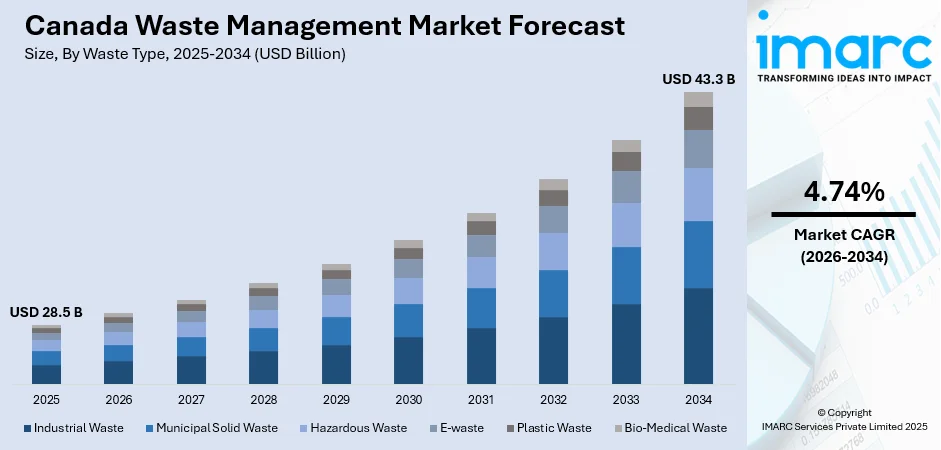

Canada Waste Management Market Report by Waste Type (Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-waste, Plastic Waste, Bio-Medical Waste), Disposal Method (Landfill, Incineration, Recycling), and Region 2026-2034

Canada Waste Management Market Overview:

The Canada waste management market size reached USD 28.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 43.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.74% during 2026-2034. The market is experiencing significant rise in Canada waste management market share driven by ongoing technological advancements, rising sustainability initiatives, increased recycling efforts, and rapid expansion of capabilities by various key players through AI integration, waste-to-energy projects, and strategic acquisitions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 28.5 Billion |

|

Market Forecast in 2034

|

USD 43.3 Billion |

| Market Growth Rate 2026-2034 | 4.74% |

Access the full market insights report Request Sample

Canada Waste Management Market Analysis:

- Major Drivers: Government regulations, increasing urbanization, rising environmental awareness, and corporate sustainability goals are driving investment in efficient, innovative waste management solutions, including recycling, composting, and waste-to-energy technologies.

- Key Maret Trends: Rising demand in the circular economy practices, digitization of waste tracking, smart bins, and increased public-private partnerships are shaping the future of waste management in Canada towards efficiency and sustainability are surging the Canada waste management market growth.

- Market Opportunities: Expanding recycling infrastructure, innovations in plastic waste processing, adoption of AI in waste sorting, and increased investment in waste-to-energy plants offer significant growth avenues for market players.

- Market Challenges: Based on the Canada waste management market analysis, high operational costs, inconsistent provincial regulations, contamination in recyclables, and limited public awareness hinder efficient waste management and the scalability of sustainable waste processing technologies across the country are some of the factors impeding the market demand.

To get more information on this market Request Sample

Canada Waste Management Market Trends:

Increasing Adoption of Circular Economy Principles

One of the prominent Canada waste management market trends is the growing adoption of circular economy principles. This approach emphasizes reducing waste generation, reusing materials, and recycling waste into valuable resources. Additionally, according to the Government of Canada, in 2019, Canada launched the Canada-Wide Strategy and Action Plans on Zero Plastic Waste to encourage circular strategies such as remanufacturing, redesigning, and reducing waste. Companies and municipalities are increasingly implementing circular economy initiatives to minimize landfill usage and create sustainable waste management practices. This shift is driven by environmental concerns and economic opportunities. Businesses are recognizing that adopting circular economy principles can lead to cost savings, new revenue streams, and enhanced corporate reputation. Government policies and incentives also support this trend, promoting waste reduction, recycling programs, and extended producer responsibility schemes. This trend is expected to continue growing as more stakeholders recognize the benefits of moving toward a more sustainable and resource-efficient economy.

Technological Advancements in Waste Management

Technological advancements are transforming the waste management landscape in Canada, driving efficiencies, and improving environmental outcomes. The integration of smart technologies, such as IoT (Internet of Things) devices, data analytics, and automation, is enhancing waste collection, sorting, and processing operations. For instance, in 2022, 62.1% of enterprises in Canada adopted at least one advanced technology, with significant adoption seen in the utilities (80.5%), professional services (75.2%), and manufacturing (74.9%) sectors, as per Statistics Canada. IoT-enabled waste bins, for example, can monitor fill levels in real time, optimizing collection routes and reducing fuel consumption. Data analytics provide valuable insights into waste generation patterns, enabling better planning and resource allocation. Additionally, innovations in waste-to-energy technologies are gaining traction, converting waste into valuable energy resources. These technological advancements help in managing waste more effectively and contribute to reducing greenhouse gas emissions and supporting Canada's climate goals. As technology continues to evolve, the waste management sector is expected to see further improvements in operational efficiency and sustainability.

Expansion of Organics Recycling Programs

The expansion of organics recycling programs is another significant trend in the Canada waste management market. Organic waste, including food scraps, yard trimmings, and other biodegradable materials, represents a substantial portion of the waste stream. Recognizing the environmental impact of organic waste in landfills, where it generates methane, a potent greenhouse gas, many Canadian municipalities are expanding their organics recycling programs. The resulting compost or biogas can be used as a valuable resource for agriculture, landscaping, and renewable energy production. Public awareness campaigns and educational initiatives are also promoting participation in organics recycling programs, helping to reduce contamination and improve program effectiveness. The expansion of these programs helps in diverting waste from landfills and supports soil health and renewable energy goals. As more communities adopt and enhance organics recycling programs, the overall environmental footprint of waste management in Canada is expected to decrease. According to the Statistique Canada, in 2019, 76% of Canadian households reported composting their organic waste, up from 61% in 2009, reflecting growing participation in organic recycling initiatives.

Latest News and Developments:

- In March 2025, Circular Materials will launch Phase 1 of Alberta’s extended producer responsibility (EPR) program for packaging and paper products on April 1, 2025. The initiative shifts recycling costs and management to producers, fostering innovation, efficiency, and better material use. Celebrated with government, industry, and municipal leaders in Edmonton, the milestone aims to strengthen environmental outcomes, enhance recycling systems, and advance Alberta’s circular economy for the benefit of residents and communities.

- In November 2024, The Nuclear Waste Management Organization (NWMO) has chosen Wabigoon Lake Ojibway Nation and the Township of Ignace as host communities for Canada’s deep geological repository for used nuclear fuel. Selected through a consent-based process launched in 2010, the project meets rigorous safety standards and aims to protect people and the environment long term. Both communities confirmed willingness, marking a historic step in Canada’s sustainable and responsible nuclear waste management.

Canada Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on waste type and disposal methods.

Waste Type Insights:

- Industrial Waste

- Municipal Solid Waste

- Hazardous Waste

- E-waste

- Plastic Waste

- Bio-Medical Waste

The report has provided a detailed breakup and analysis of the market based on the waste type. This includes industrial waste, municipal solid waste, hazardous waste, e-waste, plastic waste, and bio-medical waste.

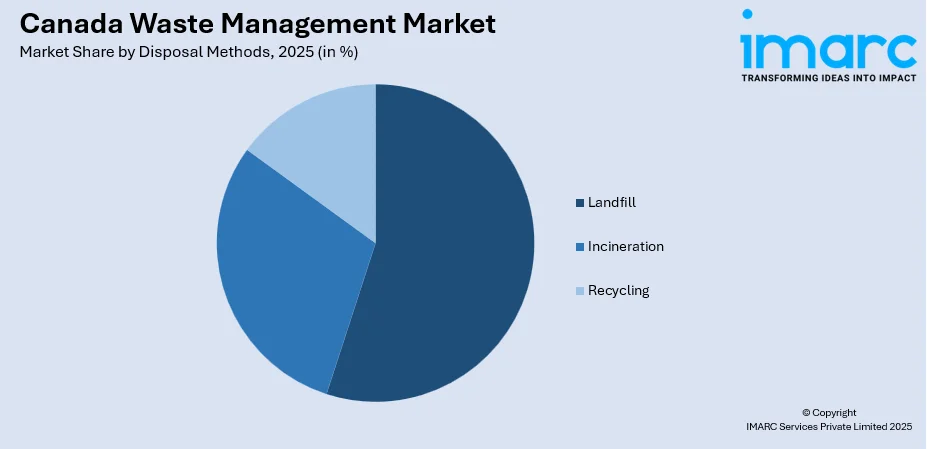

Disposal Methods Insights:

To get detailed segment analysis of this market Request Sample

- Landfill

- Incineration

- Recycling

A detailed breakup and analysis of the market based on the disposal methods have also been provided in the report. This includes landfill, incineration, and recycling.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Waste Types Covered | Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-waste, Plastic Waste, Bio-Medical Waste |

| Disposal Methods Covered | Landfill, Incineration, Recycling |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada waste management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste management market in Canada was valued at USD 28.5 Billion in 2025.

The Canada waste management market is projected to exhibit a CAGR of 4.74% during 2026-2034, reaching a value of USD 43.3 Billion by 2034.

The Canada waste management market is driven by stringent environmental regulations, rising urbanization, growing waste volumes, increased recycling targets, technological innovations, public awareness of sustainability, corporate ESG commitments, and investments in circular economy initiatives, fostering efficient, eco-friendly waste handling and resource recovery across residential, commercial, and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)