Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2025-2033

Carbon Capture and Storage Market Size and Share:

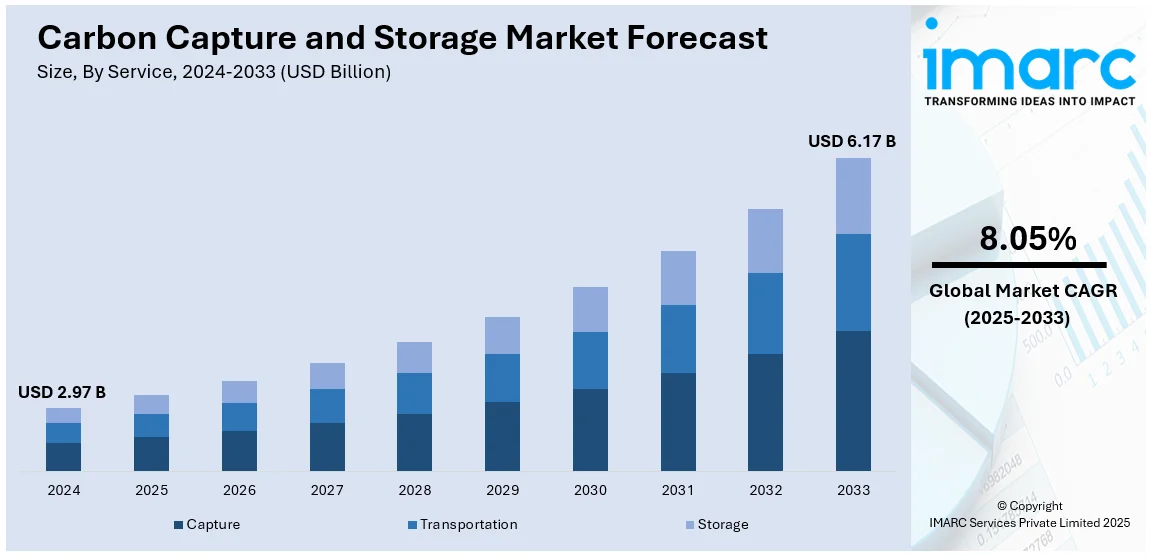

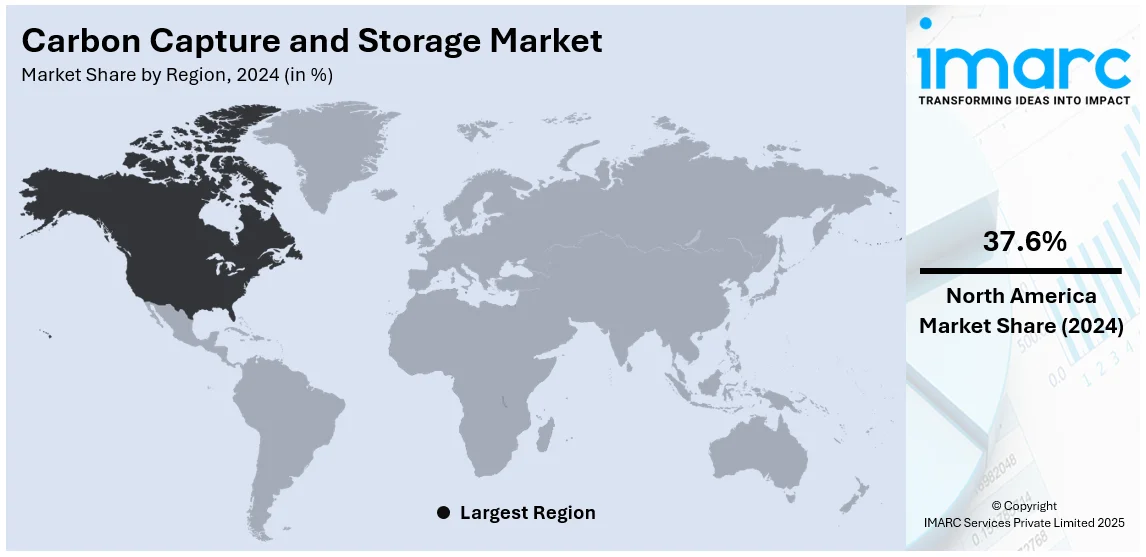

The global carbon capture and storage market size was valued at USD 2.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.17 Billion by 2033, exhibiting a CAGR of 8.05% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.6% in 2024. The market is driven by stringent government regulations, which encompass regulatory objectives and financial incentives, encouraging industries, particularly in the energy and manufacturing sectors, to implement CCS for compliance and emission reduction. The market is witnessing considerable expansion, with numerous market analyses forecasting significant growth in both market size and share, followed by the adoption of post-combustion and direct air capture technologies, with the oil and gas sector being a primary end-use industry. Moreover, the increasing global dedication to reaching net-zero emissions supports ongoing demand, thereby augmenting the carbon capture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.97 Billion |

|

Market Forecast in 2033

|

USD 6.17 Billion |

|

Market Growth Rate (2025-2033)

|

8.05% |

The primary CCS market growth driver is the proactive role of governments implementing stringent policies aimed at reducing greenhouse gas emissions. These measures, including strict regulatory targets and financial incentives, have encouraged industries to adopt CCS technologies to meet compliance requirements. By aligning with these regulations, sectors are not only mitigating environmental impact but also ensuring adherence to the evolving standards dictated by these policies. For instance, in 2025, California Resources Corporation and Carbon TerraVault received approvals for what will be the state's first CCS project in which 100,000 tons a year would be captured at the Elk Hills gas plant permanently in Kern County. Such moves are especially essential in carbon-emitting industries such as energy and manufacturing, wherein emissions need to be reduced dramatically. The increasing global commitment to achieve net-zero emissions, backed by international agreements and national policies, further amplifies the demand for CCS solutions, making it an essential component of strategies to mitigate climate change and ensure environmental sustainability.

The United States is playing a crucial role in advancing the carbon capture and storage market through various policies as well as large-scale investment and technological innovation. Federal initiatives, such as the 45Q tax credit, have financial incentives for projects that capture carbon, thereby inducing further industry expansion. The U.S. Department of Energy has been funding research to increase the efficiency of CCS and lower its costs. The large-scale CCS projects, especially in the energy and industrial sectors, also flaunt leadership for the nation. For instance, in 2024, ExxonMobil won the largest U.S. offshore CO2 storage lease ever issued, on a 271,000-acre site in partnership with the Texas GLO, strengthening its onshore portfolio and the Gulf Coast's leadership in carbon capture and storage. Public and private collaboration further strengthens the CCS ecosystem, making the U.S. a global leader in mitigating carbon emissions and combating climate change.

Carbon Capture and Storage Market Trends:

Rising Focus on Climate Change Mitigation

With increasing focus on mitigation of climate change, the adoption of carbon capture and storage is on the rise. Climate change is widely acknowledged as a critical issue of the 21st century, posing significant risks to ecosystems and human communities through escalating temperatures, severe weather events, and rising sea levels. According to the European Environmental Agency, greenhouse gas (GHG) emissions dropped by 2% in 2022 across the European Union, as compared to 2021 levels as per estimates in their latest ‘Trends and Projections’ report. The European Union has achieved a 31% decrease in net greenhouse gas emissions, including those from international aviation, compared to 1990 levels, all while maintaining economic growth. Amid escalating natural gas costs, greenhouse gas emissions declined by 2% in 2022, largely due to significant reductions in the buildings and industrial sectors. However, emissions from energy supply and transportation experienced an upward trend during the same period. This is expected to fuel the carbon capture and storage market forecast over the coming years.

Significant Technological Advancements

Ongoing innovations in carbon capture and storage (CCS) systems are enhancing their efficiency, affordability, and scalability, driving increased utilization across diverse industrial sectors. For instance, in December 2023, Air Liquide announced to build, own, and operate a world-scale carbon capture unit in the industrial basin of Rotterdam, the Netherlands, leveraging its proprietary Cryocap™ technology. A new facility will be incorporated into the Group's hydrogen production site at the Rotterdam port. This unit will link to Porthos, a leading carbon capture and storage network in Europe, designed to substantially cut CO₂ emissions across this major industrial hub. This further increases demand for carbon capture and storage technology significantly.

Increasing Favorable Government Initiatives to Combat Climate Change

The world is witnessing a growing need to combat climate change and decrease emissions. In this regard, governing agencies of different countries are encouraging the adoption of carbon capture and storage (CCS) by enforcing stringent environmental regulations and carbon pricing mechanisms. For instance, The Ministry of Petroleum and Natural Gas, Government of India (GoI) initiated efforts to provide opportunities for collaboration and knowledge sharing to the industry and prepare a unified and practical strategy for the development and implementation of Carbon Capture, Utilization, and Storage (CCUS)/ Carbon Capture and Storage (CCS) techniques in the oil and gas sector in India. A task force titled ‘Upstream for CCS/CCUS’ (UFCC) to this effect is working to prepare the ‘2030 Roadmap for CCUS’ that shall provide necessary direction and guidelines for all oil and gas companies to develop and scale up CCS/CCUS techniques.

Stringent Government Regulations and Enhanced Oil Recovery (EOR)

The market is experiencing significant growth, primarily driven by escalating government regulations aimed at reducing industrial carbon emissions. India set rules for its compliance carbon market in July 2024 by instituting the Carbon Credit Trading Scheme (CCTS), which mandates emissions intensity targets in nine industrial sectors and ties credit issuance to verified CO₂ reductions. The Bureau of Energy Efficiency (BEE) will issue carbon credit certificates (CCCs), each representing one tonne of CO₂e, and trading on national power exchanges will commence in 2025. Such market-led controls provide a strategic approach for CCS project developers to monetize captured emissions in accordance with India's 2030 decarbonization goals. Stringent climate policies, carbon pricing strategies, and national decarbonization objectives are urging industries to implement CCS technologies to fulfill compliance obligations. Concurrently, the incorporation of CCS into Enhanced Oil Recovery (EOR) processes is enhancing its commercial feasibility, particularly in mature oilfields, by facilitating the injection of captured CO₂ to boost extraction rates while reducing environmental harm. This dual-purpose application is gaining momentum throughout North America and the Middle East. Additionally, swift technological progress is improving capture efficiency, decreasing operational expenses, and allowing for scalability. Innovations in solvent-based, membrane-based, and cryogenic capture technologies are establishing new standards for performance and energy efficiency. Collectively, these advancements are positioning CCS as a vital component in realizing global net-zero goals, thereby accelerating its implementation across energy-intensive industries.

Challenges and Opportunities in the Carbon Capture and Storage Market:

The market encounters a number of major issues, such as high cost of operation and capital, limited infrastructure for massive deployment, and regulatory complexities between regions. Furthermore, social concerns regarding the long-term safety and environmental hazards of storing CO₂ underground also deter widespread adoption. In addition to this, technical challenges in capturing emissions from various industrial processes and investment requirements in pipeline and storage networks also pose significant barriers. In spite of such restraints, the market presents significant opportunities fueled by increasing global pressure to achieve net-zero emissions and reduce climate change. Besides, government policies, technological breakthroughs, and strategic partnerships among industry players are increasing the viability and scalability of projects. The growth in carbon credit mechanisms and growing corporate commitments towards decarbonizing are also spurring market growth. With CCS becoming a core component of climate policy architectures, especially in high-carbon industries, it has great potential to become a key driver of sustainable industrial transition.

Carbon Capture and Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carbon capture and storage market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, technology, and end use industry.

Analysis by Service:

- Capture

- Transportation

- Storage

Capture stand as the largest service in 2024. Capture is the primary step of the CCS process responsible for capturing industrial sources of CO2 emissions before releasing them into the atmosphere. At this stage, various capture technologies are implemented as per the industrial source, for example, a power plant, cement factory, or refinery. There are essentially three types of capture technologies-post-combustion, pre-combustion, and oxy-fuel combustion. The capture process is important in reducing emissions at the source and acts as a foundation for further transport and storage stages in the value chain. For example, in February 2023, India intends to unveil a carbon capture policy that will help address its increasing emissions while still exploiting its vast coal resources. The policy, to be launched later in the year, will offer incentive schemes for corporations to trap their emissions, recycle them, and store them beneath the earth's surface. Further, this continues to drive market share in carbon capture and storage.

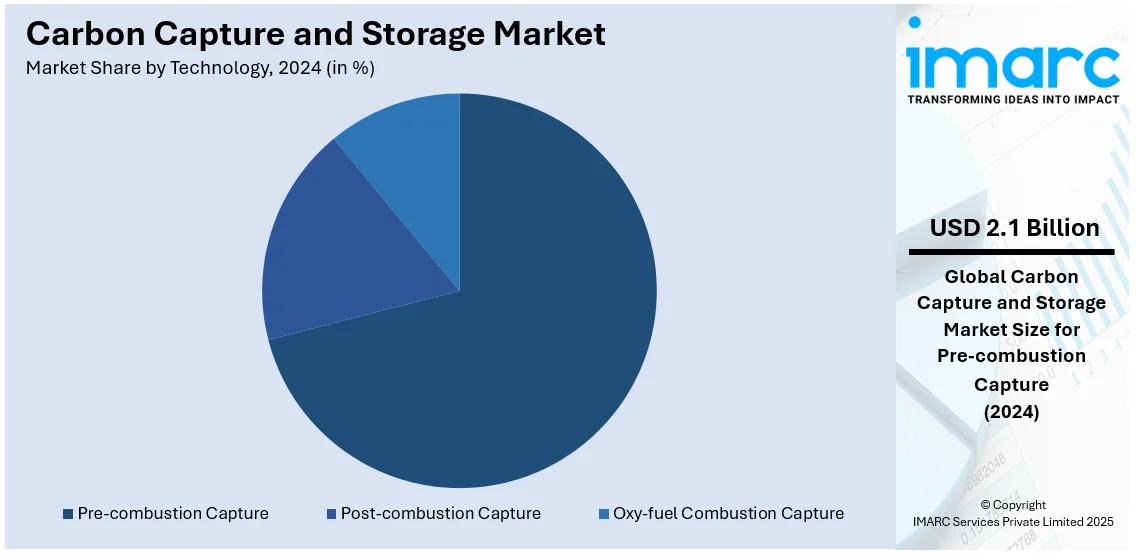

Analysis by Technology:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

Pre-combustion leads the market with around 70.8% of market share in 2024. Pre-combustion capture is a carbon capture technology that targets CO2 emissions before the combustion of fossil fuels. This process is primarily employed in power plants and certain industrial facilities, particularly those using natural gas or coal. In addition, pre-combustion capture offers various advantages, such as it can generate a cleaner fuel while capturing CO2 before it is emitted. Apart from this, continuous research and development (R&D) efforts are focused on enhancing the efficiency and cost-effectiveness of pre-combustion capture, which offers a positive carbon capture and storage market outlook.

Analysis by End Use Industry:

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

Oil and gas is the leading market in 2024, driven by its critical role in addressing greenhouse gas (GHG) emissions. The industry is one of the biggest emitters of carbon dioxide (CO2), through the extraction, processing, and consumption of fossil fuels. The CCS technologies play a crucial role in reducing the environmental impact of these operations by capturing and storing CO2 before it enters the atmosphere. The oil and gas sector integrates CCS solutions, and this way contributes to the reduction of emissions while allowing sustainable resource use. Therefore, the carbon footprint reduction and responsible practice adoption by the industry are the main factors motivating the increasing interest of consumers in CCS technologies within this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.6%. North America holds the largest market share because of the rising focus on dealing with climate change. In tandem with this, the increasing advancement in these techniques is fueling the growth of the market in the region. In addition to this, the increasing adoption of CCS due to favorable regulatory frameworks is contributing to the growth of the market. Besides, the abundant suitable geological formations that can be used as suitable structural settings for storing CO2 in depleted oil and gas fields and saline aquifers supports the growth of the market in the region. The revenue of the carbon capture and storage industry in the area is further driven by the escalating impact of fossil fuel emissions on global warming. In June 2023, numerous initiatives were launched across Los Angeles County to extract carbon dioxide from the atmosphere. These efforts aim to position Southern California as a frontrunner in global climate resilience and adaptation strategies.

Key Regional Takeaways:

United States Carbon Capture and Storage Market Analysis

US accounts for 82.2% of the market share in the North America. The United States' carbon capture and storage (CCS) market is expanding due to several key factors. Government policies play a significant role, with legislation like the Inflation Reduction Act of 2022 enhancing tax credits for CCS projects. In line with this, the rising focus on carbon capture and storage due to infrastructure investments is propelling the carbon capture and storage market growth. In line with this, economic incentives also drive the market, particularly through enhanced oil recovery (EOR) techniques. Captured CO₂ is injected into declining oil fields to boost production, providing a revenue stream that offsets CCS implementation costs. Additionally, environmental concerns are another catalyst. As industrial activities continue to emit substantial CO₂, CCS offers a method to reduce greenhouse gas emissions, aligning with global climate goals and addressing the pressing issue of climate change. The Nature Conservancy reports that the average carbon footprint per individual in the United States stands at 16 tons, ranking among the highest globally. Apart from this, technological advancements are improving the efficiency and reducing the costs of carbon capture, making it a more viable option for industries aiming to lower their carbon footprint. These developments enhance the appeal of CCS as a practical solution for emission reduction.

Asia Pacific Carbon Capture and Storage Market Analysis

The Asia Pacific carbon capture and storage (CCS) market is expanding due to several key factors. Government policies are pivotal, with nations like Indonesia streamlining regulations to attract investment in CCS projects, aiming to utilize vast storage capacities in saline aquifers and depleted oil and gas reservoirs. In line with this, economic incentives also play a significant role. Enhanced oil recovery (EOR) techniques, which inject captured CO₂ into declining oil fields to boost production, provide a revenue stream that offsets CCS implementation costs. This method is particularly relevant in regions with mature oil and gas industries. Moreover, environmental concerns are driving the market as well. The Asia Pacific region is a significant emitter of CO₂ because of its growing population, which is thereby encouraging it to adopt CCS as a viable solution to reduce greenhouse gas emissions and meet international climate commitments. As per the CEIC, the population of India reached 1,395.0 Million in March 2024. Moreover, advancements in technology are enhancing the effectiveness of carbon capture while simultaneously lowering its expenses, making it a more practical solution for industries striving to reduce their environmental impact. These developments are enhancing the appeal of CCS as a practical solution for emission reduction. In addition, public-private partnerships further bolster the market. Collaborations between government agencies and private companies facilitate the development and deployment of CCS projects, combining resources and expertise to advance the technology.

Europe Carbon Capture and Storage Market Analysis

Governing agencies in the region are implementing policies which are targeting carbon neutrality. To achieve these goals, the EU aims to capture and store up to 450 Million tonnes of CO₂ annually by 2050, according to a draft European Commission Plan. Economic incentives are also driving the market. The EU is allocating substantial funding to support CCS projects, recognizing their potential to decarbonize hard-to-abate industries. For instance, the Net-Zero Industry Act aims to incentivize clean tech investments, promising benefits like streamlined bureaucracy and quicker project approvals. In addition, CCS technology is considered essential for reducing greenhouse gas emissions, particularly in sectors where direct emission reductions are challenging. The Intergovernmental Panel on Climate Change (IPCC) is emphasizing that carbon capture and storage is a critical decarbonization strategy in most mitigation pathways. Apart from this, technological advancements are improving the efficiency and reducing the costs of carbon capture, making it a more viable option for industries aiming to lower their carbon footprint. These developments enhance the appeal of CCS as a practical solution for emission reduction. Furthermore, public-private partnerships further bolster the market. Collaborations between government agencies and private companies facilitate the development and deployment of CCS projects, combining resources and expertise to advance the technology.

Latin America Carbon Capture and Storage Market Analysis

The Latin American CCS market is experiencing notable developments. Several countries in the region are implementing carbon pricing instruments, such as emissions trading systems and carbon taxes, to incentivize emission reductions. This regulatory momentum is fostering a conducive environment for CCS initiatives. Additionally, the region's abundant natural resources and existing energy infrastructure position it favorably for CCS deployment. According to the United Nations, the region holds nearly 20% of global oil reserves, over 25% of reserves for specific strategic metals, and more than 30% of the world's primary forests. Natural-resource-based industries contribute 12% to added value, 16% to employment, and 50% to the region's exports. Besides this, the emergence of sophisticated carbon trading platforms across Latin America holds the potential to generate substantial income, aligning with the surge in global earnings from carbon pricing initiatives. In addition, the region's dedication to sustainable progress and adherence to international climate commitments is fostering growing attention and investments in carbon capture and storage (CCS) technologies.

Middle East and Africa Carbon Capture and Storage Market Analysis

The Middle East and Africa (MEA) region is witnessing significant developments in the CCS market. In Saudi Arabia, Aramco, in collaboration with SLB and Linde, is constructing a CCS project in Jubail, aiming to capture and store up to 9 Million metric Tons of CO₂ annually by 2027. Moreover, Qatar is advancing its CCS initiatives by highly investing in CCS projects. These initiatives underscore the MEA region's commitment to integrating CCS technologies to reduce industrial carbon emissions and support global climate objectives. According to the Ember, carbon intensity in the Middle East countries is high, with an average of 658g CO2 per kWh in 2023.

Competitive Landscape:

The competitive landscape of the carbon capture and storage (CCS) market is characterized by a mix of established companies and innovative startups, driving technological advancements and project deployment. Key players leverage extensive resources and expertise to implement large-scale CCS projects. For instance, in 2024, Shell Canada approved the Polaris project at Scotford, Alberta, designed to capture 650,000 tonnes of CO2 annually from its refinery and chemicals complex, advancing carbon capture efforts. Emerging firms contribute through specialized technologies, enhancing capture efficiency and cost-effectiveness. Strategic collaborations between governments, private companies, and research institutions play a significant role in market expansion. Geographic competition intensifies as regions like North America, Europe, and Asia-Pacific prioritize emissions reduction, further diversifying the market with advancements in storage capacity, transport infrastructure, and regulatory compliance.

The report provides a comprehensive analysis of the competitive landscape in the carbon capture and storage market with detailed profiles of all major companies, including:

- Air Liquide S.A.

- Aker Solutions ASA

- Baker Hughes Company

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton Company

- Honeywell International Inc.

- Linde plc

- Mitsubishi Heavy Industries Ltd.

- NRG Energy Inc.

- Occidental Petroleum Corporation

- Schlumberger Limited

- Shell plc

- Siemens AG

Latest News and Developments:

- June 2025: Norway officially launched the Longship flagship carbon capture and storage initiative, marking the first full-scale value chain that captures CO₂ from industrial sources and stores it beneath the North Sea. The project, which began with CO₂ shipments from Heidelberg’s Brevik cement plant, will initially sequester 400,000 tonnes annually and expand through the Hafslund Celsio incineration plant to reach 750,000 tonnes by 2029. Funded at approximately NOK 34 Billion (about USD 3.36 Billion), Longship is designed as a scalable European infrastructure under the Northern Lights consortium, aligning with IPCC-endorsed strategies to decarbonize hard-to-abate sectors.

- May 2025: Wärtsilä launched its commercial carbon capture product for ships following a successful full-scale deployment on the Clipper Eris of Solvang ASA, which reduced CO₂ emissions from exhaust gases by up to 70%. According to the IMO's decarbonization targets for 2050, the system can be adapted to multiple marine fuels and used for both retrofitting vessels and newbuilds, with an estimated capture cost ranging from €50 to €70 (approximately USD 57.89 to USD 81.06) per tonne. This scalable technology is enhancing the application of carbon capture and storage (CCS) in the shipping industry by offering shipowners a viable solution for meeting compliance requirements and reducing emissions.

- April 2025: Mitsubishi Shipbuilding Co., part of Mitsubishi Heavy Industries Group, received Approval in Principle (AiP) from Nippon Kaiji Kyokai for its Onboard Carbon Capture and Storage system (OCCS), marking a major step in maritime CO₂ mitigation. The OCCS, derived from MHI’s onshore CO₂ capture technology, is capable of capturing, liquefying, and storing ship exhaust CO₂, signaling rapid progress toward decarbonizing global shipping. With this approval, MHI will now accelerate development efforts to commercialize the system and contribute significantly to the maritime industry’s decarbonization.

- March 2024 SLB announced an agreement to combine its carbon capture business with Aker Carbon Capture (ACC) to support accelerated industrial decarbonization at scale. Bringing together complementary technology portfolios, leading process design expertise and an established project delivery platform, the combination will leverage ACC’s commercial carbon capture product offering and SLB’s new technology developments and industrialization capability.

- June 2023: Technip Energies (T.EN) introduced Capture.Now, a comprehensive platform designed to centralize its Carbon Capture, Utilization, and Storage (CCUS) technologies and offerings. Expanding on this initiative to strengthen its position in the CCUS sector, T.EN has also unveiled Canopy by T.EN, a versatile suite of modular and adaptable post-combustion carbon capture solutions.

- June 2023: PETRONAS entered into a development agreement with TotalEnergies Carbon Neutrality Ventures (TotalEnergies) and Mitsui & Co. Ltd. (Mitsui) to collaboratively advance a CCS initiative in Malaysia. The agreement encompasses various facets of CCS development, including assessing and advancing depleted fields and saline aquifers for storage, identifying prospective clients, and setting up the required legal and commercial structures.

- March 2023: Carbfix Iceland announced the commencement of its pilot CCS facility at ON Power’s geothermal power station in Nesjavellir, Iceland. This launch builds on extensive research and development conducted under the EU Horizon2020 project GECO, which focused on enhancing Carbfix’s technology. The pilot site is designed to be portable, enabling deployment at various locations for upcoming pilot initiatives.

Carbon Capture and Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End Use Industries Covered | Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Chemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A., Aker Solutions ASA, Baker Hughes Company, Exxon Mobil Corporation, Fluor Corporation, General Electric Company, Halliburton Company, Honeywell International Inc., Linde plc, Mitsubishi Heavy Industries Ltd., NRG Energy Inc., Occidental Petroleum Corporation, Schlumberger Limited, Shell plc, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carbon capture and storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global carbon capture and storage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carbon capture and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carbon capture and storage market was valued at USD 2.97 Billion in 2024.

IMARC estimates the carbon capture and storage market to exhibit a CAGR of 8.05% during 2025-2033.

The carbon capture and storage (CCS) market is driven by stringent government regulations on emissions, increased investment in clean technologies, advancements in CCS technology, and growing demand for sustainable energy. Rising industrial emissions, corporate sustainability goals, and financial incentives for emission reductions further bolster the adoption of CCS solutions globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the carbon capture and storage market include Air Liquide S.A., Aker Solutions ASA, Baker Hughes Company, Exxon Mobil Corporation, Fluor Corporation, General Electric Company, Halliburton Company, Honeywell International Inc., Linde plc, Mitsubishi Heavy Industries Ltd., NRG Energy Inc., Occidental Petroleum Corporation, Schlumberger Limited, Shell plc, Siemens AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)