Canada Security Services Market Report by Service Type (Physical Security, Security Consulting and Planning, Security Equipment and Technology, Asset Tracking, Smart Parking), End User (Individuals (Private/Personal), Residential, Commercial, Public Transport, Industrial Facilities, and Others), and Region 2026-2034

Canada Security Services Market Overview:

The Canada security services market size reached USD 45.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 83.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.73% during 2026-2034. The market is experiencing significant growth driven by rising awareness of cybersecurity threats, heightening adoption of cloud computing and the Internet of Things (IoT) that necessitates robust security solutions, and regulatory compliance requirements that encourage organizations to invest in advanced security services across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 45.2 Billion |

| Market Forecast in 2034 | USD 83.6 Billion |

| Market Growth Rate (2026-2034) | 6.73% |

Access the full market insights report Request Sample

Canada Security Services Market Trends:

Escalating Cybersecurity Demand

The Canadians are increasing their digital activities at a high rate which has augmented demand for cybersecurity. According to the Canadian Centre for Cyber Security, there was an 81% increase in cyber incidents in 2020 from a year prior, showing the significance of safeguarding measures. This has raised the awareness of business organizations and government institutions to invest heavily in the proffered security of these assets against emerging threats. The security services market is experiencing dramatic shifts in the business environment as companies focus on strengthening their cybersecurity measures. This means ensuring the application of the best security technologies and the successful application of extended plans that address threat identification, handling of security incidents, and their risks. As the digital domain continues to grow converged the necessity for efficient cyber security has escalated, creating an unrelenting search for unique means of combating new and ever-advancing forms of cyber threats.

Rising Regulatory Compliance

Requirements such as PIPEDA require organizations to prioritize the security services to meet the requirements of the given acts. For instance, in 2020, the Office of the Privacy Commissioner of Canada recorded a higher level of 57% increase in complaints within the privacy sector. In this context, security service providers are seen to play a critical part in helping businesses manage diverse compliance issues and manage legal issues. These providers possess experience and competence mostly in the deployment and management of secure solutions aligned to expected compliance thereby protecting valuable data and establishing the faith of clients. Security professionals can work alongside organizations to identify compliance issues and keep up with regulatory changes and build robust regulatory policies within organizations for data protection. This approach assists organizations in discharging their legal and in underlining a company’s dedication to upholding consumer privacy in a sphere that becomes progressively governed.

Emerging Technologies

The adoption of advanced technologies such as AI, IoT, and cloud computing presents significant opportunities and challenges for security services. According to the International Data Corporation (IDC), Canada's IT spending reached $4 trillion by 2027, reflecting the widespread embrace of these technologies to boost productivity. However, this digital transformation also introduces heightened security risks, as these technologies expand the attack surface and create new vulnerabilities. Security service providers are stepping up with innovative solutions to address these emerging threats, offering advanced threat detection, AI-driven cybersecurity tools, and comprehensive risk management strategies. By focusing on securing the interconnected and data-rich environments that AI, IoT, and cloud computing create, these providers are well-positioned to capitalize on the growing market demand. As organizations continue to invest in these technologies, the need for robust security measures will drive sustained growth in the security services sector, ensuring both technological advancement and protection.

Canada Security Services Market News:

- In May 2024, Canada joins international security partners in release of advisory, guidance on growing cyber security threats to civil society.

- In January 2024, Nanalysis Scientific Corp., a leader in portable NMR machines, MRI technology for industrial and research applications, and detection equipment services, gives an update on its subsidiary K'(Prime) Technologies ("KPrime") security services business and the five-year $160 million contract with Canadian Air Transport Security Authority ("CATSA").

Canada Security Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type and end user.

Service Type Insights:

To get detailed segment analysis of this market Request Sample

- Physical Security

- Manned Guarding

- Personal/Private Security

- Escorts

- Mobile Patrol

- Event Security

- Crowd Management

- K9 Security

- Police Support Service

- Airport Security

- Traffic Control Services

- Others

- Security Consulting and Planning

- Loss Prevention

- Investigation Consulting

- Security Risk Management

- Roadside Assistance

- Security Equipment and Technology

- Access Control

- KeyFobs/Card Access

- Biometric/Keypad Access

- Facial Recognition

- Visitor Management

- Surveillance Systems

- Video Surveillance

- Alarm Systems

- Access Control

- Asset Tracking

- Smart Parking

The report has provided a detailed breakup and analysis of the market based on the service type. This includes physical security (manned guarding, personal/private security, escorts, mobile patrol, event security, crowd management, k9 security, police support service, airport security, traffic control services, and others), security consulting & planning (loss prevention, investigation consulting, security risk management, and roadside assistance), security equipment and technology [access control (keyfobs/card access, biometric/keypad access, facial recognition, and visitor management), and surveillance systems (video surveillance and alarm systems)], asset tracking, and smart parking.

End User Insights:

- Individuals (Private/Personal)

- Residential

- Individual Homes

- Colonies and Societies

- Commercial

- Educational Institutions

- Hospitals and Clinics

- Corporate Offices

- Retail

- Banks and Financial Institutions

- Others

- Public Transport

- Industrial Facilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individuals (private/personal), residential (individual homes and colonies and societies), commercial (educational institutions, hospitals and clinics, corporate offices, retail, banks and financial institutions, and others), public transport, industrial facilities, and others.

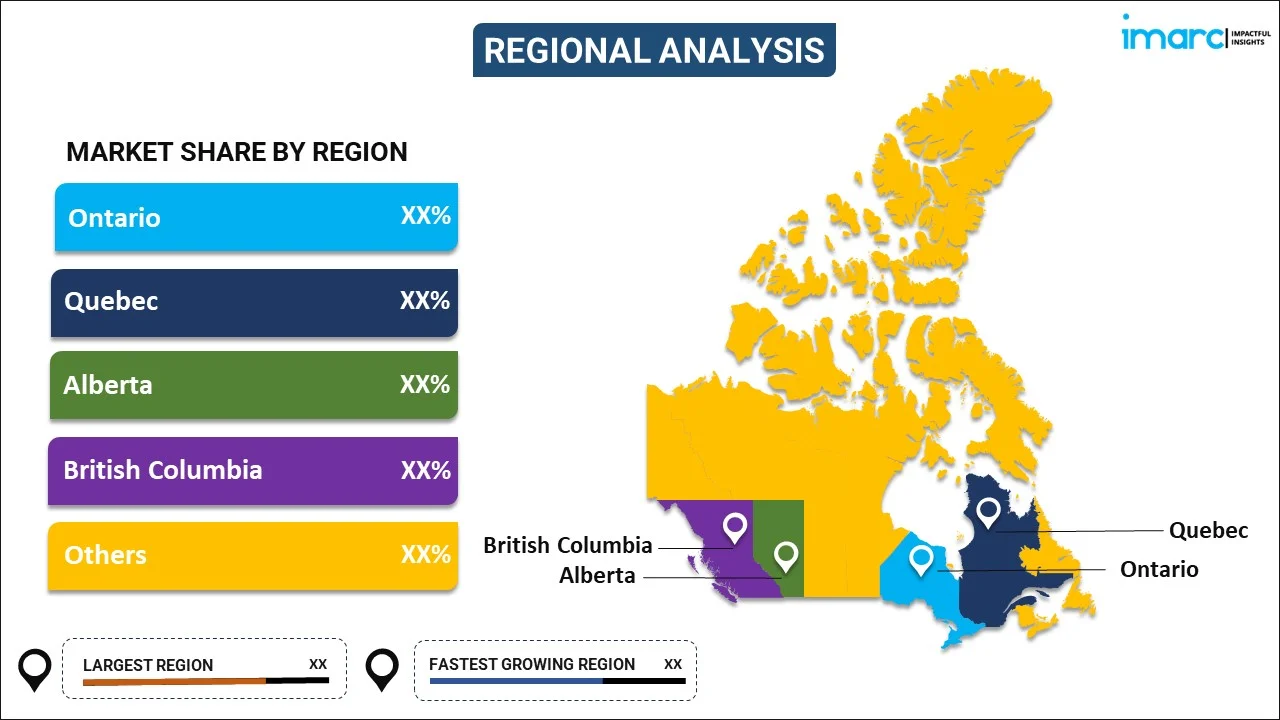

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Security Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered |

|

| End Users Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada security services market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada security services market on the basis of service type?

- What is the breakup of the Canada security services market on the basis of end user?

- What are the various stages in the value chain of the Canada security services market?

- What are the key driving factors and challenges in the Canada security services?

- What is the structure of the Canada security services market and who are the key players?

- What is the degree of competition in the Canada security services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada security services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada security services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)