, Suki, the AI-driven digital assistant, made an announcement about its partnership with Zoom Video Communications, Inc., a leading communications technology company to create clinical notes and integrate AI features into the latter’s offerings. This plan focuses on enhancing user experience and improving patient care.

The report provides a comprehensive analysis of the competitive landscape in the care management solutions market with detailed profiles of all major companies, including:

- Allscripts Healthcare Solutions Inc.

- Cerner Corporation

- Cognizant

- Epic Systems Corporation

- Exlservice Holdings Inc.

- i2i Population Health

- International Business Machines Corporation

- Koninklijke Philips N.V.

- Medecision Inc. (Health Care Service Corporation)

- Pegasystems Inc.

- Salesforce.com Inc.

- Zeomega Inc.

Latest News and Developments:

- September 2024: The Care Management Copilot, a state-of-the-art tool from Innovaccer, was created to reduce care managers' administrative burden. This solution uses automation and AI to improve patient engagement, expedite workflows, and enhance care coordination effectiveness. Care managers can focus more on individualized patient care and results by using the Copilot to reduce manual duties.

- May 2024: Holly Health and Loughborough University have teamed up to use a digital behavior change tool that is grounded in science to encourage healthier living and overall wellbeing. With the support of individualized coaching and tactics, this partnership will concentrate on assisting users in creating long-lasting habits that enhance both physical and mental health. The collaboration is in line with the university's mission to promote breakthroughs in health.

- March 2024: ChartSpan and Inova have partnered to enhance patient chronic care management (CCM) services. By utilizing ChartSpan's CCM experience, this partnership seeks to deliver more thorough patient-centered treatment. For those managing chronic diseases, the alliance aims to improve overall results, increase patient participation, and streamline treatment processes.

Care Management Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Software, Services |

| Delivery Modes Covered | Cloud-based and Web-based, On-premises |

| Applications Covered | Chronic Care Management, Disease Management, Utilization Management |

| End Users Covered | Healthcare Payers, Healthcare Providers, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allscripts Healthcare Solutions Inc., Cerner Corporation, Cognizant, Epic Systems Corporation, Exlservice Holdings Inc., i2i Population Health, International Business Machines Corporation, Koninklijke Philips N.V., Medecision Inc. (Health Care Service Corporation), Pegasystems Inc., Salesforce.com Inc., Zeomega Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the care management Solutions market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global care management solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the care management solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Care management solutions are tools and technologies designed to coordinate and streamline patient care, particularly for individuals with chronic conditions or complex health needs. These solutions enable healthcare providers to create personalized care plans, monitor patient progress, and facilitate communication among care teams, patients, and caregivers. By leveraging data analytics, telemedicine, and remote monitoring, care management solutions aim to improve patient outcomes, reduce hospital readmissions, and lower healthcare costs while supporting the shift towards value-based care models.

The global care management solutions market was valued at USD 18.68 Billion in 2024.

IMARC estimates the global care management solutions market to exhibit a CAGR of 10.04% during 2025-2033.

Governments agencies are wagering on improving healthcare systems and implementing policies that encourage the adoption of care management solutions. Additionally, the rising emphasis on preventive care and early intervention to reduce healthcare costs is driving the demand for care management solutions that enable proactive monitoring. Apart from this, the increasing integration of care management solutions with other healthcare systems like telemedicine platforms, and hospital management systems, to provide comprehensive care, is bolstering the market growth.

In 2024, software represented the largest segment by type due to its ability to integrate advanced features like data analytics, patient monitoring, and real-time communication. It offers scalability, enhances workflow efficiency, and supports personalized care, making it essential for healthcare providers.

Cloud-based and web-based exhibit a clear dominance in the market by delivery mode owing to their scalability, cost-effectiveness, and flexibility. They enable real-time data access, seamless integration with existing systems, and enhance collaboration.

The healthcare providers account for the majority of the market share by end user, as they prioritize improving care coordination, managing chronic diseases, and transitioning to value-based care. Care management solutions help healthcare professionals to streamline workflows, enhance patient engagement, and comply with regulatory standards.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global care management solutions market include Allscripts Healthcare Solutions Inc., Cerner Corporation, Cognizant, Epic Systems Corporation, Exlservice Holdings Inc., i2i Population Health, International Business Machines Corporation, Koninklijke Philips N.V., Medecision Inc. (Health Care Service Corporation), Pegasystems Inc., Salesforce.com Inc., Zeomega Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)