Canada Payments Market Report by Mode of Payment (Point of Sale, Online Sale), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, and Others), and Region 2026-2034

Canada Payments Market Overview:

The Canada payments market size reached 24.1 Billion Transactions in 2025. Looking forward, IMARC Group expects the market to reach 39.1 Billion Transactions by 2034, exhibiting a growth rate (CAGR) of 5.27% during 2026-2034. The market is driven by thriving e-commerce industry, which results in an overall increase in transaction volume, along with the growing reliance on online payments that provide an unmatched level of convenience to people.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 24.1 Billion Transactions |

| Market Forecast in 2034 | 39.1 Billion Transactions |

| Market Growth Rate (2026-2034) | 5.27% |

Access the full market insights report Request Sample

Canada Payments Market Trends:

Thriving E-Commerce Industry

According to an article published in 2023 on the website of the International Trade Administration (IEA), there were around 27 million eCommerce users in Canada, accounting for 75% of the Canadian population in 2022. The need for payment processing services is rising as more Canadians are shopping online and as a result, there is an overall increase in transaction volume. Financial institutions and payment service providers benefit from increased transaction revenues. Secure payment methods are necessary for e-commerce transactions to safeguard private financial data. Innovations in payment security solutions, including fraud detection systems, tokenization, and encryption, is fueled by this demand and benefits both customers and retailers. The expansion of e-commerce promotes the use of various payment methods other than credit and debit cards. Online shoppers are increasingly using alternative payment methods including digital wallets, buy now pay later (BNPL) services, and bank transfers. This is opening new chances for payment service providers to deliver innovative solutions.

Cross-border transactions are increasing as a result of Canadian firms are able to sell their goods and services to buyers all over the world through e-commerce. This trend is advantageous to payment service providers who handle currency conversion and international payment processing. With more people turning to smartphones and tablets for payment purposes, the market for payments is growing along with mobile commerce. M-commerce transactions are greatly aided by mobile payment options like in-app purchases and mobile wallets.

Increasing Reliance on Online Payment

An article published in 2023 on the website of the Statistique Canada shows that 78% Canadians used internet to conduct online banking in 2022. Online payments provide customers with an unmatched level of convenience. Canadians no longer need to carry cash or visit actual establishments in order to make purchases, they can do it while relaxing at home or on the go. The acceptance of online payment options is fueled by this convenience element. Online payment solutions are in more demand as the e-commerce industry is growing due to factors like evolving customer tastes and technological developments. The payments market is expanding because businesses need reliable and secure payment processing services to enable online transactions. The expansion of online payments in Canada is facilitated by the growing use of digital wallets. These digital wallet solutions facilitate easy and safe online shopping for customers.

Online payments are growing in part because more people are using smartphones and other mobile devices for online purchasing. Online payment methods are being adopted more widely because mobile commerce platforms and applications give customers a convenient way to explore, shop, and pay for goods and services. Online payment systems are always improving to provide stronger fraud protection tools and more security features. People are encouraged to use online payment methods for their transactions as a result, which boosts their confidence and trust and propels the payments market's expansion.

Canada Payments Market News:

- September 2023: Bank of America introduced its business-to-consumer (B2C) payments solution in Canada as it continues to bolster its digital solutions.

- April 2024: Mastercard and leading Canadian fintech VoPay entered into a strategic partnership to empower Canadians to move money quickly and securely with Mastercard.

Canada Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on mode of payment and end use industry.

Mode of Payment Insights:

To get detailed segment analysis of this market Request Sample

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of payment. This includes point of sale (card payments, digital wallet, cash, and others) and online sale (card payments, digital wallet, and others).

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, entertainment, healthcare, hospitality, and others.

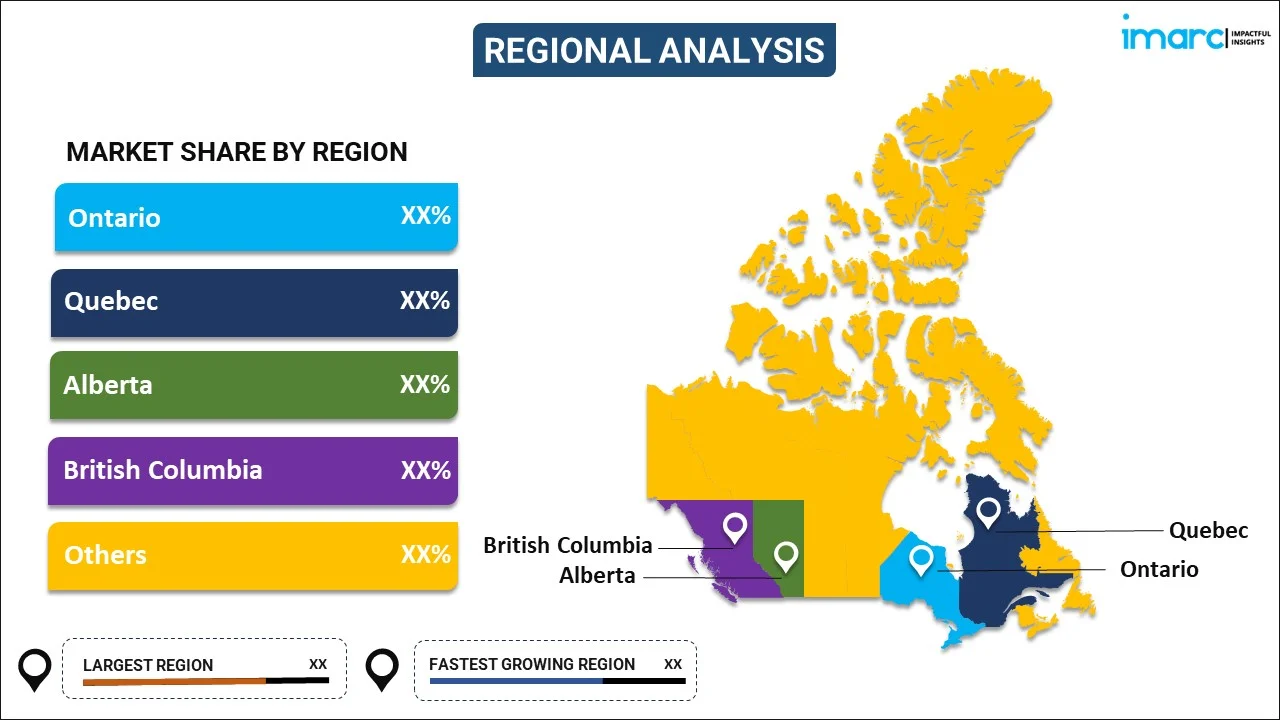

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion Transactions |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Payments Covered |

|

| End Use Industries Covered | Retail, Entertainment, Healthcare, Hospitality, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada payments market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada payments market on the basis of mode of payment?

- What is the breakup of the Canada payments market on the basis of end use industry?

- What are the various stages in the value chain of the Canada payments market?

- What are the key driving factors and challenges in the Canada payments?

- What is the structure of the Canada payments market and who are the key players?

- What is the degree of competition in the Canada payments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)