Canada Buy Now Pay Later Market Report by Channel (Online, Point of Sale (POS)), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End Use (Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, and Others), and Region 2026-2034

Canada Buy Now Pay Later Market Overview:

The Canada buy now pay later market size reached USD 226.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,051.6 Million by 2034, exhibiting a growth rate (CAGR) of 17.85% during 2026-2034. There are several factors that are driving the Canada buy now pay later market share, which include various partnerships and collaboration among key players, expanding digital wallets and fintech ecosystem, thriving e-commerce sector, and rising demand for flexible payment options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 226.7 Million |

|

Market Forecast in 2034

|

USD 1,051.6 Million |

| Market Growth Rate 2026-2034 | 17.85% |

Access the full market insights report Request Sample

Canada Buy Now Pay Later Market Analysis:

- Major Drivers: Rising e-commerce adoption, demand for flexible payments, and younger consumers’ credit aversion drive Canada buy now pay later market growth. Partnerships between fintechs and retailers further enhance accessibility, increasing transaction volumes significantly.

- Key Market Trends: BNPL providers are integrating with major e-commerce platforms, expanding into in-store purchases, and offering subscription-based services. Consolidation and strategic alliances with banks and credit card issuers are reshaping the competitive landscape.

- Market Opportunities: Untapped retail segments, cross-border BNPL offerings, and partnerships with small businesses present major growth avenues. Expanding into healthcare, travel, and high-ticket purchases could further enhance Canada buy now pay later market analysis.

- Market Challenges: Regulatory uncertainty, rising delinquency risks, and potential overextension of consumers pose hurdles. Increased competition, profit margin pressures, and the need for robust fraud prevention strategies complicate sustainable BNPL expansion in Canada.

Canada Buy Now Pay Later Market Trends:

Partnerships Among Key Players

On 29 April 2024, Klarna partnered with luggage and travel accessories brand Away. With this collaboration, Klarna’s interest-free BNPL options are available to Away’s clients in Canada, the United States, and the United Kingdom. The company is looking for ways to make shopping smooth for a wider range of individuals. These partnerships allow BNPL services to reach a broad user base, increasing adoption rates. Apart from this, collaborations with small and medium-sized enterprises (SMEs) help BNPL providers tap into niche markets and provide flexible payment options to a diverse consumer base. Seamless integration of BNPL options into retailers' online and offline checkout processes improves user experience, making it easier for individuals to choose BNPL as a payment method thus positively influencing the Canada buy now pay later market analysis.

Expanding Digital Wallets and Fintech Ecosystem

On 19 January 2023, Samsung Electronics announced that Samsung Wallet will be available in eight new markets that are Canada, Australia, Brazil, Hong Kong, India, Malaysia, Singapore, and Taiwan. Samsung Wallet is a more secure and go-everywhere app to conveniently organize and use daily essentials. Moreover, the integrations with popular digital wallets make BNPL payments more seamless and accessible to users. Users can access BNPL options directly from their digital wallet without needing to go through lengthy application processes. This quick access encourages more frequent use of BNPL services. Besides this, digital wallets come with advanced security features such as encryption, biometric authentication, and tokenization. These features provide an additional layer of security for BNPL transactions, enhancing user confidence in using these services. Integration with digital wallets also leverages their robust fraud prevention mechanisms, reducing the risk of fraudulent transactions and enhancing the Canada buy now pay later market demand. When BNPL services are integrated with these wallets, it extends the reach and acceptance of BNPL, allowing users to use it at more retailers.

Canada Buy Now Pay Later Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on channel, enterprise size, and end use.

Channel Insights:

- Online

- Point of Sale (POS)

The report has provided a detailed breakup and analysis of the market based on the channel. This includes online and point of sale (POS).

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises.

End Use Insights:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes consumer electronics, fashion and garment, healthcare, leisure and entertainment, retail, and others.

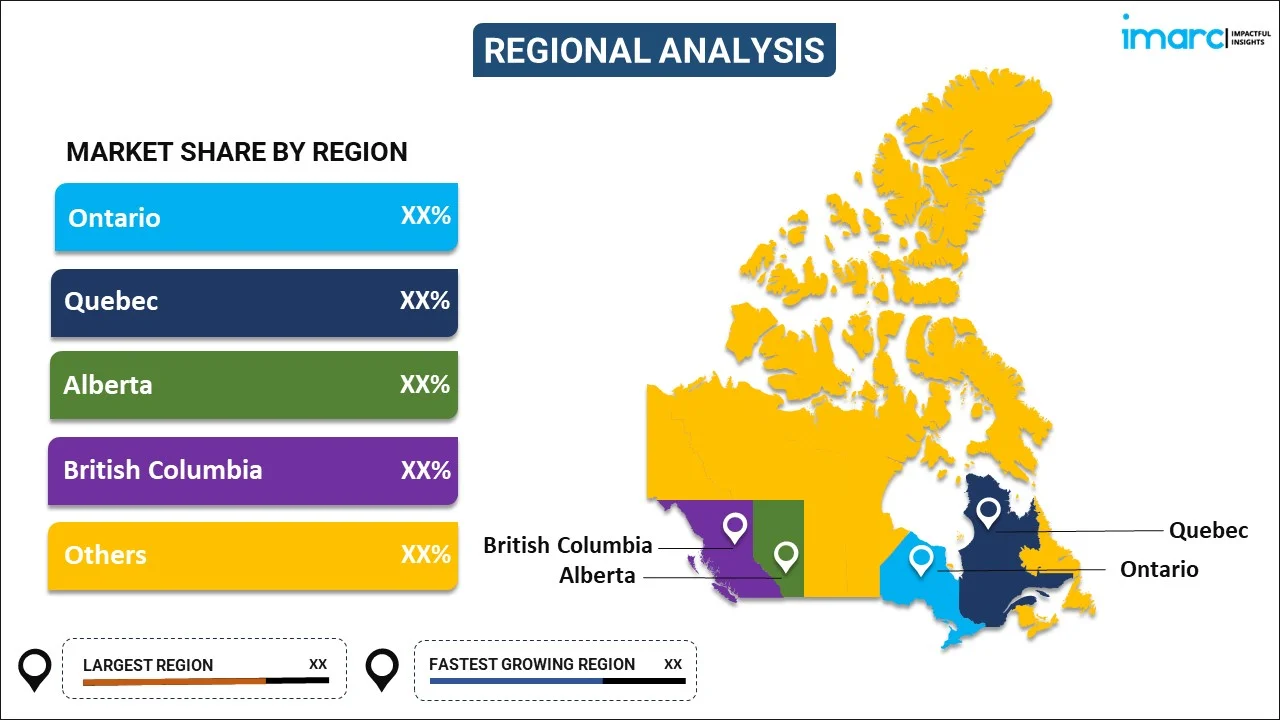

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In February 2025, Affirm expanded its partnership with Shopify to bring buy now, pay later (BNPL) options to merchants and shoppers in Canada and the UK. This move extends their existing collaboration, enhancing flexible payment solutions for Shopify’s global merchant network. The expansion allows customers to split purchases into manageable installments, driving affordability and boosting sales opportunities. Affirm aims to strengthen its international presence while supporting Shopify merchants with competitive BNPL offerings.

- In December 2024, Klarna expanded its Apple Pay integration to Canada, offering consumers flexible payment options for online and in-app purchases. The service allows users to pay in four interest-free installments or choose financing for larger purchases with competitive APRs. Compatible with iOS 18 and iPadOS 18, the integration leverages Apple Pay’s privacy and security features. Klarna aims to enhance accessibility and convenience, replicating its successful rollouts in the US and UK.

Canada Buy Now Pay Later Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada buy now pay later market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada buy now pay later market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada buy now pay later industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The buy now pay later market in Canada was valued at USD 226.7 Million in 2025.

The Canada buy now pay later market is projected to exhibit a CAGR of 17.85% during 2026-2034, reaching a value of USD 1,051.6 Million by 2034.

Key factors driving Canada’s Buy Now, Pay Later (BNPL) market include rising e-commerce adoption, growing demand for flexible and interest-free payment solutions, younger consumers avoiding traditional credit, and partnerships between fintechs, retailers, and banks. Technological advancements and expanding in-store BNPL offerings further fuel market growth, improving accessibility and consumer adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)