Canada 3PL Market Report by Mode (Roadways, Railways, Waterways, Airways), Services (Dedicated Contract Carriage (DCC)/Freight Forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing and Distribution, Value Added Logistics Services (VALs)), End Use (Automotive, Manufacturing, Chemical, Retail, Healthcare and Pharmaceuticals, Construction, and Others), and Region 2026-2034

Canada 3PL Market Overview:

The Canada 3PL market size reached USD 25,214.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 36,361.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.03% during 2026-2034. The increasing e-commerce growth, the rising demand for efficient supply chain management, advancements in technology, rapid globalization, the growing need for cost-effective logistics solutions, and the expansion of trade agreements are some of the major factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 25,214.4 Million |

|

Market Forecast in 2034

|

USD 36,361.2 Million |

| Market Growth Rate 2026-2034 | 4.03% |

Access the full market insights report Request Sample

Canada 3PL Market Analysis:

- Major Market Drivers: Online commerce growth, international trade, and need for affordable logistics are fueling the growth of third-party logistics. Greater outsourcing by manufacturers and retailers continues to support Canada 3PL market share, particularly in distribution, transportation, and warehousing segments in major provinces.

- Key Market Trends: Implementation of AI, automation, and IoT is revolutionizing 3PL operations. Focus on sustainability, cold-chain shipping, and omnichannel fulfillment is increasing. These trends are in line with changing consumer expectations and regulatory pressures, influencing technology investment and service design in Canada's logistics networks.

- Competitive Landscape: The marketplace features international and domestic participants competing based on service integration, geographic scope, and digital capability. Carriers with sophisticated fulfillment, last-mile capabilities, and data-driven insights are defeating competitors, particularly in metro centers and industries such as retail, manufacturing, and pharma.

- Challenges and Opportunities: Growing operating expenses, manpower shortages, and infrastructural deficiencies confront providers. Opportunities exist in rural growth, logistics for SMEs, and last-mile development. Continual Canada 3PL market analysis indicates robust potential for digital expansion and value-added services that match changing customer and industry requirements.

Canada 3PL Market Trends:

E-commerce Growth

The rapid expansion of e-commerce in Canada significantly boosts the demand for efficient logistics and fulfillment services. This is further prompting businesses to rely on 3PL providers to manage their supply chains and meet consumer expectations for fast and reliable deliveries. According to the International Trade Administration, in 2022, there were over 27 million eCommerce users in Canada, accounting for 75% of the Canadian population. This number is expected to grow to 77.6% in 2025. According to Statistics Canada, eCommerce retail trade sales in Canada amounted to an all-time high of US$ 3.82 billion in December 2020, surpassing the boost recorded in May 2020 (US$ 3.2 billion) due to the coronavirus pandemic lockdown measures. In March 2022, e-commerce sales amounted to approximately US$ 2.34 billion. It is estimated that retail eCommerce sales will total US$ 40.3 billion by 2025. Retailers are investing in digital platforms to reach consumers dispersed over a vast landmass while responding to competition from websites, such as Amazon Canada. Fifty-nine percent of Canadian shoppers use credit cards when shopping online and a further 20% use PayPal. Digital wallets are steadily increasing and are estimated to account for 27% of online payments by 2025. As consumer expectations for seamless fulfillment rise and digital infrastructure continues to evolve, these developments are playing a pivotal role in accelerating Canada 3PL market growth, especially in the areas of warehousing, order processing, and last-mile delivery.

Technological Advancements

The widespread adoption of advanced technologies like IoT, AI, and automation in logistics operations improves tracking, inventory management, and route optimization which is acting as a major growth-inducing factor. 3PL providers leveraging these technologies offer enhanced services, driving their demand in the market. For instance, in April 2024, Oracle launched updated artificial intelligence (AI) capabilities in its Oracle Fusion Cloud Supply Chain & Manufacturing platform. The software company added new AI capabilities in a bid to help companies increase efficiencies throughout their operations. The tactic has been popular among supply chain software providers, who have added AI features promising to help with a broad range of rote tasks, such as risk prediction or inventory visibility. These advancements reflect broader Canada 3PL market trends, where digital transformation is becoming central to improving supply chain resilience, optimizing asset utilization, and delivering greater transparency across increasingly complex logistics networks.

Canada 3PL Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on mode, services, and end use.

Mode Insights:

To get detailed segment analysis of this market Request Sample

- Roadways

- Railways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market based on the mode. This includes roadways, railways, waterways, and airways.

Services Insights:

- Dedicated Contract Carriage (DCC)/Freight Forwarding

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Warehousing and Distribution

- Value Added Logistics Services (VALs)

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes dedicated contract carriage (DCC)/freight forwarding, domestic transportation management (DTM), international transportation management (ITM), warehousing and distribution, value added logistics services (VALS).

End Use Insights:

- Automotive

- Manufacturing

- Chemical

- Retail

- Healthcare and Pharmaceuticals

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive, manufacturing, chemical, retail, healthcare and pharmaceuticals, construction, and others.

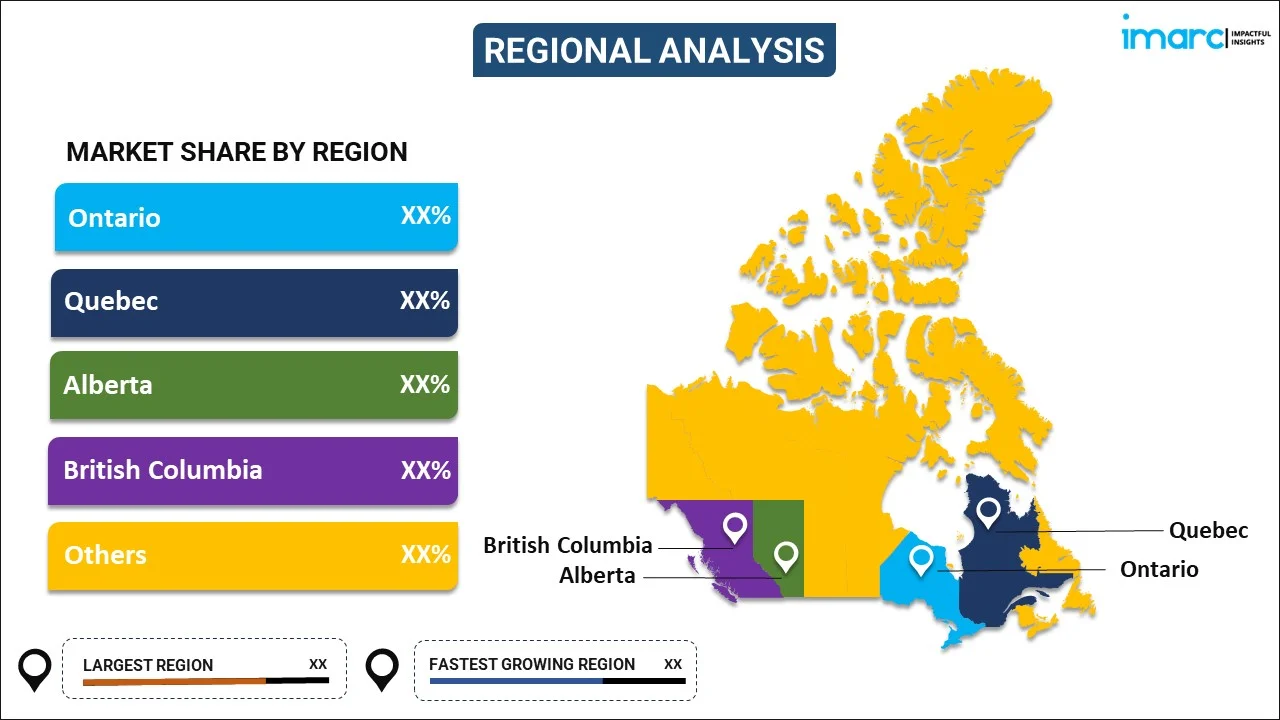

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In February 2024, Röhlig Logistics continued to grow its international presence through the launch of a new subsidiary in Toronto, Canada. The expansion is expected to further consolidate the company's North American presence by taking advantage of Toronto's economic prowess and Canada's multiple industry sectors.

Canada 3PL Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes Covered | Roadways, Railways, Waterways, Airways |

| Services Covered | Dedicated Contract Carriage (DCC)/Freight Forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing and Distribution, Value Added Logistics Services (VALs) |

| End Uses Covered | Automotive, Manufacturing, Chemical, Retail, Healthcare and Pharmaceuticals, Construction, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada 3PL market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada 3PL market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada 3PL industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 3pl market in Canada was valued at USD 25,214.4 Million in 2025.

The Canada 3pl market is projected to exhibit a (CAGR) of 4.03% during 2026-2034, reaching a value of USD 36,361.2 Million by 2034.

The market is fueled by the accelerating growth of e-commerce, amplifying demand for cost-effective last-mile delivery, heightened cross-border trade with the United States, and the requirement for scalable logistics solutions. Furthermore, widespread technology adoption such as automation, AI, and real-time tracking improves operational efficiency and stimulates third-party logistics service demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)