Canada Electric Mobility Market Size, Share, Trends and Forecast by Drive Type, End-Use, Battery, and Region, 2025-2033

Canada Electric Mobility Market Size and Share:

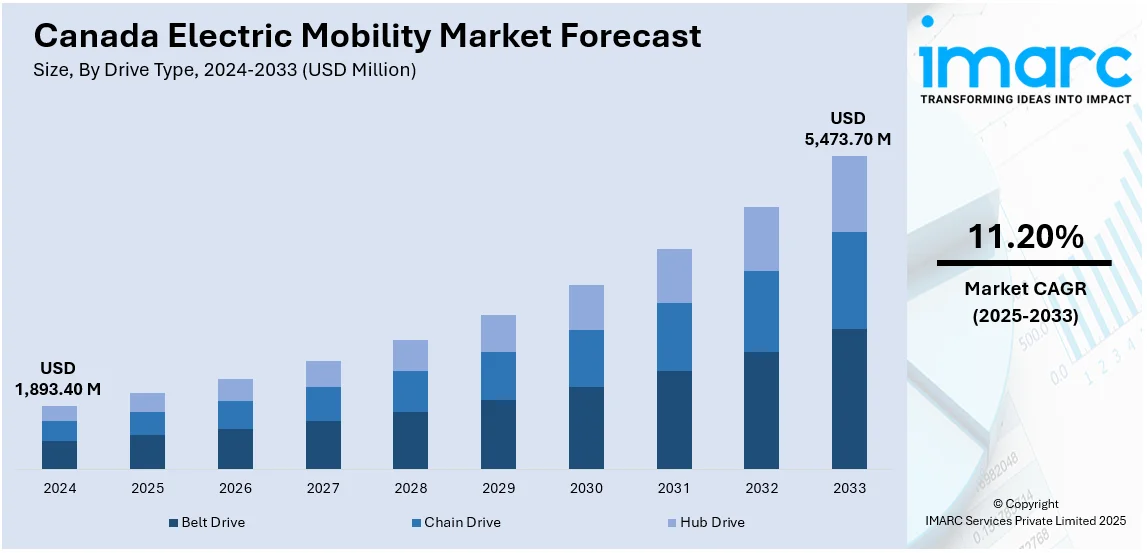

The Canada electric mobility market size was valued at USD 1,893.40 Million in 2024. Looking forward, the market is expected to reach USD 5,473.70 Million by 2033, exhibiting a CAGR of 11.20% during 2025-2033. The market is advancing rapidly, supported by government sustainability policies, growing charging infrastructure, and rising consumer interest in eco-friendly transportation. Increasing investments from automakers and technological improvements in battery efficiency are also accelerating adoption across passenger and commercial segments, strengthening competitiveness and innovation within the industry, thereby enhancing the Canada electric mobility market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,893.40 Million |

| Market Forecast in 2033 | USD 5,473.70 Million |

| Market Growth Rate (2025-2033) | 11.20% |

The market is witnessing robust growth, driven by multiple converging factors that reflect both government initiatives and shifting consumer preferences. A key driver is Canada’s strong regulatory support and environmental commitments. Federal and provincial governments offer incentives such as rebates, tax credits, and subsidies for electric vehicle (EV) purchases and charging infrastructure installation. These measures align with Canada’s long-term climate goals to reduce greenhouse gas emissions and promote a cleaner transportation sector. Infrastructure expansion is another significant factor. The swift expansion of public and private charging infrastructure, featuring high-speed stations in key urban areas and along major highways, is easing concerns about driving range and enhancing the practicality of electric vehicle adoption for both individual drivers and commercial fleet operators.

The Canada electric mobility market growth is also driven by rapid technological advancements. Continuous improvements in battery efficiency, extended driving ranges, and decreasing production costs make EVs increasingly competitive with traditional internal combustion vehicles. At the same time, innovations in energy storage and smart grid integration support broader adoption across personal and commercial transportation. Market demand is further stimulated by rising consumer awareness of environmental issues and a growing preference for eco-friendly mobility solutions. Automakers are responding with diverse electric models, from passenger cars to buses and trucks, catering to various needs and price points. Additionally, corporate sustainability goals and fleet electrification initiatives across logistics, delivery, and public transport sectors contribute significantly to the expanding market. For instance, in December 2023, ABB introduced its Terra AC Wallbox lineup across Canada through select Installation Product distribution partners, establishing a new benchmark for EV charging infrastructure. These advanced chargers deliver customized, smart, and connected solutions for diverse settings, including residential properties, commercial sites, public venues, workplaces, multifamily buildings, and fleet parking facilities.

Canada Electric Mobility Market Trends:

Increased Policy Support and Regulatory Framework

The market is advancing rapidly, driven by strong government policies, initiatives, and regulatory measures. Additionally, federal and provincial incentives, tax credits, and zero-emission vehicle (ZEV) mandates are accelerating the transition from internal combustion engines. For example, on August 9, 2024, the Canadian government allocated USD 4.2 Million toward projects focused on medium- and heavy-duty vehicles (MHDVs) as part of a USD 7.5 Million initiative to promote ZEVs. This funding, through the Zero-Emissions Vehicles Awareness Initiative, supports public education on ZEV technologies, charging infrastructure, and clean fuels. Fuel economy and carbon emission regulations further support the shift, while fleet electrification programs encourage public and commercial transport to adopt electric solutions. Urban planning now integrates EV infrastructure, ensuring long-term adoption, which contributes to the Canda electric mobility market trends. Carbon pricing mechanisms provide financial incentives for businesses to transition to cleaner transportation, thereby fueling market expansion. These efforts, combined with regulatory measures, position Canada as a key player in global electric mobility, fostering sustainable mobility and strengthening its competitiveness in the clean transportation sector.

Strengthening the Domestic Supply Chain for EV Components

Canada is strengthening its domestic battery production ecosystem by leveraging its reserves of lithium, nickel, and cobalt. According to a recently published report by the Government of Canada, Canada possesses approximately 3.2 Million Tonnes of lithium oxide reserves. This strategy reduces reliance on foreign suppliers, minimizes supply chain risks, and enhances efficiency., thereby creating a positive Canada electric mobility market outlook. Expanding battery manufacturing and processing facilities are creating localized supply networks that lower costs and improve logistics. Automakers, mining companies, and technology firms are collaborating to advance next-generation battery chemistries, improving energy density and durability. Recycling initiatives are reclaiming critical materials from used batteries, supporting circular economy principles, and reducing environmental impact. Government and industry investments are accelerating the market growth. On July 11, 2024, the Government of Canada plans to invest more than USD 9 Million to fortify British Columbia's domestic lithium battery supply chain. Automakers are also investing in domestic electric powertrain and electronic control system manufacturing, securing Canada’s role in global electric mobility. These developments position Canada as a key player in battery technology and sustainable transportation, ensuring long-term competitiveness in the market.

Canada Electric Mobility Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Canada electric mobility market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on drive type, end use, and battery.

Analysis by Drive Type:

- Belt Drive

- Chain Drive

- Hub Drive

Belt drive systems are expected to hold a large share of the Canada electric mobility market because they offer smooth, quiet operation and require minimal maintenance compared to traditional chain mechanisms. Their lightweight design enhances energy efficiency, extending battery life and improving overall ride comfort. Belt drives are highly resistant to rust and weather conditions, making them ideal for Canada’s diverse climate. Their long lifespan reduces the need for frequent replacements, lowering total ownership costs. Additionally, their compatibility with premium e-bikes, scooters, and motorcycles attracts eco-conscious consumers seeking durable, low-maintenance solutions, further strengthening their popularity in Canada’s expanding electric mobility sector.

Chain drive technology remains a dominant segment of the Canada electric mobility market due to its proven durability, affordability, and high torque transmission. Its ability to handle heavy loads and steep inclines makes it well suited for Canada’s varied terrain and demanding applications such as cargo e-bikes and electric motorcycles. Chain drives are easily serviceable and supported by an extensive supply network, ensuring accessibility for both urban and rural users. Their cost-effectiveness appeals to budget-conscious consumers and commercial fleet operators. According to the Canada electric mobility market forecast, this balance of reliability, strength, and widespread availability sustains chain drive systems as a preferred choice across multiple electric mobility applications in Canada.

Hub drive systems are anticipated to command a significant share of the Canada electric mobility market because they integrate the motor directly into the wheel hub, simplifying design and reducing maintenance. This configuration provides a quiet, efficient ride with consistent power delivery, ideal for city commuting and recreational use. Hub drives eliminate complex drivetrain components, lowering overall weight and enhancing efficiency. Their seamless integration supports sleek, compact vehicle designs favored in e-bikes, scooters, and light electric vehicles. With minimal maintenance requirements and dependable performance in all weather conditions, hub drives are particularly attractive to urban riders and commercial fleets across Canada.

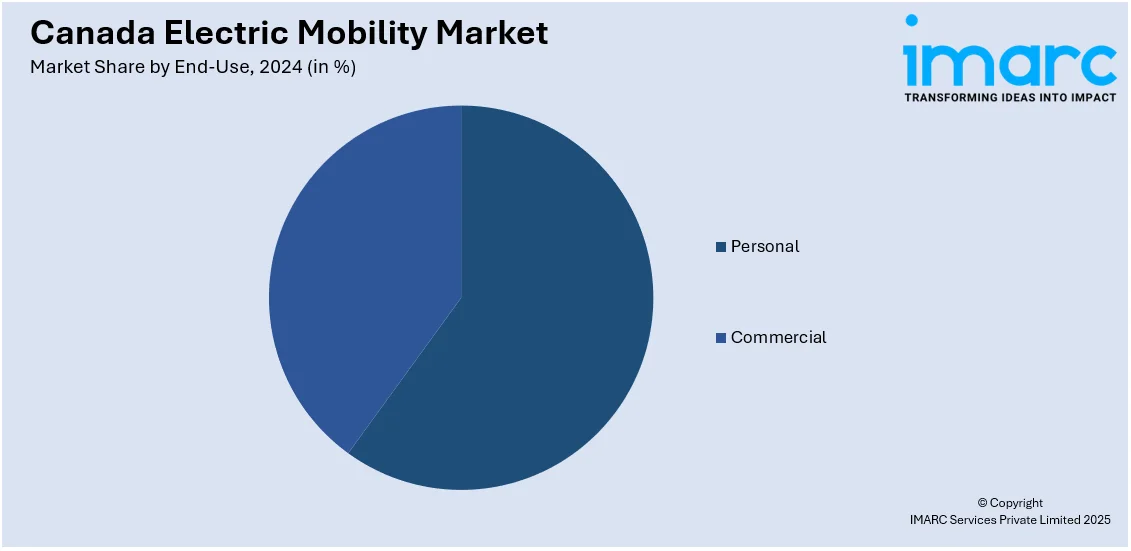

Analysis by End Use:

- Personal

- Commercial

The personal segment is projected to capture a major share of the Canada electric mobility market as rising environmental awareness and government incentives drive consumer adoption of e-bikes, electric scooters, and passenger EVs. Urban commuters value the convenience, cost savings, and zero-emission benefits these vehicles offer for daily travel. Expanding charging infrastructure and improvements in battery efficiency enhance reliability and reduce range anxiety, encouraging individuals to shift from traditional gasoline-powered vehicles. Additionally, lifestyle changes emphasizing health, sustainability, and smart mobility solutions appeal to a broad demographic, making personal electric mobility an increasingly preferred option for both short-distance and recreational transportation across Canada.

The commercial segment is expected to dominate the market due to the growing need for sustainable transportation in logistics, delivery services, and public transit. Companies are transitioning to electric fleets to lower fuel expenses, meet stringent emissions regulations, and achieve corporate sustainability goals. Electric vans, buses, and trucks support cost-effective operations with reduced maintenance requirements and long-term savings. Government funding programs and zero-emission mandates further accelerate fleet electrification across industries such as e-commerce, municipal transport, and ride-hailing services. The combination of economic efficiency, regulatory compliance, and environmental responsibility makes electric mobility solutions highly attractive for Canadian commercial operators and fleet managers.

Analysis by Battery:

- Lead-acid Battery

- Lithium-ion Battery

- Others

Lead-acid batteries are anticipated to retain a strong share of the market because of their low cost, proven reliability, and widespread availability. They are ideal for electric two-wheelers, low-speed electric vehicles, and short-range mobility solutions where affordability is a priority. Their robust performance in cold climates, ease of recycling, and established supply chains make them attractive for budget-conscious consumers and fleet operators. Additionally, lead-acid technology benefits from mature manufacturing infrastructure and compatibility with existing charging systems, ensuring steady demand. These advantages keep lead-acid batteries relevant despite competition from advanced chemistries, especially in cost-sensitive segments of Canada’s growing electric mobility ecosystem.

Lithium-ion batteries are expected to command the largest share of the market due to their high energy density, lightweight design, and superior charging efficiency. These attributes deliver longer driving ranges and faster charging times, which are critical for electric cars, buses, and commercial fleets. Continuous advancements in battery chemistry are improving durability and reducing costs, making lithium-ion technology increasingly accessible for consumers and businesses. Government incentives for zero-emission vehicles and investments in advanced battery production further boost adoption. Their versatility across applications, ranging from personal electric vehicles to large-scale commercial transportation, cements lithium-ion batteries as the preferred energy storage solution across Canada’s electrified transportation sector.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario drives the Canada electric mobility market demand through strong provincial incentives, expanding EV charging networks, and supportive policies like the Green Vehicle license program. The province’s significant automotive manufacturing base is investing in EV production, while government-backed funding encourages clean transportation projects. Urban centers such as Toronto and Ottawa foster high consumer adoption due to dense populations and commuter demand. Partnerships with automakers for battery and EV assembly attract global investment, further strengthening Ontario’s position. Growing public awareness of climate change and provincial commitments to reduce emissions accelerate the shift toward electric vehicles, making Ontario a leading hub for Canada’s electric mobility growth.

Quebec leads in Canada’s electric mobility market with its ambitious zero-emission targets and abundant renewable hydroelectric energy, offering clean power for EV charging. Provincial rebates, including generous purchase incentives and home charging station subsidies, drive strong consumer adoption. The government’s 2030 Plan for a Green Economy prioritizes electrification of transport, supporting EV manufacturing and infrastructure projects. Montreal and Quebec City’s urban density and public transit electrification programs further boost demand. Collaborations with global battery producers and investments in critical mineral supply chains enhance the province’s EV ecosystem, positioning Quebec as a key market for sustainable transportation and advanced electric mobility solutions.

Alberta’s electric mobility market benefits from growing diversification efforts beyond its traditional oil and gas economy. Provincial initiatives supporting clean energy and low-emission vehicles encourage investment in EV infrastructure and fleet electrification. Calgary and Edmonton are expanding charging networks to accommodate rising consumer interest, while municipal sustainability programs promote electric buses and shared mobility options. Businesses increasingly adopt electric fleets to meet corporate ESG goals and reduce fuel costs. Additionally, renewable energy developments like wind and solar projects create opportunities for clean EV charging. These factors collectively position Alberta as an emerging player in Canada’s evolving electric mobility landscape.

British Columbia stands at the forefront of Canada’s electric mobility market thanks to its Zero-Emission Vehicles Act, which mandates ambitious EV adoption targets. Substantial provincial rebates for EV purchases and home charging stations stimulate consumer demand. Vancouver and Victoria’s dense urban populations and strong environmental culture accelerate adoption of electric cars, bikes, and public transit. Significant investments in fast-charging infrastructure support long-distance travel across the province’s varied terrain. British Columbia also benefits from robust clean energy resources, ensuring sustainable charging solutions. Ongoing government-industry collaborations and research initiatives further advance battery technology and EV production, making the province a leader in electric mobility innovation.

Competitive Landscape:

The market features a dynamic and competitive environment with global automakers, domestic manufacturers, and technology providers actively expanding their presence. Leading EV brands such as Tesla, Hyundai, and General Motors compete with emerging Canadian players like Lion Electric and ElectraMeccanica, while battery specialists and charging infrastructure companies, including ABB, Flo, and ChargePoint, strengthen ecosystem support. Strategic partnerships between automakers, battery producers, and governments accelerate product innovation and infrastructure development. Regional incentives and provincial sustainability mandates drive rapid adoption, prompting established automotive suppliers to invest in electric drivetrains and battery technologies. This mix of international giants and innovative local firms fosters rapid growth and evolving strategies across the market share.

The report provides a comprehensive analysis of the competitive landscape in the Canada electric mobility market with detailed profiles of all major companies, including:

- Toyota Motor Corporation

- Volkswagen AG

- General Motors Company

- Ford Motor Company

- Honda Motor Co. Ltd.

- BYD Company Limited

- BMW Group

- Tesla, Inc.

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

Latest News and Developments:

- August 2025: PowerCo Canada formally began its first hiring campaign for the nation's largest-ever EV battery production facility in Ontario, representing a major step forward for the project, the community, and the local economy. With an estimated investment of USD 7 Billion, the plant is expected to be operational by 2027.

- July 2025: The Richmond Centre launched the biggest multi-residential EV charging project in Canada in an effort to promote electric mobility. The project was implemented by Enlightened Building Technologies with the help of Elocity’s Canada-made smart EV charging systems and involves the installation of 1,212 cutting-edge Elocity smart chargers across a parkade.

- July 2025: United Chargers officially introduced Canada's very first EV charging subscription service in a groundbreaking effort to promote electric mobility across the country. With this revolutionary program, customers can receive a free EV charger, installation assistance, and monthly payback incentives—all for a single, easy membership.

- May 2025: A group of experienced Canadian investor-entrepreneurs announced the successful acquisition of LION, previously known as ‘Lion Electric.’ The purchase aims to preserve the company's local roots and prevent foreign investors from acquiring a vital industrial asset. Post-acquisition, the new owners intend to improve operations by concentrating only on locally produced, completely electric school buses designed for the Quebec market.

- May 2025: Nissan Canada entered into a collaborative alliance with Wallbox to introduce a national integrated home charging program for owners of Nissan EVs in Canada. As a part of this initiative, RocketEV will offer expert installation services, assisting in creating a smooth, one-stop experience for new and current Nissan EV users. This initiative aims to make home charging easier to use and more widely available.

- November 2024: In order to build more than 1,600 Level 2 and Level 3 EV chargers in Toronto and across the country, the Canadian government announced an investment of USD 18.6 Million. This project, which is supported by Natural Resources Canada's Zero Emission Vehicle Infrastructure Program, is to improve charging infrastructure to accommodate the increasing number of EV users. As of right now, the initiative has helped install over 41,000 EV chargers nationwide.

- September 2024: At the EVVE 2024 conference, Nissan Canada joined Electric Mobility Canada (EMC). The goal of this collaboration is to promote innovation and acceptance of electric vehicles in Canada. Daniel Breton, president and CEO of EMC, expressed excitement about the partnership and emphasized Nissan's dominance in the EV sector.

Canada Electric Mobility Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drive Types Covered | Belt Drive, Chain Drive, Hub Drive |

| End-Uses Covered | Personal, Commercial |

| Batteries Covered | Lead-acid Batter, Lithium-ion battery, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Companies Covered | Toyota Motor Corporation, Volkswagen AG, General Motors Company, Ford Motor Company, Honda Motor Co. Ltd., BYD Company Limited, BMW Group, Tesla, Inc., Nissan Motor Co., Ltd., Hyundai Motor Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada electric mobility market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Canada electric mobility market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada electric mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric mobility market in Canada was valued at USD 1,893.40 Million in 2024.

The Canada electric mobility market is projected to exhibit a CAGR of 11.20% during 2025-2033, reaching a value of USD 5,473.70 Million by 2033.

The Canada electric mobility market is driven by government incentives, expanding charging infrastructure, and stricter emission regulations, fueling Canada’s electric mobility growth. Rising fuel costs, technological advancements in batteries, and strong consumer demand for sustainable transportation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)