Canada Freight and Logistics Market Report by Logistics Function (Courier, Express and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Others), End Use Industry (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Region 2026-2034

Canada Freight and Logistics Market Overview:

The Canada freight and logistics market size reached USD 128.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 199.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.84% during 2026-2034. The market is experiencing robust growth driven by e-commerce expansion, significant government infrastructure investments, and technological advancements. Enhanced real-time tracking, route optimization, and increased capacity for efficient freight handling are key trends shaping the Canada freight and logistics market share, ensuring improved operational efficiency and customer satisfaction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 128.4 Million |

|

Market Forecast in 2034

|

USD 199.0 Million |

| Market Growth Rate 2026-2034 | 4.84% |

Access the full market insights report Request Sample

Canada Freight and Logistics Market Analysis:

- Major Drivers: Investment in infrastructure, e-commerce development, and USMCA trade deals propel Canada freight and logistics market growth. Increased consumer demand and supply chain digitalization further spur freight activity across rail, road, air, and maritime systems.

- Key Market Trends: Artificial intelligence (AI), automation, and green logistics adoption define operations. Cold chain development, urban micro-fulfillment centers, and multimodal integration capture attempts to increase efficiency, transparency, and sustainability in Canadian logistics.

- Market Challenges: Infrastructure bottlenecks, labour shortages, environmental standards, and cross-border nuances frustrate ease of operations. Weather-related disruptions and high fuel prices also impact operational margins and service reliability for logistics operators.

- Market Opportunities: Data analytics, investment in green technologies, and growth in intermodal hubs create new prospects. Additionally, strategic alliances and last-mile innovations can unlock Canada freight and logistics market analysis growth.

Canada Freight and Logistics Market Trends:

Rise of E-Commerce Market

The rise of ecommerce has significantly transformed the logistics sector in Canada with online retail sales becoming one of the key Canada freight and logistics market trends. This growth is driven by the rising consumer preference for online shopping, facilitated further by the COVID-19 pandemic. According to an article by the International Trade Administration, in Canada over 27 million people used ecommerce platforms in 2022 which is almost 75% of the total population, this number is expected to grow to 77.6% by 2025. Retail ecommerce sales Canada reached 3.82 billion USD in December 2020 with estimates of reaching 40.3 billion USD by 2025. Electronics is a leading category followed by fashion and furniture. Credit cards are used by 59% of Canadian online shoppers while digital wallets are estimated to account for 27% of online payments by 2025. As a result, logistics providers are facing higher freight volumes and need for faster more efficient delivery solutions. To meet these demands companies nowadays are investing in advanced technologies like automated warehouses, real time tracking systems and robust last mile delivery networks. This shift not only improves operational efficiency but also enhances consumer satisfaction by ensuring timely and accurate deliveries. The ecommerce boom is thus reshaping the logistics landscape prompting a revaluation of supply chain strategies to accommodate the rising demand.

Technological Advancements

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is revolutionizing the freight management industry in Canada. For instance, in February 2024, C.H. Robinson revolutionized the freight industry by introducing touchless appointment technology, automating the process of scheduling pick-up and delivery appointments. This innovation, driven by extensive data and artificial intelligence, is saving shippers time and money while speeding up the shipping process. With touchless appointments completed in less than 2 minutes, shippers and carriers benefit from increased efficiency and reduced costs, marking a significant advancement for the logistics industry. These technologies enhance real time tracking which further provides precise visibility of shipments throughout the supply chain. AI and ML algorithms optimize routes by analyzing vast amount of data including traffic patterns, weather conditions and delivery schedules ensuring the most efficient and cost-effective paths are chosen. This optimization reduces fuel consumption and operational cost while improving delivery speed and reliability. In line with this, predictive analytics powered by AI can forecast demand fluctuations allowing logistics companies to adjust their capacities proactively. Automation of warehousing operations through robotics and AI driven systems enhances inventory management, order picking and packaging processes which in turn boost the productivity and accuracy. These technological advancements are important for maintaining competitiveness and rapidly evolving market. They enable logistics providers to meet growing consumer expectations of faster, reliable and transparent services.

Canada Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Logistics Function Insights:

To get detailed segment analysis of this market Request Sample

- Courier, Express and Parcel

- By Destination Type

- Domestic

- International

- By Destination Type

- Freight Forwarding

- By Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- By Mode of Transport

- Freight Transport

- By Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- By Mode of Transport

- Warehousing and Storage

- By Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- By Temperature Control

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel [by destination type (domestic and international)], freight forwarding [by mode of transport (air, sea and inland waterways, and others)], freight transport [by mode of transport (air, pipelines, rail, road, and sea and inland waterways)], warehousing and storage [by temperature control (non-temperature controlled and temperature controlled)], and others.

End Use Industry Insights:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

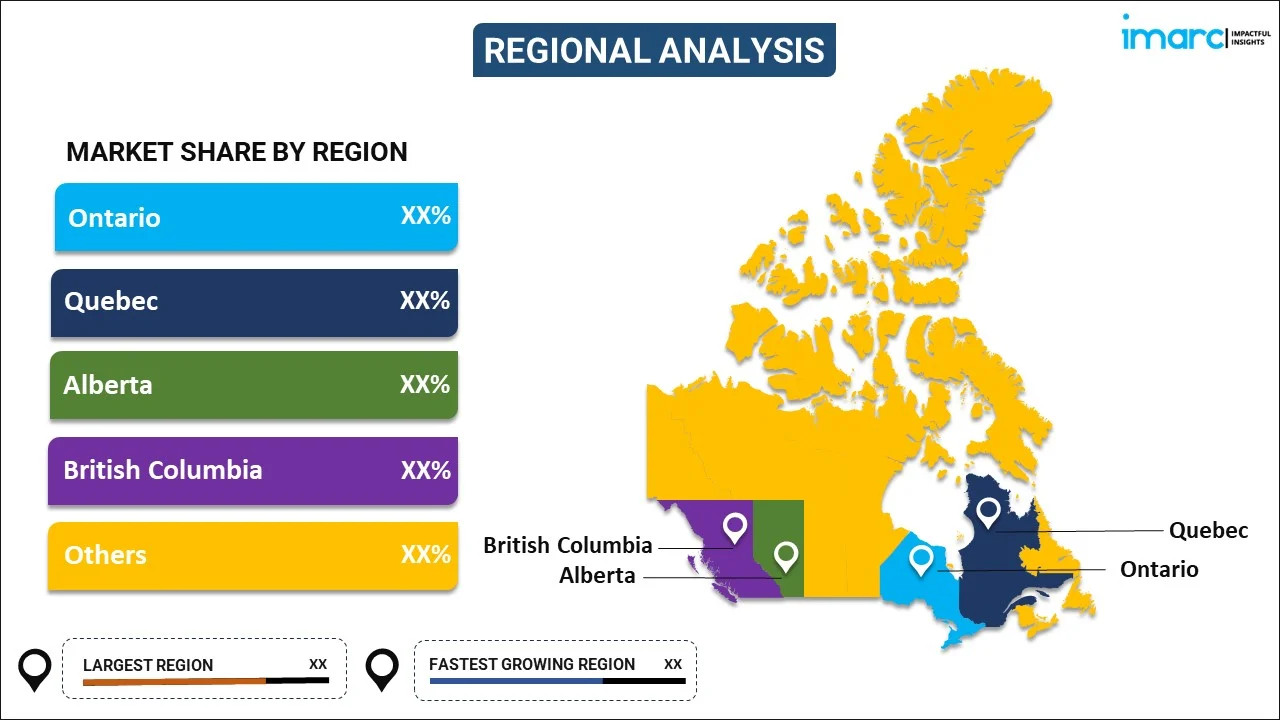

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, Freight platform Cargado expanded its cross-border services into Canada, enabling shipments across Canada, the U.S., and Mexico via one platform. Launched in April 2024, Cargado now serves over 200 logistics firms and 900 carriers. Co-founded by Matt Silver and Rylan Hawkins, the platform began as an invite-only load board for Mexico-U.S. freight. A new market rates tool further enhances transparency for brokers and carriers across North America.

- In December 2024, CITT launched its Canadian Transportation & Distribution Logistics microcredential, now available industry-wide. Previously exclusive, the 6-month online program starts January 20, 2025, and equips early-career professionals and corporate teams with essential logistics skills. It also offers credit toward the CCLP designation. Designed to meet rising demand for rapid, credible training, the program supports both career growth and organizational development across Canada’s transportation and distribution sectors.

- In January 2024, Syngenta Canada partnered with Future Transfer to introduce electric trucks to its logistics transportation fleet, aiming to achieve zero CO2e emissions in 2024. This move makes Syngenta the first agricultural company in Canada to adopt electric trucks for product delivery, reducing CO2e emissions by approximately 25,000 kilograms annually. The company plans to debut three electric trucks in southern Ontario this year, with the initiative expected to contribute to 38% global emissions reduction by 2030.

- In January 2024, Roadrunner, a leading transportation company, announced its largest LTL expansion in five years. The expansion includes the addition of 135 new lanes to its network, as well as the introduction of new services to Canada and Portland. This expansion aligns with Roadrunner's strategy to provide premium LTL long-haul carrier service.

Canada Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada freight and logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight and logistics market in Canada was valued at USD 128.4 Million in 2025.

The Canada freight and logistics market is projected to exhibit a CAGR of 4.84% during 2026-2034, reaching a value of USD 199.0 Million by 2034.

Key factors driving the Canada freight and logistics market include rising e-commerce demand, cross-border trade (especially under USMCA), infrastructure development, and technological advancements like automation and real-time tracking. Government investments, environmental sustainability goals, and growing consumer expectations for faster, more reliable delivery also significantly influence market expansion and modernization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)