Canada Cloud Computing Market Size, Share, Trends and Forecast by Service, Workload, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Canada Cloud Computing Market Overview:

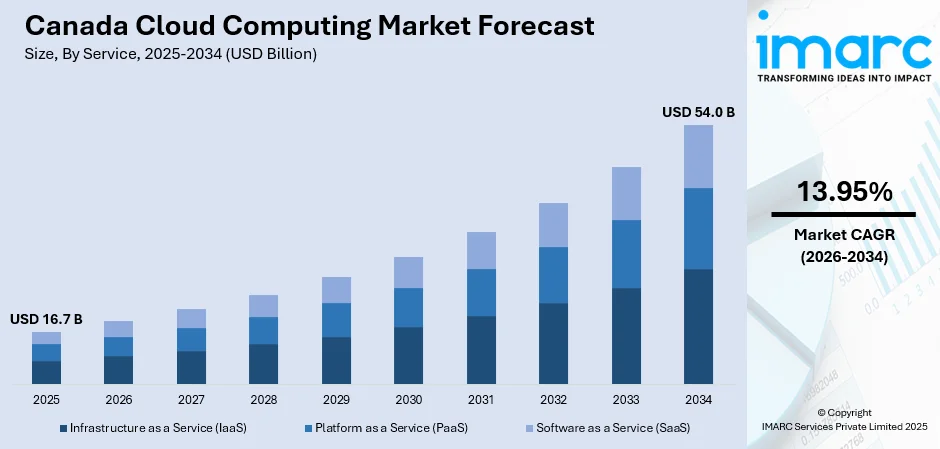

The Canada cloud computing market size reached USD 16.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 54.0 Billion by 2034, exhibiting a growth rate (CAGR) of 13.95% during 2026-2034. The market is witnessing strong growth fueled by hybrid and multi-cloud adoption, AI and machine learning integration and heavy investments in data centers. A stronger focus on data security, compliance, edge computing, and increasing emphasis on sustainability are also building a positive market scenario throughout the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.7 Billion |

| Market Forecast in 2034 | USD 54.0 Billion |

| Market Growth Rate (2026-2034) | 13.95% |

Access the full market insights report Request Sample

Canada Cloud Computing Market Analysis:

- Major Market Drivers: Rising digital transformation efforts in industries propel Canada cloud computing market growth. Enterprises look for scalable, affordable solutions to enable remote work and operational effectiveness. Government directives focusing on data sovereignty and compliance, increased cybersecurity fears and the urgency for continued business operations, also fuel Canada cloud computing market demand.

- Key Market Trends: Artificial Intelligence (AI), machine learning (ML), and big analytics integration drives the market demand. Businesses embrace multi-cloud technologies and edge computing for mission-critical real-time applications. Green cloud solutions are driven by sustainability programs, while sector-specific cloud platforms in healthcare, finance, and government drive adoption. These drivers foster long-term Canada cloud computing market growth.

- Competitive Landscape: The market share continues to be competitive with providers distinguishing themselves through niche infrastructure services, regulatory compliance, and strategic alliances. Investments in data centers and industry-specific cloud solutions enhance market presence. The changing environment guarantees ongoing innovation, driving Canada cloud computing market demand and improving the overall Canada cloud computing market outlook.

- Challenges and Opportunities: The market outlook is aided by government cloud adoption, digitalization of SMEs, and integration of emerging technologies. Although data sovereignty, cybersecurity, and skills concerns are present, scalable, compliant, and innovative cloud solutions create opportunities for ongoing market growth, increasing Canada cloud computing market share, and strengthening its relevance in industries. requirements create substantial growth potential for domestic and international providers.

To get more information on this market Request Sample

Canada Cloud Computing Market Trends:

Growth of AI and Machine Learning Integration

The convergence of artificial intelligence (AI) and machine learning (ML) with cloud services is a key trend influencing Canada's cloud computing industry. Cloud-based AI and ML solutions are being increasingly used by Canadian companies to improve data analytics, automate sophisticated processes and fuel innovation in different industries, such as healthcare, finance, and retail. By tapping these cutting-edge technologies, businesses can dig deeper insights from massive amounts of data to make better-informed decisions and offer tailored customer experiences. AI-led automation automates tasks, eliminates human intervention, and minimizes errors resulting in improved efficiency and cost reduction. Moreover, integration also promotes building new-age products and services assisting Canadian organizations to remain competitive globally. This trend not only speeds up digital transformation but also enables companies to realize the maximum value of their data driving long-term growth and operational excellence. Canada cloud computing market demand continues rising as organizations seek to integrate these advanced capabilities. To this end, in April 2024, Bell Canada revealed its collaboration with Google Cloud to bring Google Cloud Contact Center AI (CCAI) to Canadian companies, the first complete AI solution for Bell's enterprise and mid-sized customers. This solution, backed by professional services capabilities, is designed to improve customer and agent experiences via intelligent automation and analytics. The alliance is poised to accelerate digital transformation and enhance customer satisfaction, agent performance, and operational efficiency.

Investment in Cloud Infrastructure and Data Centers

Massive investments are being made to expand cloud infrastructure and launch new data centers across Canada, reflecting the country's robust growth in the cloud computing sector. Canada cloud computing market share expands as providers establish local presence to meet regulatory requirements. For instance, in 2025 Backblaze, a pioneer in cloud storage that offers a cutting-edge substitute for conventional cloud providers, announced the launch of a new data zone in Canada. With its new Canada East (CA East) area in Toronto, Ontario, the company is making a big step forward in its goal of providing enterprises all around the world with high-performance, legally compliant, and reasonably priced cloud storage solutions. The expansion is primarily driven by the growing demand for local cloud services, which offers faster access and improved performance for Canadian businesses. Canada cloud computing market outlook remains positive as regulations like PIPEDA impose data residency requirements, meaning data must be stored within the geographic limit of countries, and to meet compliance needs, firms have been establishing local data centers. Additionally, mandating high-quality, low-latency connections enables real-time applications and more richly interactive user experiences for industries like financial services, health care, and gaming. These investments also make Canada's tech infrastructure stronger, bring in global cloud providers, and create high-skilled jobs, helping Canada compete in the global cloud space. More infrastructure enables scalability and reliability, which enables businesses to grow and innovate without hassle. For instance, AWS recently launched its second infrastructure region in Canada, the AWS Canada West (Calgary) Region, in December 2023. It provides consumers with additional options for running workloads, encrypting data securely, and delivering end users with lower latency. This expansion is aimed to help Canadian developers, startups, companies, and institutions of higher learning with leading-edge cloud technologies. In addition, these investments are essential to meeting the evolving needs of the digital economy, promoting innovation, and maintaining Canadian companies nimble and competitive in the international economy.

Canada Cloud Computing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on service, workload, deployment mode, organization size, and vertical.

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

The report has provided a detailed breakup and analysis of the market based on the serviced. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Workload Insights:

- Application Development and Testing

- Analytics and Reporting

- Data Storage and Backup

- Integration and Orchestration

- Resource Management

- Others

The report has provided a detailed breakup and analysis of the market based on the workload. This includes plastic containers, loose cloud computing, paper boards, aluminum tins, cloud computing bags, and others.

Deployment Mode Insights:

- Public

- Private

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes public, private and hybrid.

Organization Size Insights:

- Large Enterprise

- Small and Medium Enterprise

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprise, and small and medium enterprise.

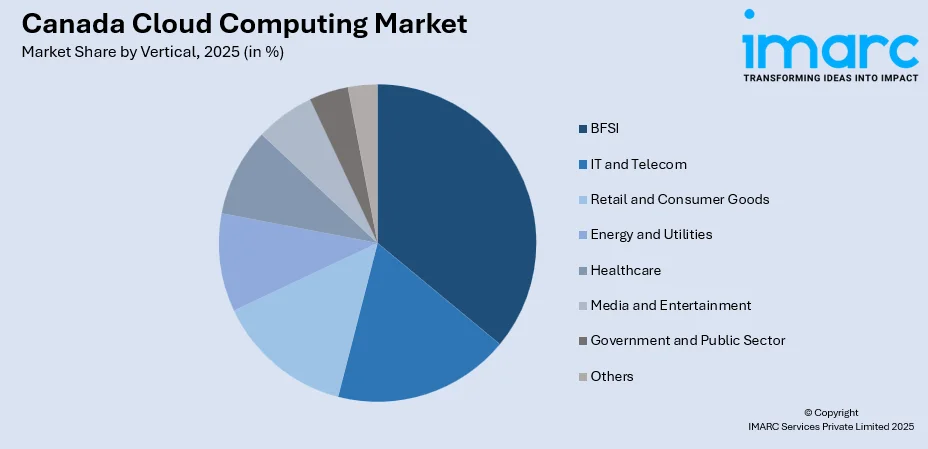

Vertical Insights:

To get detailed segment analysis of this market Request Sample

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, IT and telecom, retail and consumer goods, energy and utilities, healthcare, media and entertainment, government and public sector, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Cloud Computing Market News:

- February 2025: Bell Canada has introduced an AI-driven network operations solution on Google Cloud, enabling proactive detection and faster resolution of network issues. The system leverages AI/ML for real-time monitoring, improving network performance, reducing service disruptions, and enhancing customer experience, marking a shift from reactive management to intelligent, automated network optimization.

- January 2025: Oracle and Google Cloud announced plans to launch eight new cloud regions across the U.S., Canada, Japan, India, and Brazil, expanding existing capacities in London, Frankfurt, and Ashburn. The expansion enhances multi-cloud services, disaster recovery, and database flexibility, improving security, scalability, and cost efficiency for enterprises.

- April 2024: IBM announced plans to open a new Cloud Multizone Region in Montreal, Quebec, aimed at supporting Canadian enterprises with generative AI, hybrid cloud, and regulated workloads. The MZR will enhance resiliency, security, scalability, and data sovereignty, providing advanced cloud services to businesses across Quebec and Canada.

Canada Cloud Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Workloads Covered | Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, Others |

| Deployment Modes Covered | Public, Private, Hybrid |

| Organization Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Verticals Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada cloud computing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada cloud computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud computing market in Canada was valued at USD 16.7 Billion in 2025.

The Canada cloud computing market is projected to exhibit a CAGR of 13.95% during 2026-2034, reaching a value of USD 54.0 Billion by 2034.

Rising digital transformation initiatives, government data sovereignty requirements, hybrid and multi-cloud adoption strategies, AI/ML integration demands, enhanced cybersecurity needs, and business continuity requirements drive significant market growth across Canadian enterprises and organizations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)