Canada Dairy Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Canada Dairy Market Size and Share:

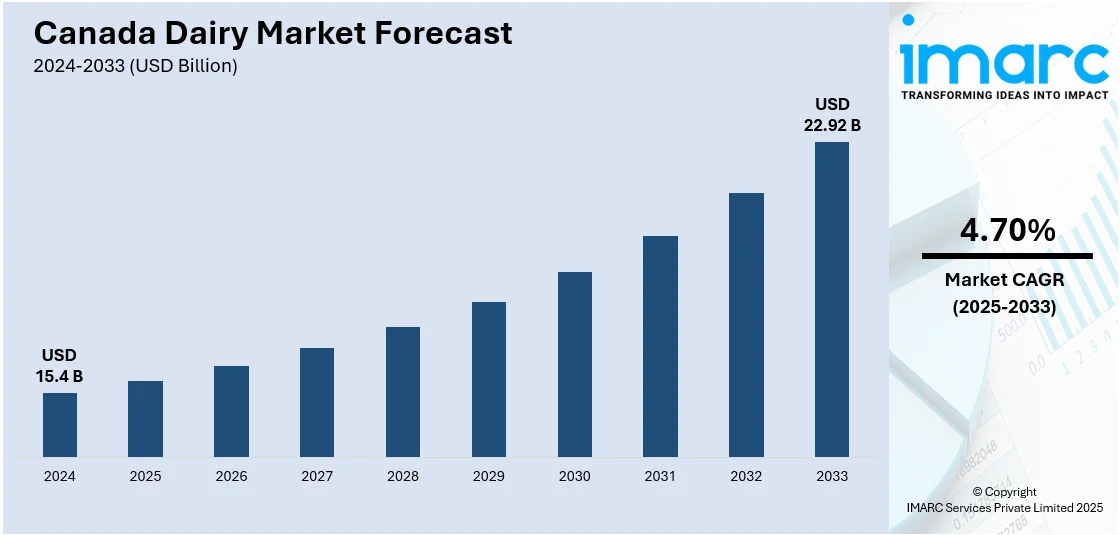

The Canada dairy market size was valued at USD 15.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.92 Billion by 2033, exhibiting a CAGR of 4.70% from 2025-2033. The Canada dairy market share is growing steadily, driven by rising consumer demand for diverse and functional dairy products, government policies supporting domestic production, and innovations focusing on sustainability and health-conscious offerings, catering to evolving preferences and ensuring consistent market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 22.92 Billion |

| Market Growth Rate (2025-2033) | 4.70% |

Canada Dairy Market Insights:

- Major Market Drivers: The Canada dairy market is led by increasing demand for high-protein foods, increased health awareness, and robust domestic production. Government incentives and innovation in functional dairy foods also support continued consumer interest and market growth.

- Key Market Trends: Key trends are the growth in consumption of lactose-free and plant-based dairy substitutes, premiumization of conventional dairy products, and demand for organic and clean-label options. Processing technology advancements also influence product innovation and variety.

- Competitive Landscape: The industry has a combination of major multinational companies and regional cooperatives competing based on price, sustainability, and product differentiation. Brand recognition, extensive distribution networks, and R&D and packaging innovation investments are important in sustaining competitive edge.

- Challenges and Opportunities: Threats come in the form of volatile milk prices, weather-sensitive production hazards, and competition from alternative plant-based options. But opportunities abound in increased exports, reaching health-oriented consumers, and tapping e-commerce and functional product innovation to access new market niches.

The growth in the dairy market of Canada is because of various notable factors, such as intensifying knowledge about the nutraceutical profile of dairy- rich nutrients including calcium, proteins, and vitamin which boosts the overall demand in this key category with products like milk, cheese, and yogurt. Functional foods, including beverages which carry probiotics as well as supplements, have more lately also supported expansion. Government policies in the form of subsidies and supply management systems stabilize the domestic dairy industry, which ensures stable production and pricing. The growing immigrant population in Canada is also diversifying consumer preferences, escalating demand for culturally specific dairy products such as specialty cheeses and yogurt. For instance, In May 2024, Bel Canada launched a plant-based version of its iconic Laughing Cow cheese, made with almonds, providing a creamy, spreadable experience for consumers seeking plant-based alternatives. Moreover, technological advancements in processing and packaging enable manufacturers to provide a wider variety of high-quality dairy products catering to changing consumer tastes and convenience-focused lifestyles.

To get more information on this market, Request Sample

Health consciousness in Canada is supporting growth in organic and lactose-free dairy products. The accelerating demand for natural and less processed food has created an uptrend in organic dairy, whereas dietary restrictions or preferences are amplifying demand for lactose-free products. The thriving foodservice sector, supported by the booming hospitality industry and popularity of quick-service restaurants, supports cheese, butter, and cream in the preparation of foods. Additionally, the adoption of online platforms for grocery sales has been improving access to dairy products for a wider market. The seasonal demand for dairy-based desserts and beverages, especially during peak festival seasons, also sustains the market. For example, in July 2024, Kawartha Dairy launched three new ice cream flavors made with fresh, local ingredients, continuing their expansion and commitment to quality, offering unique flavors like Dockside Cappuccino, Grape, and Nanaimo Bar. Furthermore, all these factors bring about sustainable growth in the Canada dairy market while catering to diverse demands of the market and trend influences.

Canada Dairy Market Trends:

Rising Demand for Functional Dairy Products

A prominent trend in the Canada dairy market analysis is the escalating consumer preference for functional dairy products. Canadians are highly becoming health-conscious, seeking dairy items that provide added nutritional benefits, such as probiotics, vitamins, and minerals. Products like fortified milk, protein-enriched cheese, and probiotic yogurt are particularly appealing to those focused on improving gut health, immunity, and overall wellness. In February 2024, Danone Canada's Silk® introduced a new plant-based yogurt made with Canadian pea protein, offering 12g of protein per 175g serving. The product comes in two flavors: Key Lime and Vanilla. It's also a champion of local sourcing and nutrition. Additionally, this trend is supported by technological advancements in dairy processing, enabling manufacturers to create innovative products that cater to diverse health needs. Marketing campaigns emphasizing the health advantages of functional dairy have also resonated with younger consumers and aging populations alike. The functional food and beverage (F&B) category is rapidly expanding, driving producers to prioritize innovation and differentiation. As this trend evolves, it continues to reshape the Canadian dairy market growth and the delivery of high-value, health-focused products.

Growth in Organic and Lactose-Free Dairy

The rising popularity of organic and lactose-free dairy products is transforming the market. Canada dairy market demands have shifted towards organic dairy products, which contain no synthetic additives and are prepared using environmentally friendly methods, have become highly demanded by consumers as they shift to natural and less processed food items. At the same time, the market is offering lactose-free milk, yogurt, and cheese to customers with dietary limitations or lactose intolerance. These products combine the health benefits of traditional dairy with enhanced accessibility for diverse consumer groups. Organic dairy, often perceived as more environmentally friendly and nutritious, aligns with the growing interest in sustainable consumption. Lactose-free options, on the other hand, serve a broader demographic seeking comfort and dietary compatibility without sacrificing taste or nutrition. This dual focus on organic and lactose-free categories is encouraging manufacturers to invest in innovative processes and expand product portfolios, thereby increasing Canada dairy market share and responding to evolving consumer needs.

Expansion of Digital Dairy Retail Channels

The expansion of digital platforms is reshaping how Canadians shop for dairy products. E-commerce platforms, online grocery stores, and subscription-based delivery services are increasingly popular, offering consumers convenience and accessibility. Advanced logistics systems and cold chain technologies ensure that perishable dairy products maintain their freshness and quality during delivery. Digital channels also enable convenient shopping, such as tailored suggestions based on individual consumer preferences. This convenience enables consumers to make more frequent purchases and to become aware of more dairy products - specialty and niche products, especially. Younger, tech-savvy consumers, as well as busy professionals, are driving the growth of online dairy retail, appreciating the seamless and efficient shopping experience. Manufacturers and retailers can optimize their offerings and promotions through data analytics and customer feedback. The digital transformation is a key driver of Canada dairy market growth, bringing dairy products closer to consumers and enhancing overall satisfaction.

Canada Dairy Industry Segmentation:

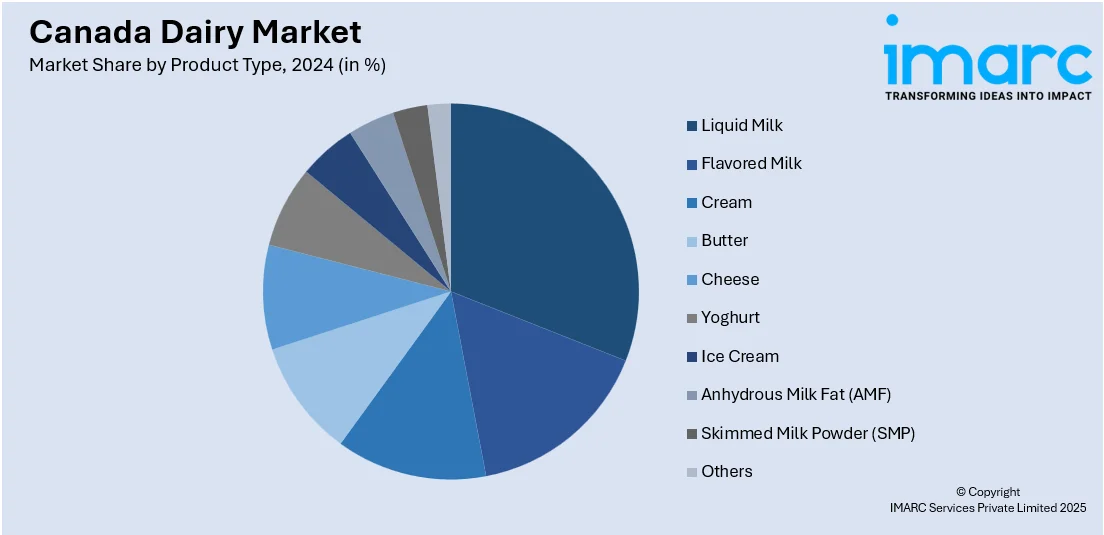

IMARC Group provides an analysis of the key trends in each segment of the Canada dairy market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type.

Analysis by Product Type:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Liquid milk continues to be the heart of the Canadian dairy market. It remains popular because it provides rich nutrients like calcium, protein, and vitamins. Its form is mainly liquid, either whole, skimmed, or low-fat, as people have various preferences. A basis for so many beverages and recipes, liquid milk is here to stay.

Flavored milk is the alternative to plain milk, and what makes it really appealing is adding flavors to milk, like chocolate, strawberry, and vanilla. It will naturally attract more people, particularly youngsters, looking for a convenient nutritious snack. Being very rich in necessary nutrients, flavored milk can deliver taste and nutrition at the same time.

Cream is a versatile dairy product used widely in cooking and baking. Heavy, whipping, and sour cream are some of the forms it comes in, which add texture and richness to dishes. The creamy consistency makes it indispensable in desserts, soups, sauces, and beverages like coffee and hot chocolate.

Butter is a staple ingredient in households and foodservice is prized for its rich flavor and texture. It is used in cooking, baking, and as a spread to add flavor to sweet and savory dishes. Salted, unsalted, and cultured butter are different types of butter to suit various culinary requirements.

Cheeses do occupy an important position in the dairy market; they range from cheddar, mozzarella, to brie, giving a versatile supply of choices which can be key ingredients for cooks, starting with pizzas to salads. Full of protein and calcium, cheese will meet all kinds of nutritional demands and also taste buds.

Yoghurt is one of the nutrient-rich, flexible dairy products found in various styles-plain, flavored, or Greek. This yoghurt has high amounts of probiotics and promotes a healthy gut. A great source for snack or to blend smoothies or be a savory component of any recipe, yoghurt will cater to both the healthy and time-pressed customer.

Ice cream remains the favorite dairy delight that is popular across all ages. It's available in flavors and formats and indulges into celebration moments as well as satiates the pleasure cravings. Some new developments in its packaging and formulation like lactose-free or high-protein help boost its scope in the market.

Anhydrous milk fat has been used essentially in industrialized food manufacturing mainly for its deep flavor and storability. Therefore, it's applied in biscuits, confections, and in spreads based on dairy products; hence, because of its characteristics, it gives high-quality, nutritious food.

SMP is the dehydrated form of non-fat milk. Skimmed milk powder (SMP) boasts a long shelf life and high nutritional value. It is widely used in food manufacturing, bakery products, and reconstituted milk, providing customers with an affordable and convenient way to enjoy the benefits of dairy.

Whole milk powder maintains the natural fat content of milk, offering an indulgent rich creamy texture. It is used extensively in confectionery, in baked goods, and in beverages. WMP's extended shelf life and ease of transportation make it an indispensable dairy ingredient for global markets.

Whey protein is in high demand across the health and fitness industries as it is widely known for possessing high-quality proteins. It builds, repairs, and supports muscular growth, development, and recuperation. Because of its excellent powder form, it is available in shakes, bars, functional foods, which appeal to an active consumer population.

Lactose powder, derived from milk, is a natural sweetener used in various food and pharmaceutical applications. Its modest sweetness and adhesive property make it ideal for bakery products, infant formulas, and medicines. Lactose powder is one of the essential by-products in processing dairy with applications in multiple industries.

Curd is a traditional dairy product formed by fermenting milk with natural cultures. It is rich in probiotics, aiding digestion and gut health. Commonly consumed as a standalone item or incorporated into meals, curd remains a staple in many households and cuisines worldwide.

The "Others" category encompasses niche and emerging dairy products, including kefir, dairy-based beverages, and specialty spreads. These products cater to specific dietary preferences or trends, such as high-protein or low-fat options. Continuous innovation in this segment ensures diverse choices for evolving consumer demands.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario is the biggest dairy-producing province in Canada. It has an enormous number of dairy farms and processing facilities and thus is supported by a good agricultural policy as well as healthy local demand for milk, cheese, and yogurt. Its infrastructure supports production and distribution very efficiently.

Quebec is well known for its active dairy industry and extensive artisanal cheese-making traditions. As a well-known producer of dairy farms, the province provides the considerable volume of milk from the country. Its unique dairy products, such as specialty cheeses and cultured products are widely in demand both within the province and beyond its borders.

Alberta is a growing player in the dairy market of Canada, with modern farming practices and advanced technology. The province is renowned for its high-quality milk and dairy products, catering to both the local and export markets. Sustainability and efficiency drive Alberta's national dairy industry contributions.

British Columbia features a diverse, innovative dairy industry, with emphasis on organic and specialty products. The province enjoys a mild climate and sustainable practice, which allow for high milk yields. The province is identified as a producer of health-conscious consumers' favorite lactose-free, probiotic, and premium dairy products-reflecting shifting market trends.

The "Others" category includes provinces and territories, which can be classified as having a minor industry, such as the provinces of Manitoba and Saskatchewan, as well as the Atlantic provinces. These regions contribute to the overall market through niche products or local demand. Innovation and targeted strategies develop growth here.

Competitive Landscape:

The Canadian dairy market is extremely competitive with a mix of large processors, regional players, and niche producers. Competition largely involves innovation activity to develop products so that the companies keep coming up with new things as preferences change among consumers--more lactose-free products, organic, or fortified. This well-regulated supply management system leads to stability in production and pricing but builds a need for differentiation among producers. Advances in technology, including automation and sustainable practices, are highly important for enhancing efficiency and quality. The hike in demand for value-added dairy products, like probiotic yogurt and specialty cheeses, has been a significant force behind competition that has driven companies to diversify. Digital retail channels have also changed the ways in which companies interact with their customers, creating greater access and brand loyalty. Smaller producers rely on regional flavors and artisanal techniques to differentiate themselves, whereas the larger players look at scale, exports, and innovation as their competitive advantage.

The report provides a comprehensive analysis of the competitive landscape in the Canada dairy market with detailed profiles of all major companies, including:

- Saputo Inc.

- Agropur Cooperative

- Lactalis Canada Inc.

- Gay Lea Foods Co-operative Limited

- Amalgamated Dairies Ltd

- Reid’s Dairy Company Ltd

- St-Albert Cheese Co-operative

- Maple Dale Cheese Inc.

Latest News and Developments:

- In August 2024, Saputo USA announced exciting product launches, including a collaboration with Mike’s Hot Honey, combining goat cheese with sweet heat, launching in September. The company also unveiled Montchevre Goat Gouda and Treasure Cave Mild Blue Cheese, catering to evolving consumer preferences and expanding their innovative dairy portfolio.

- In March 2024, Kraft Heinz, in partnership with TheNotCompany, launched KD NotMacandCheese, a plant-based version of the classic KD. Alongside this, the company introduced KD Gluten-Free to meet the growing demand for gluten-free options. Both products are now available nationwide, expanding Kraft Heinz’s portfolio to cater to evolving consumer preferences.

- In February 2024, Chapman’s Cold Brew Coffee ice cream was honored as Product of the Year. The ice cream, made with Indigenous-owned Birch Bark Coffee, stands out for its bold flavor and premium ingredients. A portion of sales contributes to clean drinking water initiatives for Indigenous communities across Canada.

Canada Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder, (WMP), Whey Protein, Lactose Powder, Curd, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Companies Covered | Saputo Inc., Agropur Cooperative, Lactalis Canada Inc., Gay Lea Foods Co-operative Limited, Amalgamated Dairies Ltd, Reid’s Dairy Company Ltd, St-Albert Cheese Co-operative, Maple Dale Cheese Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada dairy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Canada dairy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Canada dairy market was valued at USD 15.4 Billion in 2024.

The growth of the Canadian dairy market is driven by factors such as boosting consumer demand for nutritious dairy products, the rise of functional foods with added benefits like probiotics, and growing interest in organic and lactose-free options. Government support through subsidies and supply management systems provides stability, while innovations in dairy processing and packaging cater to changing consumer preferences for convenience and quality.

IMARC Group estimates the market to reach USD 22.92 Billion by 2033, exhibiting a CAGR of 4.70% from 2025-2033.

Some of the major players in the keyword market include Saputo Inc., Agropur Cooperative, Lactalis Canada Inc., Gay Lea Foods Co-operative Limited, Amalgamated Dairies Ltd, Reid’s Dairy Company Ltd, St-Albert Cheese Co-operative, Maple Dale Cheese Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)