Canada Hot Food Vending Machine Market Report by Food Type (Sandwiches, Pizza, Burgers, Hot Dogs, Pack Soup, Ready Meat, Steam Products, French Fries, and Others), Capacity (Below 100 Units, 100-150 Units, Above 150 Units), Material Type (Steel, Aluminum, and Others), Application (Hospitals and Clinics, Hotels and Restaurants, Malls and Retail Stores, Airports and Railways Stations, Corporates and Offices, Academic Institutions, Hypermarkets/Supermarkets, Food Service Companies/Operators, and Others), and Region 2026-2034

Canada Hot Food Vending Machine Market Overview:

The Canada hot food vending machine market size reached USD 470.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 696.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.32% during 2026-2034. The market in Canada is majorly driven by the increasing demand for convenient meal solutions, continual technological advancements, diverse food offerings, heightened health and safety awareness, rapid urbanization, demographic shifts, sustainability considerations, rising investments, expansion into new locations, and the growing emphasis on health and wellness thus surging the Canada hot food vending machine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 470.7 Million |

|

Market Forecast in 2034

|

USD 696.8 Million |

| Market Growth Rate 2026-2034 | 4.32% |

Access the full market insights report Request Sample

Canada Hot Food Vending Machine Market Analysis:

- Major Drivers: Increasing demand for convenient, ready-to-eat (RTE) meals, urban lifestyle shifts, labor shortages in foodservice, and advancements in vending technology drive Canada hot food vending machine market growth across universities, offices, and transportation hubs.

- Key Market Trends: Rise in smart vending with artificial intelligence (AI), cashless payments, healthier hot meal options, and 24/7 availability trends shape consumer preferences, especially in metropolitan areas and tech-driven environments.

- Market Challenges: High upfront investment, stringent food safety regulations, limited menu variety, and maintenance complexities pose operational hurdles for operators expanding across diverse Canadian climates and regional consumer tastes.

- Market Opportunities: Growth potential in transit hubs, remote workplaces, and educational institutions; partnerships with local food brands; and leveraging Internet of Things (IoT) analytics for inventory and demand forecasting create strong expansion pathways in the Canada hot food vending machine market analysis.

Canada Hot Food Vending Machine Market Trends:

Convenience and Accessibility

Extensive use and proper availability of hot food vending machine in the country are mainly influenced by the high Canada hot food vending machine market demand for convenient and easy availability of food products in the Canada market. Hot food vending machines offers convenience by allowing individuals to have meals whenever they want it without waiting in long lines for a restaurant or waiting for a restaurant to open. These machines are situated at areas, including office complexes, colleges and universities, hospitals, airports and stations, and shopping malls. This placement strategy is strategic in a way that consumers of hot meals will always be close and within reach of a function. The convenience of purchasing a hot meal in just a few minutes is highly appealing, especially for those with limited time during lunch breaks or between meetings.

Continual Technological Advancements

The Canada market is primarily driven by continual advancements in technology that has enhanced the market in terms of accessibility and convenience. The vending machines can be controlled by touch panels for ease of menu selection, users can pay cashless either through credit or debit cards or through mobile payment mechanism, sophisticated inventory and vending machine performance tracking systems. This is accompanied by the incorporation of internet of things (IoT) which makes it easy for operators to monitor and control vending machines from a distance. This involves keeping records of raw stocks, evaluating the condition of equipments, and observing the pattern of consumer needs and demands. It also assists operators in adjusting frequently with the strategy so that all machines have the inventory of popular products and mechanical problems are fixed as soon as possible to reduce time wastage and improve customer satisfaction.

Urbanization and Demographic Shifts

Individuals are shifting to urban centers for their residences and thus they look for foods that are quick and easy to prepare. Vending machines may also readily be placed in areas of high human traffic such as business districts of urban centres as they are able to comfortably reach high numbers of customers within a limited geographical space.

It is also found that the energy-drink-vending generation, or the millennial and Gen Z generations, are more likely to buy their meals from vending machines. The consumers being tech-savvy and keen on convenience opt for meals that can be accessed easily due to their busy schedules. Therefore, increasing population of young people from the ages of 18 to 40 in urban areas adds to the market for hot food vending machines.

Environmental Considerations

Sustainability and environmental concerns are becoming increasingly important to consumers. Hot food vending machines can contribute to reducing food waste and minimizing environmental impact in several ways. Many modern machines are designed to optimize portion sizes and maintain food freshness, reducing the likelihood of food spoilage. Additionally, some vending machine operators are adopting eco-friendly packaging solutions and sourcing ingredients locally to support sustainable practices. By addressing environmental considerations, the hot food vending machine market aligns with the values of environmentally conscious consumers. This alignment helps attract more customers and enhances the overall reputation of vending machine operators committed to sustainability.

Canada Hot Food Vending Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on food type, capacity, material type, and application.

Food Type Insights:

To get detailed segment analysis of this market Request Sample

- Sandwiches

- Pizza

- Burgers

- Hot Dogs

- Pack Soup

- Ready Meat

- Steam Products

- French Fries

- Others

The report has provided a detailed breakup and analysis of the market based on the food type. This includes sandwiches, pizza, burgers, hot dogs, pack soup, ready meat, steam products, french fries, and others.

Capacity Insights:

- Below 100 Units

- 100-150 Units

- Above 150 Units

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 100 units, 100-150 units, and above 150 units.

Material Type Insights:

- Steel

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel, aluminum, and others.

Application Insights:

- Hospitals and Clinics

- Hotels and Restaurants

- Malls and Retail Stores

- Airports and Railways Stations

- Corporates and Offices

- Academic Institutions

- Hypermarkets/Supermarkets

- Food Service Companies/Operators

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hospitals and clinics, hotels and restaurants, malls and retail stores, airports and railways stations, corporates and offices, academic institutions, hypermarkets/supermarkets, food service companies/operators, and others.

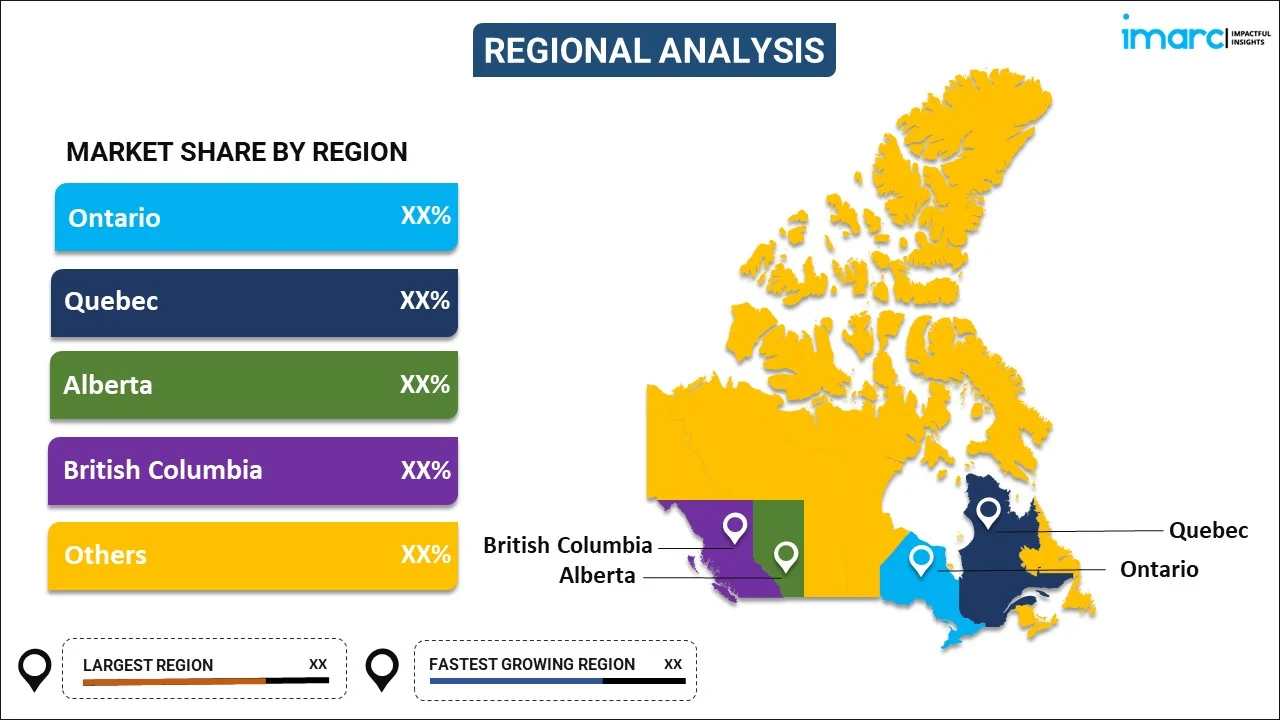

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- On 3rd March 2024, Godrej & Boyce took an initiative to invest about Rs 40 crore over the next three years to expand its distribution footprint for its consumer brands in the tier-II and tier-III cities.

- In March 2024, Sodexo and Automated Retail Technologies (ART) launched thousands of AI-powered Just Baked Smart Bistro kiosks across U.S. client sites. Serving fresh meals like sliders and bao buns, the kiosks bring 24/7 convenience to healthcare, education, and corporate sectors. This collaboration showcases innovation in automated dining, leveraging ART’s robotics and Sodexo’s foodservice reach to revolutionize on-demand hot food delivery.

- In March 2024, Micromart unveiled its modular Smart Stores, featuring pantry, fridge, freezer, and heating capabilities for autonomous foodservice. Designed for both private and public spaces, these plug-and-play units enable remote monitoring and data analysis. After success with KitchenMate in Toronto, Micromart now offers white-labeled solutions across Canada and the U.S., empowering operators to run branded, 24/7 smart food stores.

- On 26th June 2023, Nestlé Professional partnered with PVR-INOX to elevate the theatre experience. This partnership is a step towards building multiple, relevant consumption occasions for our range of beverages.

Canada Hot Food Vending Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Sandwiches, Pizza, Burgers, Hot Dogs, Pack Soup, Ready Meat, Steam Products, French Fries, Others |

| Capacities Covered | Below 100 Units, 100-150 Units, Above 150 Units |

| Material Types Covered | Steel, Aluminum, Others |

| Applications Covered | Hospitals and Clinics, Hotels and Restaurants, Malls and Retail Stores, Airports and Railways Stations, Corporates and Offices, Academic Institutions, Hypermarkets/Supermarkets, Food Service Companies/Operators, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada hot food vending machine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada hot food vending machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada hot food vending machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hot food vending machine market in Canada was valued at USD 470.7 Million in 2025.

The Canada hot food vending machine market is projected to exhibit a CAGR of 4.32% during 2026-2034, reaching a value of USD 696.8 Million by 2034.

Key factors driving the Canada hot food vending machine market include growing demand for convenient, ready-to-eat meals, especially in urban and remote areas. Technological advancements in AI-powered vending, contactless payment, and 24/7 availability enhance user experience. Labor shortages in foodservice and rising operational costs also make automated solutions attractive. Additionally, changing consumer preferences for on-the-go dining and healthier food options contribute to the market's rapid growth and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)