Cardiovascular Information System Market Size, Share, Trends and Forecast by Type, Component, Mode of Operation, End-User, Application, and Region, 2025-2033

Cardiovascular Information System Market Size and Share:

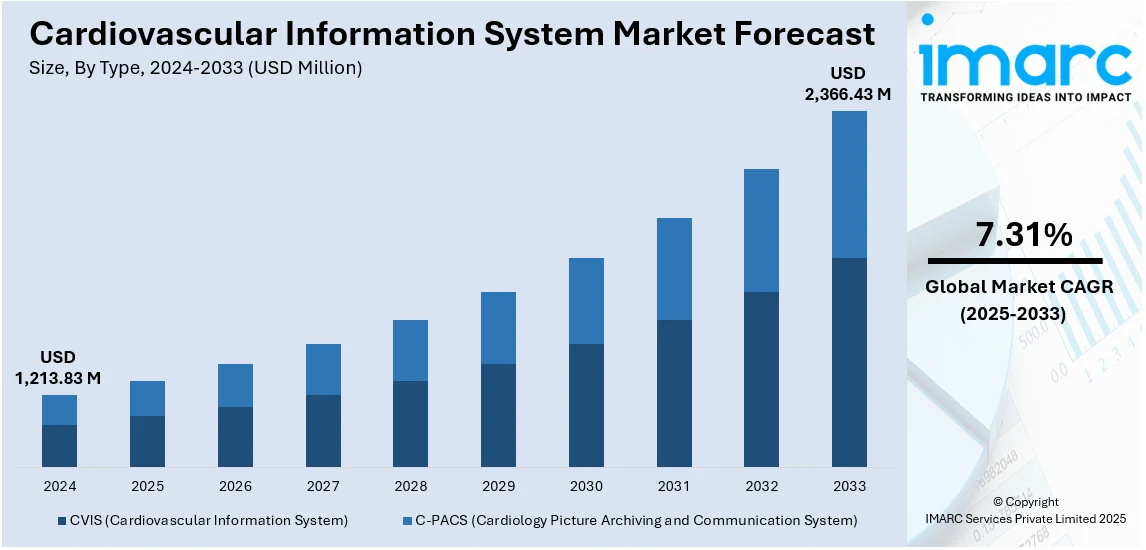

The global cardiovascular information system market size was valued at USD 1,213.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,366.43 Million by 2033, exhibiting a CAGR of 7.31% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.2% in 2024. The market is experiencing significant growth, driven by the rising incidence of heart diseases, advancements in diagnostic technologies, and increasing demand for efficient healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,213.83 Million |

|

Market Forecast in 2033

|

USD 2,366.43 Million |

| Market Growth Rate 2025-2033 | 7.31% |

The increasing integration of machine learning and artificial intelligence into cardiovascular information systems is driving advancements in cardiology diagnostics and patient management. AI-powered CIS platforms enhance real-time data analysis, automate risk assessment, and improve decision-making for early disease detection. Additionally, the growing adoption of cloud-based CIS solutions is streamlining data accessibility across multiple healthcare facilities, enabling seamless interoperability and remote patient monitoring. The rising prevalence of cardiovascular diseases (CVDs), coupled with an aging population, is accelerating demand for predictive analytics and personalized treatment strategies. Furthermore, the push for value-based care models is prompting healthcare providers to invest in CIS technologies that improve clinical efficiency and patient outcomes. As cybersecurity threats in healthcare rise, enhanced data security and compliance measures are also becoming a key focus in CIS development.

Moreover, regulatory support, including the U.S. Food and Drug Administration approvals for AI-driven diagnostic tools, is fostering market growth. Cardio Diagnostics’ expansion in February 2025 reinforces the U.S. Cardiovascular Information System sector, highlighting the increasing demand for precision cardiovascular medicine. The integration of Epi+Gen CHD and PrecisionCHD into provider organizations underscores the shift toward AI-driven, epigenetic-based diagnostics for heart disease risk assessment and management. As coronary heart disease remains the leading cause of death in the U.S., this expansion strengthens the role of CIS platforms in preventive healthcare, enabling more proactive and personalized treatment approaches. Additionally, healthcare providers in multiple regions, including Michigan, Illinois, Texas, Florida, California, and Connecticut, are leveraging these AI-powered tools to enhance patient outcomes. The adoption of genetic and epigenetic testing in CIS solutions signifies a growing emphasis on precision medicine, aligning with the industry’s push toward data-driven, patient-centric care models.

Cardiovascular Information System Market Trends:

Rising CVD Cases and Digital Adoption

The increasing healthcare sector, coupled with the incidence of numerous cardiovascular diseases, is one of the primary drivers of market growth. As per the reports, from 2025 to 2050, cardiovascular disease incidence is estimated to grow by 90%, and in 2050, 35.6 Million cardiovascular-related deaths are anticipated, which is a surprising increase from 20.5 Million in 2025. Due to the increase in the geriatric population and sedentary lifestyle patterns, the number of patients with cardiac failures, ischemic heart disease (IHD), and arrhythmia is drastically increasing globally. As per the World Health Organization (WHO), in 2050, almost 80% of elderly individuals will be residing in low- and middle-income nations, which is the reason that scalable, data-based healthcare solutions to deal with age-related conditions, such as cardiovascular diseases, are the need of the hour. In addition, the developing trend of digitization and developments in the healthcare information technology (IT) segment are also boosting the market growth. The healthcare organizations are adopting the system to access medical data and images remotely, thus further improving the diagnostic centers' efficiency and interoperability. Also, the gradually improving adoption rate of zero-footprint systems is playing another stimulating growth factor role. The CVIS dispenses with the requirement for extra hard drives to hold the software as it has the capability of data transfer via the web and offers the ease of delivery, in addition to the effective examination of compressed data sets. Several other factors, such as the growing need for data-driven technologies, advancements in technology and heavy research and development (R&D) efforts, are expected to push the market ahead.

Advanced AI Integration in Cardiology

The growing role of artificial intelligence in cardiology is driving the adoption of Cardiovascular Information Systems (CIS). AI-powered tools are enhancing risk assessment, early detection, and clinical decision-making. With increasing cardiovascular cases, healthcare providers are focusing on predictive analytics to improve patient outcomes. The integration of AI reduces diagnostic errors, accelerates data analysis, and streamlines workflows in cardiology. For instance, in February 2025, Heart Eye introduced Dr.Noon CVD, an AI-powered retinal imaging system that enables cardiovascular risk assessment with accuracy comparable to heart CT scans. This noninvasive solution enhances CIS by providing faster screenings, improving accessibility, and supporting early diagnosis. The expansion of AI-driven predictive models strengthens CIS adoption by improving efficiency, reducing costs, and supporting personalized treatment strategies. As hospitals prioritize automation and digital transformation, AI-powered cardiology solutions are becoming essential.

Enhanced ECG and Imaging Interoperability

Seamless data exchange and interoperability across imaging and ECG platforms are key drivers of the Cardiovascular Information System market. Hospitals and clinics need integrated solutions that enable efficient data flow between diagnostic tools, electronic health records (EHRs), and cardiology workstations. Improved interoperability enhances decision-making, reduces redundancies, and streamlines patient management in cardiovascular care. Aligned with this trends, in June 2024, Philips launched the Cardiac Workstation in EMEA, improving ECG data analysis and clinical workflows. This innovation enhances interoperability by ensuring real-time data access and risk assessment support, accelerating cardiology interventions. With the growing demand for advanced imaging and ECG systems, vendors are focusing on interoperable solutions to improve connectivity and efficiency. Standardized data integration across cardiology platforms is making CIS adoption more effective, improving collaboration and clinical accuracy.

Cardiovascular Information System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cardiovascular information system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, mode of operation, end-user, application, and region.

Analysis by Type:

- CVIS (Cardiovascular Information System)

- C-PACS (Cardiology Picture Archiving and Communication System)

Cardiovascular Information System (CVIS) stands as the largest segment by type, driving market expansion. The increasing demand for integrated data solutions in cardiology is a key factor fueling its dominance. CVIS streamlines workflow, enhances diagnostic accuracy, and improves patient management by centralizing imaging, ECG data, and clinical records. Hospitals and healthcare providers are prioritizing digital transformation, accelerating CVIS adoption. Advancements in AI-driven analytics, interoperability, and cloud-based platforms further strengthen its market position. Ongoing research and regulatory compliance efforts continue to enhance CVIS efficiency and scalability, ensuring sustained growth.

Analysis by Component:

- Software

- Hardware

- Services

In 2024, software led the market by component with 32.6% of the market share. The rising demand for integrated data management, real-time diagnostics, and cloud-based solutions is driving this segment’s growth. CVIS software enhances workflow automation, imaging interoperability, and clinical decision-making, improving cardiology care efficiency. Hospitals and diagnostic centers are increasingly adopting AI-powered analytics, boosting demand for advanced software solutions. The shift toward cloud-based, zero-footprint systems ensures seamless data access and regulatory compliance. Continuous R&D investments in AI-driven diagnostics and predictive analytics are further strengthening software’s dominance, positioning it as the key growth driver in the CVIS market.

Analysis by Mode of Operation:

- Web-based

- Onsite

- Cloud-based

In 2024, web-based stand as the largest mode of operation holding around 74.8% of the market. The increasing demand for cloud-based platforms that enable remote access, seamless data integration, and real-time collaboration is driving adoption. Web-based CVIS enhances interoperability between hospitals, imaging centers, and cardiology departments, improving efficiency and patient outcomes. The shift toward digitization in healthcare, combined with growing investments in telecardiology, is reinforcing this trend. Hospitals and clinics are prioritizing web-based solutions due to their scalability, cost-effectiveness, and ability to support AI-driven analytics. Additionally, reduced infrastructure requirements and zero-footprint technology eliminate the need for extensive hardware installations. Rising cardiovascular disease cases and the need for instant, data-driven decision-making further fuel adoption. As regulatory bodies emphasize data security and interoperability, web-based CVIS remains the preferred choice, ensuring continuous market expansion.

Analysis by End-User:

- Hospitals and Clinics

- Cardiac Cath Labs

- Diagnostic Centers

- Others

In 2024, hospitals and clinics led the cardiovascular information system market, holding the largest share by end-user. The increasing prevalence of cardiovascular diseases (CVDs), coupled with rising patient admissions for cardiac care, is driving segment growth. Hospitals and specialized cardiac centers are rapidly adopting CVIS to enhance workflow efficiency, streamline diagnostics, and improve patient outcomes. These systems enable seamless integration of imaging, ECG data, and electronic health records (EHRs), ensuring faster and more accurate clinical decision-making. The demand for data-driven cardiac care is fueling investments in advanced CVIS solutions that support real-time monitoring and predictive analytics. Additionally, regulatory compliance and the shift toward value-based healthcare models are pushing hospitals to adopt interoperable systems, reinforcing their dominance in the CVIS market. Expanding telehealth services further accelerates this segment’s growth.

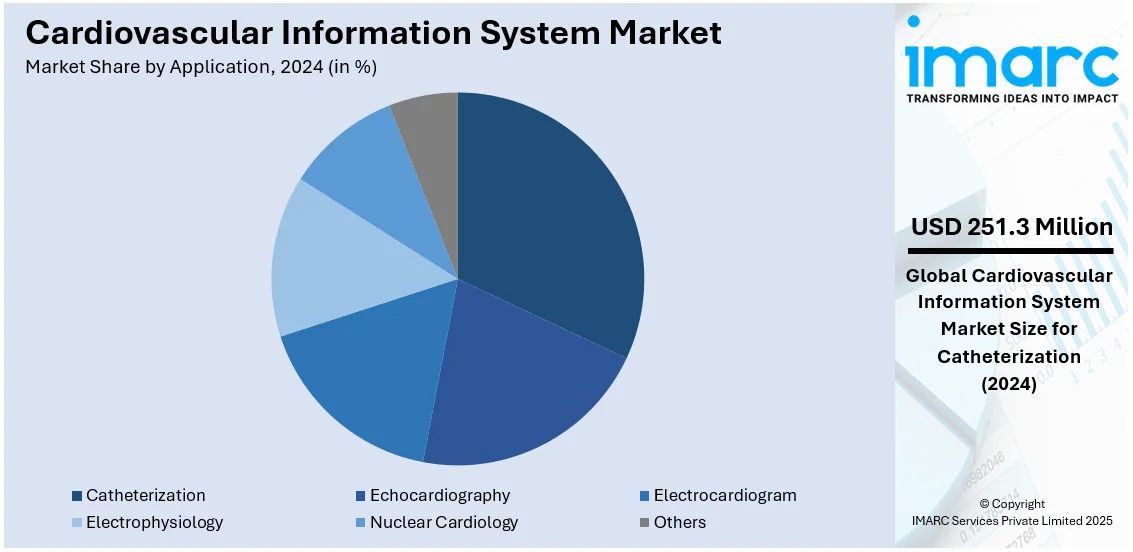

Analysis by Application:

- Catheterization

- Echocardiography

- Electrocardiogram

- Electrophysiology

- Nuclear Cardiology

- Others

In 2024, catheterization accounted for the largest market share of 20.7%. The increasing reliance on catheterization procedures for diagnosing and treating cardiovascular diseases is a key factor driving this segment. CVIS enhances workflow efficiency by integrating real-time imaging, hemodynamic monitoring, and patient data management, making it essential for catheterization labs. The growing prevalence of ischemic heart disease, arrhythmias, and structural heart conditions is fueling demand for advanced digital solutions that support precision diagnostics and intervention. Hospitals and specialized cardiology centers are adopting CVIS to streamline data analysis, improve decision-making, and enhance patient care. Regulatory mandates for standardized data integration and real-time analytics further boost adoption. Continuous advancements in imaging technology and AI-driven diagnostics are reinforcing CVIS adoption in catheterization, ensuring sustained market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America region dominated the cardiovascular information system market, accounting for the largest share over 33.2%. The region’s leadership is driven by advanced healthcare infrastructure, strong digital adoption, and high cardiovascular disease (CVD) prevalence. Hospitals and cardiology centers are increasingly adopting CVIS to streamline patient management, enhance diagnostics, and improve clinical outcomes. The widespread integration of AI, cloud-based solutions, and electronic health records (EHRs) is further accelerating CVIS adoption. The presence of major healthcare IT providers and ongoing investments in data-driven cardiology solutions reinforce market growth. Additionally, regulatory frameworks promoting interoperability and patient-centric care are pushing healthcare facilities toward CVIS implementation. With rising demand for real-time data analytics and predictive healthcare models, North America continues to lead in CVIS adoption, driving innovation and efficiency in cardiology care.

Key Regional Takeaways:

United States Cardiovascular Information System Market Analysis

In 2024, United States accounted for 88.60% of the market share in North America. The United States cardiovascular information system market is experiencing robust growth, driven by the increasing prevalence of cardiovascular diseases (CVDs) and the rising demand for streamlined healthcare data management solutions. According to the American Heart Association, cardiovascular disease claims more than 850,000 lives in the U.S. each year, highlighting the urgent need for advanced healthcare technologies to improve patient outcomes. The growing adoption of electronic health records (EHR) and the need for integrated platforms to manage patient information, diagnostic images, and treatment plans are key factors propelling market expansion. Advanced cardiovascular information systems offer real-time access to patient data, enabling healthcare providers to improve clinical decision-making and operational efficiency. The integration of cloud-based solutions, artificial intelligence (AI), and data analytics tools further enhances diagnostic accuracy and patient outcomes. Additionally, favorable government initiatives promoting healthcare digitization and interoperability are supporting the market growth. With the increasing shift toward value-based care models and rising investments in healthcare IT infrastructure, the United States cardiovascular information system market is poised for consistent expansion in the coming years.

Europe Cardiovascular Information System Market Analysis

The Europe cardiovascular information system market is witnessing steady growth, driven by rising healthcare digitization and the increasing burden of cardiovascular diseases (CVDs) across the region. According to the World Health Organization, CVDs are the leading cause of disability and premature death in the European Region, accounting for over 42.5% of all deaths annually, which translates to approximately 10,000 deaths per day. This alarming prevalence is pushing healthcare providers to adopt advanced data management solutions to improve patient care and early diagnosis. The demand for centralized cardiovascular information systems that enhance workflow efficiency, diagnostic precision, and data integration is driving adoption across hospitals, diagnostic centers, and specialty clinics. Technological advancements such as cloud-based platforms, remote patient monitoring, and AI-powered data analytics are reshaping the market landscape. Additionally, the widespread implementation of electronic health records (EHR) and adherence to GDPR are accelerating the deployment of these systems. Government initiatives and investments in smart healthcare infrastructure are creating lucrative opportunities for cardiovascular information system providers, making Europe a key market for future growth.

Asia Pacific Cardiovascular Information System Market Analysis

The Asia Pacific cardiovascular information system market is expanding rapidly, fueled by increasing healthcare infrastructure development, rising healthcare expenditures, and the growing incidence of cardiovascular diseases. The adoption of healthcare IT solutions to improve clinical workflows and enhance patient care is significantly contributing to market growth. Healthcare providers in the region are leveraging cloud-based cardiovascular information systems to streamline patient data management, diagnostic imaging, and treatment planning. The rising awareness about digital healthcare solutions and increasing government investments in healthcare digitization projects are supporting market expansion. According to the India Brand Equity Foundation, the health-tech sector is set for significant expansion, with hiring projected to rise by 15-20% in 2024, reflecting the increasing demand for innovative healthcare solutions and the integration of technology in medical services. Moreover, the penetration of telemedicine platforms, AI-driven diagnostics, and mobile health applications is further boosting the adoption of cardiovascular information systems across the region, creating new growth opportunities for market players.

Latin America Cardiovascular Information System Market Analysis

The Latin America cardiovascular information system market is growing due to the rise in cardiovascular diseases and the adoption of healthcare IT solutions. The demand for centralized data management systems is driving market expansion. Healthcare providers are integrating cloud-based systems for remote data access, patient monitoring, and collaborative decision-making. Government initiatives and customized solutions are creating new growth opportunities. Moreover, the rising aging population is anticipated to further drive the demand for cardiovascular information systems, as elderly individuals are more prone to developing cardiovascular diseases. According to reports, approximately 37.8% of Brazil's population will be aged 60 and over by 2070, highlighting the need for advanced healthcare solutions to support the region’s growing geriatric population.

Middle East and Africa Cardiovascular Information System Market Analysis

The Middle East and Africa cardiovascular information system market is expanding due to healthcare modernization and digital transformation. The increasing burden of cardiovascular diseases and demand for efficient data management solutions are driving the adoption of these systems, which streamline patient data storage, diagnostic imaging, and treatment planning, and improve clinical decision-making. Additionally, rising government investments in healthcare IT infrastructure and strategic collaborations between public and private sectors are boosting the adoption of cardiovascular information systems across the region. For instance, the International Trade Administration states that under Vision 2030, the Saudi Arabian Government plans to invest over USD 65 Billion to develop the country’s healthcare infrastructure, and reorganize, and privatize health services and insurance.

Competitive Landscape:

Technological advancements, data integration, and rising demand for efficient healthcare management are shaping the cardiovascular information system market. Expanding applications in hospitals, diagnostic centers, and specialty clinics, along with regulatory compliance and interoperability improvements, are driving market growth. Increasing investments in AI-driven analytics, cloud-based solutions, and workflow optimization are fostering innovation. Regional expansions, research initiatives, and evolving healthcare IT standards are intensifying competition, promoting cost-effective and high-performance solutions across various end-use settings.

The report provides a comprehensive analysis of the competitive landscape in the cardiovascular information system market with detailed profiles of all major companies, including:

- Agfa Healthcare India Private Limited

- Cerner Corporation

- Digisonics Inc.

- Fujifilm Medical Systems

- GE Healthcare

- LUMEDX Corporation

- McKesson Corporation

- Merge Healthcare, Inc.

- Koninklijke Philips N.V.

- Siemens Healthineers AG

Latest News and Developments:

- December 2024: AGFA HealthCare and Rad AI announced a strategic collaboration to enhance radiology workflows using AI-powered reporting and FHIRcast integration. The partnership improved interoperability, automated data entry, reduced inefficiencies, and addressed radiologist burnout, setting new standards in radiology innovation and patient care.

- December 2024: Fujifilm opened the NURA Global Innovation Center in Kozhikode, India, combining health screening services, medical staff training, and remote image interpretation. The center aimed to expand Fujifilm's health screening business, improve service quality, and accelerate AI diagnostic support technology development across emerging markets.

- July 2024: AbbaDox partnered with Merge Healthcare Solutions to enhance ambulatory radiology workflow solutions through cloud-based technology. Merge began referring clients to AbbaDox, offering advanced cloud services, seamless workflow transitions, and improved operational efficiency. The collaboration aimed to boost patient care and support cloud adoption in radiology.

- July 2024: Siemens Healthineers began local manufacturing of the Multix Impact E digital radiography X-ray system in Bengaluru, India, to improve access to care. The system offers low-dose quality imaging and intuitive operation, aiding in the diagnosis of TB, COPD, and trauma injuries, aligning with India's healthcare needs.

- March 2024: Wipro GE Healthcare planned to launch 40 new products across MRI, CT, PET/CT, Ultrasound, and patient care devices in 2024. The company prioritized local manufacturing, with 40% of sales from Indian-made products and aimed to support National Health Mission and PPP projects across states.

Cardiovascular Information System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | CVIS (Cardiovascular Information System), C-PACS (Cardiology Picture Archiving and Communication System) |

| Components Covered | Software, Hardware, Services |

| Mode of Operations Covered | Web-based, Onsite, Cloud-based |

| End-Users Covered | Hospitals and Clinics, Cardiac Cath Labs, Diagnostic Centers, Others |

| Applications Covered | Catheterization, Echocardiography, Electrocardiogram, Electrophysiology, Nuclear Cardiology, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agfa Healthcare India Private Limited, Cerner Corporation, Digisonics Inc., Fujifilm Medical Systems, GE Healthcare, LUMEDX Corporation, McKesson Corporation, Merge Healthcare, Inc., Koninklijke Philips N.V. and Siemens Healthineers AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cardiovascular information system market from 2019-2033.

- The cardiovascular information system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cardiovascular information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cardiovascular information system market was valued at USD 1,213.83 Million in 2024.

The cardiovascular information system market is projected to exhibit a CAGR of 7.31% during 2025-2033, reaching a value of USD 2,366.43 Million by 2033.

Key factors driving the cardiovascular information system market include rising cardiovascular disease prevalence, technological advancements, aging population, government funding, EHR integration, telemedicine adoption, health awareness, minimally invasive procedures, and cost-effectiveness.

North America currently dominates the cardiovascular information system market, accounting for a share of 33.2%. The market growth is driven by advanced healthcare infrastructure, high cardiovascular disease prevalence, technological innovations, government initiatives, and increasing healthcare investments.

Some of the major players in the cardiovascular information system market include Agfa Healthcare India Private Limited, Cerner Corporation, Digisonics Inc., Fujifilm Medical Systems, GE Healthcare, LUMEDX Corporation, McKesson Corporation, Merge Healthcare, Inc., Koninklijke Philips N.V. and Siemens Healthineers AG.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)