Canada Blockchain in Finance Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033

Canada Blockchain in Finance Market Size and Share:

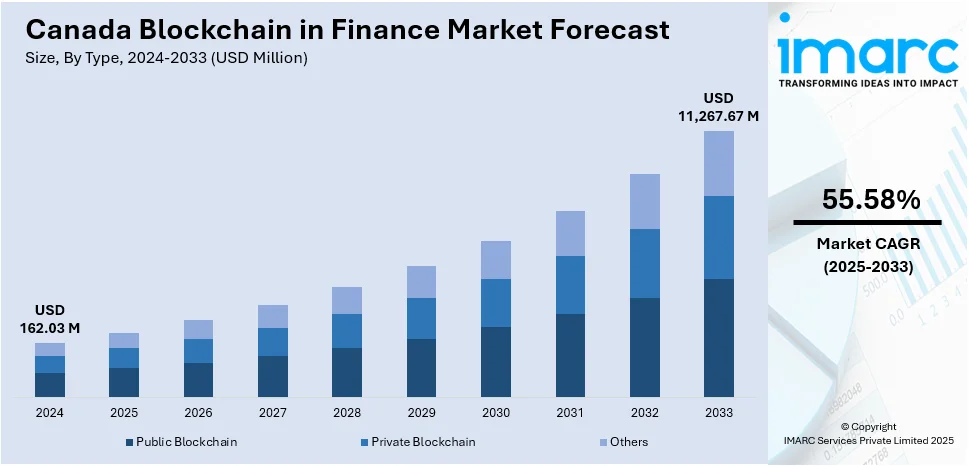

The Canada blockchain in finance market size reached USD 162.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,267.67 Million by 2033, exhibiting a growth rate (CAGR) of 55.58% during 2025-2033. The increasing demand for transparency and security in transactions, rising investment in fintech, growing regulatory support, the growing need for cost reduction in financial processes, the widespread adoption of cryptocurrencies and decentralized finance (DeFi) solutions, and advancements in technology are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 162.03 Million |

| Market Forecast in 2033 | USD 11,267.67 Million |

| Market Growth Rate (2025-2033) | 55.58% |

Canada Blockchain in Finance Market Trends:

Growing Regulatory Support

Government initiatives and frameworks that promote blockchain innovation and ensure compliance are encouraging Blockchain adoption among financial institutions. For instance, on June 14, 2023, the Canadian digital asset and blockchain community witnessed the historic occasion when the House of Commons Standing Committee on Industry and Technology (the Committee) released its report, "Blockchain Technology: Cryptocurrencies and Beyond." For the first time in its history, a publication from a House of Commons committee would be solely about the field of digital asset and blockchain technologies. In line with this, Canadian regulators are increasingly supportive of blockchain by promoting its use in finance and fostering innovation across the sector.

Rising Demand for Transparency and Security

The need for enhanced security, fraud reduction, and transparent transactions is pushing financial organizations to explore blockchain solutions. This study by Payments Canada finds that in September 2024 one in five of all Canadian businesses was reported having had fraudulent payments occur within the past six months, though 63% of them felt fairly confident their businesses were safe from being scammed. Interestingly, businesses are paying the price of payment fraud (20%) at a much higher rate compared with Canadian consumers (13%). Blockchain offers enhanced security and transparency, reducing fraud and improving data integrity in financial transactions, which is expected to boost the demand for blockchain in finance.

Growing Digital Banking and Payment Systems

The widespread adoption of digital banking and mobile payments encourages financial institutions to use blockchain for efficiency. The Canadian Bankers Association states that 87% of individuals have engaged in online banking over the past year; however, online banking habits seem to be increasingly shifting toward app-based platforms over time. Young adults (ages 18-29) tend to prefer apps, whereas older adults (ages 70+) engage more in online banking. The typical number of reported visits to a bank branch each month decreased from 1.8 in 2021 to 1.3 in 2024. The adoption of e-transfer has nearly increased twofold over 6 years, averaging 4 transactions monthly in 2023, while 97% express satisfaction with online banking

Canada Blockchain in Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Public Blockchain

- Private Blockchain

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes public blockchain, private blockchain, and others.

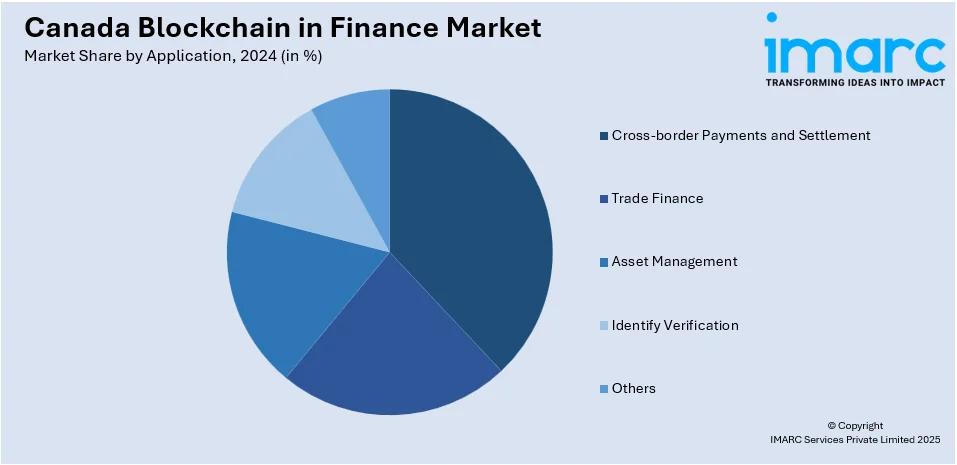

Application Insights:

- Cross-border Payments and Settlement

- Trade Finance

- Asset Management

- Identify Verification

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cross-border payments and settlement, trade finance, asset management, identify verification, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Blockchain in Finance Market News:

- In July 2023, the University of Toronto, Canada’s largest university by enrollment, announced the launch of an independent XRP ledger validator focused on payments, in collaboration with Ripple as it aims to foster the next wave of the crypto sector. This action is included in Ripple's University Blockchain Research Initiative (UBRI) in Canada, through which the company has previously allocated over $2 million to the leading universities and colleges in the country over five years

Canada Blockchain in Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Public Blockchain, Private Blockchain, Others |

| Applications Covered | Cross-border Payments and Settlement, Trade Finance, Asset Management, Identify Verification, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada blockchain in finance market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada blockchain in finance market on the basis of type?

- What is the breakup of the Canada blockchain in finance market on the basis of application?

- What is the breakup of the Canada blockchain in finance market on the basis of region?

- What are the various stages in the value chain of the Canada blockchain in finance market?

- What are the key driving factors and challenges in the Canada blockchain in finance?

- What is the structure of the Canada blockchain in finance market and who are the key players?

- What is the degree of competition in the Canada blockchain in finance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada blockchain in finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada blockchain in finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada blockchain in finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)