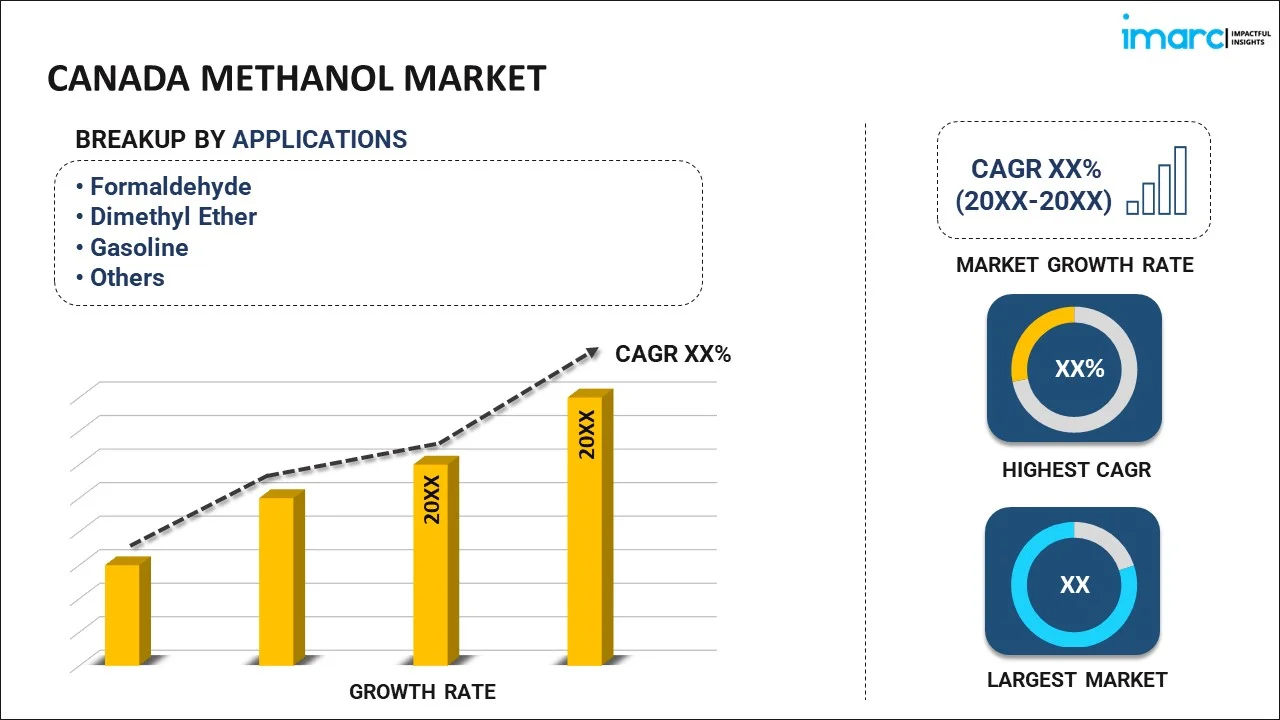

Canada Methanol Market Report by Application (Formaldehyde, Dimethyl Ether, Gasoline, Chloromethane, MTBE/TAME, Acetic Acid, and Others), and Region 2026-2034

Canada Methanol Market Overview:

The Canada methanol market size reached USD 802.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,244.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.84% during 2026-2034. The growing demand in the automotive and construction sectors, increasing applications in chemical manufacturing, government support for cleaner fuels, advancements in production technology, and rising partnerships between key players are some of the factors propelling the market growth in Canada.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 802.6 Million |

|

Market Forecast in 2034

|

USD 1,244.1 Million |

| Market Growth Rate 2026-2034 | 4.84% |

Access the full market insights report Request Sample

Canada Methanol Market Trends:

Increasing Demand in the Marine Sector

Stringent regulations set by the international maritime organization (IMO) are leading to a rise in the demand for methanol in Canada as the shipping industry transitions to using cleaner marine fuels. The requirement from the IMO to decrease sulfur oxide emissions from ships is increasing the adoption of methanol as an alternative marine fuel. Methanol provides environmental advantages by releasing reduced amounts of sulfur oxides, nitrogen oxides, and particulate matter in comparison to traditional marine fuels, making it an appealing choice for lowering the ecological footprint of maritime transportation. Canadian ports and shipping companies are progressively turning to methanol because of its affordability and adherence to environmental regulations.

Advancements in Waste-to-Methanol Technology

Progress in waste-to-methanol technology is transforming the methanol industry by offering an eco-friendly solution to waste disposal and the creation of renewable fuel. This technology transforms municipal solid waste, agricultural residues, and other organic waste into methanol using gasification or anaerobic digestion followed by synthesis processes. Recent advancements are concentrating on enhancing the effectiveness and expansibility of these transformation procedures, rendering them more economically feasible and ecologically sustainable. Advanced gasification techniques, improved catalyst formulations, and carbon capture and utilization systems are greatly reducing the carbon footprint of methanol manufacturing. Furthermore, waste-to-methanol technology tackles both waste management and renewable energy generation issues, in line with worldwide sustainability objectives. Pilot projects and commercial plants in various regions, including Canada, are demonstrating the feasibility and benefits of this approach. For example, in August 2023, Technip Energies and Enerkem agreed to work together to speed up the implementation of Enerkem's technology for converting waste into biofuels and circular chemicals, including producing methanol. The goal of the collaboration was to improve the ability and pace of delivering projects for constructing new waste-to-methanol facilities on a commercial scale.

Strategic Partnerships and Investments in Methanol Infrastructure

Partnerships among major industry players, government agencies, and research institutions are fostering the development of methanol production facilities and distribution networks. Funds are being allocated towards constructing modern methanol facilities with cutting-edge technologies to improve productivity and environmental sustainability. Furthermore, collaborating with overseas companies is helping Canada increase its exports, allowing for entry into worldwide markets and maintaining a continuous methanol supply. These partnerships help to transfer knowledge and encourage innovation, speeding up the implementation of renewable methanol production techniques. They are also essential for enhancing the methanol supply chain and infrastructure, particularly in sectors like offshore renewable energy, where there is a heightened demand for cleaner fuels.

Canada Methanol Market News:

- May 2024: Kotug Canada conducted a keel-laying event for two escort tugs powered by methanol, which were created by Robert Allan Ltd to assist the Trans Mountain pipeline expansion. The tugboats, scheduled to be delivered by mid-2025, will guide tankers from Vancouver to the Pacific Ocean.

- June 2023: Algoma Central Corporation purchased two methanol-capable 37,000 dwt product tankers from Hyundai Mipo Shipyard for a price of $127 million CAD. The goal of these ships was to assist Irving Oil in their long-term charters by facilitating sustainable energy transport while also having the ability to use methanol fuel in the future.

Canada Methanol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on application.

Application Insights:

To get detailed segment analysis of this market Request Sample

- Formaldehyde

- Dimethyl Ether

- Gasoline

- Chloromethane

- MTBE/TAME

- Acetic Acid

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes formaldehyde, dimethyl ether, gasoline, chloromethane, MTBE/TAME, acetic acid, and others.

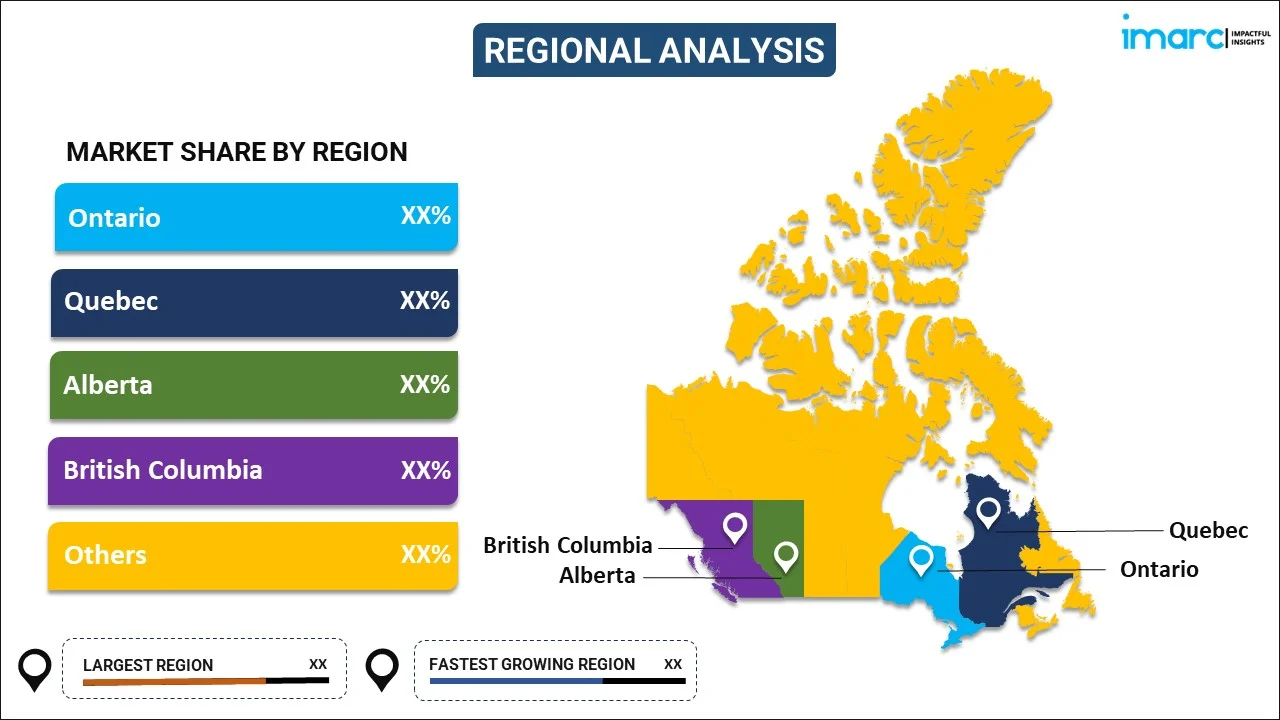

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Methanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Formaldehyde, Dimethyl Ether, Gasoline, Chloromethane, MTBE/TAME, Acetic Acid, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada methanol market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada methanol market on the basis of application?

- What are the various stages in the value chain of the Canada methanol market?

- What are the key driving factors and challenges in the Canada methanol?

- What is the structure of the Canada methanol market and who are the key players?

- What is the degree of competition in the Canada methanol market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada methanol market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada methanol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada methanol industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)