Camping Tent Market Size, Share, Trends and Forecast by Tent Type, Tent Capacity, End Use, Distribution Channel, and Region, 2025-2033

Camping Tent Market Size and Share:

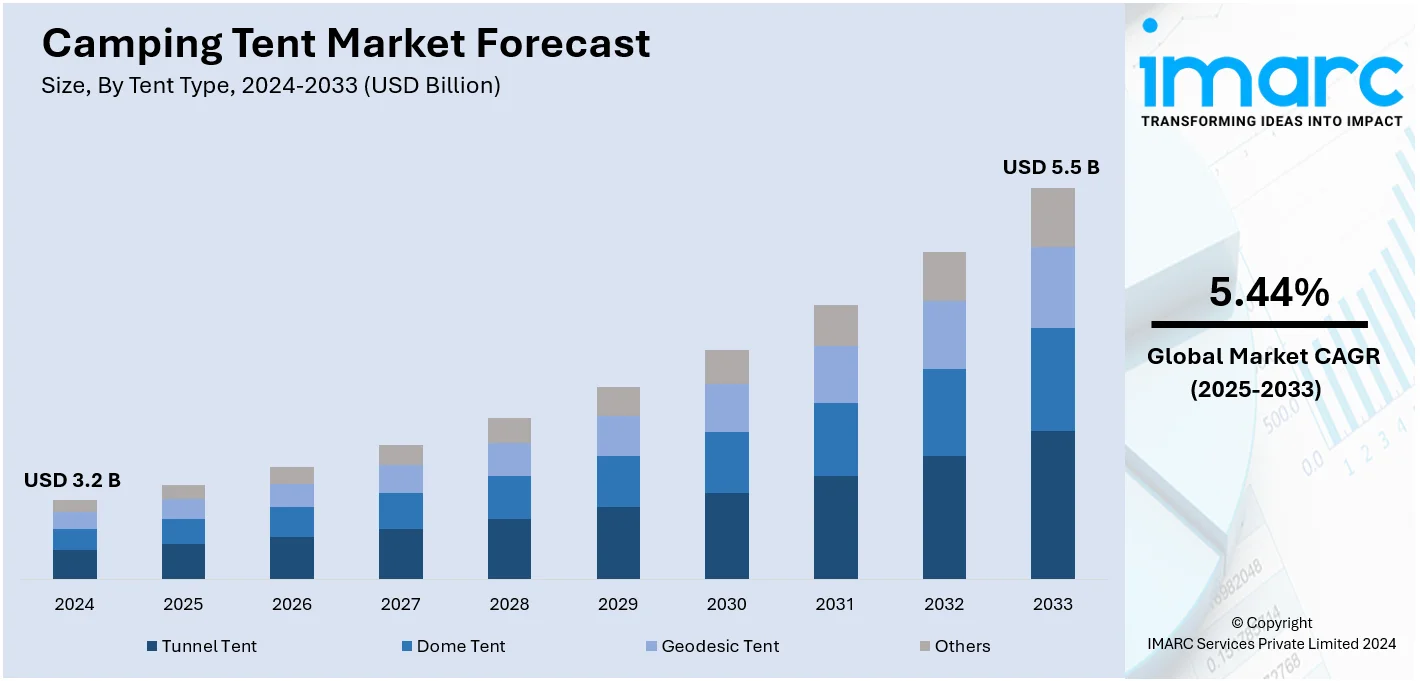

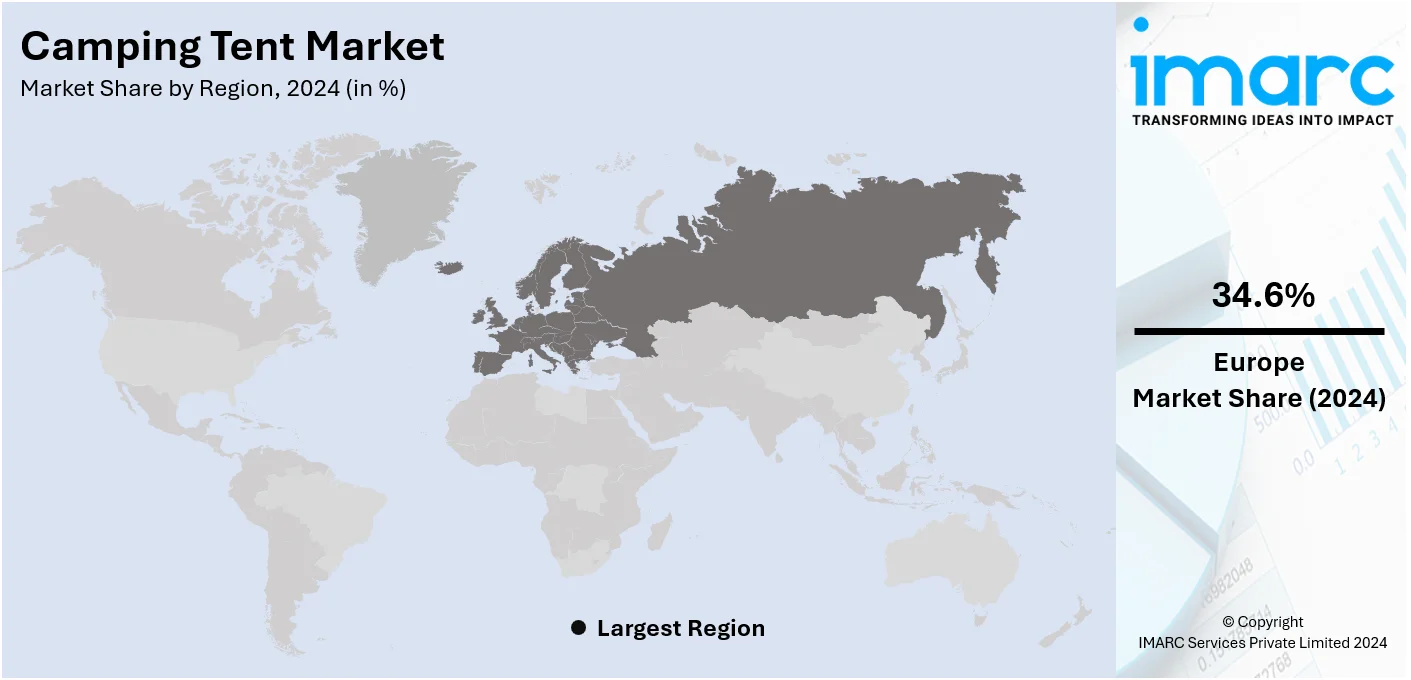

The global camping tent market size was valued at USD 3.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.5 Billion by 2033, exhibiting a CAGR of 5.44% during 2025-2033. Europe currently dominates the market in 2024. The increasing interest in outdoor activities and adventure tourism, the improved availability of diverse and high-quality options, strategic partnerships between manufacturers and tourism agencies, and the growing influence of extreme sports and adventure shows represent some of the factors that are propelling the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Market Growth Rate (2025-2033) | 5.44% |

The global camping tent market is propelled by numerous factors such as increasing outdoor recreational activities, including hiking, camping, and trekking. With the rising number of health-conscious individuals, outdoor adventures are gaining popularity. Additionally, on account of significant developments in tent technology, including lightweight, durable materials, better waterproofing, and ease of setting them up, individuals across the globe are becoming more comfortable venturing on these adventures. Furthermore, the increasing number of families and groups travelling and camping together is further propelling the market growth. Moreover, the rapid expansion of e-commerce platforms along with the increasing marketing of outdoor gear is increasing accessibility and visibility. According to the IMARC Group, the global e-commerce market has reached USD 26.8 Trillion in 2024, and is expected to exhibit a CAGR of 25.83% during 2025-2033.

The United States stands out as a key market disruptor, driven by the focus on outdoor activities and adventure tourism. As individuals seek outdoor activities for leisure and health benefits, camping has gained popularity for weekend retreats and family trips. Besides this, the rising popularity of sustainable and eco-conscious products is impacting the market, as numerous campers choose tents constructed from environmentally safe materials. In line with this, innovations in camping equipment, such as lightweight and sturdy tents designed for quick assembly and improved weather protection, have made camping more approachable and attractive to a wider range of individuals. Moreover, the rising trend of glamping (luxury camping) is fueling the need for bigger, more comfortable tents that come with additional amenities.

Camping Tent Market Trends:

Surging participation in outdoor recreational activities

The rising participation in outdoor recreational activities is significantly driving the camping tent market growth. There is a noticeable trend toward outdoor activities such as camping, hiking, backpacking, and wilderness exploration. For instance, according to KAO's monthly report, issued in January 2022, 70% of those who went camping in 2021 intended to camp again in 2022. Similarly, according to research published by the North American Camping Club in April 2022, camping accounted for 40% of leisure vacation trips, with 36% of North Americans camping at least once a year. According to the report, in 2021, 66% of individuals prefer to camp in tents. Besides this, improved accessibility to national parks, camping sites, and recreational areas encourages more individuals to engage in camping. Governments and private sectors invest in infrastructure such as campgrounds, trails, and facilities, making outdoor recreation more accessible and appealing. For instance, in March 2023, the Alberta government announced to invest in campgrounds and trails to improve and extend recreational opportunities and access to provincial parks and Crown land. The province planned to invest USD 211.3 Million over three years in Alberta's great outdoors. The province reported that 60 campgrounds, day-use areas, and trail enhancement projects were ongoing in Alberta, with a total investment of USD 50.9 Million by 2023. These factors are further positively influencing the camping tent market forecast.

Rising adoption of smart technologies

One pivotal driver shaping the camping tent market is the integration of smart technologies into tent designs. With the advent of the Internet of Things (IoT) and other technological advancements, tents are no longer just simple shelters. As per research report, the number of IoT devices is expected to reach approximately 18.8 Billion at the end of 2024. Modern tents now incorporate features such as solar panels for electricity, USB ports for device charging, and even Wi-Fi capabilities. Various manufacturers are developing such tents. For instance, in May 2024, Bruce and Phillip Baum of Norwalk, CA, developed the Smart Sight, a movable tent made from solar panels that absorb energy and transform it into usable electricity. Each tent has solar panels on the roof and sidewalls that power an electric outlet. Solar panels allow users to operate equipment, boil water, and execute various other electricity-related tasks. Moreover, these features enhance the overall camping experience, making it more convenient, safe, and enjoyable. With these technological integrations, campers can stay connected even in remote locations, ensuring safety and peace of mind. These factors are further contributing to the camping tent market share.

Increasing trend of customization and personalization

Customization and personalization are quickly becoming key determinants in consumer purchasing decisions across various sectors, and the camping tent market is no exception. With diversified consumer needs and preferences, brands are moving away from the traditional one-size-fits-all approach. They are now offering an extensive array of customization options to cater to individual needs. For instance, in September 2023, REI introduced the REI Co-op Wonderland X, a high-end tent priced at USD1,249. A tough and customizable tent-shelter hybrid that's perfect for group camping. The enormous tent can be changed from a comfortable, four-person tent to a freestanding shelter in only a few minutes. Apart from this, the growing penetration toward portable and lightweight tents is also contributing to the market growth. Various manufacturers are developing portable tents in order to make them feasible for travelers. For instance, in August 2023, Rafael Amzallag launched the revolutionary Pantanal Ultralight Tent, the lightest tent of its size in the world. The designer draws on the mentality of ultralight travelers who seek only the necessities, redesigning the tent construction with detachable hiking poles serving as the core component rather than conventional poles. It is easily transported, folding down into a compact form approximating a 1.5-liter bottle and weighing only 872 grams (with stakes). These factors are driving the camping tent industry’s growth.

Camping Tent Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global camping tent market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on tent type, tent capacity, end use, and distribution channels.

Analysis by Tent Type:

- Tunnel Tent

- Dome Tent

- Geodesic Tent

- Others

Tunnel tent stands as the largest component in 2024, due to their spaciousness and ease of set-up. These tents offer more headroom and storage, making them suitable for family camping or longer expeditions. The structure of tunnel tents is generally more stable, which makes them popular in extreme weather conditions. Innovations such as inflatable beams instead of poles have made these tents even more user-friendly. Manufacturers are incorporating advanced materials to make these tents lighter and more durable, thereby driving the demand in this segment. For instance, in June 2024, Jack Wolfskin launched a new ultralight, and sustainable tent range. The collection featured 22 models including 3 tunnel tents, all of the range is crafted from 100% recycled, PFC-free fabric.

Analysis by Tent Capacity:

- One Person

- Two Persons

- Three or More Persons

Three or more persons lead the market in 2024, which is majorly driven by an increase in family and group camping activities. The trend toward experiencing outdoor recreational activities as a family or group necessitates larger tent space, thus boosting the market for bigger camping tents. Another factor contributing to its growth is the multifunctional use of such tents; they can serve as sleeping or living quarters, providing a more comfortable camping experience. Technological advancements in manufacturing lightweight and durable tents have also contributed to the growing popularity of this segment. Finally, the rise of organized camping sites that accommodate larger tents also plays a significant role in fueling this market segment. For instance, in January 2024, Decathlon expanded its gear rental service to include tents. The on-rent model included a large inflatable 6-person Air Seconds 6.3.

Analysis by End Use:

- Recreational Activities

- Military and Civil

- Others

Recreational activities lead the market in 2024. With the increase in interest in outdoor activities and adventure sports, the demand for high-quality camping tents has grown exponentially. The rise of eco-tourism, along with the growing popularity of music festivals and other outdoor events that require camping, also contributes to the demand. Family camping is another major factor, as individuals seek to spend quality time in nature. Government initiatives to promote domestic tourism also provide a boost to this segment.

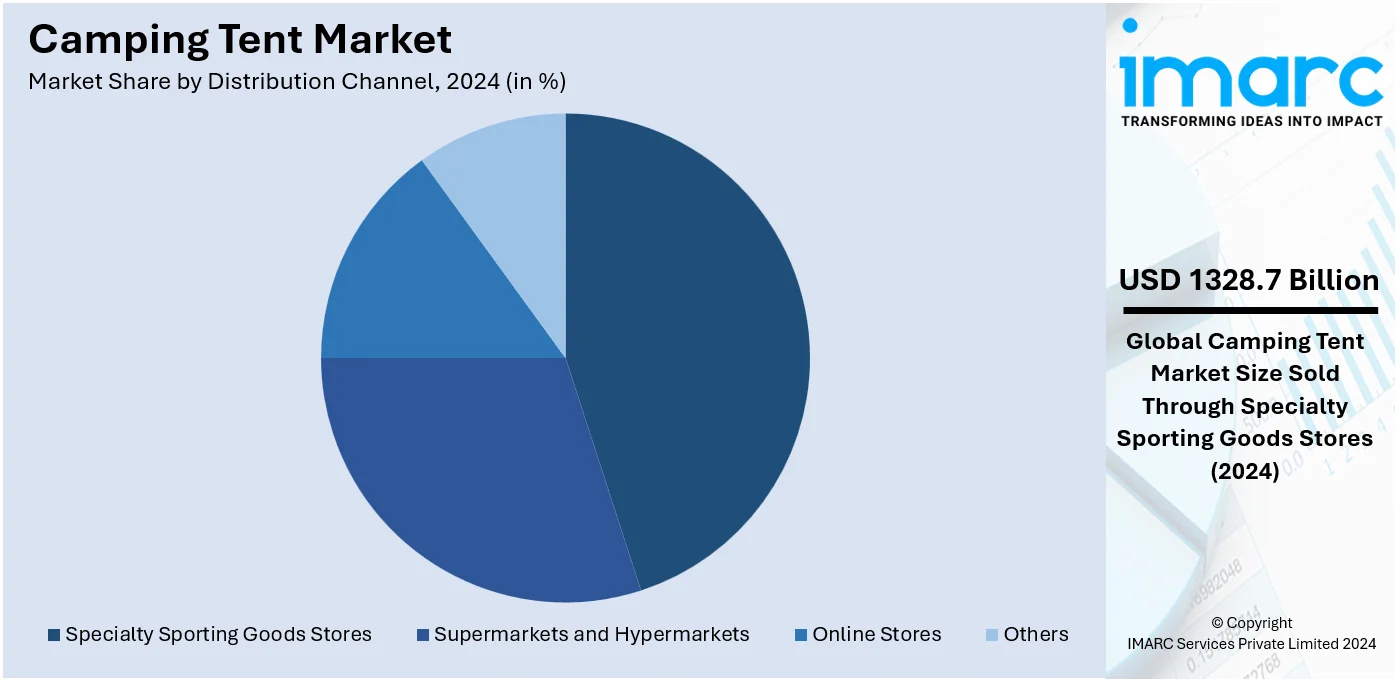

Analysis by Distribution Channel:

- Specialty Sporting Goods Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

Specialty sporting goods stores lead the market in 2024, due to the range of high-quality, specialized camping gear they offer. These stores are seen as trustworthy by consumers because they often provide expert advice and in-depth product knowledge. The availability of various brands, as well as the opportunity to physically inspect the product, greatly contributes to consumer trust and, consequently, sales. The rise of experiential retail within these stores, where consumers can try out tents, also boosts this segment. Various seasonal promotions and discounts add to the stores' allure, driving growth in this segment.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Europe accounted for the largest market share, due to the rising cultural inclination toward outdoor activities which has created a strong demand for all types of camping tents. The region is home to numerous camping sites, national parks, and outdoor recreational facilities that encourage camping activities. Moreover, a well-established retail network of specialty sporting goods stores contributes to easy access to quality tents. The presence of key manufacturers in the region also ensures the availability of a wide range of products. E-commerce is another strong channel, with seamless delivery and easy return policies that make online shopping more convenient. Government initiatives to promote local tourism and outdoor activities further contribute to the market. Additionally, the inflating disposable income levels also allow consumers to spend more on high-quality, durable tents. Technological advancements in tent materials and features are more rapidly adopted in this region, adding another dimension to market growth. Moreover, the diverse geography of Europe, ranging from deserts to mountains, allows for various types of camping activities, thus requiring different kinds of tents. Moreover, various manufacturers are introducing new camping tents in order to cater to the needs of the consumers. For instance, in March 2023, Dometic launched its new compact camping tent series in Europe, with a focus on the region's outdoor season in 2023. The new line has a worldwide design and tiny proportions that fit into the rear of a passenger car. The collection includes a Redux recyclable material model and a Pico-sized tent that can be carried as a backpack.

Key Regional Takeaways:

United States Camping Tent Market Analysis

The increased need to connect with nature is making more individuals camp, thereby increasing the demand for camping tents in the country. Moreover, companies are developing tents using lightweight and durable materials that are resistant to weather and comfortable. The innovations include improved fabrics with better waterproofing, UV protection, and breathability. Other than this, sustainability is also an issue among consumers. There is a growing demand for tents made from recycled or environmentally friendly materials. Brands react to this by creating more environmentally friendly products, through the use of eco-friendly dyes, and trying to reduce waste in its manufacturing processes. The demand for glamping, also known as glamorous camping, is also increasing. This trend meets the demand for a more affluent outdoor experience by the individuals, and thereby the high-end tents with facilities have gained a greater demand. On similar lines, the trend of being fit and sound in body and mind is influencing individuals to indulge in outdoor activities such as camping. This fast-paced and technology-dependent world has increasingly started taking a toll on many who are leading sedentary lives, who experience stress or mental fatigue. Camping, therefore, provides the much-needed chance of going outdoors and hiking or biking around, swimming, or simply mere walking or running around that can help individuals improve heart health, build strength, or endurance.

Asia Pacific Camping Tent Market Analysis

The camping tent market in the Asia Pacific is growing swiftly due to various significant factors. The Asia Pacific area is experiencing a swift increase in the enthusiasm for outdoor leisure activities. As individuals seek to enjoy the outdoors beyond the city, they are engaging in activities such as camping, hiking, and adventure sports. This trend is increasingly evident in urban nations such as China, India, and Japan, where higher income levels and an expanding middle class enable more individuals to engage in outdoor activities. The CIA reported that in 2023, 64.6% of China's total population resided in urban areas. Furthermore, innovations in tent design and materials are contributing to the expansion of the market. Producers are creating lightweight, robust, and weatherproof tents to cater to the varied requirements of campers. Innovations feature durable materials, enhanced waterproof methods, and designs that facilitate quick assembly and increase portability. A fresh trend is linked to glamping, as this idea merges camping with upscale lodging, attracting a wider range of individuals, such as family units and couples. As reported by the Australian Trade and Investment Commission, in the year concluding 2023, Australians embarked on 15.3 million trips for caravanning and camping, which also encompassed glamping. There is an increasing demand for luxury tents that come with features such as cozy bedding, electricity, and temperature regulation, especially in nations such as Japan, which is fueling market expansion.

Europe Camping Tent Market Analysis

Growing demand for outdoor recreational activities by people is pushing the growth of the market. Several individuals seek nature-based experiences and adventure tourism, thus catalyzing the demand for efficient camping tents. In the region, people are increasingly spending on adventure tourism. The European Travel Commission estimates that tourists will spend 794.2 Billion dollars in Europe in 2024; a growth of 14.3% compared to the previous year. The different and scenic natural scenery in Europe, including the Alps, virgin forests, coastlines, and national parks, presents attractive reasons for camping and venturing into the outdoors, creating high demand for camping tents. Advances in tent design and materials are also a significant driver of this market. Some key players in the region have directed their focus towards lightweight and durable, yet weather resistant, to help cover campers of wide varieties. Some innovations through usage of high-strength fabric, improved waterproofing technique, and designs to ensure ease of setting up portability are also found. And the increasing focus on the luxury accommodation aspect of camping helps augment the market growth. The demand for luxurious tents with amenities, including cozy beds, electricity, and air conditioning, is in an upward trend, especially in France, Spain, and Germany.

Latin America Camping Tent Market Analysis

Latin American camping tents market is one of the notable markets witnessing growth. Increasing trends for various activities by enthusiasts have driven market growth. With an ever-growing population seeking escape from the hectic lifestyle in cities, activities such as camping, trekking, and adventure sports are now being preferred more than before. This is mainly in countries such as Brazil, Mexico, and Argentina where increased income levels and a higher middle class are making more individuals go out and enjoy themselves outdoors. According to the CIA, the urban population in Brazil in 2023 was 87.8% of the total population. Additionally, manufacturers are implementing new technologies to reach the larger population. Besides this, the market is moving toward eco-friendly and sustainable camping options. The need for tents constructed from recycled or biodegradable materials is increasing, highlighting a greater awareness of environmental issues.

Middle East and Africa Camping Tent Market Analysis

A major element driving the expansion of the camping tent market is the rising enthusiasm for outdoor activities. Individuals are increasingly participating and spending more money in sports activities in order to refresh their mind. For instance, the Middle East sportswear market is projected to exhibit a CAGR of 3.40% during 2024-2032, as reported by the IMARC Group. This trend is especially noticeable in nations like Saudi Arabia, the United Arab Emirates, South Africa, Egypt, and Israel, as a result of evolving consumer habits. Moreover, the market is experiencing a transition towards environmentally friendly and sustainable camping choices. People are progressively looking for tents created from recycled or biodegradable materials, showing a greater awareness of environmental issues. This change is encouraging manufacturers to implement sustainable practices and materials in their offerings. Additionally, innovations in technology are promoting the creation of lightweight, sturdy, and weatherproof tents that meet the various requirements of campers.

Competitive Landscape:

The leading players in the camping tent market are taking strategic measures to drive the market forward and fulfill the needs of consumers. Manufacturers have focused on innovation through innovative features, such as fast setting up tents, durability, and resistance to bad weather, making it easy and comfortable to go for camping. Besides this, numerous companies are investing in research and development to make lightweight, compact tents easy to carry, further attracting adventure seekers and backpackers. In line with this, sustainability is another one of priorities, and many brands are now using eco-friendly materials such as recycled fabrics to keep up with consumer awareness about the environment. In addition, partnerships with outdoor influencers and the emergence of e-commerce platforms have helped the leading players expand their consumer reach.

The report provides a comprehensive analysis of the competitive landscape in the camping tent market with detailed profiles of all major companies, including:

- AMG-Group

- Hilleberg the Tentmaker

- Newell Brands

- Johnson Outdoors Inc.

- Oase Outdoors

- Big Agnes, Inc.

- Exxel Outdoors, LLC

- NEMO Equipment, Inc

- Simex Outdoor International GmbH

- Skandika

- Snugpak

- VF Corporation

Latest News and Developments:

- May 2024: Jack Wolfskin introduced new ultralight and ultra-sustainable tent range. These tents are made from 100% recycled and PFC -free fabric.

- May 2024: InventionHome launched the Smart Sight, a portable tent developed using solar panels that convert the absorbed energy into usable electricity. Every tent is equipped with solar panels on the roof and sides that provide electricity to an outlet.

- May 2024: Helinox introduced its limited-release ‘off-the-ground’ tents. The tactical cot tent selection includes three types of shelters: mesh, fabric, and solo fly.

- March 2024: TAXA Outdoors, a top producer of lightweight, minimalist mobile living spaces for outdoor activities, unveiled the 2024 Evolutions of its Mantis and Woolly Bear trailers. Moreover, the brand is introducing entirely new rooftop tents, the MoonMoth Clamshell and MoonMoth Foldout, created for compatibility with TAXA habitats and nearly any vehicle.

Camping Tent Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tent Types Covered | Tunnel Tent, Dome Tent, Geodesic Tent, Others |

| Tent Capacities Covered | One Person, Two Persons, Three Or More Persons |

| End Uses Covered | Recreational Activities, Military and Civil, Others |

| Distribution Channels Covered | Specialty Sporting Goods Stores, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AMG-Group, Hilleberg the Tentmaker, Newell Brands, Johnson Outdoors Inc., Oase Outdoors, Big Agnes, Inc., Exxel Outdoors, LLC, NEMO Equipment, Inc., Simex Outdoor International GmbH, Skandika, Snugpak, VF Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the camping tent market from 2019-2033.

- The camping tent market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the camping tent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global camping tent market was valued at USD 3.2 Billion in 2024.

IMARC estimates the global camping tent market to exhibit a CAGR of 5.44% during 2025-2033.

The global camping tent market is propelled by a rise in outdoor leisure activities, improvements in tent technology, a rise in demand for sustainable products, and the increasing appeal of family and luxury camping adventures.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global camping tent market including AMG-Group, Hilleberg the Tentmaker, Newell Brands, Johnson Outdoors Inc., Oase Outdoors, Big Agnes, Inc., Exxel Outdoors, LLC, NEMO Equipment, Inc., Simex Outdoor International GmbH, Skandika, Snugpak, VF Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)