Carbon Management Software Market Size, Share, Trends, and Forecast by Component, Application, Industry, and Region, 2026-2034

Carbon Management Software Market Size, Share Analysis & Growth Insights:

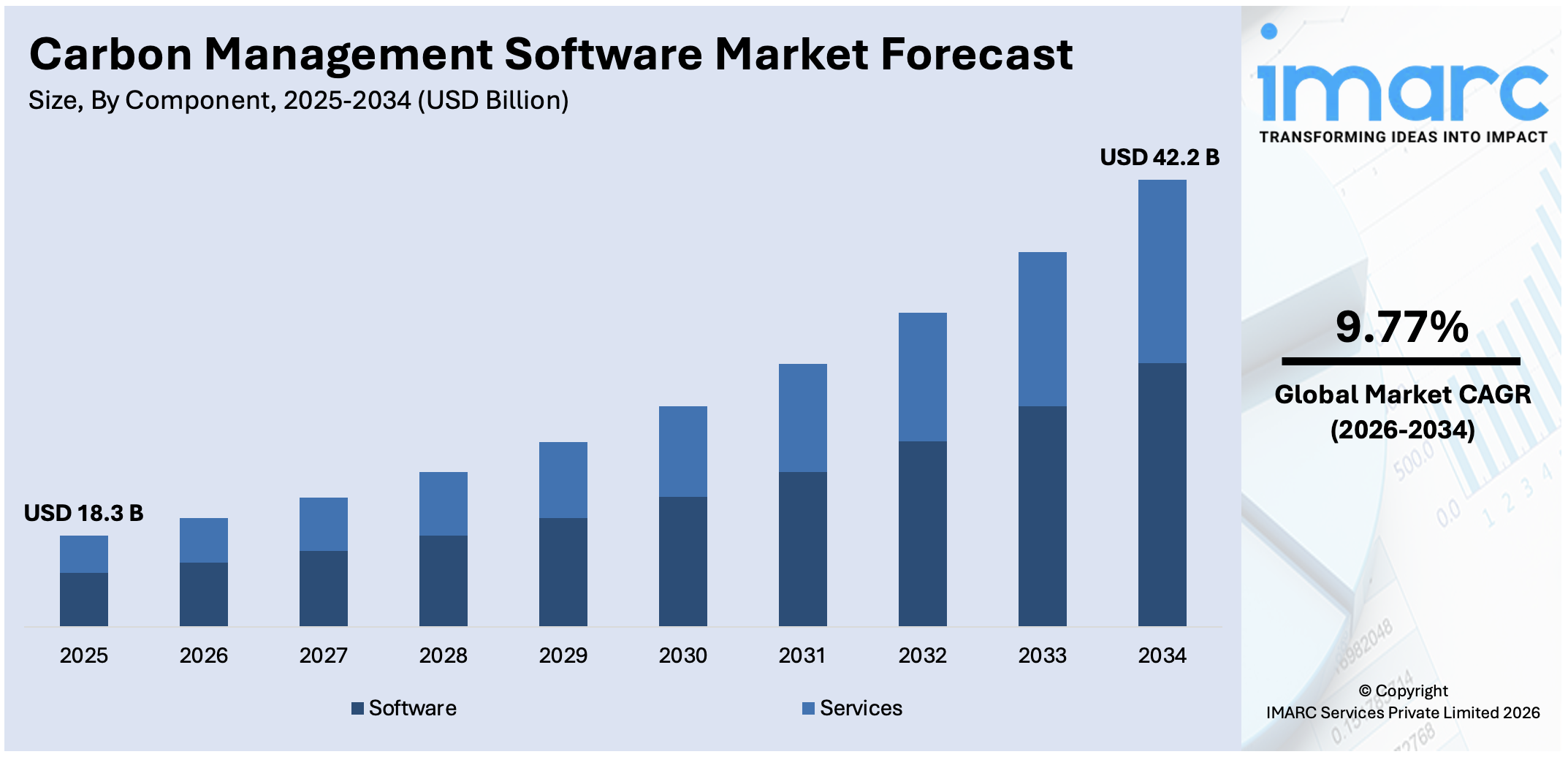

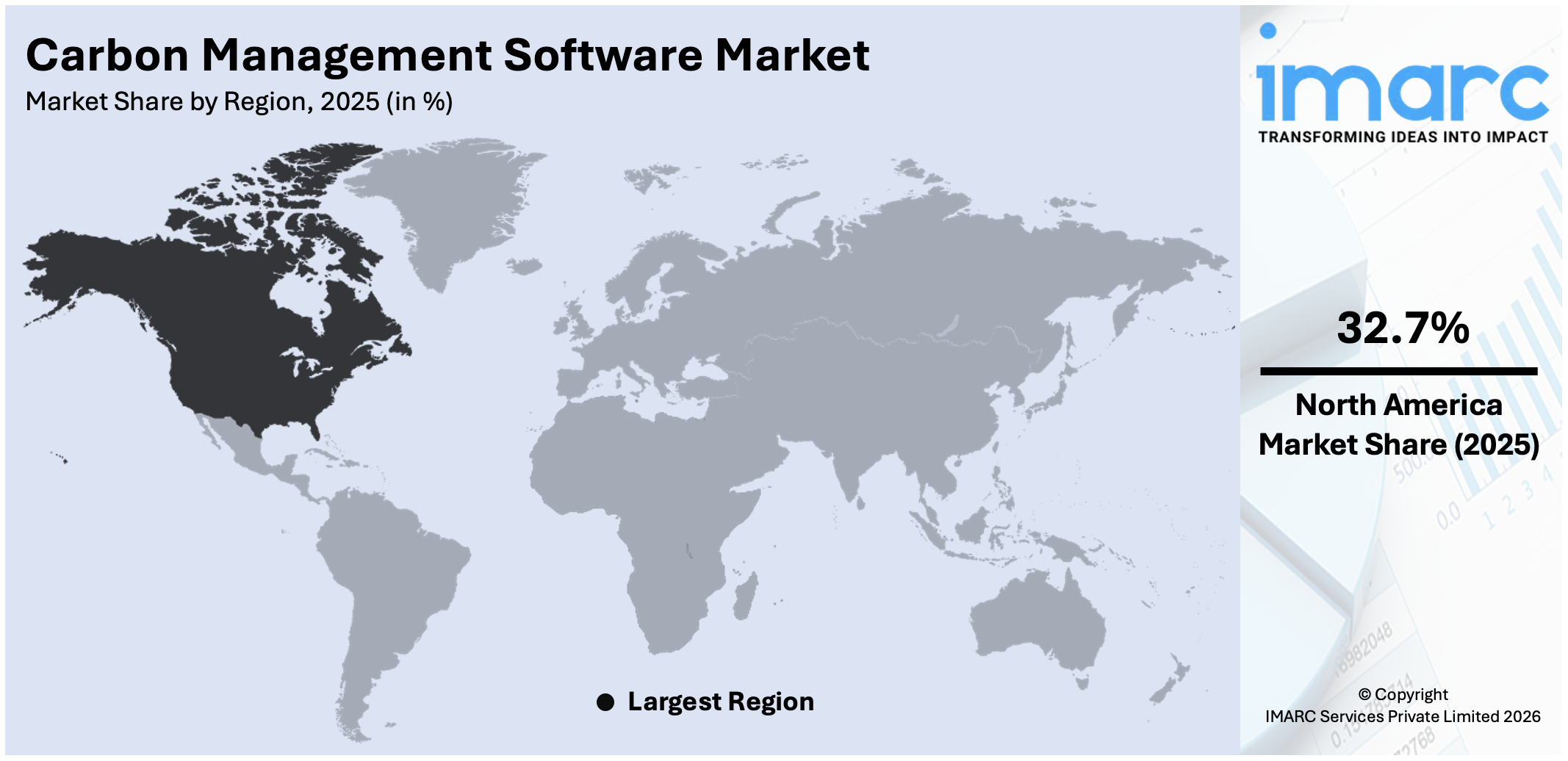

The global carbon management software market size was valued at USD 18.3 Billion in 2025. Looking forward, the market is projected to reach USD 42.2 Billion by 2034, exhibiting a CAGR of 9.77% during 2026-2034. North America currently dominates the market, holding a significant market share of over 32.7% in 2025, driven by stringent environmental regulations, widespread adoption of sustainability practices, and increasing demand for advanced emissions tracking and reduction solutions across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 18.3 Billion |

|

Market Forecast in 2034

|

USD 42.2 Billion |

| Market Growth Rate 2026-2034 | 9.77% |

One of the major carbon management software market growth drivers is the increasing emphasis on corporate sustainability and adherence to regulatory mandates. For instance, in March 2024, UL Solutions and SINAI Technologies partnered to promote each other’s ESG solutions, combining UL 360 and SINAI’s carbon platform to empower businesses with a comprehensive approach to decarbonization and sustainability. Furthermore, organizations worldwide face heightened pressure from governments, stakeholders, and consumers to reduce their carbon footprints and adopt environmentally responsible practices. Regulations and carbon pricing mechanisms compel businesses to track, manage, and report emissions accurately. Carbon management software provides robust tools for monitoring greenhouse gas emissions, optimizing energy use, and ensuring compliance with sustainability goals. This growing demand for accountability and efficiency drives the widespread adoption of such solutions across diverse industries.

To get more information on this market Request Sample

The United States plays a pivotal role in the carbon management software market outlook by fostering innovation and adoption through advanced technologies and regulatory frameworks. With stringent environmental policies, such as the Inflation Reduction Act and state-level carbon pricing initiatives, the U.S. encourages organizations to adopt carbon management solutions. For instance, in March 2024, Persefoni released Persefoni Pro, a free Climate Management & Accounting Platform for SMBs and enterprises, offering trusted carbon calculations to 2000 companies with AI-driven accuracy, following two years of development and real-world feedback. Leading software providers leverage the country’s robust digital infrastructure and investment in sustainability to develop cutting-edge tools for tracking and reducing emissions. According to the carbon management software market forecast report, the U.S. business landscape, marked by growing corporate sustainability commitments, drives demand for comprehensive carbon management solutions, positioning the country as a key contributor to the global market’s growth.

Carbon Management Software Market Trends:

Increasing Regulatory Compliance and Carbon Footprinting Concerns

One of the significant carbon management software market drivers is the growing need for regulatory compliance. According to International Energy Agency, Global energy-related CO2 emissions rose by 1.1% in 2023, adding 410 Million Tons to reach a record 37.4 Billion Tons, highlighting the growing carbon footprint and increasing demand for carbon management software solutions. According to the carbon management software market growth insights, governments across the world impose stringent regulations to alleviate the impact of climate change, which is surging the demand for solutions that allow organizations to track and report their carbon emissions precisely. This software makes it easier for companies to adhere to the regulation requirements, avoid penalty charges, and maintain public acceptance since they are displaying responsible attitudes towards the environment. Because of the recent sensitivities about carbon print, the business world is increasingly using the software to analyze their emission print, track the process, and report so as to contribute to a clean globe. The company gets areas of improvement within its carbon footprint, hence helping businesses develop better techniques for reducing carbon.

Advancements in Technology and Integration Capabilities

Technological advancements are one of the major factors driving growth in the market. Advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) also contribute to enhancing the software capabilities. The technologies have been able to analyze massive amounts of emission data in more accurate and efficient manners, thus leading to proper decision-making regarding carbon reduction strategies. For instance, in March 2024, GE Vernova’s CERius carbon management software debuted at Globeleq’s Azito Energie power plant in Cote D’Ivoire, leveraging AI and ML to produce 713 MW of electricity, 30% of the nation’s base load. Moreover, the integration of the software with existing business systems and processes has become easier, pushing it across industries. These integration capabilities allow for effective flow and analysis of data, promoting cohesive and comprehensive carbon management practices. Its ability to adapt and scale based on the size of the business and sector can be a key factor that influences its adoption across numerous sectors, as it could be tailored to specific requirements based on industry needs or compliance requirements.

Corporate Sustainability Commitments and Stakeholder Pressure

There's also the increase in pressure to corporate sustainability through stakeholders- investors, customers, as well as employees. Most companies are embracing the value of reducing environmental impact while keeping their corporate social responsibility into consideration. For example, Novisto teamed up with SINAI Technologies in April 2024 with the aim of helping corporations reach net zero by aligning ESG and carbon data, thereby providing actionability and the ability for strategic decision-making for a sustainable business model. This shift in culture in organizations inclined towards sustainability is boosting the adoption of the software to attain and showcase these commitments. The software assists in emissions monitoring and reduction, thus reporting such efforts transparently to stakeholders. Transparency in this case is essential in that it creates trust, thereby enhancing the reputation of the company, which would increase customer loyalty, investor confidence, and market competitiveness. Besides, employees are currently more interested in working for environmentally responsible companies, which makes carbon management an aspect of attracting and retaining talent.

Impact of AI on the Carbon Management Software Market

Artificial intelligence (AI) is revolutionizing the carbon management software market by enhancing data accuracy, predictive analytics, and automation. AI-powered platforms enable organizations to monitor emissions, optimize energy usage, and ensure regulatory compliance with greater efficiency. Advanced machine learning algorithms analyze vast datasets in real-time, identifying patterns and recommending strategic actions to reduce carbon footprints. Moreover, AI facilitates automated reporting and risk assessment, streamlining sustainability initiatives for businesses. By integrating AI, companies can make data-driven decisions, improve operational transparency, and achieve long-term environmental goals. As governments impose stricter regulations on carbon emissions, AI-driven solutions will play a crucial role in supporting corporate sustainability efforts and fostering a low-carbon economy.

Carbon Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carbon management software market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, application, and industry.

Analysis by Component:

- Software

- Services

Software stands as the largest component in 2025, holding around 63.4% of the market. The software segment includes many software solutions for carbon emission monitoring, analysis, and management. It is very important for companies to monitor their carbon footprint accurately to ensure compliance with environmental regulations and to support the development of strategies to reduce carbon emissions. In most cases, the software uses AI and IoT, which make it more efficient and accurate. Its scalability and adaptability to different industry needs make it versatile for businesses of all sizes. The demand for software solutions is also high in the manufacturing, energy, and transportation industries, where complex operations and significant emissions make the demand for the right solutions higher.

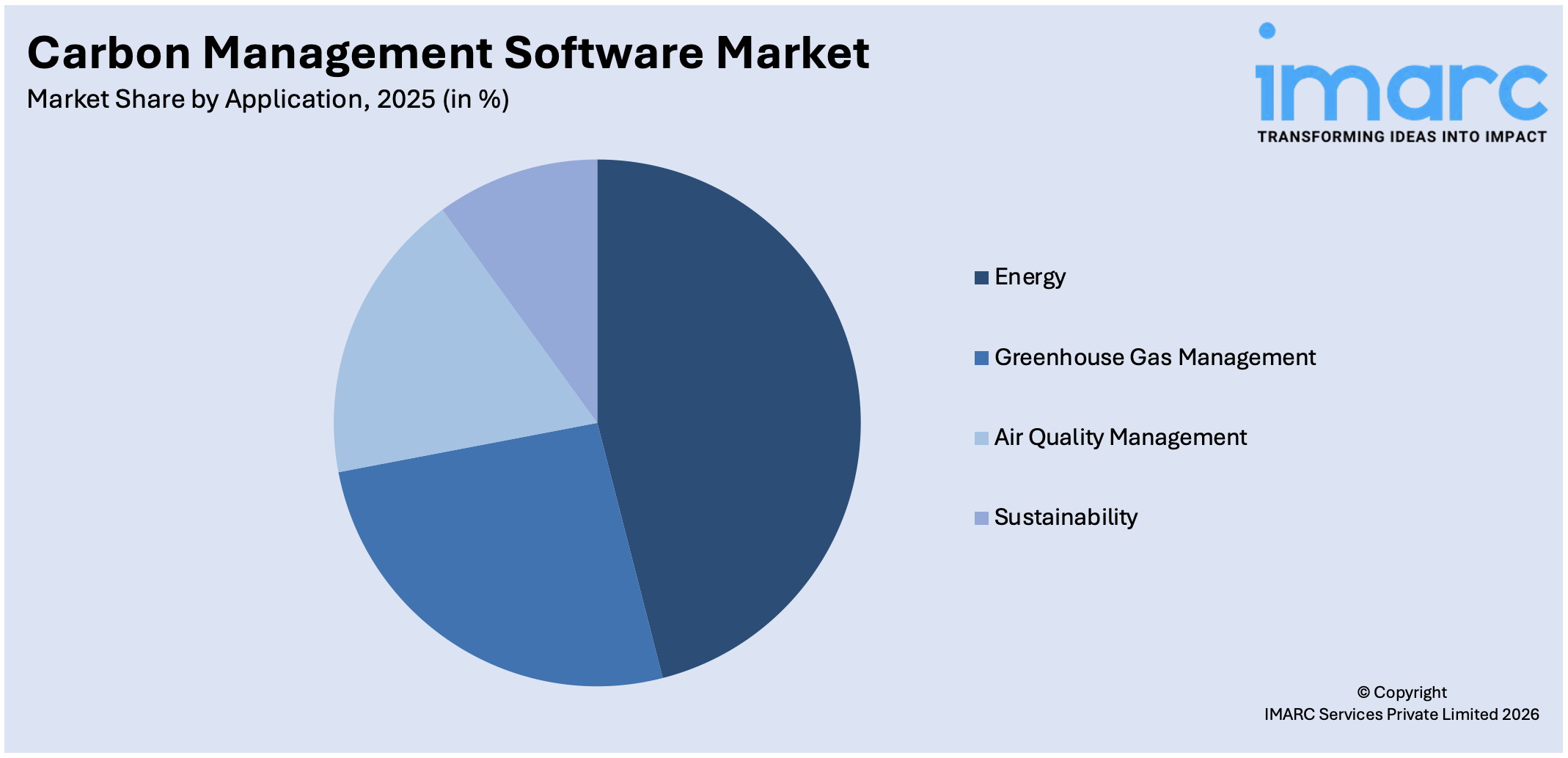

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Energy

- Greenhouse Gas Management

- Air Quality Management

- Sustainability

Energy leads the market with around 33.6% of the market share in 2025. In the market, the energy segment is prominent due to its critical role in carbon emissions and management. This segment primarily focuses on monitoring and reducing carbon emissions in the energy production and consumption process. With the global inclination towards renewable energy and sustainable practices, energy companies are increasingly adopting the software to optimize energy use, reduce emissions, and comply with environmental regulations. Additionally, the software aids in tracking and analyzing energy consumption patterns, identifying areas for improvement, and implementing energy-efficient practices.

Analysis by Industry:

- Manufacturing

- IT and Telecom

- Government Sector

- Energy and Power

- Others

Manufacturing leads the market with around 27.5% of market share in 2025. The manufacturing segment dominance is attributed to the significant carbon emissions and energy consumption associated with manufacturing processes. In this sector, the software is crucial for monitoring and reducing emissions, optimizing energy usage, and ensuring compliance with environmental regulations. The diverse range of manufacturing industries, from automotive to chemicals, all require tailored solutions to manage their specific emission profiles. As manufacturers increasingly focus on sustainability and reducing their environmental impact, the demand for effective carbon management solutions in this segment continues to grow, driven by both regulatory pressures and corporate social responsibility initiatives.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 32.7%. North America leads the market, largely due to stringent environmental regulations and high awareness of sustainability issues in the region. The United States and Canada are at the forefront, with numerous industries adopting carbon management practices to comply with regulatory standards and corporate sustainability goals. Additionally, the presence of major market players and technological innovators in this region also contributes to its dominance. Furthermore, the increasing adoption of renewable energy sources and the shift towards greener practices in sectors such as manufacturing and transportation are driving the carbon management software market share in North America.

Key Regional Takeaways:

United States Carbon Management Software Market Analysis

In North America, US accounts for 85.7% share of the market in 2025. The adoption of carbon management software is accelerating as the demand for electricity rises. According to U.S. Energy Information Administration, the growing demand for electricity in the U.S., reaching 4.07 Trillion kWh in 2022, 14 times higher than in 1950, presents a significant opportunity for carbon management software to help optimize energy usage and reduce emissions. This increasing consumption highlights the need for more efficient and sustainable energy solutions. The integration of renewable energy into traditional grids and the shift toward cleaner energy sources have created the need for robust carbon management tools. Power companies increasingly seek software solutions to track emissions, optimize energy usage, and meet stringent environmental regulations. This demand has also been fueled by the expansion of smart grids, which generate complex data requiring advanced analytics to manage carbon footprints effectively. According to the carbon management software industry insights, the energy sector's transition toward decentralized power systems, coupled with the surge in electrification of transport and heating, further necessitates efficient carbon tracking and reporting. According to the carbon management software market forecast report, the growth in energy storage technologies has encouraged the deployment of such software, enabling organizations to ensure compliance with emission standards. The alignment of emission tracking software with broader climate goals has made it an essential component in energy and power sectors.

Asia Pacific Carbon Management Software Market Analysis

The increasing adoption of carbon management software within the IT and telecom sector has been driven by the industry's rapid expansion and its emphasis on sustainability. According to the National Association of Software and Service Companies (NASSCOM), the Indian IT industry's revenue reached USD 245 Billion in FY23, reflecting a 15.5% YoY growth. This growth drives the adoption of carbon management software, offering enhanced sustainability solutions for businesses. Data centers, which consume significant power, are integrating advanced solutions to monitor and reduce emissions. Telecom operators focusing on green networks require precise tracking of carbon footprints across their operations, including network infrastructure and supply chains. Rising deployment of 5G infrastructure has also intensified the need for sophisticated carbon management tools to manage the environmental impacts of widespread connectivity. Moreover, organizations within this sector are adopting these tools to align their operations with global emission reduction goals. The integration of software with IoT-enabled devices across telecom networks enables real-time monitoring and enhanced reporting capabilities. This approach not only supports compliance with emission standards but also fosters a more sustainable operational environment for IT and telecom companies.

Europe Carbon Management Software Market Analysis

The manufacturing sector has emerged as a major adopter of carbon management software as it aims to mitigate the environmental impact of its operations. According to reports, the EU's industrial production saw an 8.5% growth in 2021 and a further 0.4% increase in 2022, fuelling the demand for carbon management software to support sustainable practices across expanding industries. This growth presents opportunities for software solutions to enhance carbon tracking and efficiency. Industries across various verticals are embracing digital tools to reduce emissions, optimize resource usage, and improve energy efficiency. The increasing adoption of automation and advanced manufacturing techniques has heightened the need for tools capable of monitoring carbon footprints and integrating sustainability metrics into production processes. Additionally, manufacturers are deploying software to manage emissions throughout their supply chains, from raw material sourcing to product delivery. Policies requiring transparency in reporting and reductions in greenhouse gases have made software solutions indispensable for compliance. Advanced analytics integrated into these tools enable manufacturers to identify inefficiencies and develop strategies for emissions reductions. The push for greener and more sustainable manufacturing processes has reinforced the role of carbon management software as a vital resource for industries striving to meet environmental goals.

Latin America Carbon Management Software Market Analysis

In Latin America, the expansion of the mining industry is a key factor driving the adoption of carbon management software. According to International Energy Agency, Latin America, contributing 40% of global copper production, with Chile (27%), Peru (10%), and Mexico (3%) leading, presents significant growth in mining, driving demand for advanced carbon management software to support sustainable practices. As mining activities grow, so too does the environmental impact, particularly in terms of carbon emissions. The mining sector, with its heavy reliance on energy-intensive processes, faces increasing pressure to reduce its carbon footprint in response to global environmental concerns and regulatory changes. Carbon management software offers a valuable solution for tracking, managing, and reducing emissions associated with mining operations. By integrating these tools, mining companies can better monitor their energy consumption, improve resource efficiency, and ensure compliance with both local and international environmental standards. Furthermore, as the sector grows, the ability to demonstrate sustainability and reduce environmental impacts becomes a critical component of business success. This has led to increased adoption of carbon management software to help the industry move toward more sustainable practices.

Middle East and Africa Carbon Management Software Market Analysis

The real estate construction activities and projects in the region are a major driving factor behind the adoption of carbon management software. For instance, with over 5,200 construction projects valued at USD 819 Billion underway in Saudi Arabia, comprising 35% of active GCC projects, the growing real estate sector boosts demand for carbon management software to support sustainability efforts. With a focus on reducing the environmental impacts of large-scale developments, the need for tools that can track and manage emissions is becoming more evident. Construction companies are increasingly recognizing the importance of managing energy use and emissions during the building process. As sustainable construction practices gain traction, software solutions that allow for real-time tracking of carbon emissions, resource consumption, and overall environmental impact are becoming more widely adopted. These tools are also essential for meeting regulatory requirements, ensuring that construction projects comply with environmental standards, and helping firms achieve their sustainability goals.

Top Leading Carbon Management Software Companies:

The carbon management software market is highly competitive, with prominent players leading the industry by offering advanced solutions to track, analyze, and report carbon emissions across various sectors. Startups are emerging with niche offerings tailored to specific industries, intensifying competition. Strategic partnerships, acquisitions, and R&D investments are key strategies employed to gain carbon management software market share. Moreover, the growing demand for real-time analytics, scalability, and compliance with stringent environmental regulations drives innovation. Additionally, regional players focus on localized solutions to meet unique regulatory and business requirements, further diversifying the competitive landscape. For instance, in May 2024, ENGIE partnered with CarbonX to scale permanent carbon removal solutions, reinforcing its leadership in the green transition and commitment to achieving net zero through decarbonization and permanent CO2 removal from the atmosphere.

The report provides a comprehensive analysis of the competitive landscape in the carbon management software market with detailed profiles of all major companies, including:

- ENGIE Impact

- GreenStep Solutions Inc.

- Greenstone+ Ltd.

- Metrix Software Solutions (Pty) Ltd.

- Salesforce Inc.

- SAP SE

- Sphera Solutions Inc.

- Wolters Kluwer N.V.

Latest News and Developments:

- December 2024: SAP has launched SAP Green Ledger, a carbon accounting solution that helps businesses track and report their carbon footprint across products, services, and units. Part of SAP Sustainability solutions, it integrates with financial data to allocate emissions to economic activities. Initially introduced in 2023, the tool is now generally available. SAP aims to enhance sustainability through seamless ERP integration.

- December 2024: Berlin-based startup carbmee has raised approximately USD 21 Million to enhance its carbon management platform and services. Founded in 2021, the company provides AI-powered tools to help organizations manage and report carbon emissions. The funding will support the development of its Environmental Intelligence System (EIS), designed to meet EU carbon regulations.

- June 2024: SCS Consulting Services has partnered with Sustain.Life to launch a carbon accounting and management software, enabling faster climate action. The solution simplifies measuring, managing, and reporting GHG emissions, aligning with global standards like CDP and ISSB. It supports organizations in setting Science-Based Targets, engaging suppliers, and meeting regulatory compliance. This initiative aims to help businesses reduce their carbon footprint effectively and meet investor and customer expectations.

- June 2024: Workiva has introduced Workiva Carbon, a new tool to enhance its ESG and Sustainability Platform, aiding businesses in meeting global climate regulations. The solution supports compliance with frameworks like CSRD and SEC rules while simplifying net-zero target management. Designed to address transparency demands, it aligns with international sustainability guidelines. This launch marks a significant expansion of Workiva’s integrated reporting solutions portfolio.

- March 2024: SLB announced plans to acquire an 80% stake in Aker Carbon Capture, combining their expertise to advance industrial decarbonization. The partnership will integrate complementary technologies and operations to accelerate global carbon capture solutions. Aker will retain a 20% stake, leveraging its commercial products with SLB’s innovation capabilities. This collaboration aims to scale disruptive carbon capture technologies on a proven platform.

Carbon Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Applications Covered | Energy, Greenhouse Gas Management, Air Quality Management, Sustainability |

| Industries Covered | Manufacturing, IT and Telecom, Government Sector, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ENGIE Impact, GreenStep Solutions Inc., Greenstone+ Ltd., Metrix Software Solutions (Pty) Ltd., Salesforce Inc., SAP SE, Sphera Solutions Inc., Wolters Kluwer N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carbon management software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global carbon management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carbon management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global carbon management software market was valued at USD 18.3 Billion in 2025.

IMARC Group estimates the market to reach USD 42.2 Billion by 2034, exhibiting a CAGR of 9.77% during 2026-2034.

Key factors driving the global carbon management software market include increasing regulatory mandates for emission reductions, rising corporate sustainability initiatives, advancements in AI and analytics technologies, and growing awareness of climate change. The demand for accurate carbon tracking and reporting solutions across industries further accelerates the adoption of these tools.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Carbon Management Software market include ENGIE Impact, GreenStep Solutions Inc., Greenstone+ Ltd., Metrix Software Solutions (Pty) Ltd., Salesforce Inc., SAP SE, Sphera Solutions Inc., Wolters Kluwer N.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)