Canada Solar Energy Market Report by Technology (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), Application (On-grid, Off-grid), End User (Residential, Commercial, Industrial), and Region 2026-2034

Canada Solar Energy Market Size, Share & Analysis

The Canada solar energy market size reached 7.9 GW in 2025. Looking forward, IMARC Group expects the market to reach 14.5 GW by 2034, exhibiting a growth rate (CAGR) of 6.93% during 2026-2034. The market growth is being propelled by the increasing awareness of environmental sustainability, rising government incentives for renewable energy, reducing costs of solar panels, technological innovations in solar power systems, the adoption of pay-as-you-go (PAYG) model, and the escalating demand for clean energy solutions in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 7.9 GW |

| Market Forecast in 2034 | 14.5 GW |

| Market Growth Rate (2026-2034) | 6.93% |

Access the full market insights report Request Sample

Canada Solar Energy Market Trends:

Government Incentives and Policies

Government incentives and policies, including tax credits, rebates, and grants, serve as a key driver for the solar energy market in Canada by making renewable energy investments more financially attractive and accessible. These incentives help reduce the upfront costs associated with purchasing and installing solar panels. Moreover, initiatives such as the Paris Agreement and national programs like the Solar Electricity for Community Buildings Program and SolarHomes Program propel the adoption of solar photovoltaic (PV) technology. The support from key players like BP and involvement in clean energy programs by organizations like the Canadian Renewable Energy Association contribute to the upward trends. According to BP Statistical Review of World Energy, solar energy generation in Canada increased by approximately 20% from the previous year, reaching 5.2 TWh and representing 10% of the country's total renewable energy generation in 2021. Projections indicate that Canada aims to install 35 GW of solar capacity by 2050, which would considerably boost its contribution to renewable energy generation. Moreover, according to the data by the Government of Canada, the country is a world leader in the production and use of energy from renewable resources. In 2022, renewable energy sources provided 16.9% of Canada’s total primary energy supply. Currently, the cumulative installed capacity for solar PV has grown to 6,452 MW. In line with this, as per the Canadian Renewable Energy Association, the country’s renewable energy sector has grown by 11.2% in 2023.

Decreasing Cost of Solar Technology

The reduction in solar technology costs is a major catalyst for the expansion of Canada's solar energy market, enhancing both affordability and accessibility for a diverse array of consumers and businesses. As production increases and technology advances, the prices of solar panels and related equipment have significantly decreased, making solar installations more economically viable compared to conventional energy sources. This drop in prices motivates not only individual homeowners but also large-scale commercial and industrial businesses. Additionally, the Canadian Renewable Energy Association reports that there are over 43,000 solar (PV) installations on residential, commercial, and industrial rooftops across Canada. These installations directly supply power to the corresponding homes and businesses, demonstrating a strong adoption of solar energy in the region. As a result, an increasing number of individuals and businesses are investing in solar energy, attracted by the considerable savings on energy expenses and the opportunity to support environmental sustainability. For instance, in October 2022, TC Energy Corporation initiated pre-construction efforts for the Saddlebrook Solar Project nxear Aldersyde, Alberta. The company is investing USD 146 million in its inaugural Canadian solar power endeavor, which will have a capacity of about 81 megawatts, which is sufficient to supply energy to 20,000 homes each year. The first phase of construction involves setting up solar panels on TC Energy's property within the local industrial park.

Canada Solar Energy Market News:

- In January 2023, Neoen, a French renewable energy developer, began building a 93 MW solar project in Alberta, Canada. ATCO Electric is managing the operation of this solar power plant. The project is anticipated to be commissioned in 2024, and it plans to sell electricity through power purchase agreements (PPAs) and the electricity market.

- In April 2023, Brookfield Renewable, headquartered in Canada, purchased a majority stake (51%) in CleanMax Enviro Energy Solutions Pvt Ltd (CleanMax), a renewable energy firm, by investing $360 million in an equity round.

- In June 2024, D.R. Horton is partnering with Canadian Solar Inc. to supply solar PV panels and residential batteries for powering communities across California. Canadian Solar announced that under the new agreement, they will provide a comprehensive home energy battery backup solution. This includes their high-efficiency solar panels and the EP Cube, a fully integrated residential energy storage system. The system enables homeowners in D.R. Horton communities to store solar energy they produce themselves, offering a dependable power supply during times of high electricity rates and outages.

Canada Solar Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

To get detailed segment analysis of this market Request Sample

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solar photovoltaic (PV) and concentrated solar power (CSP).

Application Insights:

- On-grid

- Off-grid

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes on-grid and off-grid.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

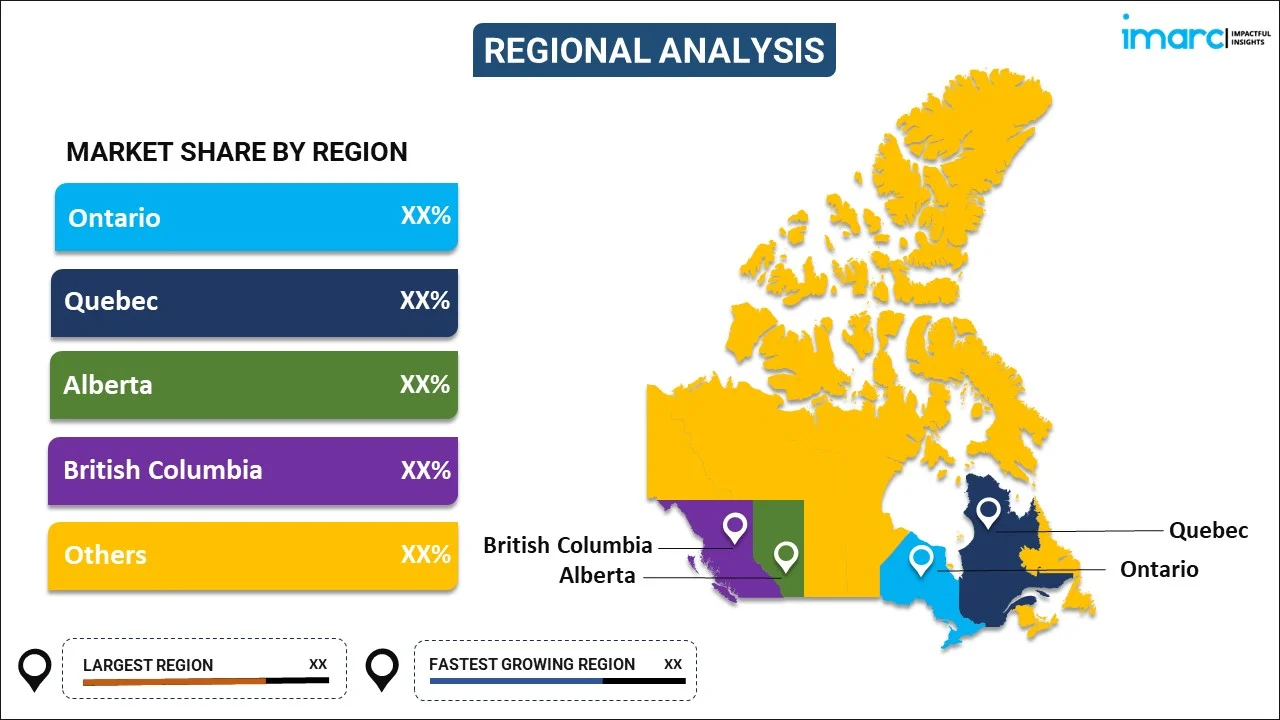

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Applications Covered | On-grid, Off-grid |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada solar energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada solar energy market on the basis of technology?

- What is the breakup of the Canada solar energy market on the basis of application?

- What is the breakup of the Canada solar energy market on the basis of end user?

- What are the various stages in the value chain of the Canada solar energy market?

- What are the key driving factors and challenges in the Canada solar energy?

- What is the structure of the Canada solar energy market and who are the key players?

- What is the degree of competition in the Canada solar energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada solar energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada solar energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)