Canada Connector Market Report by Product Type (PCB (Printed Circuit Board) Connector, Rectangular I/O, Application Specific Connector, Fiber Optic Connector, RF (Radio Frequency) Coax, Circular Connector, IC (Integrated Circuit) Sockets, and Others), End Use Industry (Automotive and Transportation, Consumer Electronics, Computer and Peripherals, Industrial, Telecom/Datacom, and Others), and Region 2026-2034

Canada Connector Market Overview:

The Canada connector market size reached USD 1,854.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,115.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.75% during 2026-2034. The market is primarily driven by rapid growth in renewable energy projects and the electric vehicle sector, significant expansion in the automotive industry, and the increased demand for durable and innovative connectors due to significant investments in green energy with supportive government policies for EV adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,854.9 Million |

|

Market Forecast in 2034

|

USD 3,115.3 Million |

| Market Growth Rate 2026-2034 | 5.75% |

Access the full market insights report Request Sample

Canada Connector Market Trends:

Expansion of Renewable Energy Projects

Canada is rapidly expanding its renewable energy production to decrease its carbon impact and improve energy security. This shift toward renewable energy, through wind and solar projects, needs a strong infrastructure to properly manage and distribute the generated energy. Additionally, electrical connections are required in these installations to unite the various components of renewable energy systems, guaranteeing safe and dependable energy transfer. According to the International Trade Administration, the Canada Energy Regulator (CER) predicts that renewables will account for 12% of total Canadian electricity output by 2035. Wind energy is the nation's second-largest renewable energy source, with an installed capacity of 13,588 megawatts (MW) in 2021. Ontario led with 5,436 MW, followed by Quebec (3,882 MW) and Alberta (1,685 MW). In addition, Canada's total installed solar photovoltaic (PV) capacity topped 2,600 MW by 2021. Hence, the expansion of these projects increases the demand for high-quality, long-lasting connections and drives innovation in connector technology to satisfy the special requirements of renewable energy settings across the region.

Automotive Industry Growth

The expansion of the automotive industry in Canada, notably in the electric vehicle (EV) sector, is influencing the market growth. Furthermore, as government incentives drive EV adoption, the demand for enhanced connecting solutions within these vehicles propels the market growth. Connectors are used in a variety of EV systems, including battery management, power distribution, and advanced driver assistance systems (ADAS). For instance, British Columbia's ZEV Act has progressive targets for new light-duty vehicle sales, aiming for 26% ZEV sales by 2026, growing to 90% by 2030, and reaching 100% by 2035. Quebec has proposed similar adjustments to its ZEV Standard, with yearly objectives increasing to 85% by 2030 and full implementation by 2035. Similarly, Quebec intends to boost its ZEV presence on the road from 1.6 million to 2 million cars by 2030. As Canada draws closer to its goal of achieving zero-emission vehicles (ZEV) by 2035, the demand for sophisticated and dependable connections is likely to rise, further energizing the industry and stimulating advancements in connector technology targeted for automotive applications.

Canada Connector Market News:

- June 2023: Electrify Canada has announced intentions to integrate the North American Charging Standard (NACS) connection into its fast-charging network. This project is part of the company's long-term commitment to extending charging alternatives for electric vehicle (EV) drivers. Electrify Canada will continue to provide the Combined Charging System (CCS-1) connector across its network while moving to accommodate automakers who have NACS charging terminals. By 2025, the business plans to provide NACS connector choices to existing and planned charging stations, increasing convenience for EV owners.

- August 2023: ZEROVA Technologies has announced its initiative to outfit electric vehicle (EV) charging stations across Canada and the U.S. with North American Charging Standard (NACS) connectors. The company joins others in the EV industry in ensuring their charging solutions support NACS connectors. Starting in the last quarter of 2023, ZEROVA Technologies integrated NACS connectors into both its AC and DC product lines. Additionally, they will also provide retrofit kits for authorized partners to upgrade previously deployed chargers with NACS compatibility.

Canada Connector Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- PCB (Printed Circuit Board) Connector

- Rectangular I/O

- Application Specific Connector

- Fiber Optic Connector

- RF (Radio Frequency) Coax

- Circular Connector

- IC (Integrated Circuit) Sockets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes PCB (printed circuit board) connector, rectangular I/O, application specific connector, fiber optic connector, RF (radio frequency) coax, circular connector, IC (integrated circuit) sockets, and others.

End Use Industry Insights:

- Automotive and Transportation

- Consumer Electronics

- Computer and Peripherals

- Industrial

- Telecom/Datacom

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive and transportation, consumer electronics, computer and peripherals, industrial, telecom/datacom, and others.

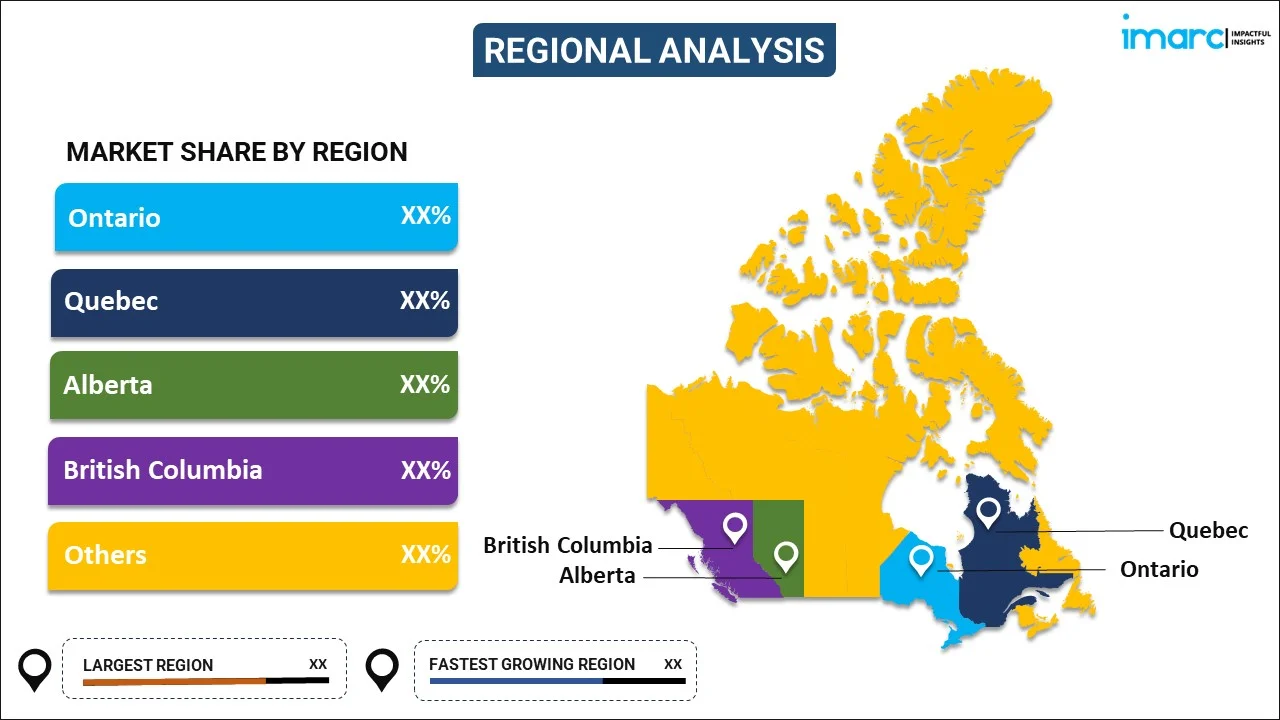

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Connector Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | PCB (Printed Circuit Board) Connector, Rectangular I/O, Application Specific Connector, Fiber Optic Connector, RF (Radio Frequency) Coax, Circular Connector, IC (Integrated Circuit) Sockets, Others |

| End Use Industries Covered | Automotive and Transportation, Consumer Electronics, Computer and Peripherals, Industrial, Telecom/Datacom, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Canada connector market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada connector market on the basis of product type?

- What is the breakup of the Canada connector market on the basis of end use industry?

- What are the various stages in the value chain of the Canada connector market?

- What are the key driving factors and challenges in the Canada connector?

- What is the structure of the Canada connector market and who are the key players?

- What is the degree of competition in the Canada connector market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada connector market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada connector market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada connector industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)