Car Sharing Market Size, Share, Trends and Forecast by Car Type, Business Model, Application and Region, 2025-2033

Car Sharing Market 2024, Size and Trends:

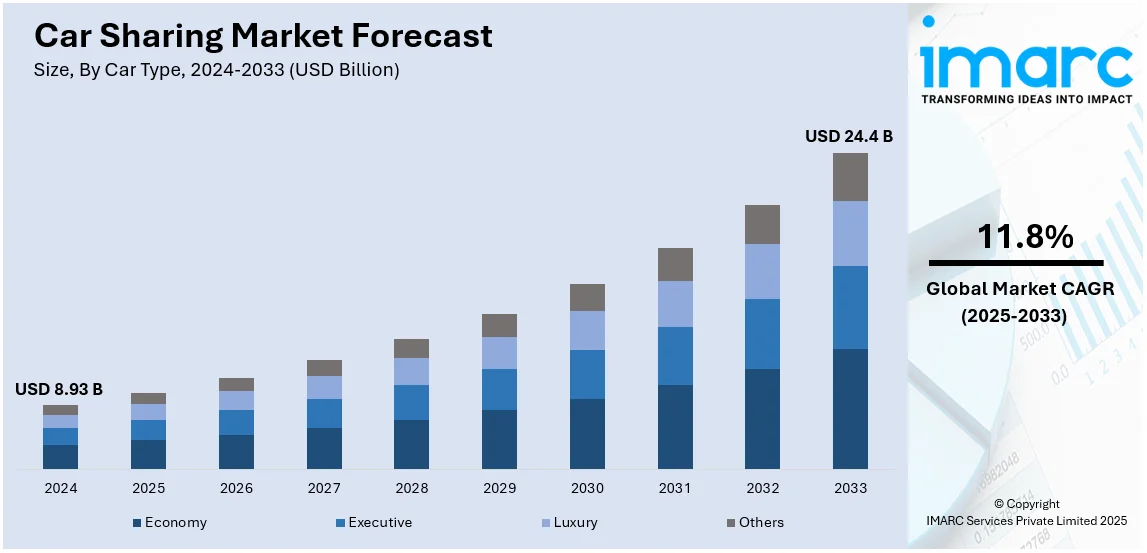

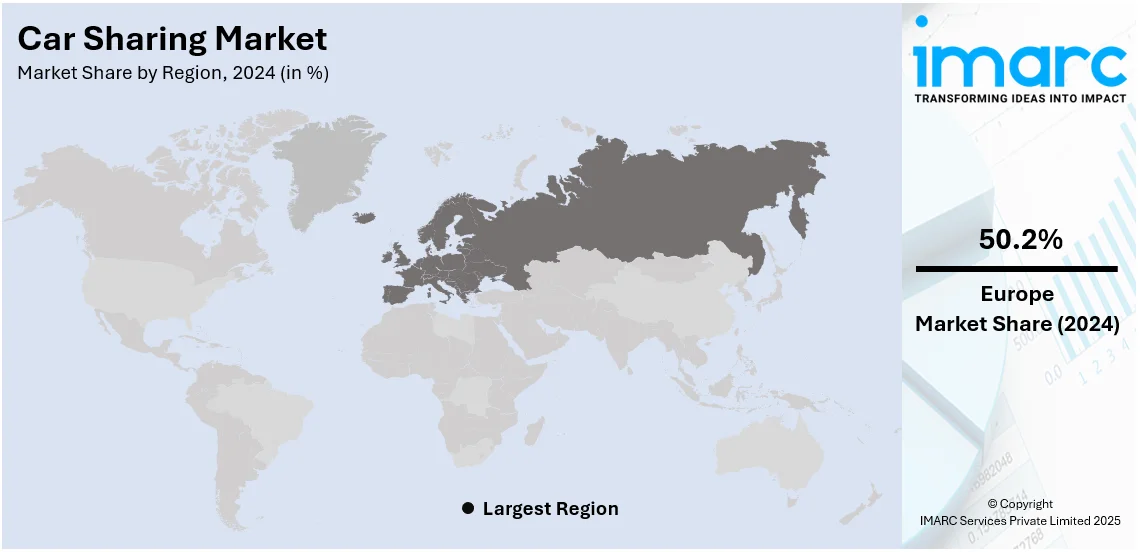

The global car sharing market size was valued at USD 8.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.4 Billion by 2033, exhibiting a CAGR of 11.8% from 2025-2033. Europe currently dominates the market, holding a market share of over 50.2% in 2024. The increasing consumer preference for alternative modes of transportation that are convenient and cost-effective, urbanization, rising environmental awareness, and government support for reducing traffic congestion and emissions are some of the key factors bolstering the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.93 Billion |

|

Market Forecast in 2033

|

USD 24.4 Billion |

| Market Growth Rate (2025-2033) | 11.8% |

Environmental concerns and supportive government policies are key drivers for the growth of the car sharing market. Car-sharing services help in achieving environmental sustainability through the reduction of privately owned vehicles, which reduces greenhouse gas emissions and reduces urban congestion. Governments worldwide are implementing policies and incentives to encourage car sharing to achieve environmental goals. The integration of shared mobility options in public transportation systems across the United States is also facilitated by federal funding programs that aim at enhancing accessibility and minimizing dependence on private cars. More so, some states have tax credits for employers to encourage car sharing among their employees, hence encouraging more uptake of shared mobility solutions. The environmental benefits paired with government support create a friendly environment for the growth of car-sharing services, satisfying wider goals of sustainable urban development and a reduced carbon footprint.

The U.S. car sharing market is emerging as a major disruptor, holding 80.00% of the total share. This market is growing because of urbanization, environmental awareness, and support policies. Because of population growth in the cities, it poses significant challenges like traffic congestion and parking availability. This service is quite helpful because car-sharing can be taken for short time periods on flexible and economic terms as a mode of vehicle ownership for millennial and Gen Z customers. Technological advancements, such as app-based booking, GPS tracking, and remote vehicle access, are making these services more accessible and user-friendly. Moreover, concern for the environment is creating pressure on consumers and policy makers to make sustainable modes of transportation. Electric vehicle integration into car-sharing fleets is on the rise, while federal and state incentives are prompting low-emission vehicle adoption. According to recent reports, greenhouse gas emissions can decrease by as much as 34% in urban areas if shared mobility services replace personal car ownership.

Car Sharing Market Trends:

Growing Integration of EVs

One of the significant trends in the market is the widespread adoption of electric vehicles. As environmental awareness continues to rise and regulations regarding emissions levels become stringent, various car sharing companies across countries are widely adopting EVs that appeal to eco-friendly individuals. For instance, in September 2023, Autonomy, one of the electric vehicle subscription companies, and the leading all-electric vehicle car-sharing platform, EV Mobility, LLC., collaborated to accelerate flexibility by making an electric vehicle available to anyone with a credit card, valid driver's license, and smartphone. Similarly, in September 2023, Marubeni Corporation introduced a PoC project for the car-sharing of electric vehicles (EVs) in Gunma Prefecture, Japan. In line with this, the research conducted by the European Energy Agency reveals electric cars emit roughly 17-30% less carbon as compared to gasoline or diesel vehicles. Apart from this, EVs not only aid in reducing pollution but also lower operational costs associated with fuel and maintenance, thereby aligning with global sustainability goals. For instance, in March 2024, Uber developed a luxury electric vehicle-sharing service called 'Uber Comfort Electric' in New York City, U.S. In addition, it also unveiled a new product feature called 'Emissions Scorecard' to encourage customers to make eco-friendly choices. Furthermore, in January 2024, Míocar, one of the nonprofit car-sharing platforms, expanded its reach across the rural California Central Valley to bring electric transportation options and vehicles to low-income communities.

Increasing Digital Advancements

The inflating technological advancements, coupled with the elevating adoption of mobile apps, are positively influencing the car sharing market outlook, thereby enhancing user experience and operational efficiency. For instance, in March 2024, Arval Group developed a mobile car sharing application exclusively dedicated to companies, which focuses on the mobility and comfort of employees. The Arval Car Sharing app, like other apps in the Arval portfolio, assists fleet managers in streamlining fleet costs and provides employees with cars they can easily share. As stated by the GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC), over half of the global population, which is roughly 4.3 Billion people currently owns a smartphone. Besides this, mobile apps are gaining extensive traction, as they allow users with easy access to unlocking, booking, and locating vehicles. For example, in May 2024, Roamly, one of the API-enabled digital insurance platforms, announced the introduction of its proprietary car share insurance product specifically designed for commercial fleet vehicle operators. Through the launch, car sharing marketplace companies can cover the specific needs of users during both non-rental and rental periods, thereby providing modernized insurance coverage to reward car-sharers while also removing premiums for features they aren't using, which, in turn, aids in safeguarding their profits. Apart from this, in April 2024, Yango, a global tech company, introduced Yango SuperApp, which makes it easy for individuals to select and rent a vehicle with just a few taps on their devices.

Emphasis on Urban Mobility Solutions

The rising traffic congestion, along with limited parking spaces, are making car sharing an integral part of urban mobility solutions. For instance, in January 2024, one of the German-based remote-driving startups, Vay, introduced a remotely driven rental car service in Las Vegas, Nevada, that enables users to rent a car on a per-minute basis, thereby offering a cost-effective and hassle-free mobility solution. Additionally, cities are collaborating with car sharing companies to integrate these services into public transportation networks to offer residents with convenient and flexible transportation options. For instance, in December 2023, Zipcar teamed up with university campuses, cities, and both commercial and residential businesses to provide electric vehicles to drivers seeking easy and affordable access. Additionally, the company committed to dedicating 25% of its electric fleet to disadvantaged communities in need of affordable, convenient transportation for work, errands, or visiting family and friends. Apart from this, in May 2024, Seattle-based car-sharing firm Zero Emission Vehicle Cooperative (ZEV Co-op) partnered with Gonzaga University, Urbanova, and Avista to introduce an electric vehicle car sharing program in Spokane, U.S. In line with this, it allows users to borrow a car by joining ZEV CO-op and paying an hourly fee to use the car.

Car Sharing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global car sharing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on car type, business model, and application.

Analysis by Car Type:

- Economy

- Executive

- Luxury

- Others

Economy cars are the major segment in car sharing with respect to their affordability and fuel efficiency and suitability to urban environments. They become highly preferred for car-sharing companies and users because the operational cost is lower in these vehicles and appeal toward a broad demographic seeking inexpensive transportation solutions. For example, the Zipcar fleet is composed mostly of small and super-mini economy vehicles such as the Honda Fit and the Toyota Yaris, ideal for urban drives and short distances. Since the rentals for economy vehicles are quite low, this service makes car sharing more appealing compared to other conventional car rentals and car ownership, particularly among young working professionals and students. Economy cars are more convenient to park and drive in congested urban environments. Therefore, this segment is likely to drive the growth of the market over the next few years.

Analysis by Business Model:

- P2P

- Station Based

- Free-Floating

P2P leads the market with around 25.0% of market share in 2024. The Peer-to-Peer (P2P) business model in the market has revolutionized the way individuals access and share vehicles. This model enables people owning private cars to sell the vehicles for rent for when they are not on the road, thus commercializing underutilized capacity into productive resources. Platforms like Turo and Getaround facilitate these transactions by connecting car owners with potential renters through user-friendly mobile apps and websites. For instance, Turo operates in numerous cities worldwide, allowing users to choose from a wide range of vehicles, from everyday sedans to luxury and specialty cars. This model benefits car owners by offsetting ownership costs and providing an additional income stream, while renters enjoy a diverse selection of vehicles at competitive prices. The P2P model also promotes more efficient use of existing cars, reducing the need for additional vehicles on the road and contributing to environmental sustainability. For example, in March 2024, Ejaro collaborated with Tawuniya, one of the peer-to-peer (P2P) car rental firms, to boost the car rental market growth in line with Saudi Arabia's Vision 2030.

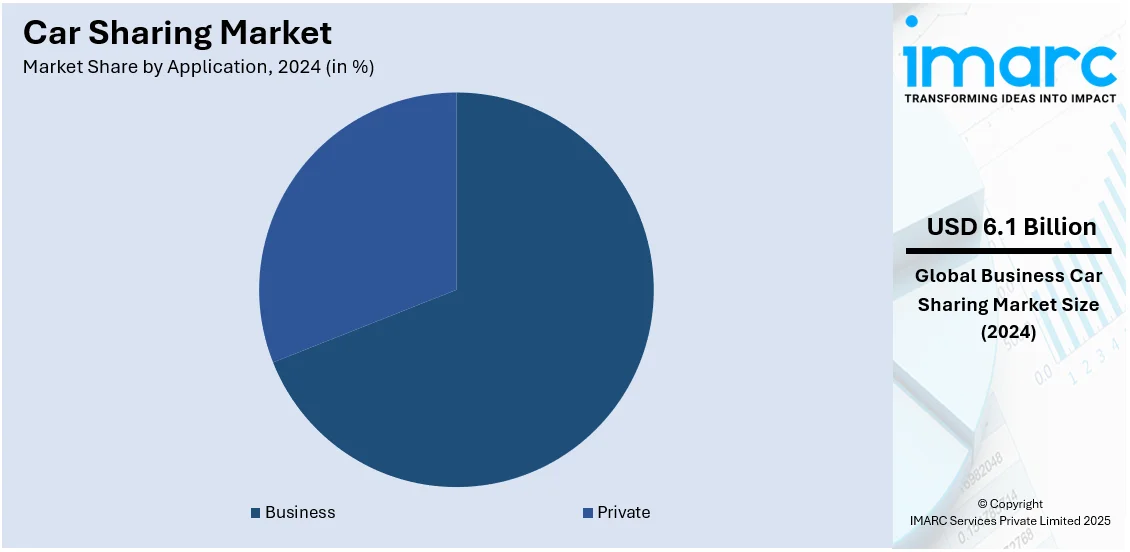

Analysis by Application:

- Business

- Private

Business leads the market with around 68.7% of market share in 2024. Business use represents the largest market segmentation in the car sharing market due to the growing need for flexible, cost-effective transportation solutions among companies. Corporations are increasingly adopting car sharing services to manage their fleet requirements, reduce transportation costs, and enhance employee mobility. This shift is driven by the desire to avoid the high costs associated with owning and maintaining a corporate fleet, such as depreciation, insurance, and parking. For example, companies like Enterprise CarShare and Zipcar offer tailored programs that provide businesses with access to a fleet of vehicles on demand, allowing employees to use cars for client meetings, business trips, and daily commutes. These services often include fuel, insurance, and maintenance, simplifying logistics for businesses and enabling them to allocate resources more efficiently. Besides, by carpooling, corporations further support sustainability goals in reduced numbers of required vehicles and stimulating the use of fuel-efficient and electric vehicles.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 50.2%. Major cities across Europe have embraced car sharing as a key component of their transportation strategies, aiming to reduce traffic congestion and pollution. For example, in cities like Paris and Berlin, car sharing services, such as Share Now (formerly Car2Go and DriveNow), provide a large fleet of vehicles, including electric models, to cater to the demand for eco-friendly transport options. Additionally, companies like BlaBlaCar and Ubeeqo, offer both short-term car rentals and ride-sharing options, addressing various mobility needs. Besides this, according to the Arval Mobility Observatory - Fleet and Mobility Barometer 2023, 64% of companies in Romania have already implemented at least one mobility system for their employees, whereas 90% are planning to invest in these mobility alternatives. Furthermore, the wide availability of vehicles in urban centers is expected to fuel the regional market in the coming years.

Key Regional Takeaways:

North America Car Sharing Market Analysis

The car-sharing market in North America is expanding due to a combination of economic, technological, and environmental factors. Growing consumer demand for flexible and cost-effective transportation alternatives has driven the adoption of car-sharing services, especially among younger generations who prioritize convenience and affordability over ownership. Rising urbanization and concerns about congestion and emissions have further emphasized the appeal of shared mobility, with services offering a sustainable solution to reduce the number of vehicles on the road. Technological advancements, such as GPS-enabled apps and seamless vehicle access, have enhanced user experiences, making car-sharing more accessible and efficient. Additionally, government policies promoting environmental sustainability, including incentives for electric vehicle (EV) adoption within car-sharing fleets, have bolstered the market. With reduced costs for maintenance, insurance, and parking, alongside environmental benefits like lower emissions, car sharing is increasingly becoming a preferred choice for individuals and businesses across North America.

United States Car Sharing Market Analysis

The car-sharing industry in the United States is witnessing significant expansion, propelled by various factors such as increased environmental consciousness, urban development, and changing consumer tastes. A report from Washington State University projects that 75% of Americans plan to emphasize sustainability while traveling, indicating an increasing demand for environmentally friendly transportation choices. Car-sharing services are also gaining recognition as a more sustainable option owing to its reduced carbon footprint relative to conventional vehicle ownership. Besides this, burgeoning urbanization is also impacting consumer choices significantly, particularly among millennials and Gen Z, who are preferring flexible mobility options that remove the financial and logistical stresses of car ownership. The ease of mobile applications for reservations, payments, and vehicle monitoring additionally boosts the attractiveness of car-sharing services. Moreover, the increase of electric vehicle (EV) fleets in car-sharing services is in harmony with government efforts to encourage electric mobility, contributing to the expansion of the market. Collectively, these elements are promoting the growth of car-sharing as an effective, sustainable transportation option in urban regions throughout the US.

Europe Car Sharing Market Analysis

In the European countries, the car-sharing market is being driven by factors including strong environmental policies, burgeoning urbanization, and a growing preference for sustainable and cost-effective transportation options. European cities like Berlin, Paris, and Amsterdam are experiencing increasing adoption of car-sharing solutions owing to stringent environmental regulations in order to reduce carbon emissions. In line with this, the widespread application of public transportation is also influencing shared mobility trends, with 81% of Europeans relying on public transit for day-to-day travel, according to a GART/UTPF study presented at EuMo. This presents an opportunity for car-sharing services to complement public transport, offering an efficient alternative for individuals who do not own a private vehicle. Furthermore, supportive government policies and incentives for EVs are also encouraging car-sharing companies to expand their EV fleets in the region, thereby favoring the market growth. The integration of car-sharing with existing public transport systems provides a seamless, sustainable transportation option, making it an attractive solution for Europeans looking for flexible mobility.

Asia Pacific Car Sharing Market Analysis

The car-sharing market in the Asia Pacific region is significantly being driven by a n expanding middle-class population coupled with increasing environmental pollution and relative concerns. The region is also experiencing heightening urbanization which is also driving the demand for car sharing particularly in the areas with high traffic congestion such as New Delhi, Tokyo, Seoul, and Shanghai. This is prompting governments to implement stricter regulations that in turn are favoring shared mobility. The region is also experiencing a shift in the mindset of the younger population increasingly turning to car-sharing services as a flexible and cost-effective alternative to traditional car ownership. According to GSMA, in 2022, mobile technologies and services contributed nearly 5% to Asia Pacific’s GDP, amounting to USD 810 Billion in economic value. This widespread adoption of mobile technologies has facilitated the growth of car-sharing platforms, making it easier for consumers to access these services via smartphones. Furthermore, investments in electric vehicle (EV) infrastructure are accelerating the adoption of car-sharing fleets, supporting the region’s shift toward sustainable mobility solutions. These factors are driving the growing demand for car-sharing in urban areas across APAC.

Latin America Car Sharing Market Analysis

In Latin America, the car-sharing market is primarily influenced by burgeoning urbanization, rising traffic congestion, and economic conditions. In urban areas such as São Paulo, Mexico City, and Buenos Aires, the expensive costs of vehicle ownership present car-sharing services consumers as a desirable and economical options. Moreover, increasing worries regarding air pollution are motivating consumers to look for sustainable transportation options. As per GSMA, mobile services and technologies accounted for 8% of Latin America's GDP in 2023, underscoring the region's growing dependence on digital platforms. The extensive use of mobile technology simplifies access to car-sharing services for consumers, accelerating the market's expansion throughout the region.

Middle East and Africa Car Sharing Market Analysis

In the Middle East and Africa, the car-sharing industry is fueled by urban growth, increasing traffic congestion, and a rising need for adaptable transportation solutions. Cities such as Dubai and Johannesburg are experiencing a growing interest in car-sharing as a substitute for personal vehicle ownership, particularly among younger individuals. According to the Dubai Water and Electricity Authority, the count of EVs in Dubai increased to 25,929 by December 2023, an increase from 15,100 in 2022, highlighting the area's dedication to sustainable transportation. The increase in EV adoption, along with technological progress, is boosting the development of car-sharing services in the area.

Competitive Landscape:

Leading players in the car-sharing market are implementing multifaceted strategies to enhance their services and expand their reach. A significant trend is the integration of electric vehicles (EVs) into their fleets, driven by environmental concerns and supportive government policies. For instance, several companies have partnered with various EV manufacturers to offer drivers discounted rates, thereby promoting the adoption of electric vehicles through their platform. Technological innovation is another focal point. Companies are advancing autonomous driving technologies, aiming to introduce robotaxi services that could revolutionize car sharing by reducing the need for human drivers and potentially lowering operational costs. Strategic partnerships are also shaping the market. Companies are collaborating with other players to integrate self-driving vehicles into their platform exemplifies efforts to enhance service offerings and operational efficiency through alliances.

The report provides a comprehensive analysis of the competitive landscape in the car sharing market with detailed profiles of all major companies, including:

- Cambio Mobilitätsservice GmbH & Co. KG

- Car2Go Ltd.

- CarShare Australia Pty. Ltd.

- Cityhop Ltd.

- Communauto Inc.

- DriveNow GmbH & Co. KG (BMW AG)

- Ekar FZ LLC

- Getaround Inc.

- HOURCAR

- Locomute (Pty.) Ltd.

- Lyft Inc.

- Mobility Cooperative

- Modo Co-operative

- Turo Inc. (ICA)

- Zipcar Inc. (Avis Budget Group)

Latest News and Developments:

- October 2024: Envoy Technologies Inc. introduced Lucid Air EVs to its car-sharing programs, starting with installations at three luxury properties in California: The Holland Group’s Orlo and Monticello in Santa Clara, and Beaudry in Downtown Los Angeles.

- October 2024: The European Investment Bank granted EUR 34 Million (USD 36.80 Million) to Vay, a German teledriving startup, to advance its car-sharing operations. The loan will support the development of remote driving technology, allowing vehicles to be controlled by drivers at a distance. Vay is also planning to expand its car-sharing service across Europe and North America.

- May 2024: Roamly launched its Carshare Insurance product for commercial fleet operators, offering coverage for carsharing users during both rental and non-rental periods. The product allows car-sharers to reduce premiums by only paying for active coverage. Roamly Carshare is integrated with Getaround and HyreCar, extending protection to their Power User communities. The insurance covers vehicles during gaps between rentals, including when they are parked or being serviced.

- March 2024: Uber launched Comfort Electric service in New York, marking its largest market for the all-electric luxury rideshare offering. This service began in May 2022, and allows riders to book premium EVs like Tesla and Polestar.

- March 2024: Arval Group launched a mobile car-sharing app in Romania, aimed at improving employee mobility and optimizing fleet costs. Developed in response to pandemic challenges, the app is gaining traction as a corporate mobility solution. According to the Arval Mobility Observatory 2023, 64% of Romanian companies have implemented mobility systems, with 90% planning further investments in sustainable solutions.

Car Sharing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Car Types Covered | Economy, Executive, Luxury, Others |

| Business Models Covered | P2P, Station Based, Free-Floating |

| Applications Covered | Business, Private |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cambio Mobilitätsservice GmbH & Co. KG, Car2Go Ltd., CarShare Australia Pty. Ltd., Cityhop Ltd., Communauto Inc., DriveNow GmbH & Co. KG (BMW AG), Ekar FZ LLC, Getaround Inc., HOURCAR, Locomute (Pty.) Ltd., Lyft Inc., Mobility Cooperative, Modo Co-operative, Turo Inc. (ICA), Zipcar Inc. (Avis Budget Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the car sharing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global car sharing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the car sharing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Car sharing is a transportation model where individuals or businesses access vehicles on a short-term basis, typically for a few hours or days, without owning the car. It operates as a subscription or membership-based service, allowing users to book vehicles as needed through online platforms or mobile apps. Car-sharing services are typically designed for urban areas where owning a car might not be practical due to costs, parking limitations, or environmental concerns.

The car sharing market was valued at USD 8.93 Billion in 2024.

IMARC estimates the global car sharing market to exhibit a CAGR of 11.8% during 2025-2033.

The market is growing fast due to expanding integration of electric vehicles (EVs), significant digital advancements across the globe, and rising emphasis on urban mobility solutions.

In 2024, economy represented the largest segment by car type due to their affordability, fuel efficiency, and suitability for urban environments.

P2P leads the market by business model as they have revolutionized the way individual access and share vehicles. This model allows private car owners to rent out their vehicles when they are not in use, effectively turning underutilized assets into revenue-generating resources.

The business is the leading segment by application, due to the growing need for flexible, cost-effective transportation solutions among companies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global car sharing market include Cambio Mobilitätsservice GmbH & Co. KG, Car2Go Ltd., CarShare Australia Pty. Ltd., Cityhop Ltd., Communauto Inc., DriveNow GmbH & Co. KG (BMW AG), Ekar FZ LLC, Getaround Inc., HOURCAR, Locomute (Pty.) Ltd., Lyft Inc., Mobility Cooperative, Modo Co-operative, Turo Inc. (ICA), Zipcar Inc. (Avis Budget Group), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)