Canada IT Services Market Report by Service Type (Professional Services (System Integration and Consulting), Managed Services), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Deployment Mode (On-premises, Cloud-based), End Use Industry (BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, and Others), and Region 2026-2034

Canada IT Services Market Overview:

The Canada IT services market size reached USD 28.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 72.2 Billion by 2034, exhibiting a growth rate (CAGR) of 10.41% during 2026-2034. The Canada market is majorly driven by digital transformation initiatives, increased cloud adoption, heightened cybersecurity needs, expanding tech startup ecosystem, e-commerce expansion, remote and hybrid work models, continual advancements in AI and ML, fintech innovations, and widespread IoT adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.3 Billion |

| Market Forecast in 2034 | USD 72.2 Billion |

| Market Growth Rate (2026-2034) | 10.41% |

Access the full market insights report Request Sample

Canada IT Services Market Trends:

Digital Transformation Initiatives

Numeorus firms are realizing the significance of the reinvention of IT as a growing amount of business activities are going digital. This change entails the use of technologies, including cloud computing, AI, ML, and IoT in developing and improving organizational processes, customer touchpoints, and products and services. The Canadian government has also supported the organization’s growth through championing the adoption of digital technologies. As the government enforces policies, such as the digital charter which seeks to establish the cornerstone for a competitive digital economy, data protection, privacy, and innovation are encouraged. Moreover, continual developments in IT and communication technologies, provision of broadband connection in the countryside, are also expanding the opportunity for investment in superior types of IT assistance. Furthermore, IT services are being funded to get rid of outdated network structures or to shift data storage to the cloud, to build up data analysis tools and applications that are tailored to an enterprise’s requirements. This demand is thus creating a market for consultants, implementors and managed services from IT service providers.

Increasing Adoption of Cloud Services

Cloud computing offer several benefits such as reduced costs, expansion possibilities and high versatility so it is widely adopted among various industries. As more companies look forward to cutting their capital intensity on physical structures and towards operating expenditure cloud services is becoming popular. The rate of cloud service adoption in Canada has also risen sharply especially for public, private and hybrid cloud services. Popular public cloud vendors including amazon web services (AWS), Microsoft azure, google cloud, among others are increasingly offering an extensive portfolio of services for the Canada based organizations, to address various needs. They are also making investments in local data centers to solve for data jurisdiction concerns and Canada’s regulations. Specifically for the SMEs, which are adopting cloud services actively, access to the enterprise level IT infrastructure and capabilities is available at minimum upfront costs. Solutions such as cloud-based CRM, ERP, and collaboration applications are increasingly popular among SMEs, making such non-IT services as migration, integration, and management relevant to them.

Cybersecurity Concerns and Compliance Requirements

The need to safeguard sensitive data, intellectual property, and critical infrastructure is driving considerable investments in cybersecurity solutions and services. The Canadian government has introduced stringent regulations and standards, such as the personal information protection and electronic documents act (PIPEDA), to ensure data privacy and security. Organizations are seeking comprehensive cybersecurity services, including threat detection and response, vulnerability assessment, and incident management. The rise in remote work has further amplified cybersecurity risks, as employees access corporate networks from various locations and devices. This trend has led to increased demand for secure remote access solutions, multi-factor authentication, and endpoint security services. Moreover, industries such as finance, healthcare, and government are subject to strict compliance requirements, necessitating robust cybersecurity measures. IT service providers are capitalizing on this demand by offering managed security services, compliance consulting, and risk management solutions. The growing awareness of cyber risks and the necessity for proactive cybersecurity strategies are propelling the expansion of the IT services market in Canada.

Canada IT Services Market News:

- On 20th February 2024, Wipro Limited announced the launch of Wipro enterprise artificial intelligence (AI)-ready platform, a new service that will allow clients to create their enterprise-level, fully integrated and customized AI environments. This new service enhances operations with a suite of capabilities spanning across tools, large language models (LLMs), streamlined processes, and robust governance.

- On 13th November 2023, Vodafone Group Plc announced the partnership with Accenture to commercialize Vodafone’s shared operations to accelerate growth, enhance customer service and drive significant efficiencies for Vodafone’s operating companies and partner markets, as well as create new career opportunities for its individuals.

Canada IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, enterprise size, deployment mode, and end use industry.

Service Type Insights:

To get detailed segment analysis of this market Request Sample

- Professional Services (System Integration and Consulting)

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes professional services (system integration and consulting) and managed services.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

End Use Industry Insights:

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, telecommunication, healthcare, retail, manufacturing, government, and others.

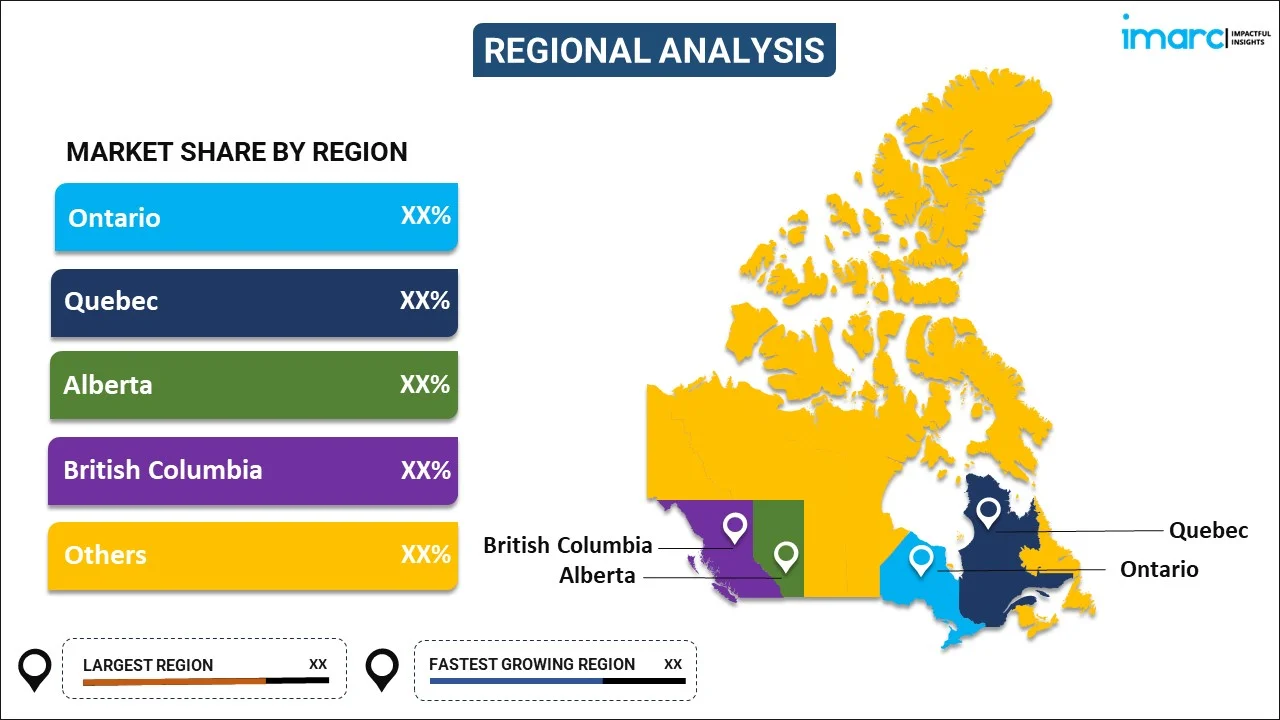

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Professional Services (System Integration and Consulting), Managed Services |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada IT services market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Canada IT services market?

- What is the breakup of the Canada IT services market on the basis of service type?

- What is the breakup of the Canada IT services market on the basis of enterprise size?

- What is the breakup of the Canada IT services market on the basis of deployment mode?

- What is the breakup of the Canada IT services market on the basis of end use industry?

- What are the various stages in the value chain of the Canada IT services market?

- What are the key driving factors and challenges in the Canada IT services?

- What is the structure of the Canada IT services market and who are the key players?

- What is the degree of competition in the Canada IT services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada IT services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)