Cancer Immunotherapy Market Size, Share, Trends and Forecast by Therapy Type, Application, End User, and Region, 2025-2033

Cancer Immunotherapy Market Size and Share:

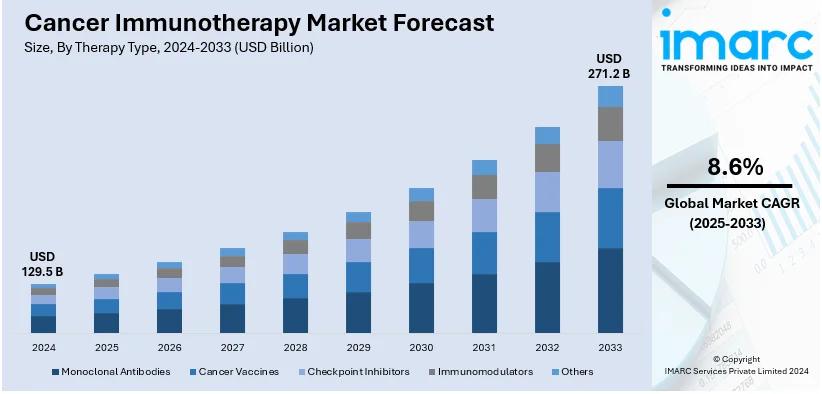

The global cancer immunotherapy market size was valued at USD 129.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 271.2 Billion by 2033, exhibiting a CAGR of 8.6% from 2025-2033. North America currently dominates the market, holding a market share of over 45.2% in 2024. The growing number of cancer cases, favorable government initiatives, and easy availability of medical insurance represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 129.5 Billion |

|

Market Forecast in 2033

|

USD 271.2 Billion |

| Market Growth Rate 2025-2033 | 8.6% |

The rising need for focused therapies due to the increasing incidences of cancer are driving growth in the cancer immunotherapy industry. While supportive regulatory regulations and quicker drug approvals are driving market expansion, ongoing breakthroughs like neoantigen-based vaccinations and bispecific antibodies are expanding treatment possibilities. The effectiveness of immunotherapy is being enhanced by developments in diagnostics, including liquid biopsies and biomarkers. To overcome resistance to T cell-based treatments, BioMed X and Ono Pharmaceutical teamed together on December 19, 2023, to create next-generation immunotherapies that target neutrophils in solid tumours. This collaboration, hosted in Germany, invites global researchers to advance oncology innovation. Additionally, growing patient and healthcare provider knowledge is increasing the uptake and reaffirming immunotherapy's vital position in contemporary oncology.

To get more information on this market, Request Sample

The market's dominant region is the United States, mostly due to significant R&D expenditures and a robust biotechnology and pharmaceutical industry. Prostate, lung, and colorectal cancers account for 48% of cases in males and 51% in females, respectively, with 2,001,140 new cases and 611,720 deaths predicted in 2024, according to the NCI. 14,910 cases and 1,590 fatalities are anticipated for those with ages 0–19. The effectiveness of treatment and patient selection are enhanced by ongoing advancements in next-generation sequencing and artificial intelligence. The existence of prestigious academic institutions and federal initiatives like Cancer Moonshot encourage market innovation. The market for immunotherapy is also growing as a result of growing clinical trials and the increasing use of combination treatments.

Cancer Immunotherapy Market Trends:

Increasing Prevalence of Cancer

The primary reason that is driving the market for cancer immunotherapies is the increasing cancer cases globally. According to International Agency for Research on Cancer, approximately 19.29 Million of cancer cases had been estimated for the year 2020. Those cases are anticipated to grow by 2030 up to 24.58 Million cases. So, that much growth of cancer cases is adding to the demand for effective treatment solution such as immunotherapy. GLOBOCAN shows that in 2020, there were approximately 2,281,658 new cancer cases diagnosed and 612,390 deaths due to cancer alone in the United States. Other than this, lung cancer and breast cancer are two of the most common cancers found in individuals. The Canadian Cancer Society (CCS) reported that in 2020, nearly 29,800 Canadians were diagnosed with lung cancer, which accounted for 13% of all new cancer cases. Approximately 21,200 Canadians were expected to die from lung cancer, which comprised 25% of all cancer deaths in 2020. This reflects an increasing demand for effective and more sophisticated cancer immunotherapy. Therefore, growing demand for effective and long-term cancer treatment is expected to present attractive growth opportunities to the market in general.

Rising Approval of Novel Immunotherapies

There are several key market players who are heavily investing in research and development (R&D) activities to develop and introduce advanced and more effective immunotherapies. According to the National Clinical Trials (NCT) Registry, there are more than 1,000 ongoing clinical trials worldwide as of September 8, 2020, for the development of cancer treatment with immune-based therapies. Furthermore, officials and responsible regulators of many nations are trying to hasten the clearance process of advanced immunotherapies and hence it is expected to provide more fuel to the business in question. For example, " Quizartinib (Vanflyta)," in July 2023, has been approved by FDA as an advanced treatment against the acute myeloid leukemia phase of newly diagnosed acute myeloid leukemia that covers various phases. Quizartinib targets FLT3, one of the kinases that becomes scrambled in approximately one-third of AML cases.

Partnerships and Collaborations between Pharmaceuticals and Research Institutions

There are a number of strategic activities by key players launching new products. In this respect, Immatics and Moderna have collaborated strategically to develop oncology therapeutics in September 2023. The collaboration includes an evaluation of Immatics' investigational PRAME203 TCRT in confluence with the MARTE mRNA cancer vaccine under development by Moderna. In addition, FBD Biologics Limited and Shanghai Henlius Biotech, Inc. announced a strategic collaboration in August 2023 to strengthen the development of new immunotherapies. Likewise, in December 2023, BioMed X, a German research institution, launched a new joint research project with Ono Pharmaceutical Co. Ltd., a Japanese pharmaceutical company, to design next-generation immunotherapies based on the antitumor effects of neutrophils. The Partnership for Accelerating Cancer Therapies, a five-year public-private research collaboration of USD 220 Million, aims to advance immune therapies for cancer. PACT has been working on identifying, developing, and validating strong biomarkers to enhance the therapies that tap the power of the immune system to combat cancer, with more than 37 clinical trials and 4,000 planned participants across 15+ types of cancers. Such collaborations, along with merger and acquisition activities by companies like Amgen Inc., AstraZeneca plc, Bayer AG, and Eli Lilly and Company, are expected to further augment the revenue of the market in the coming future.

Cancer Immunotherapy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cancer immunotherapy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on therapy type, application, and end user.

Analysis by Therapy Type:

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- Others

Monoclonal antibodies lead the market with around 71.2% of market share in 2024. Growing funding for monoclonal antibody research and development (R&D) is creating new opportunities for oncology medicines businesses to expand in the market. The potential of monoclonal antibodies as a treatment for different kinds of cancer is being investigated in great detail. For example, the FDA authorised Talvey in August 2023 to treat adult patients with relapsed or refractory multiple myeloma who have had at least four lines of treatment, including immunomodulatory drugs, antiCD38 monoclonal antibodies, and proteasome inhibitors.

Analysis by Application:

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Melanoma

- Prostate Cancer

- Head and Neck Cancer

- Others

The market's largest revenue share is attributed to lung cancer. This is explained by the rising incidence of lung cancers, the growing use of immunotherapy, and the existence of a strong pipeline of research candidates. Additionally, new product releases and growing product approval are giving the market an optimistic outlook. For example, the US Food and Drug Administration (FDA), in November 2023 authorized Augtyro (Bristol, Inc.) to market Repotrectinib for the treatment of locally refractory or metastatic Non-Small Cell Lung Cancer (NSCLC).

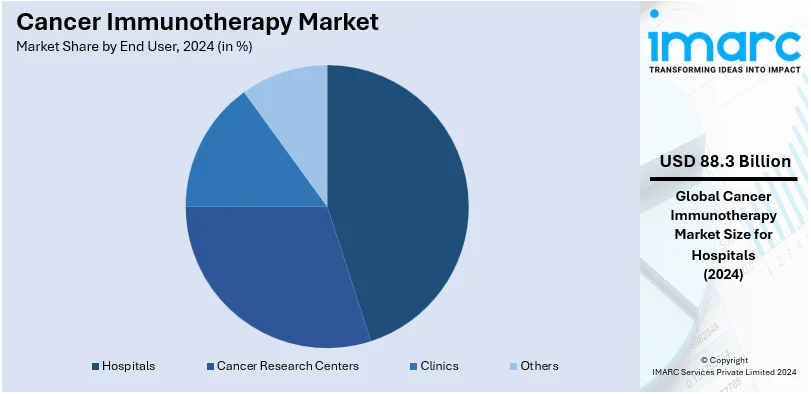

Analysis by End User:

- Hospitals

- Cancer Research Centers

- Clinics

- Others

Hospitals lead the market with around 68.2% of market share in 2024. With cases of cancer growing, increasing rates of treatment, and most hospitals offering immunotherapies, more patients are being admitted to a hospital. Immunotherapies, these days, are widely being used to treat cancer by the hospitals. in April 2023, according to the National Cancer Institute, 25% of patients died in a hospital in the United States, while 62% were hospitalized for the cancer treatments at least one time in the last month of their lives.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.2%. The growth in the region is due to increasing patients affected by cancer, rapid development of bioinformatic tools, and the government's initiatives that are favorable to such technologies. GLOBOCAN estimates reveal that approximately 2,281,658 new cancer cases are diagnosed, and 612,390 deaths are caused due to cancer in the US alone, in the year 2020. Additionally, the presence of leading companies operating in this region is also driving this market. According to an article published by Elsevier Ltd, in April 2023, the U.S. National Cancer Institute published its envisioned national cancer plan, a roadmap, and calls to action on how to improve all stages of care for those afflicted with cancer.

Key Regional Takeaways:

United States Cancer Immunotherapy Market Analysis

In 2024, the United States accounted for 92.70% of the North America cancer immunotherapy market. Robust healthcare investments and innovative research are propelling the U.S. cancer immunotherapy market. The National Cancer Institute states that the U.S. allocated over USD 7.22 Billion to cancer research in 2024, which helps promote the advancement of immunotherapy. CAR-T therapies, such as Novartis’s Kymriah will continue to gain traction. Main market leaders in this arena are Merck (Keytruda) and Bristol-Myers Squibb (Opdivo), accounting for more than 60% of immunotherapy revenues in the U.S. market, an industrial report stated. FDA approvals and government programs, such as the Cancer Moonshot, will help increase the progress in the field by two times within a couple of years. The U.S. leads in clinical trials, as of March 2024, there are 2,306 active interventional cancer cell therapy clinical trials in the IO Intelligence database of the Cancer Research Institute, which reflects the national emphasis on innovative therapies. Additionally, patient assistance programs and insurance coverage expansion improve access.

Europe Cancer Immunotherapy Market Analysis

Europe's cancer immunotherapy market is moving forward with the ever-increasing research and development (R&D) activities and government funding. According to the European Commission, the EU allocated USD 4.75 Billion to Horizon Europe's health programs in 2023, of which part is for cancer immunotherapy. The region is led by Germany and France, where cancer care expenditure in Germany had reached USD 40.1 Billion in 2023, as per an industrial report. Companies such as Roche (Tecentriq) and AstraZeneca (Imfinzi) are driving the innovation and adoption process. Innovations in therapy, such as the EMA accelerated approvals of novel therapies in 2024- BioNTech's individualized neoantigen-based immunotherapies have become a testimony of the focus of Europe in personalized medicine. The trend of increased academia-industry collaborations and the robust support of regulations all assure Europe's sharp competitive edge in the cancer immunotherapy market.

Asia Pacific Cancer Immunotherapy Market Analysis

The Asia Pacific cancer immunotherapy market is rapidly growing mainly due to the rising incidence of cancer and investments in healthcare. According to an article published on Nature, Asia accounted for an estimated 9,503,710 new cancer cases and 5,809,431 cancer-related deaths in 2023, making it the region with the highest disease burden for cancer globally. India has reportedly allocated ₹89,155 crore or approximately 10.8 Billion USD to health spending for 2023-24. That figure is 13% greater than the fiscal year ending in March. The innovative companies in this region are the ones that are local, such as, BeiGene and Junshi Biosciences. Its PD-1 inhibitor Toripalimab won approval in many markets. The region is also witnessing big investments in R&D for the advanced therapies like CAR-T and checkpoint inhibitors. Clinical trials backed by the government, partnerships with Western firms, and more personalization in treatment are placing Asia Pacific firmly as the emerging future market for cancer immunotherapy in the global market.

Latin America Cancer Immunotherapy Market Analysis

Latin America's cancer immunotherapy market is developing due to increasing awareness of cancer and the growing healthcare systems. More than 600,000 new cancer cases in 2023, according to INCA (Brazilian National Cancer Institute), highlight the increasing need for immunotherapies in the region. Roche leads the way with products such as Tecentriq, targeting this increasing patient population. Mexico and Argentina are taking the approach of biosimilar development to decrease therapy costs, while public-private partnerships ensure accessibility. For example, in 2024, Brazil partnered with MSD to expand Keytruda's availability through government programs. Greater adoption of digital platforms for patient monitoring and telemedicine also supports market growth.

Middle East and Africa Cancer Immunotherapy Market Analysis

The Middle East and Africa cancer immunotherapy market is expanding gradually, driven by the growing incidence of cancer and government initiatives. According to International Trade Administration, in 2023, Saudi Arabia dedicated USD 50.4 Billion to healthcare, part of which was used for oncology research and the procurement of immunotherapy. South Africa leads in the region of sub-Saharan Africa, with increasing use of checkpoint inhibitors like Opdivo. Regional partnerships, including the UAE's health ministry and the agreement AstraZeneca entered into in 2024, are vying for more access to immunotherapy. Governments are also making investments in medical tourism, with countries like Turkey providing low-cost immunotherapy. Increased awareness campaigns and increased funding for clinical trials increase the uptake of advanced cancer treatments.

Competitive Landscape:

The global cancer immunotherapy market is highly competitive, driven by rapid advances in immunological research and increasing interest in personalized medicine. The major players are investing in novel treatments like immune checkpoint inhibitors, CAR-T cell therapies, and cancer vaccines. New biopharmaceutical firms are innovating targeted therapies, raising the competition level. The strategic collaborations, acquisitions, and clinical trials are shaping the market, with companies trying to enhance product pipelines and global reach. Regulatory approvals and patent expirations further influence competition. The increasing adoption of combination therapies and focus on biomarkers bring out the dynamic and changing landscape of cancer immunotherapy.

The report provides a comprehensive analysis of the competitive landscape in the cancer immunotherapy market with detailed profiles of all major companies, including:

- Amgen Inc

- AstraZeneca plc

- Bayer AG

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GSK plc.

- Johnson & Johnson

- Merck & Co., Inc.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Sanofi S.A

Latest News and Developments:

- October 2024: The FDA approved Bristol Myers Squibb's Opdivo (nivolumab), a PD-1 inhibitor, for perioperative treatment in resectable NSCLC. This is an immunotherapy regimen: neoadjuvant Opdivo and platinum-doublet chemotherapy, surgery, and adjuvant Opdivo monotherapy. Based on the CheckMate-77T trial, the treatment showed a 42% reduction in disease recurrence, progression, or death risk and significantly improved pCR rates compared to chemotherapy alone.

- September 2024: Amgen reported encouraging data for its DLL3-targeting Bispecific T-cell Engager (BiTE) molecule, IMDELLTRA (tarlatamab-dlle), at WCLC 2024. In the Phase 1b DeLLphi-303 study, IMDELLTRA in combination with PD-L1 inhibitors as first-line maintenance therapy for extensive-stage small cell lung cancer (ES-SCLC) demonstrated a manageable safety profile and sustained disease control.

- July 2024: AstraZeneca announced the results of ADRIATIC Phase III trial. It showed that AstraZeneca's Imfinzi, or durvalumab, highly significantly improved overall survival as well as progression-free survival in patients with limited-stage small cell lung cancer after treatment with chemoradiotherapy. This is the first global Phase III immunotherapy for a survival benefit in such a setting. The safety profile was consistent with previously reported data, and all findings will be submitted to regulatory authorities. The secondary arm of the trial, combining Imjudo, also known as tremelimumab, with Imfinzi, continues to the next analysis.

- December 2023: Oxford University Hospitals launched a new mRNA cancer vaccine trial for patients with head and neck cancers.

- December 2023: BioMed X, a German research institution announced a new joint research project with Ono Pharmaceutical Co. Ltd, a Japanese pharmaceutical company, to design next-generation immunotherapies by leveraging the antitumor effects of neutrophils.

Cancer Immunotherapy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered | Monoclonal Antibodies, Cancer Vaccines, Checkpoint Inhibitors, Immunomodulators, Others |

| Applications Covered | Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Prostate Cancer, Head and Neck Cancer, Others |

| End Users Covered | Hospitals, Cancer Research Centers, Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc, AstraZeneca plc, Bayer AG, Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc., Johnson & Johnson, Merck & Co., Inc., Merck KGaA, Novartis AG, Pfizer Inc., Sanofi S.A, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cancer immunotherapy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cancer immunotherapy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cancer immunotherapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cancer immunotherapy is a treatment approach that enhances the body's immune system to recognize and destroy cancer cells. It includes methods like immune checkpoint inhibitors, CAR-T cell therapy, cancer vaccines, and monoclonal antibodies, offering targeted and personalized solutions to improve efficacy and minimize damage to healthy tissues.

The cancer immunotherapy market was valued at USD 129.5 Billion in 2024.

IMARC estimates the global cancer immunotherapy market to exhibit a CAGR of 8.6% during 2025-2033.

The market is primarily driven by the increasing prevalence of cancer among the masses, demand for targeted treatments, technological advancements, supportive regulatory policies, expedited drug approvals, and ongoing innovations. Strategic collaborations and rising R&D investments are further propelling market growth.

In 2024, monoclonal antibodies represented the largest segment by therapy type, driven by extensive R&D investments and therapeutic advancements.

Lung cancer leads the market by application attributed to its high prevalence, adoption of immunotherapy, and robust product pipelines.

Hospitals are the leading segment by end user, driven by increasing cancer treatments, higher admission rates, and access to advanced immunotherapies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cancer immunotherapy market include Amgen Inc, AstraZeneca plc, Bayer AG, Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc., Johnson & Johnson, Merck & Co., Inc., Merck KGaA, Novartis AG, Pfizer Inc., Sanofi S.A, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)