Cannabidiol Market Size, Share, Trends and Forecast by Product, Source Type, Grade, Sales Type, and Region, 2025-2033

Cannabidiol Market Size and Share:

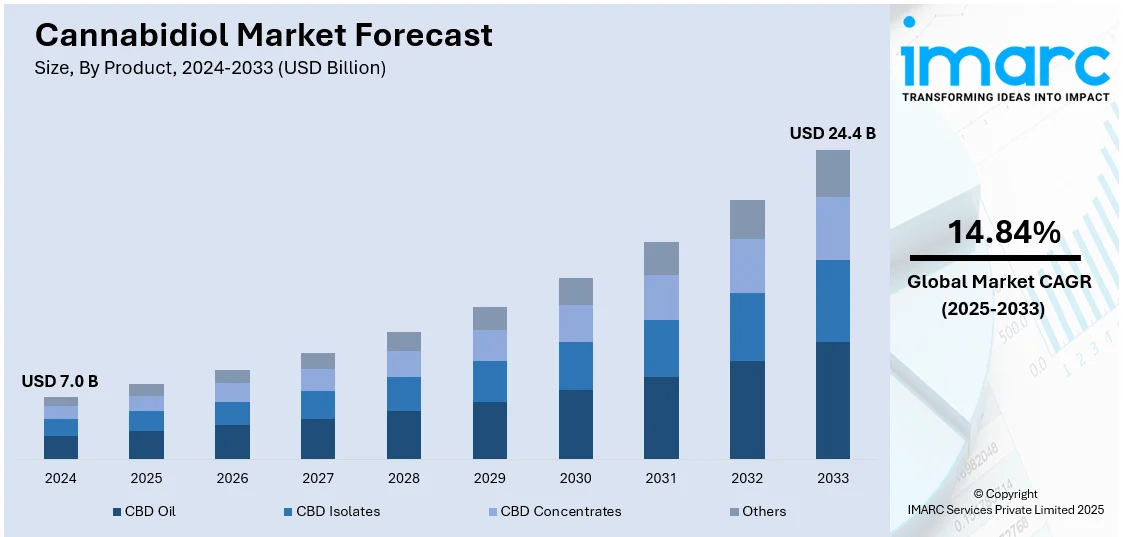

The global cannabidiol market size was valued at USD 7.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.4 Billion by 2033, exhibiting a CAGR of 14.84% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.4% in 2024. The increasing product legalization, growing consumer awareness of its health benefits, innovations in product offerings, and a shift toward natural remedies are driving the North America cannabidiol market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.0 Billion |

| Market Forecast in 2033 | USD 24.4 Billion |

| Market Growth Rate 2025-2033 | 14.84% |

One of the major factors driving the global cannabidiol (CBD) market is the growing awareness amongst consumers regarding the therapeutic benefits of CBD across health and wellness sectors. With the rising number of individuals being diagnosed with chronic illnesses, such as insomnia, pain management needs, and anxiety on account of sedentary lifestyles, and improper dietary patterns, the need for CBD-based products has increased incessantly. According to the American Psychiatric Association, in 2024, 43% of American individuals, aged 18 and above report feeling more anxious as compared to 2023. Besides this, there have been numerous favorable regulatory changes across the globe, such as the legalization of production of cannabis-derived compounds for medical and recreational purposes, which is further creating a positive market outlook. In line with this, another major factor creating a favorable growth environment for the market is the widespread adoption of CBD in numerous other products such as beverages, personal care items, and dietary supplements.

The United States has emerged as a key regional market for cannabidiol. The market witnesses, significant growth owing to the increase in traction of alternative health products and wellness trends. Besides this, the U.S. Farm Bill supported local production of hemp, promoted development of a sturdy distribution channel within the region, further propelling the market growth. In line with this, CBD is also being utilized in pet wellness products, which leads to its widespread application in the veterinary industry. Moreover, strategic partnerships between CBD producers and mainstream retailers are urging individuals to adopt these products. Furthermore, the United States cannabidiol market is also growing on account of the extensive research and development (R&D) activities focused on creating latest formulations, so as to cater to medical and recreational users.

Cannabidiol Market Trends:

Growing Legislative Changes and Legalization

The legalization of cannabis for both medical and recreational use in several countries is a key factor in the growth of the cannabidiol market. This modification in legislation has expanded the legal structure that permits the growing, production, and sale of various CBD products, while also legitimizing and enhancing consumer confidence in these goods. Nations such as the United States, Canada, and many European countries have exhibited notable shifts in their cannabis laws. In 2018, the U.S. Farm Bill sanctioned hemp-based CBD products, leading to a rise in their market appeal and consumption. In February 2024, Germany decriminalized marijuana, permitting individuals over 18 to possess 25 grams and grow up to three plants at home. In addition, cannabis clubs were permitted to accommodate a maximum of 500 members, with each member having a monthly allowance of 50 grams. This legal support has led to a rising market with more accessibility for customers and compliance with regulatory safety and quality criteria.

Increasing Awareness and Acceptance of CBD's Therapeutic Properties

Consumers are becoming conscious of the possible medical advantages of CBD as clinical trials and scientific research steadily bolster CBD's effectiveness in treating a range of ailments, including anxiety, pain, and inflammation. Its potential to cure more serious illnesses like multiple sclerosis and epilepsy is also favoring its market expansion. The Food and Drug Administration (FDA) in the United States authorized Epidiolex, a medication containing hemp-derived, pure cannabidiol. This medication aids in the treatment of uncommon seizure disorders. According to the FDA's study, using this medication is both safe and effective. Also, based on a January 2024 Pew Research Center survey, almost 90% of Americans say that marijuana should be allowed for either medical or recreational usage. An overwhelming majority of U.S. adults, accounting for 88%, say either that marijuana should be legal for medical use only (32%) or that it should be legal for medical and recreational use (57%).

Rapid Innovation in Product Offerings

Advancements in cannabidiol development are majorly contributing to the expansion of the market. Companies are continuously diversifying their product lines to include various CBD-infused products, like oils, capsules, edibles, topicals, and cosmetics. For instance, in March 2023, mood elevation expert Daytrip Beverages showcased its NightTrip gummies at the Natural Products Expo West. These gummies are available in a CBD and CBN-infused variant and are gluten-free and vegan. They are known to ease tension and support restful sleep. In addition, in January 2023, HempMeds Brasil introduced two new full-spectrum products in Brazil, with concentrations ranging from 3,000 to 6,000 mg, available in 30 ml and 60 ml jars. Also, in December 2021, Cibdol, a Netherlands-based CBD and wellness company, revealed its CBD Oil 2.0 range. This product offers hiked levels of essential compounds, including CBC, CBG, CBN, and CBDa, alongside high-purity CBD. It is expected to address many physical and mental challenges that are associated with modern living and offer solutions for problems related to appetite, mood, pain, and sleep.

Cannabidiol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, source type, grade, and sales type.

Analysis by Product:

- CBD Oil

- CBD Isolates

- CBD Concentrates

- Others

CBD isolates dominate the market. They are the most concentrated type of CBD, with a purity level of 99% cannabidiol, and all other elements like terpenes, flavonoids, and other cannabinoids are eliminated. The high level of purity makes isolates appealing to consumers looking for the unique advantages of CBD without the impacts of other cannabis substances. Furthermore, they are popular in areas with rigorous tetrahydrocannabinol (THC) limitations, as they guarantee absence of THC that might cause legal problems or mind-altering effects. In addition, the flexibility of CBD isolates, which can be utilized in different forms such as powders and crystals, and are simple to add to edibles, cosmetics, and topical products, is enhancing the overall revenue of the cannabidiol market.

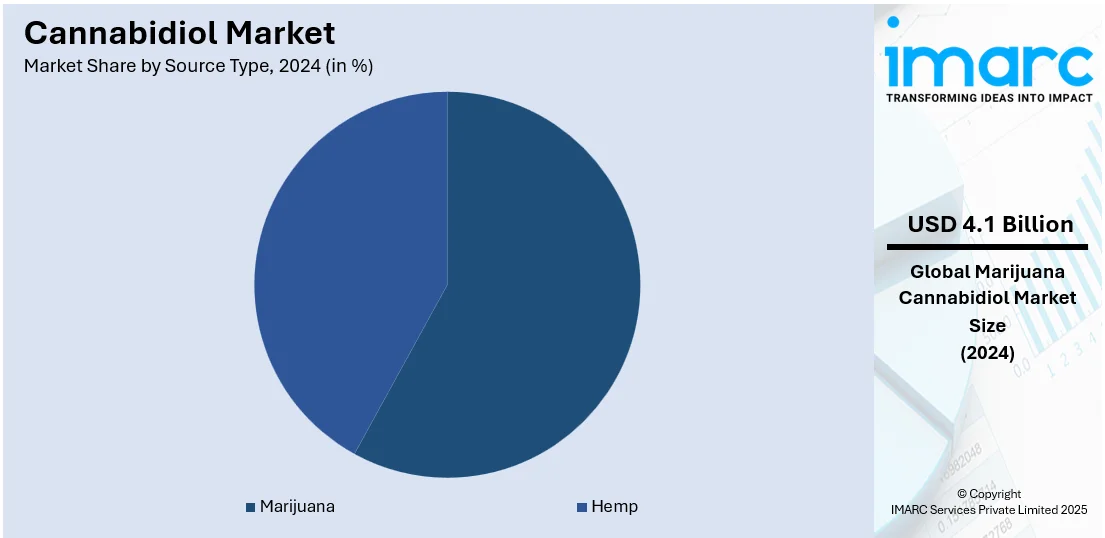

Analysis by Source Type:

- Marijuana

- Hemp

Marijuana leads the market with around 58.1% of market share in 2024, due to its elevated levels of THC which enhance the entourage effect. The chemical compounds in combination have a synergistic effect that boosts the medicinal advantages of the plant. The increasing demand for marijuana-based CBD in areas where marijuana is legal for both recreational and medical purposes is driving market growth, as it enables the creation of products with stronger and more wide-ranging benefits. Additionally, the strong foundation of dispensaries and a firmly established consumer group who value the wide range of benefits offered by the cannabis plant are driving the demand for the cannabidiol market.

Analysis by Grade:

- Food Grade

- Therapeutic Grade

Therapeutic grade leads the market with around 62.7% of market share in 2024. This category is focused on health and wellness applications, providing products aimed at relieving conditions like anxiety, chronic pain, and sleep issues. Furthermore, high-quality CBD for therapeutic purposes is characterized by its strict quality criteria such as purity and strength, guaranteeing the safety and efficacy of the products. Furthermore, the increasing number of clinical studies backing the therapeutic benefits of CBD is boosting the market for cannabidiol. Additionally, the growing support from medical professionals and the incorporation of CBD into conventional treatment strategies are driving the expansion of the market.

Analysis by Sales Type:

- B2B

- B2C

B2B holds the maximum number of shares with around 55.7% of market share in 2024. It includes transactions between CBD manufacturers and different businesses like wholesalers, retailers, and makers of CBD products. The CBD industry's increasing demand for supply chain services and the use of premium raw materials and processed products by companies to make various consumer goods like wellness supplements and personal care items are boosting the recent prospects of the cannabidiol market. Additionally, the market growth is being sustained by long-term contractual relationships, volume sales, and recurring business.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.4%, on account of the progressive laws that have widely approved and managed the manufacturing, selling, and consumption of CBD items. These regulations have created a supportive atmosphere for expansion by increasing consumer trust and opening up opportunities for a wide range of products and innovations to enter the market. Furthermore, the established infrastructure for cannabis research and development (R&D) is driving market growth by enabling ongoing innovation in CBD products. Moreover, the recent advancements in the cannabidiol market are being driven by the combination of high consumer awareness and acceptance, along with significant investments in marketing and distribution networks.

Key Regional Takeaways:

United States Cannabidiol Market Analysis

In 2024, the United States accounts for over 82.8% of cannabidiol in North America. The U.S. cannabidiol (CBD) market is experiencing significant growth due to increasing consumer awareness and the expanding acceptance of CBD products across various industries, including healthcare, beauty, and wellness. Legislative changes, particularly the 2018 Farm Bill, which legalized hemp-derived CBD, have played a pivotal role in the market’s expansion. The growing adoption of CBD for its potential health benefits, including pain relief, stress reduction, and anti-inflammatory properties, is driving demand. Furthermore, the rise in chronic conditions such as anxiety, arthritis, and insomnia, combined with the shift toward natural and plant-based treatments, is fostering market growth. According to CDC, in 2018, 51.8% of civilian, noninstitutionalized adults were diagnosed with at least one of ten selected chronic conditions. Increased investments in product development, including CBD-infused beverages, edibles, skincare, and supplements, are also contributing to the sector's momentum. The rise in e-commerce platforms has made it easier for consumers to access CBD products, further accelerating market penetration. Additionally, ongoing research into the therapeutic potential of CBD, coupled with increasing endorsements from healthcare professionals, continues to boost consumer confidence and demand.

Asia Pacific Cannabidiol Market Analysis

The CBD market in the Asia-Pacific region is set for notable expansion as the awareness of CBD's health benefits, such as pain management and stress relief, continues to increase. Australia and Japan have witnessed favorable regulatory changes related to CBD, especially in medical applications, leading to the growth of the market. As the preference for natural and plant-based products like CBD increases, driven by health-conscious consumers seeking alternative wellness solutions, the demand for these products is on the rise. This changing environment offers significant potential for those involved in the market. A significant instance is Aurora Cannabis Inc.'s acquisition of MedReleaf Australia in February 2024. This strategic decision positioned Aurora as the leading medical cannabis company worldwide in legal markets, strengthening its presence in the fast-growing Australian market. Despite remaining cautious in some APAC countries, the regulatory environment, along with growing global interest in CBD and changing consumer preferences towards wellness and alternative medicine, continues to fuel market expansion. The establishment of regional manufacturing and distribution networks is also contributing to enhancing the availability and accessibility of products in the area.

Europe Cannabidiol Market Analysis

The CBD market in Europe is expanding quickly, fueled by a growing approval of CBD for wellness purposes. The legal environment concerning CBD in the area, which has been modified to support hemp-based CBD products, has significantly helped in the growth of the market. The increasing recognition of CBD's healing properties, especially in relieving pain, decreasing anxiety, and enhancing sleep, is driving the need for it. The CBD market is experiencing additional growth due to consumer favoritism toward natural and organic products in health and wellness industries. Moreover, the regulations of the European Union concerning the safety and quality assurance of products have established a more trustworthy market for consumers, boosting their trust in CBD products. The growth of health-conscious buyers and the rising utilization of CBD in beauty products, skincare, and supplements are important factors as well. With the increasing number of retailers selling CBD products in pharmacies, wellness stores, and online platforms, access to CBD has greatly improved, leading to market expansion. It is anticipated that the e-commerce penetration rate in Europe will reach 55.81% by 2029. Furthermore, current scientific studies on the advantages of CBD and clear regulations are anticipated to drive market growth even more.

Latin America Cannabidiol Market Analysis

In Latin America, the market for cannabidiol (CBD) is experiencing steady growth due to the growing awareness among consumers and the increased demand for natural health products. Brazil and Mexico are experiencing slow changes in regulations to permit the medical application of CBD, leading to increased market opportunities. An increasing interest in CBD's possible healing advantages, especially in pain and anxiety management, is a significant trend propelling the market. NIH states that anxiety, depression, distress, and insomnia had rates of 35%, 35%, 32%, and 35%, respectively, in Latin America. Moreover, the increasing shift toward plant-based and organic items in the health and beauty industries is fostering the demand for CBD-infused skincare and cosmetic products. The rise in online platforms and local retailers selling CBD products is also helping drive market expansion. As regulations change and the medicinal benefits of CBD are more recognized, the market is anticipated to grow throughout the area.

Middle East and Africa Cannabidiol Market Analysis

In the Middle East and Africa (MEA), the cannabidiol (CBD) market is emerging, driven by growing interest in wellness and natural health products. As global awareness of CBD’s potential therapeutic benefits rises, interest in the region’s markets, particularly in countries like South Africa, is increasing. The potential applications of CBD in managing conditions such as pain, stress, and anxiety are generating consumer interest, particularly in the health and wellness sectors. According to Gallup, 52% of workers in the Middle East reported experiencing stress on a daily basis. However, regulatory uncertainties and restrictions on cannabis-related products remain a challenge. Despite this, as global attitudes toward cannabis become more accepting and local regulations evolve, there is potential for the CBD market to expand further. Increased investment in research, combined with gradual legal reforms, will likely drive further growth in this emerging market.

Competitive Landscape:

Key players in the cannabidiol (CBD) market are focusing on innovation and strategic collaborations to strengthen their market position. Leading companies are investing in advanced extraction techniques to ensure high-purity products that meet regulatory standards. Partnerships with pharmaceutical firms and research institutions are enabling the development of new CBD-based formulations for medical and therapeutic applications. Major brands are also expanding their product portfolios to include edibles, beverages, topicals, and pet care items, catering to diverse consumer preferences. Several players are forming alliances with large retail chains and e-commerce platforms to enhance distribution networks and increase accessibility. Efforts to secure certifications, such as Good Manufacturing Practices (GMP), are building consumer trust and credibility.

The report provides a comprehensive analysis of the competitive landscape in the cannabidiol market with detailed profiles of all major companies, including:

- Aurora Cannabis Inc.

- Canopy Growth Corporation

- CV Sciences Inc.

- Elixinol Global Limited

- Endoca BV

- Folium Biosciences

- Green Roads of Florida LLC (The Valens Company Inc.)

- Isodiol International Inc.

- Koi CBD

- Medical Marijuana Inc.

- Medterra CBD

- NuLeaf Naturals LLC

- PharmaHemp d.o.o.

- Tilray Brands Inc.

Latest News and Developments:

- November 2024: The Cannabist Company, a leading U.S. cultivator, manufacturer, and retailer of cannabis products, has announced a new partnership with Veda Warrior, a minority woman-owned Ayurvedic wellness brand based in New Jersey. The collaboration aims to make cannabis wellness more accessible. The initial launch in New Jersey features three cannabis-infused cooking essentials—ghee butter, olive oil, and coconut oil—with plans to expand to cannabis-infused edibles and topicals that incorporate Ayurvedic herb blends.

- October 2024: Aurora Cannabis Inc., a medical cannabis organization based in Canada, in collaboration with MedReleaf Australia, announced the expansion of its premium medical cannabis oil product range in Australia. This move underscores Aurora’s commitment to offering high-quality, innovative cannabis solutions to patients worldwide.

- January 2023: Medical Marijuana, Inc. announced that its subsidiary HempMeds Brasil had introduced 2 new full-spectrum products to the Brazilian market. Concentrations are 3,000-6,000 mg and available in jars of 30 mL and 60 ml.

- October 2022: High Tide Inc. made a statement regarding the release of its subsidiary, NuLeaf Naturals, multi-cannabinoid products in Ontario, Canada. Included on the list of available products are Full Spectrum Hemp Multicannabinoid oil and softgels made of plants that contain delta-9 tetrahydrocannabinol, cannabichromene, cannabidiol, cannabigerol, and cannabinol.

- June 2021: The Valens Company announced that it has acquired Green Roads for about USD 60 Million. The Valens Company aims to strengthen its capabilities to supply US domestic and global markets with an expanded product offering.

Cannabidiol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | CBD Oil, CBD Isolates, CBD Concentrates, Others |

| Source Types Covered | Marijuana, Hemp |

| Grades Covered | Food Grade, Therapeutic Grade |

| Sales Types Covered | B2B, B2C |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aurora Cannabis Inc., Canopy Growth Corporation, CV Sciences Inc., Elixinol Global Limited, Endoca BV, Folium Biosciences, Green Roads of Florida LLC (The Valens Company Inc.), Isodiol International Inc., Koi CBD, Medical Marijuana Inc., Medterra CBD, NuLeaf Naturals LLC, PharmaHemp d.o.o., Tilray Brands Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cannabidiol market from 2019-2033.

- The cannabidiol market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cannabidiol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cannabidiol is a naturally occurring compound found in cannabis plants, including hemp and marijuana. Unlike tetrahydrocannabinol (THC), CBD is non-psychoactive, meaning it does not cause a "high." It is widely used for its potential therapeutic benefits, such as reducing anxiety, alleviating pain, and improving sleep, across medical and wellness applications.

The global cannabidiol market was valued at USD 7.0 Billion in 2024.

IMARC estimates the global cannabidiol market to exhibit a CAGR of 14.84% during 2025-2033.

The cannabidiol market is driven by the increasing consumer awareness about its therapeutic benefits, expanding applications in health and wellness products, growing legalization and regulatory support, advancements in extraction technologies, rising demand for natural remedies, and the proliferation of CBD-infused food, beverages, and personal care items.

According to the report, CBD isolates dominate the market due to their high purity, lack of THC, and versatility in formulating diverse products for medical, wellness, and cosmetic applications.

Marijuana dominates the market due to its higher concentration of cannabidiol (CBD), which allows for more potent formulations and diverse applications in medical and therapeutic products.

Therapeutic grade holds the maximum number of shares due to its widespread use in medical treatments and wellness products, driven by its high purity and compliance with stringent healthcare regulations.

B2B dominates the market due to bulk purchasing by pharmaceutical companies, wellness product manufacturers, and retailers, ensuring widespread distribution and large-scale application of CBD products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Cannabidiol market include Aurora Cannabis Inc., Canopy Growth Corporation, CV Sciences Inc., Elixinol Global Limited, Endoca BV, Folium Biosciences, Green Roads of Florida LLC (The Valens Company Inc.), Isodiol International Inc., Koi CBD, Medical Marijuana Inc., Medterra CBD, NuLeaf Naturals LLC, PharmaHemp d.o.o., Tilray Brands Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)