Caravan and Motorhome Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Caravan and Motorhome Market Size and Share:

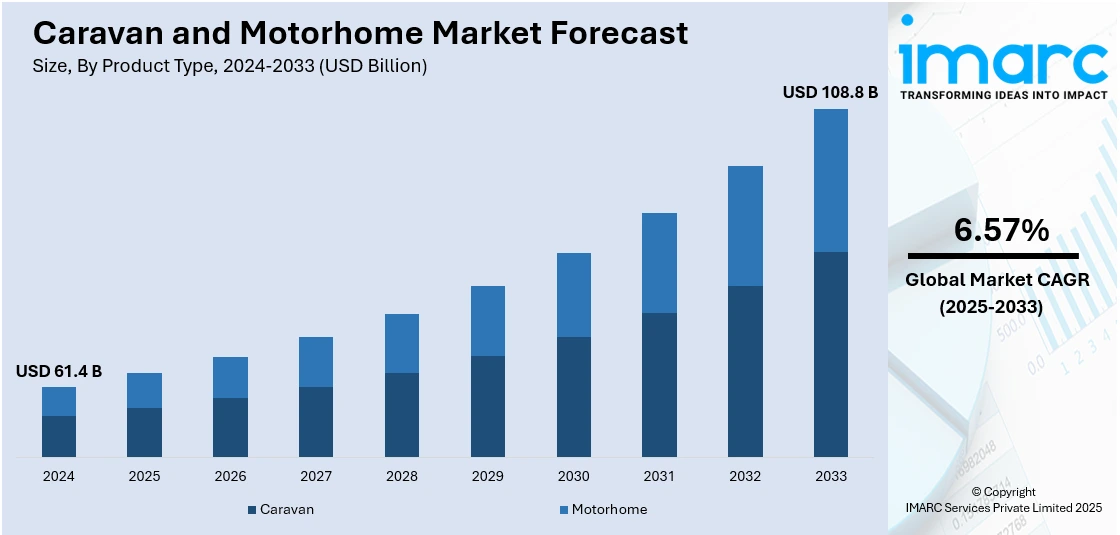

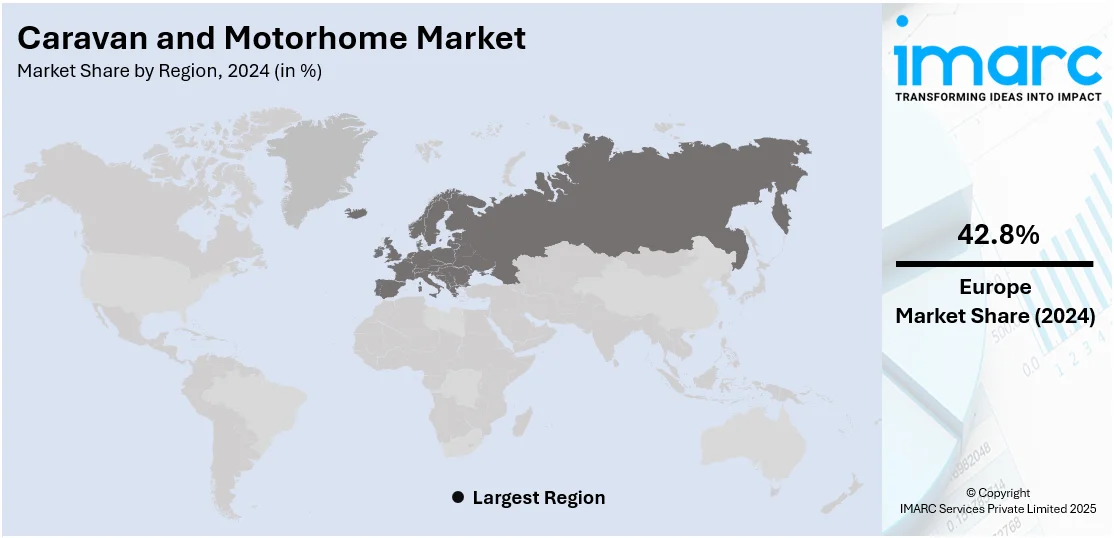

The global caravan and motorhome market size was valued at USD 61.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 108.8 Billion by 2033, exhibiting a CAGR of 6.57% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 42.8% in 2024. The growing popularity of outdoor and adventure tourism, demand for leisure and adventure travel among individuals across the globe, rising preference for staycations among the masses, and increasing popularity of retirement travel are some of the major factors propelling the market across the European region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.4 Billion |

| Market Forecast in 2033 | USD 108.8 Billion |

| Market Growth Rate 2025-2033 | 6.57% |

The growing popularity of road trips and outdoor leisure, which provide flexibility and freedom in travel, is one of the factors propelling the expansion of the global caravan and motorhome market. A wider range of consumers may now afford these cars because to rising disposable incomes, especially in developed areas. Furthermore, improvements in fuel economy, design, and technology make caravans and motorhomes more appealing and more comfortable for extended travel. Demand is also being driven by the tourist and staycation trends, as more people choose private and secure holiday options. As per the World Travel & Tourism Council (WTTC), 2024 is forecasted to be a record-breaking year for global travel and tourism, with its global economic revenue expected to hit a record USD 11.1 Trillion. Furthermore, improving infrastructure and amenities for road travelers support this growth.

The United States has become one of the major regional markets for motorhomes and caravans. The market is mostly driven by consumers' desire for more flexible and independent travel options, which has led to an increase in the popularity of road trips and outdoor recreation. These automobiles are becoming more accessible and desirable due to shifting consumer lifestyles and rising disposable incomes. Demand in the industry has also increased due to improvements in motorhome and caravan design, such as increased comfort, technological integration, and fuel efficiency. Interest in caravans and motorhomes as convenient, safe, and reasonably priced vacation options has increased as a result of the rise in staycations and travel. According to the World Travel & Tourism Council (WTTC), the tourism industry in the United States is expected to employ 18.8 million individuals nationwide, constituting 9% of the overall economy of the country in 2024. Besides this, expanding camping infrastructure also supports market growth.

Caravan and Motorhome Market Trends:

Rising demand for leisure and adventure travel

There is a rise in the demand for caravans and motorhomes due to the increasing preference for leisure and adventure travel among the masses across the globe. According to the Bureau of Labor Statistics, during the COVID-19 pandemic in 2020, individuals aged 15 and older spent an additional 32 minutes daily on leisure and sports activities. In addition, individuals are increasingly seeking enhanced experiences to explore new destinations around the world. Caravans and motorhomes offer a unique way to satisfy the desire of individuals by providing the freedom to travel by their own choice and choose diverse and off-the-beaten-path locations. In line with this, these vehicles enable travelers to connect with nature, experience the great outdoors, and engage in several activities, such as camping, hiking, trekking, and fishing worldwide.

Increasing preference for staycations

There is an increase in the preference for staycations among the masses around the world. A study by Texas A&M's Department of Hospitality, Hotel Management, and Tourism suggests that staycations are likely to become a permanent part of the "new normal" in the post-pandemic era. Individuals are seeking options that minimize travel-related stress and expenses. In addition, caravans and motorhomes offer an enhanced solution for local exploration and leisure activities among individuals. Apart from this, staycations allow individuals to rediscover their own surroundings, visit nearby attractions, and spend quality time with family and friends without the need for expensive flights or accommodations, which is offering a positive market outlook. In line with this, caravans and motorhomes facilitate these experiences by providing comfortable living quarters and the convenience of home while on the move.

Growing popularity of retirement travel

The aging population is increasingly preferring caravans and motorhomes for traveling and spending quality time with friends, families, and colleagues. According to the United Nations, the proportion of individuals aged 65 and older is growing more rapidly than that of younger age groups. As a result, the percentage of the global population aged 65 and above is projected to increase from 10% in 2022 to 16% by 2050. As individuals approach retirement, they generally seek new ways to enjoy their leisure time and explore different places. In addition, caravans and motorhomes cater to the needs of retirees who want to lead an active lifestyle during their old age. These vehicles offer a sense of independence and allow retirees to extend road trips and adventures. Apart from this, the retired population is increasingly preferring caravans and motorhomes, as they provide enhanced convenience and comfort. Furthermore, they seek mobile homes to travel and spend their leisure time exploring different places, which is positively influencing the market.

Caravan and Motorhome Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global caravan and motorhome market, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product type and end user.

Analysis by Product Type:

- Caravan

- Travel Trailers

- Fifth-Wheel Trailers

- Folding Camp Trailers

- Truck Campers

- Motorhome

- Type A

- Type B

- Type C

Motorhome stands as the largest component in 2024, holding around 65.0% of the market share. Motorhomes, also known as motorcoaches, are self-propelled recreational vehicles that combine both transportation and living quarters in a single unit. They are fully integrated vehicles with an engine that allows travelers to drive and live in the same vehicle without the need for towing. In addition, they are widely available in various classes to attract a wide consumer base. Motorhomes are popular among adventurers and those seeking a more seamless and independent travel experience, as they offer the convenience of all-in-one mobility and living amenities.

Caravans, also known as camper trailers, are towable recreational vehicles that are designed to be hitched to a car or truck during travel. They are standalone units without an engine and rely on a towing vehicle for mobility. In addition, caravans are popular among travelers who prefer the flexibility of detaching their living quarters from the vehicle while exploring various destinations.

Analysis by End User:

- Direct buyers

- Fleet Owners

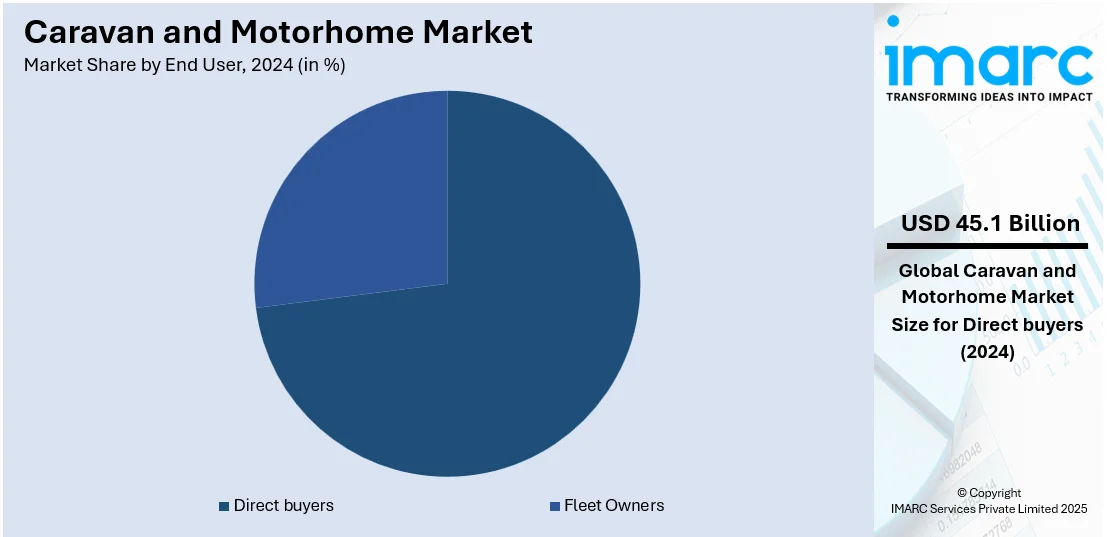

Direct buyers lead the market with around 73.4% of the market share in 2024. Direct buyers refer to individual consumers who purchase caravans or motorhomes for personal use. These buyers are generally individuals, families, or groups of friends who are interested in recreational travel and leisure experiences. They may use the vehicles for family vacations, weekend getaways, extended road trips, or outdoor adventures. Caravans and motorhomes provide and allow buyers to explore different destinations while having the convenience of their own accommodations on the road. The rising adoption of caravans and motorhomes among direct buyers is propelling the growth of the market as they seek alternative and experiential ways of traveling.

Fleet owners refer to businesses or individuals who own multiple caravans or motorhomes and rent them out as part of a rental or hire fleet. In line with this, these fleet operators cater to travelers who prefer renting recreational vehicles rather than owning them.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 42.8%. Europe held the biggest market share due to the presence of a well-developed network of campgrounds and caravan parks. In addition, the rising adoption of caravans and motorhomes, as the region has attractive spots to visit and park the vehicle, is contributing to the growth of the market. Apart from this, the increasing preference for eco-friendly and sustainable travel options among individuals is propelling the growth of the market. In line with this, the rising demand for caravans and motorhomes due to the presence of well-established recreational vehicle manufacturers is bolstering the growth of the market in Europe.

Key Regional Takeaways:

United States Caravan and Motorhome Market Analysis

In 2024, the United States accounts for 88.10% of the caravan and motorhome market in North America. The caravan and motorhome market in the United States is growing rapidly, primarily due to the increased demand for recreational vehicles due to changing lifestyle preferences and an increasing interest in outdoor activities. According to IBIS World, in 2023, there were 701 recreational vehicle manufacturing businesses in the United States, reflecting a 2.5% increase from 2022, indicating the sector's robust expansion. The trend is observed as more and more people are moving toward domestic travel and staycations. Therefore, the growth in the market is attributed to the popularity of RVs and motorhomes due to their safety and cost-effectiveness regarding accommodation. Besides this, increasing disposable income and a desire for luxury and convenience further drives this market. The growing consumer interest is also attributed to the technological innovations in RV manufacturing, including increased fuel efficiency, smart integration, and comfort features. Market growth in the United States is further encouraged by the aging population of baby boomers seeking retirement solutions that offer mobility and freedom. Access to financing options and rental services adds to the overall market momentum as consumers are able to obtain RVs and motorhomes.

Asia Pacific Caravan and Motorhome Market Analysis

The caravan and motorhome market in Asia-Pacific has recorded an impressive increase lately due to rising disposable incomes and growing propensity for regional and domestic tourism. Long established in the markets, both Australia and Japan are seeing growing demand for caravans and camp sites. The growing middle class, buoyed by increasing economic conditions in emerging markets such as China and India, is boosting interest in motorhomes and caravans, particularly due to the increased access to leisure travel. Growth in regional awareness about the advantages offered by RV tourism in flexibility, affordability, and visiting regions not accessible through traditional routes also promotes growth in the market. Furthermore, the network of campsites and national parks that is expanding in countries such as Australia and Japan simplify access to natural attractions by RV travelers. As per the Australian Trade and Investment Commission, Australians took 15.3 million caravan and camping trips, including glamping, during the year ending 2023, reflecting growth in the appeal of mobile accommodation options. As consumers in the region increasingly opt for self-contained, flexible travel options, the caravan and motorhome market is likely to continue growing in the coming years.

Europe Caravan and Motorhome Market Analysis

The caravan and motorhome market in Europe is experiencing robust growth, driven by a rising demand for sustainable and flexible travel experiences. With a strong cultural affinity for camping and outdoor activities, Europe has a well-established network of campsites and touring destinations, further supporting the caravan and motorhome lifestyle. By the end of 2022, Europe had managed to record over 6.3 Million caravans and motorhomes, registering a record-high increase since it hit 5.2 Million five years earlier. In addition, many people are now opting for eco-friendly RVs. This trend is driven by the increasing level of environmental consciousness. Following the COVID pandemic, the world witnessed a shift in self-contained travel options due to a quest for safe, private, and socially distanced vacation alternatives. Economic recovery and rising disposable incomes, particularly in Western and Northern Europe, further drives the market growth. Furthermore, government incentives and subsidies are encouraging the adoption of eco-friendly vehicles, particularly electric and hybrid models. With growing demands in sustainability and flexibility for traveling, the European caravan and motorhome market is expected to keep growing.

Latin America Caravan and Motorhome Market Analysis

In Latin America, particularly countries such as Brazil and Argentina, the market for caravan and motorhome is driven by the increasing interest in road trips and mobile tourism. In the last ten years, over 50% of the population of the region entered the middle class, as cited by the World Bank, hence the rise in disposable income and leisure activities such as caravan and motorhome travels. The increasing road networks and beautiful routes of travel make RV tourism more accessible and attractive. In addition, increased domestic tourism is prompting consumers to seek flexible options of traveling to remote destinations at their own pace. As more people take to self-sufficiency and adventure in their travels, caravan and motorhome demand is expected to rise across the region.

Middle East and Africa Caravan and Motorhome Market Analysis

The caravan and motorhome market in the Middle East and Africa is driven by the increase in disposable incomes and growing interest for luxury travel experiences. In the UAE, for example, the increasing outdoor tourism industry and a rising number of high-net-worth individuals are driving demand for premium motorhomes and caravans. This was also a boost to the economy as according to UAE Ministry of Economy, 2022 showed that Travel and Tourism sector directly contributed approximately USD 45 Billion of the GDP for the UAE, which is nearly 9% of total GDP while International tourists spend USD 32 Billion, which justifies the need for increasing investment in tourism. Growing road infrastructure coupled with other conditions such as a favorable climate across locations, encourages off-road trips. The hotel industry in 2022 in the UAE also recorded growth, with 1,189 hotels and in total 203,000 hotel rooms supporting the increase in tourism-related activities. In addition, there is growing interest in mobile accommodation, particularly by those requiring comfort and flexibility while moving to remote areas, particularly as local governments promote these activities.

Competitive Landscape:

Key players in the global caravan and motorhome market are driving growth through a variety of strategies. Manufacturers are investing in innovative designs, incorporating advanced technology such as energy-efficient systems, smart home features, and solar power integration to attract eco-conscious consumers. Companies are also focusing on enhancing comfort, durability, and convenience, offering customizable features that cater to diverse customer preferences. Additionally, expanding production capacities and improving supply chain management have enabled companies to meet the growing demand. Partnerships with rental platforms and the introduction of flexible financing options have made caravans and motorhomes more accessible. Moreover, players are utilizing digital marketing to raise awareness, promote road-trip culture, and emphasize the benefits of self-sufficient travel, effectively broadening market reach and appealing to a wider consumer base.

The report provides a comprehensive analysis of the competitive landscape in the caravan and motorhome market with detailed profiles of all major companies, including:

- Bürstner GmbH & Co. KG (Thor Industries Inc.)

- Dethleffs GmbH & Co. KG

- Forest River Inc. (Berkshire Hathaway Inc.)

- Knaus Tabbert AG

- Swift Group Limited

- Triple E Recreational Vehicles

- Winnebago Industries Inc.

Latest News and Developments:

- October 2024: German motorhome rental platform FreewayCamper raised EUR 4 Million (~USD 4.2 Million) in a two-tranche investment round. The funding came from existing shareholders, including Rockaway Capital, Nomiverse, SEK Ventures, and Miton. FreewayCamper plans to use the funds for product development, expanding its partner network, and launching new services to enhance the RV rental experience for its customers.

- April 2024: Grand Design RV announced its entry into the motorized RV market with the upcoming launch of the Lineage Class C motorhome in July. This will be the company’s first motorized product. The Lineage name reflects the brand’s strong foundation and commitment to being both dealer-centric and customer-focused. The company aims to bring the same quality, innovation, and service from its towable products to the new motorized segment, with further expansion planned.

Caravan and Motorhome Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered | Direct Buyers, Fleet Owners |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bürstner GmbH & Co. KG (Thor Industries Inc.), Dethleffs GmbH & Co. KG, Forest River Inc. (Berkshire Hathaway Inc.), Knaus Tabbert AG, Swift Group Limited, Triple E Recreational Vehicles, Winnebago Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the caravan and motorhome market from 2019-2033.

- The caravan and motorhome market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the caravan and motorhome industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A caravan is a towable vehicle used for traveling and camping, equipped with living spaces such as beds, kitchenettes, and bathrooms. A motorhome, on the other hand, is a self-propelled vehicle that combines transportation and living quarters, offering similar amenities but without the need for towing. Both provide mobile accommodation.

The global caravan and motorhome market was valued at USD 61.4 Billion in 2024.

IMARC estimates the global caravan and motorhome market to exhibit a CAGR of 6.57% during 2025-2033.

The increasing demand for flexible and self-sufficient travel options, growth in domestic tourism and staycation trends, rising interest in outdoor activities and road trips, advancements in vehicle design and technology, and greater availability of rental options and RV-sharing platforms are the primary factors driving the global caravan and motorhome market.

According to the report, motorhome represented the largest segment by product type due to their self-contained nature, offering both transportation and living space in one vehicle.

Direct buyers lead the market by end user due to their preference for ownership, offering long-term cost efficiency and freedom for travel.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global caravan and motorhome market include Bürstner GmbH & Co. KG (Thor Industries Inc.), Dethleffs GmbH & Co. KG, Forest River Inc. (Berkshire Hathaway Inc.), Knaus Tabbert AG, Swift Group Limited, Triple E Recreational Vehicles, Winnebago Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)