Canada Construction Market Size, Share, Trends and Forecast by Sector and Region, 2026-2034

Canada Construction Market Summary:

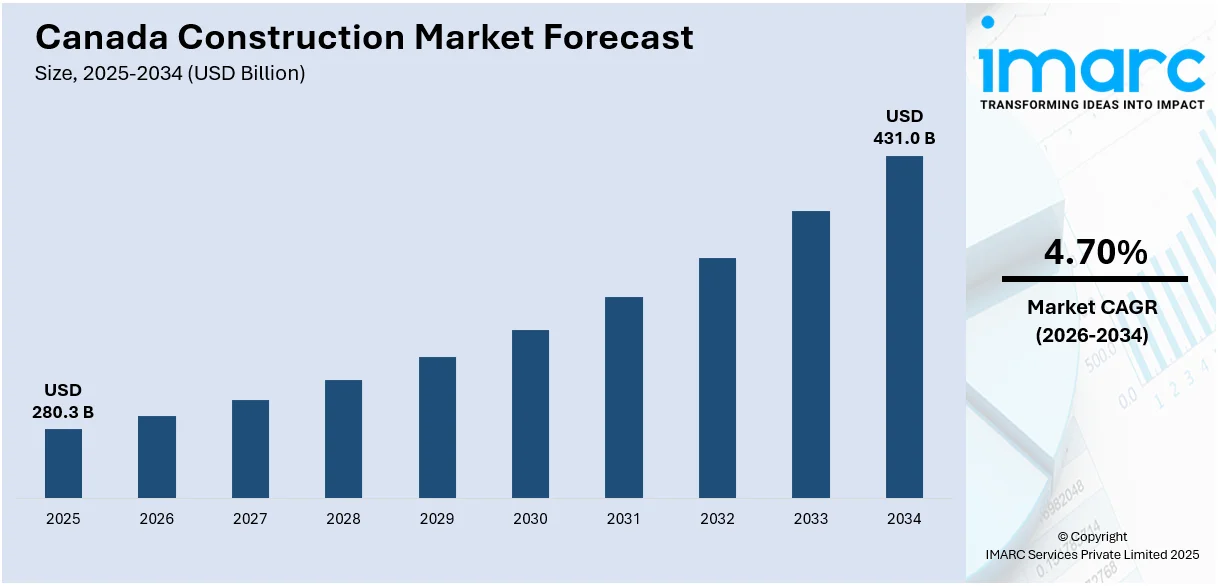

The Canada construction market size was valued at USD 280.30 Billion in 2025 and is projected to reach USD 430.98 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

The construction industry of Canada plays a crucial role in its national economic development due to sustained population growth, rapid urbanization, and increasing investments in public and private infrastructure. The residential demand for housing, led by immigration targets and a shortage of housing in cities, remains a major driver of growth. Government-backed modernization programs for infrastructure, combined with surging transportation, energy, and public utilities investments, continue to fortify the market outlook across all provinces.

Key Takeaways and Insights:

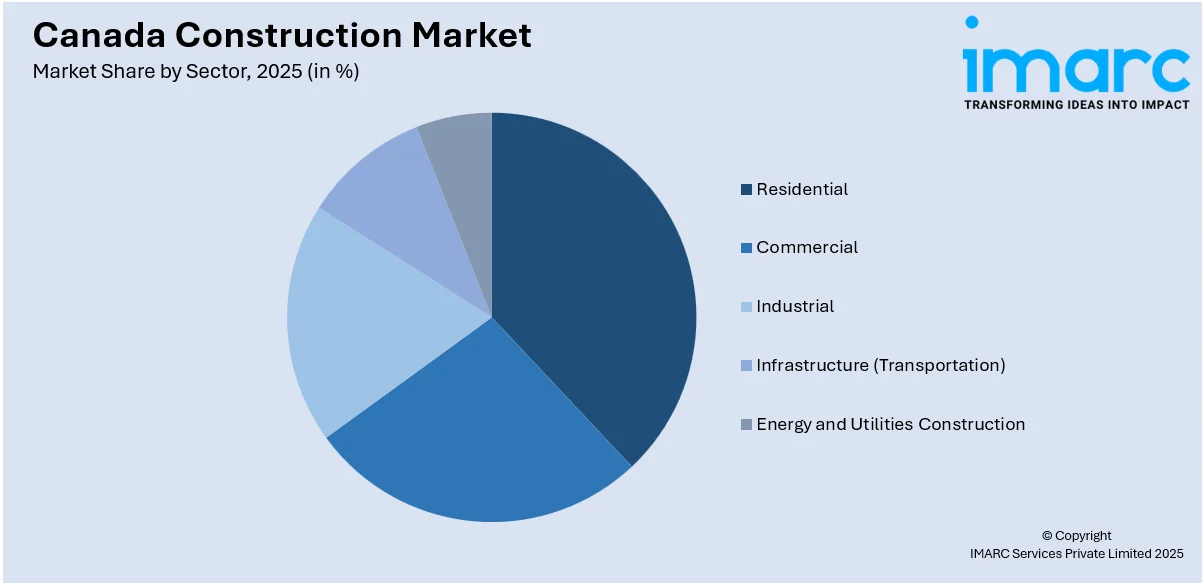

- By Sector: Residential dominates the market with a share of 58.4% in 2025, driven by strong immigration inflows, federal housing incentives, and widening adoption of prefabrication that addresses skilled labor scarcity across major metropolitan areas.

- By Region: Ontario leads the market with a share of 39% in 2025, owing to concentrated construction activity in Toronto and surrounding metropolitan areas, supported by major transit infrastructure projects and robust commercial development initiatives.

- Key Players: The Canada construction market exhibits a moderately fragmented competitive landscape, with established domestic contractors competing alongside regional builders across multiple sectors. Some of the key players operating in the market include, Aecon Group Inc., Kentel Construction Ltd., PCL Construction, EllisDon, Graham Construction, Kiewit Canada, Ledcor Group, Bird Construction, Flynn Group of Companies, Broccolini Construction, and Pomerleau

To get more information on this market Request Sample

The Canadian construction sector continues to demonstrate resilience driven by fundamental demand catalysts including record population growth fueled by immigration, persistent housing shortages in urban centers, and substantial government commitment to infrastructure modernization. In January 2026, Build Canada Homes, a federal agency launched in 2025 to accelerate housing delivery, signed multiple agreements to advance the construction of up to 4,000 new housing units using modern and modular methods, including a 540-home project in Toronto with a significant affordable housing component; these developments highlight collaboration between federal, provincial, and municipal partners to move projects into the ground more rapidly. Federal programs such as the Investing in Canada Plan provide sustained support for transit, green infrastructure, and social development projects. The industry is rapidly adopting digital tools, modular construction techniques, and sustainable building practices to improve efficiency and meet Canada's net-zero emissions targets. Major metropolitan areas including Toronto, Vancouver, Calgary, and Montreal remain focal points for high-rise residential, commercial, and mixed-use developments, while provincial initiatives continue driving regional construction activity nationwide.

Canada Construction Market Trends:

Accelerating Adoption of Digital Construction Technologies

The construction industry across Canada is witnessing rapid transformation through advanced digital technologies including Building Information Modeling, digital twins, and artificial intelligence-driven project management platforms. In 2025, a KPMG in Canada survey revealed that 90% of Canadian construction leaders believe technologies such as AI, analytics, BIM, and digital twins can boost efficiency and labor effectiveness, up from 86% in 2023, highlighting strong industry-wide momentum behind digital adoption; this growing confidence is driving firms to scale deployment of digital tools across planning, execution, and delivery. These innovations are enabling contractors to reduce on-site rework, optimize project timelines, and enhance cost forecasting accuracy. Leading construction firms are establishing in-house digital centers of excellence and forging partnerships with technology vendors to pilot cloud-based collaboration tools before scaling deployments across their project portfolios.

Growing Emphasis on Sustainable and Green Building Practices

Canada's commitment to achieving net-zero emissions is accelerating growth in green building and mass timber construction across the nation. In March 2025, the Government of Canada announced federal funding of more than $5.9 million under the Green Construction through Wood (GCWood) and related programs to support four innovative sustainable wood construction projects in Ontario, including an eight‑storey all‑wood residential building in Toronto and hybrid mass timber developments in Barrie and Oshawa, emphasizing low‑carbon construction technologies and replicable sustainable building solutions. This initiative bolsters policy alignment between federal and provincial governments driving low‑carbon construction methods, with increasing demand for energy‑efficient retrofits and climate‑resilient infrastructure.

Expansion of Modular and Prefabricated Construction Methods

Modular and prefabricated construction approaches are gaining significant traction across Canada as developers seek solutions to address labor shortages and accelerate project delivery timelines. In February 2025, the Government of Canada announced nearly $19 million in investments through the Federal Economic Development Agency for Southern Ontario to support 10 construction and homebuilding manufacturers, including firms focused on modular and prefabricated housing technologies such as Assembly Corp., CABN, and MetaLigna Modular, expanding production capabilities to build homes faster and more efficiently. These modern methods of construction offer labor savings, waste reduction, and faster build times compared to conventional approaches.

Market Outlook 2026-2034:

The Canada construction market outlook remains positive through the forecast period, supported by sustained infrastructure investment, robust residential demand, and expanding industrial construction activity. Growth will be driven by federal and provincial spending on transportation networks, renewable energy facilities, and affordable housing projects. The Major Projects Office established to streamline regulatory approvals has brought numerous significant developments under review, spanning mining, transportation, and energy sectors. The market generated a revenue of USD 280.30 Billion in 2025 and is projected to reach a revenue of USD 430.98 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

Canada Construction Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Sector |

Residential |

58.4% |

|

Region |

Ontario |

39% |

- Residential

- Commercial

- Industrial

- Infrastructure (Transportation)

- Energy and Utilities Construction

The residential dominates with a market share of 58.4% of the total Canada construction market in 2025.

The residential construction segment maintains its leading position driven by fundamental demand catalysts including record immigration inflows, generous federal incentives, and widening adoption of prefabrication technologies. Housing programs such as the Apartment Construction Loan Program and expanded GST rebates lower developer financing costs and boost buyer affordability, encouraging faster delivery of rental and entry-level units across major urban centers.

Multi-family housing, purpose-built rental developments, and high-density residential projects are emerging as high-growth niches within the sector. Rapid urban population growth in Toronto, Vancouver, Montreal, and Calgary anchors high-rise construction activity, while suburban centers capitalize on available land to attract villa and landed house construction. Technology investment accelerates site productivity, while government initiatives continue supporting affordable housing development nationwide.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario exhibits a clear dominance with a 39% share of the total Canada construction market in 2025.

Ontario maintains its dominant position in the Canadian construction landscape driven by concentrated construction activity in the Greater Toronto Area and surrounding metropolitan regions. The province benefits from major transit infrastructure investments including the Ontario Line Subway and various light rail transit projects, alongside robust commercial and institutional development. Infrastructure Ontario's ambitious capital plan represents a substantial public infrastructure investment driving construction growth across the province.

The provincial construction pipeline features numerous healthcare facilities, educational institutions, and transit-oriented developments currently in pre-procurement and active procurement stages. Recent federal-provincial agreements are streamlining regulatory approvals and accelerating construction timelines for major projects. Ontario's construction workforce continues expanding to meet demand, with significant requirements for skilled trades professionals across residential, commercial, and civil infrastructure sectors.

Market Dynamics:

Growth Drivers:

Why is the Canada Construction Market Growing?

Rising Infrastructure and Housing Investments

One of the most significant drivers of the Canada construction market is sustained investment in housing and infrastructure development. Strong population growth fueled by ambitious immigration targets has intensified demand for residential construction, particularly in urban centers such as Toronto, Vancouver, and Montreal. In December 2025, the federal government, together with Ontario and the Region of Waterloo, announced more than $291 million in targeted investments through the Public Transit Infrastructure Stream of the Investing in Canada Infrastructure Program to upgrade and expand public transit services, reduce emissions, and enhance accessibility across the Waterloo Region, strengthening transportation links that support broader construction activity. Canada Public Transit Fund has announced plans to invest significantly in public transportation infrastructure over the coming decade, further strengthening the construction pipeline across multiple provinces.

Government Commitment to Renewable Energy and Sustainability Initiatives

The Canadian government's ambitious commitment to achieving net-zero emissions is generating significant construction activity across renewable energy and sustainable infrastructure sectors. According to reports, the Government of Canada expanded the Green and Inclusive Community Buildings (GICB) Program, announcing more than $2 billion in funding for 318 community building projects that support energy‑efficient retrofits, green design, and climate resiliency upgrades nationwide, including public facilities that serve underserved communities and reduce long‑term carbon emissions. This investment underscores federal policy alignment with climate and infrastructure priorities. Substantial investment is being directed toward reducing greenhouse gas emissions while increasing installed energy storage capacity to meet environmental targets. Green building initiatives, energy-efficient retrofits, and climate-resilient infrastructure projects are creating new opportunities for construction firms with specialized capabilities.

Expansion of Public-Private Partnerships and Major Project Development

The expansion of public-private partnership frameworks is driving substantial construction growth as governments seek private sector collaboration for complex infrastructure development. These partnership models introduce risk-sharing mechanisms that reward firms with strong balance sheets while providing long-term visibility for contractors and material suppliers. In December 2025, the Government of Canada and the Province of Ontario signed a co‑operation agreement that formalizes a “one project, one review” approach to environmental and impact assessment for major infrastructure projects, reducing regulatory duplication and accelerating construction timelines while attracting private investment across transportation, energy, and industrial developments. This builds on the federal Major Projects Office’s mandate to streamline regulatory processes and coordinate financing for nationally significant developments. Federal and provincial cooperation agreements are accelerating construction timelines and attracting increased investment in critical infrastructure, positioning Canada’s construction industry for sustained growth through the forecast period.

Market Restraints:

What Challenges the Canada Construction Market is Facing?

Persistent Skilled Labor Shortages and Workforce Constraints

The Canadian construction industry faces significant workforce challenges as a substantial number of experienced tradespeople are expected to retire over the coming years. With total demand requiring a considerable influx of new workers, the industry experiences a widening gap between labor supply and project requirements. Competition for electricians, crane operators, and specialized technicians remains intense, forcing contractors to raise compensation and implement retention strategies that compress profit margins on fixed-price contracts.

Rising Material Costs and Supply Chain Volatility

Escalating construction material costs continue challenging project viability and contractor margins across the Canadian market. Volatility in lumber pricing, cement costs, and steel availability creates uncertainty in project budgeting and scheduling. Trade policy developments including tariff implementations have increased input prices for key construction materials, requiring firms to implement bulk purchasing strategies and hedging programs to shield against price fluctuations while maintaining competitive bidding capabilities.

Regulatory Complexity and Project Approval Delays

Lengthy regulatory approval processes and complex permitting requirements continue impacting construction project timelines across multiple provinces. Municipal variations in inspection procedures and building code interpretations create compliance challenges that erode efficiency gains from technological innovations. While recent federal initiatives aim to streamline major project approvals, smaller developments continue facing extended review periods that delay construction starts and increase carrying costs for developers navigating the approval landscape.

Competitive Landscape:

The Canada construction industry has a relatively low level of fragmentation in competitiveness, with national construction companies competing side by side with Canadian builders and global players. Companies compete on the basis of their technological strengths, safety records, geographical reach, and sector-specific knowledge. Major construction companies in the industry invest in digitalization initiatives such as BIM, artificial intelligence-powered project management, and modular construction to remain competitive. Project development skills in public-private partnerships and engagement with the indigenous community have become more essential in major construction contracts. Companies that perform well on environmental, social, and governance values acquire a high level of competitiveness as customers increasingly seek real-time cost management and carbon emissions information. Highly intensive competitiveness is a characteristic with which a large number of licensed construction companies operate throughout the country.

Some of the key players include:

- Aecon Group Inc.

- Kentel Construction Ltd

- PCL Construction

- EllisDon

- Graham Construction

- Kiewit Canada

- Ledcor Group

- Bird Construction

- Flynn Group of Companies

- Broccolini Construction

- Pomerleau

Recent Developments:

- In September 2025, The Government of Canada launched Build Canada Homes, a new federal housing agency with $13 billion in funding to accelerate affordable housing construction by partnering with private builders and using modern methods like modular and mass-timber construction. The program aims to significantly cut timelines, lower costs and help double Canada’s housing construction rate.

Canada Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada construction market size was valued at USD 280.30 Billion in 2025.

The Canada construction market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 430.98 Billion by 2034.

The residential sector dominated the Canada construction market with a share of 58.4%, driven by strong immigration inflows, federal housing incentives, and sustained demand across major metropolitan areas including Toronto, Vancouver, and Montreal.

Key factors driving the Canada construction market include rising infrastructure and housing investments, government commitment to renewable energy initiatives, expansion of public-private partnerships, sustained population growth, and increasing adoption of sustainable building practices.

Major challenges include persistent skilled labor shortages with significant workforce retirements expected, rising material costs and supply chain volatility, regulatory complexity and project approval delays, trade policy uncertainties, and increasing competition for specialized tradespeople across provinces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)