Canada Pulses Market Report by Type (Lentils, Dry Beans, Dry Peas, Chick Peas, and Others), Domestic Consumption and Exports (Domestic Consumption, Exports), End-Use (Retail Store, Snack Food Industry, Flour Industry, and Others), and Region 2025-2033

Market Overview:

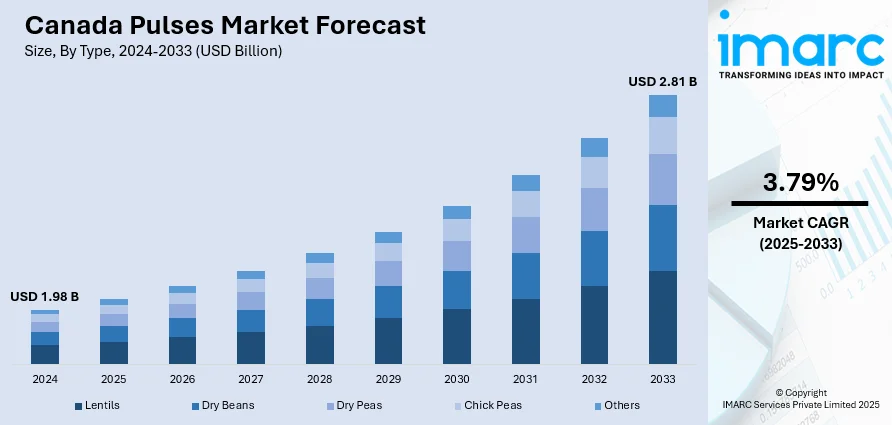

The Canada pulses market size reached USD 1.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.81 Billion by 2033, exhibiting a growth rate (CAGR) of 3.79% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.98 Billion |

| Market Forecast in 2033 | USD 2.81 Billion |

| Market Growth Rate (2025-2033) | 3.79% |

Canada represents one of the largest producers and exporter of pulse crops. The country offers large and diverse agricultural land base which is suitable for growing a wide range of pulse crops such as pea, lentil, bean and chickpea. Furthermore, appropriate weather and favorable soil conditions provide Canada with a natural production advantage. The application of the latest farm management technology and research have also been influential in increasing the production of pulse crops in the country. Dry peas currently represent the most produced type of pulse crop in Canada followed by Lentils. Canada is a net exporter of pulses with the majority of its total production being exported across the globe. India, United States and China currently represent the largest export markets for pulses from Canada.

To get more information of this market, Request Sample

IMARC Group’s latest report provides a deep insight into the Canada pulses market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the pulses market in Canada in any manner.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Canada pulses market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, domestic consumption and exports, and end-use.

Breakup by Type:

- Lentils

- Dry Beans

- Dry Peas

- Chick Peas

- Others

Breakup by Region:

- Saskatchewan

- Alberta

- Manitoba

- Ontario

- Others

Breakup by Domestic Consumption and Exports:

- Domestic Consumption

- Exports

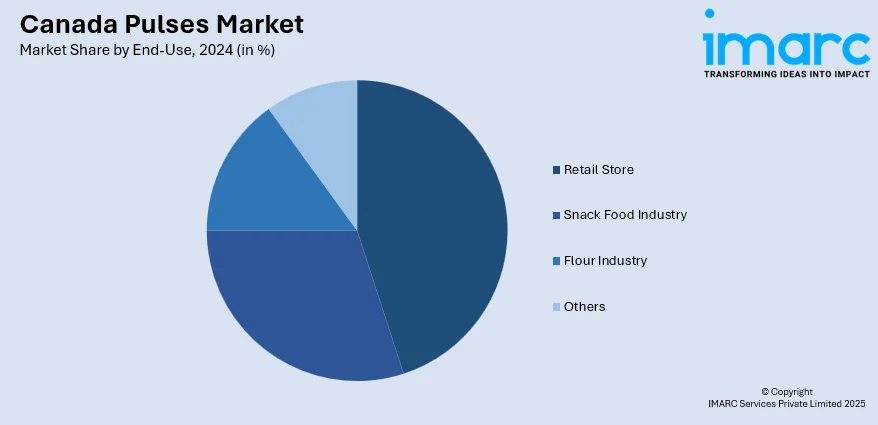

Breakup by End-Use:

- Retail Store

- Snack Food Industry

- Flour Industry

- Others

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape

- Competitive Structure

- Key Player Profiles

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Segment Coverage | Type, Domestic Consumption and Exports, End-Use, Region |

| Region Covered | Saskatchewan, Alberta, Manitoba, Ontario, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the Canada pulses market to exhibit a CAGR of 3.79% during 2025-2033.

The increasing demand for pulses, as they aid in improving digestion, reducing blood glucose, minimizing inflammation, lowering blood cholesterol, and preventing chronic health issues, such as diabetes, heart diseases and obesity, is primarily driving the Canada pulses market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of pulses across the nation.

Based on the type, the Canada pulses market can be bifurcated into lentils, dry beans, dry peas, chick peas, and others. Currently, dry peas hold the majority of the total market share.

Based on the domestic consumption and exports, the Canada pulses market has been segmented into domestic consumption and exports, where exports currently exhibit a clear dominance in the market.

Based on the end-use, the Canada pulses market can be divided into retail store, snack food industry, flour industry, and others. Currently, retail store accounts for the largest market share.

On a regional level, the market has been classified into Saskatchewan, Alberta, Manitoba, Ontario, and others, where Saskatchewan currently dominates the Canada pulses market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)