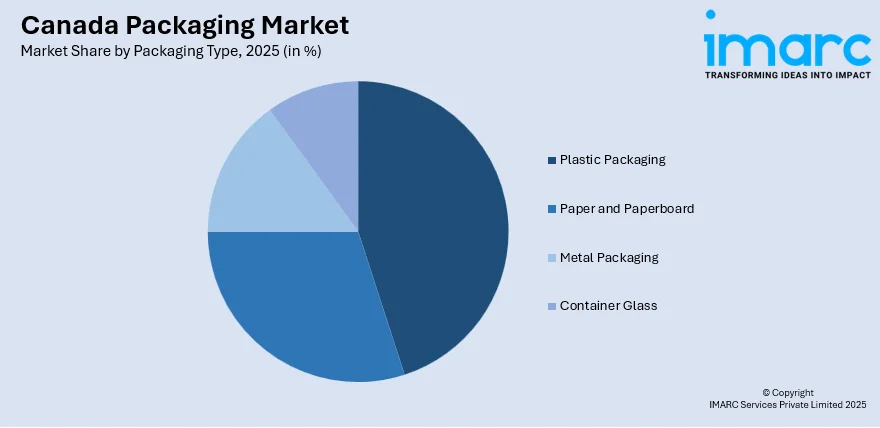

Canada Packaging Market Report by Packaging Type (Plastic Packaging, Paper and Paperboard, Metal Packaging, Container Glass), and Region 2026-2034

Canada Packaging Market Overview:

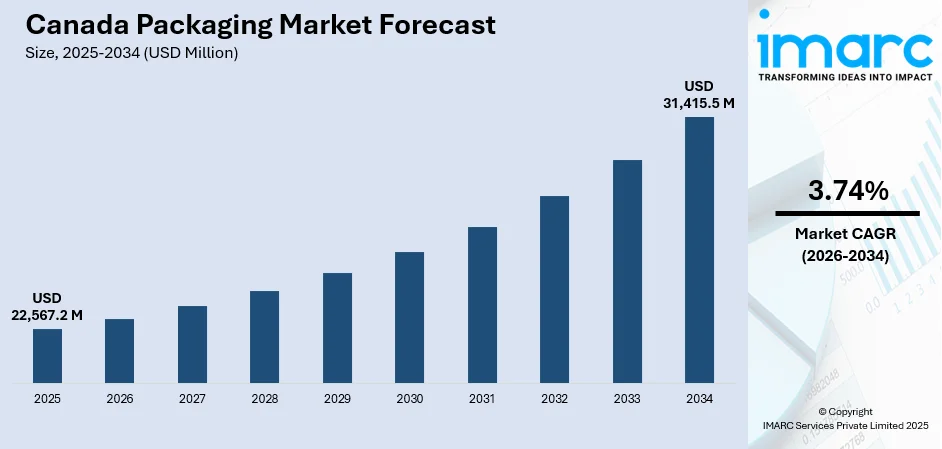

The Canada packaging market size reached USD 22,567.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 31,415.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The extensive demand for eco-friendly materials, significant technological advancements and innovation, smart packaging solutions, and regulatory compliance represents some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 22,567.2 Million |

|

Market Forecast in 2034

|

USD 31,415.5 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Access the full market insights report Request Sample

Canada Packaging Market Trends:

Sustainability and Environmental Concerns

Environmental concerns and sustainability remain key factors influencing the growth of the packaging market in Canada. This is because there has been a growing concern for the environment and the effects of plastic packaging materials. This change is driving the use of recycled, biodegradable, and compostable materials in packaging. The Canadian government’s rules on single-use plastics and efforts towards sustainable measures also support this trend. For example, in April 2022, the Circular Plastics Taskforce received support from the Canadian government's Ministry of Economy and Innovation (MEI) for projects aimed at enhancing the recycling of all plastic packaging. The organization secured over USD 399,904 from MEI to initiate the second phase of the project. To address these legal standards, firms are conducting research and development (R&D) to develop new and environmentally friendly packaging products. The concern for environmental impact and the adoption of circular economy concepts is shifting the packaging industry to more sustainable options and fueling market expansion. According to an article published by the CBC news, the federal government is banning companies from importing or making plastic bags and takeout containers by the end of this year, from selling them by the end of next year and from exporting them by the end of 2025.

To get more information on this market Request Sample

Technological Advancements and Innovation

The packaging market in Canada is growing due to technological advancements and innovations. The use of new technologies, such as QR codes, RFID tags, and NFC technology, in the design of smart packaging solutions is becoming popular in the market. These developments improve the identification of products, increase supply chain visibility, and provide a better way of engaging customers. Furthermore, new packaging materials and packaging designs are enhancing the usability and attractiveness of the products. New technologies like 3D printing and automation are improving the production rate and decreasing the expense. Advancements in digital technologies and the adoption of sustainable practices have helped packaging companies to address consumers’ changing needs and regulatory requirements, which has further boosted the market. Canadian weigh importance on improving customer experience at least 10% higher than global counterparts. Enterprise technology is expected to play a key role, with almost two-thirds of Canadians prioritizing investments in this area over the coming year.

Canada Packaging Market News:

- In May 2024, Amcor, a global leader in developing and producing responsible packaging solutions, and AVON, a cosmetics, skin care and personal care pioneer, announced the launch of the AmPrima™ Plus refill pouch for the AVON Little Black Dress classic shower gels in China. The recycle-ready packaging will result in an 83% reduction in carbon footprint, and 88% and 79% reduction in water consumption and renewable energy respectively when it's recycled.

Canada Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on packaging type.

Packaging Type Insights:

To get detailed segment analysis of this market Request Sample

- Plastic Packaging

- By Rigid Plastic Packaging

- Breakup By Material Type

- PE (HDPE, LDPE)

- PP

- PET

- PVC

- PS and EPS

- Breakup By Product Type

- Bottles and Jars (Containers)

- Caps and Closures

- Bulk-Grade Products - IBC

- Crates and Pallets

- Others

- Breakup By End Use Industry

- Food

- Beverage

- Industrial and Construction

- Automotive

- Cosmetics and Personal Care

- Others

- Breakup By Material Type

- By Flexible Plastic Packaging

- Breakup By Material Type

- PE

- BOPP

- CPP

- Others

- Breakup By Product Type

- Pouches

- Bags

- Films and Wraps

- Breakup By End Use Industry

- Food

- Beverage

- Pharmaceutical

- Cosmetics and Personal Care

- Breakup By Material Type

- By Rigid Plastic Packaging

- Paper and Paperboard

- By Product Type

- Folding Carton

- Corrugated Boxes

- Single-use Paper Products (Bags, Cups, Others)

- By End User

- Food

- Beverage

- Industrial and Electronic

- Cosmetics and Personal Care

- Healthcare

- Others

- By Product Type

- Metal Packaging

- By Product Type

- Cans (Food, Beverage, Aerosols, Others)

- Caps and Closures

- Others

- By Product Type

- Container Glass

- By End User

- Food

- Beverage (Alcoholic, Non-Alcoholic)

- Personal Care and Cosmetics

- Pharmaceuticals

- By End User

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes plastic packaging [by rigid plastic packaging, (breakup by material type {PE (HDPE, LDPE), PP, PET, PVC, and PS and EPS}, breakup by product type {bottles and jars (containers), caps and closures, bulk-grade products - IBC, crates and pallets, and others}, and breakup by end use industry {food, beverage, industrial and construction, automotive, cosmetics and personal care, and others})], and [by flexible plastic packaging, (breakup by material type {PE, BOPP, CPP, others}, breakup by product type {pouches, bags, films and wraps}, and breakup by end use industry {food, beverage, pharmaceutical, and cosmetics and personal care})], paper and paperboard [(by product type {folding carton, corrugated boxes, and single-use paper products (bags, cups, others)}, by end user {food, beverage, industrial and electronic, cosmetics and personal care, healthcare, and others})], metal packaging [by product type {cans (food, beverage, aerosols, others), caps and closures, and others}], and container glass [by end user {food, beverage (alcoholic, non-alcoholic), personal care and cosmetics, and pharmaceuticals}].

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada packaging market on the basis of packaging type?

- What are the various stages in the value chain of the Canada packaging market?

- What are the key driving factors and challenges in the Canada packaging market?

- What is the structure of the Canada packaging market and who are the key players?

- What is the degree of competition in the Canada packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)