Camping Equipment Market Report by Product Type (Backpacks, Sleeping Bags, Tents and Accessories, Cooking Systems and Cookware, and Others), Distribution Channel (Online, Offline), and Region 2026-2034

Global Camping Equipment Market:

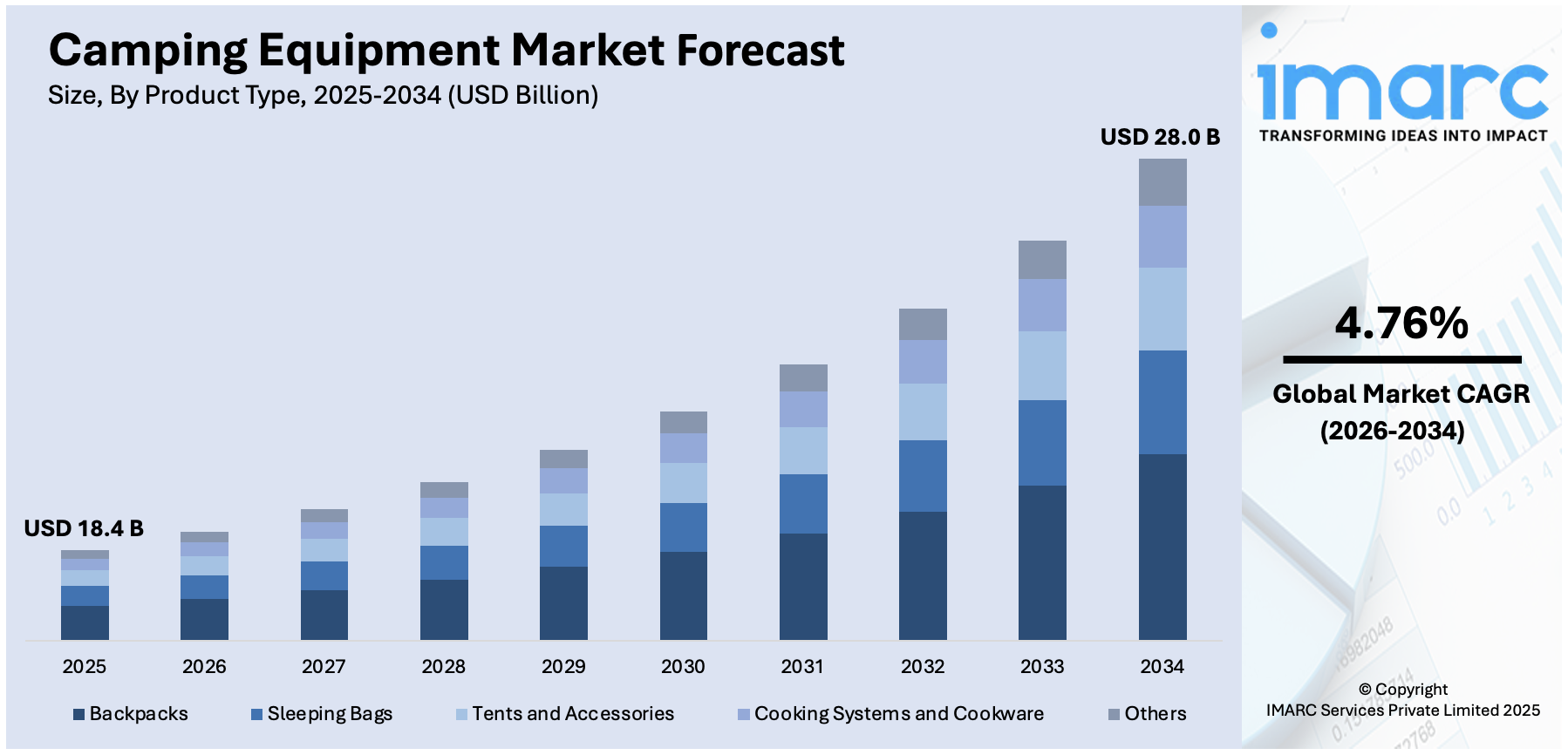

The global camping equipment market size reached USD 18.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 28.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.76% during 2026-2034. The market is experiencing stable growth driven by increasing interest in trekking and recreational activities, particularly among the youth after the pandemic, combined with the integration of various advanced smart technology in items such as tents and bags, is positively influencing the camping equipment market size 2025.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 18.4 Billion |

|

Market Forecast in 2034

|

USD 28.0 Billion |

| Market Growth Rate 2026-2034 | 4.76% |

Global Camping Equipment Market Analysis:

- Major Market Drivers: The increasing preference for recreational activities and the rising focus on healthier lifestyles among individuals are primarily driving the camping equipment market. Furthermore, there is an escalating demand for camping equipment in activities like hiking, backpacking, and recreational vehicle (RV) camping.

- Key Market Trends: Innovations in materials, such as lightweight fabrics and advanced insulation, are benefiting in improving the performance of camping equipment. In addition to this, the introduction of sustainable camping equipment is also creating a positive outlook for the overall market.

- Geographical Trends: North America leads the market, driven by the presence of well-known outdoor gear manufacturers. Furthermore, the presence of well-known outdoor gear manufacturers in the region is impelling the market growth.

- Competitive Landscape: Some of the leading players operating in the global camping equipment market include AMG-Group, Big Agnes, Inc., Exxel Outdoors, LLC, Gipfel Climbing, Hilleberg the Tentmaker, Johnson Outdoors Inc, mont-bell Co., Ltd., NEMO Equipment, Inc, Newell Brands, Nordisk Company A/S, Oase Outdoors ApS, Supa Peg, Western Mountaineering, among others.

- Challenges and Opportunities: While the market faces challenges, such as supply chain disruptions, it also encounters opportunities in rising focus on enhanced camping experience among individuals.

To get more information on this market Request Sample

Global Camping Equipment Market Trends:

Growing Demand for Outdoor Recreation

The escalating demand for camping equipment due to the rising preference for outdoor recreation is primarily driving the growth of the market. In line with this, people are increasingly seeking ways to disconnect from their monotonous life routines and reconnect with nature, which is creating a positive outlook for the overall market. According to the report published by the North American Camping Club in April 2022, camping holds 40% of leisure travel trips share, and 36% of people opt for camping at least once every year in North America. The report also indicates that, in 2021, 66% of people preferred camping in tents, while 82% of people bought recreational vehicles for camping. Apart from this, there is a rise in the desire to escape urban life and experience the peace of natural settings, further propelling the adoption of camping equipment. For instance, according to KAO's monthly report published in January 2022, 70% of the individuals who camped in 2021 were planning to camp again in 2022. In addition, camping enables people to discover new places, try various outdoor activities, and challenge themselves, making it a lucrative option for adventure seekers. People are increasingly seeking camping equipment that offers enhanced convenience, like portable cooking equipment, portable lights, and lightweight tents.

Increasing Popularity of Sustainable and Eco-Friendly Tourism

The growing preference for sustainable and eco-friendly tourism is acting as another significant driver for the growth of the glamping market. Many camping equipment are being designed and developed with a low environmental impact in mind to appeal to environmentally conscious travelers. According to a survey of 2022, over 80% of global travelers said that sustainable tourism was important to them and that they would prefer sustainable travel incentives. The increasing environmental impact of tourism is significantly alarming. The United Nations's World Tourism Organization (UNWTO) declared that global carbon dioxide (CO2) emissions from tourism-related transport accounted for a significant contributor to climate change. Transport-related emissions from tourism are anticipated to account for 5.3% of all man-made CO2 emissions by 2030. Moreover, the government authorities of various nations are taking initiatives and implementing policies to combat the climate change threat posed by the tourism sector. For instance, Australia's Tourism Ministers endorsed and launched the National Sustainability Framework and Sustainable Tourism Toolkit in November 2023. Austrade, state and territory governments, and Tourism Australia all worked together to develop and deliver the Framework and Toolkit. The Toolkit is a practical guide for tourism businesses. It helps them to respond to the growing consumer demand for sustainable travel choices. Such initiatives are anticipated to catalyze the demand for sustainable camping equipment in the coming years.

Rise of Social Media Influence and Digital Marketing

The increasing influence of social media and digital marketing is significantly bolstering the market growth. The camping industry is witnessing a surge in social media content as users search for recreational outdoor adventures. Platforms such as Instagram are becoming hotspots for showcasing plush tents, sleek airstreams, and eco-friendly cabins that offer a home away from home. Moreover, influencers and travel bloggers play a key role in this trend, as their posts and stories depicting experiences inspire followers to seek out similar adventures. Additionally, the ease of online bookings and the presence of dedicated platforms and websites for camping are making it more accessible for potential customers. In-app purchase (IAP) revenue in the travel market reached nearly US$ 114.30 Million in 2022. This digital approach simplifies the process of finding and booking these unique accommodations, which further bolsters the camping equipment market growth.

Increased Government Investment in Tours and Travel Sector

The robust growth of global tourism sector over the last few years has been aided by the governments of various nations through the implementation of a number of development policies of the tourism sector. Tourism industry assists in contributing an enormous percentage of revenue to each nation's GDP and thus promoting the government to implement various investments towards upgrading the travel infrastructural facilities in their respective nations. This consequently encourages the travelers to enhance the expenditure on the travel accessory products and thus propelling the market growth. For example, India's government launched a scheme called 'Swadesh Darshan Scheme' whose target was to promote theme-based tourism activities to develop and tap India's tourist potential.

Camping Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Breakup by Product Type:

- Backpacks

- Sleeping Bags

- Tents and Accessories

- Cooking Systems and Cookware

- Others

Backpacks account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes backpacks, sleeping bags, tents and accessories, cooking systems and cookware, and others. According to the report, backpacks represented the largest segment.

Backpacks are an essential camping accessory for storing and carrying camping gear and personal items. They include daypacks, hydration packs, hiking packs, and expedition backpacks. Various key market players are introducing compact and lightweight backpacks to cater to the unique needs of hikers. For instance, Ushi launched an all-in-one ultra-light sleepless miniaturized trailer, a micro-camping backpack for SUVs. The trailer stands a mere 4.8 feet (1.5 m) high and stretches 7.4 feet (2.3 m) long, from rear bumper to hitch tip. Similarly, in January 2024, OnePlus introduced its latest travel product, the OnePlus Adventure Backpack, alongside the OnePlus 12 series in India. This backpack boasts a rugged design inspired by nature and features the classic OnePlus logo. It is made with durable 900D polyester fabric and resists wrinkles and damage. This backpack also features a water-repellent coating, ensuring protection on rainy days.

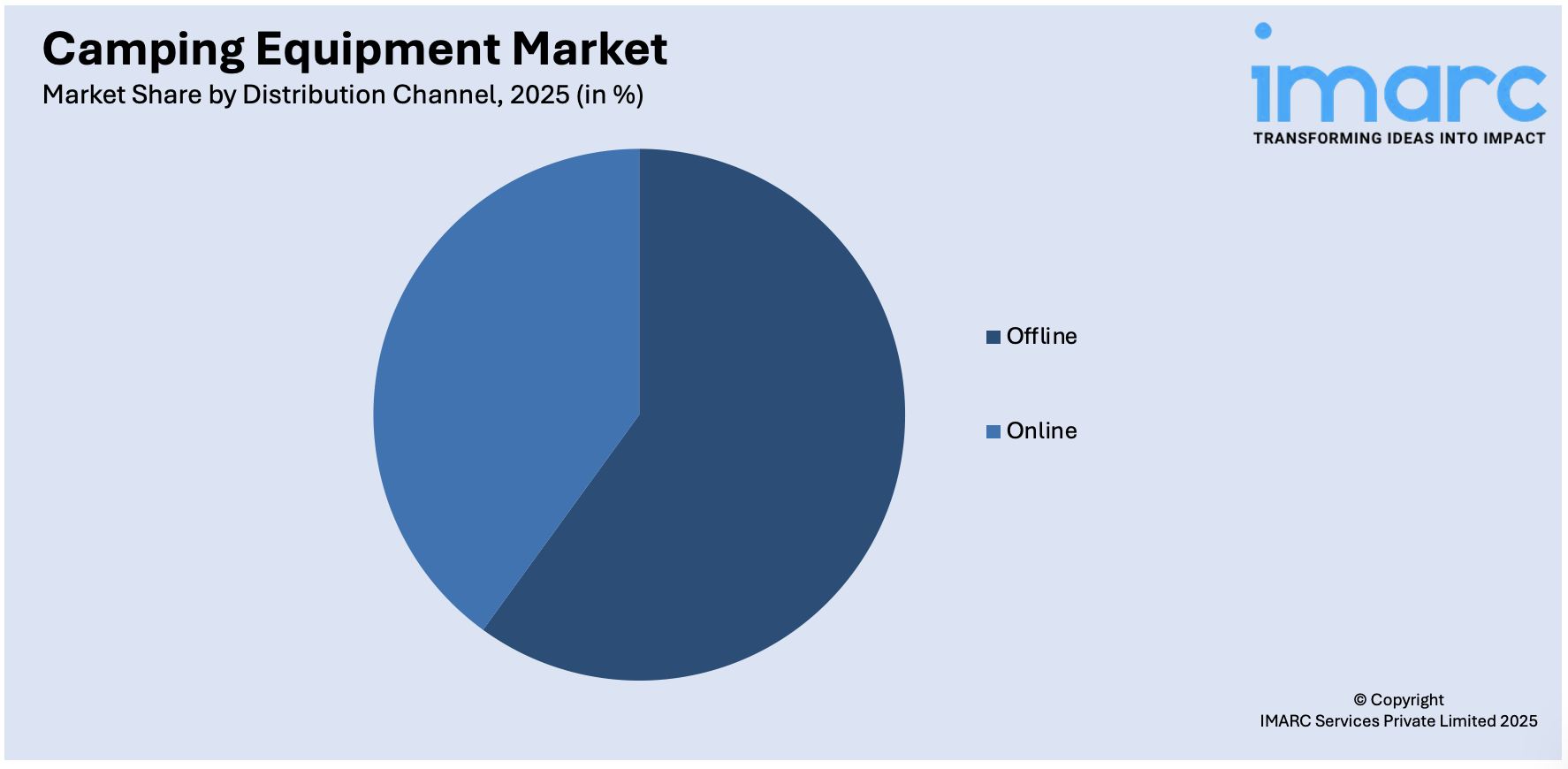

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline holds the largest market share

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline. According to the report, offline accounted for the largest market share.

Offline distribution channels are traditional brick-and-mortar retail outlets where individuals can physically visit to purchase camping equipment. They include various types of physical stores, such as outdoor retailers, sporting goods stores, department stores, big-box retailers, and independent retailers. Furthermore, department stores have dedicated sections for outdoor and camping gear, making camping equipment more accessible to a larger consumer base. Various industry players are expanding their stores across the nations to increase their sales and customer base. For instance, in September 2023, French sporting goods brand Decathlon launched a new store in Chennai spanning around 13000 sq. ft. The store is located at Marina Mall, Old Mahabalipuram Road (OMR), Egattur, Chennai. The store provides a wide range of sports apparel and equipment catering to men, women, and children, encompassing diverse categories such as outdoor, water, fitness, racket, team, cycling, running, walking, roller, and target sports. It also features a digital play/experience area spanning 350 sq. ft.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest camping equipment market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America has a vast and diverse natural landscape, including national parks, forests, mountains, and coastal areas, which makes it a suitable place for camping and outdoor activities. Grand Canyon and Canadian Rocky Mountains are some of the awe-inspiring locations in North America which were put to good use by campers in 2021 when approximately 25.9 million North American households went to camp in these locations nearly three times annually. Similarly, in 2021, according to the North American Camping Club report, Canada contributed 64% of camping incidents in the region.

Leading Key Players in the Camping Equipment Industry:

Key players are developing lighter and more durable materials and incorporating eco-friendly designs. They are introducing technologically advanced gear, such as solar-powered gadgets and portable water filtration systems. Apart from this, various companies are focusing on sustainability by using recycled materials, reducing waste, and implementing eco-conscious manufacturing processes. They are also developing and marketing eco-friendly camping equipment, such as biodegradable tents and reusable camping gear. In addition, major companies are expanding their online presence by optimizing their websites for e-commerce and partnering with online retailers and marketplaces. They are also engaging with people through social media, online forums, and feedback platforms to gather insights and enhance their products and services based on the preferences and feedback of individuals.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AMG-Group

- Big Agnes, Inc.

- Exxel Outdoors, LLC

- Gipfel Climbing

- Hilleberg the Tentmaker

- Johnson Outdoors Inc

- mont-bell Co., Ltd.

- NEMO Equipment, Inc

- Newell Brands

- Nordisk Company A/S

- Oase Outdoors ApS

- Supa Peg

- Western Mountaineering

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Camping Equipment Market News:

- March 2025: Helinox launched the new version of its Chair One, which is a packable camping chair. It comprises dual-tension technology to evenly distribute weight and maintain stability.

- June 2025: Academy Sports + Outdoors, a premier full-line sporting goods and outdoor recreation retailer, announced the opening of two new stores in Fort Walton Beach and Midlothian, and will open an additional new store in Morgantown, later this month. The openings follow the retailer's Q1 finish in excess of 300 total stores and reaffirms its dedication to delivering a wide range of quality sporting goods and outdoor products to more families throughout the nation.

- June 2025: Decathlon UK is increasing its Summer Tent Promise, a nationwide buyback scheme to minimize tent waste from campsites and festivals. Customers can also bring back any Decathlon-branded tent bought within this timeframe for its full amount in gift card form. This covers tents which have been utilized.

- May 2025: By enlarging its 'glampground,' North Shore Camping Co. is bringing the wilderness closer to those who might be tired of sacrificing the comforts of home. On opening two years ago with 10 fully furnished tents, North Shore Camping Co. has recently set up another 20. The job was contracted to be done by Cagle Construction. By the beginning of the 2024 season, the 30 'glampsites' were operational with the capacity to host up to 76 visitors at a time.

Camping Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Backpacks, Sleeping Bags, Tents and Accessories, Cooking Systems and Cookware, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMG-Group, Big Agnes, Inc., Exxel Outdoors, LLC, Gipfel Climbing, Hilleberg the Tentmaker, Johnson Outdoors Inc, mont-bell Co., Ltd., NEMO Equipment, Inc, Newell Brands, Nordisk Company A/S, Oase Outdoors ApS, Supa Peg, Western Mountaineering, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the camping equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global camping equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the camping equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global camping equipment market was valued at USD 18.4 Billion in 2025.

According to camping equipment industry statistics and IMARC report, we expect the global camping equipment market to exhibit a CAGR of 4.76% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous camping and recreational activities, thereby negatively impacting the global market for camping equipment.

Camping gear is becoming more eco-friendly with sustainable materials, while lightweight and compact designs improve portability. Smart technology, such as solar-powered devices and GPS tools, is being integrated. Comfort-focused and multifunctional equipment is also gaining popularity among campers.

Based on the product type, the global camping equipment market has been segregated into backpacks, sleeping bags, tents and accessories, cooking systems and cookware, and others. Among these, backpacks currently hold the largest market share.

Based on the distribution channel, the global camping equipment market can be bifurcated into online and offline. Currently, offline exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global camping equipment market include AMG-Group, Big Agnes, Inc., Exxel Outdoors, LLC, Gipfel Climbing, Hilleberg the Tentmaker, Johnson Outdoors Inc, mont-bell Co., Ltd., NEMO Equipment, Inc, Newell Brands, Nordisk Company A/S, Oase Outdoors ApS, Supa Peg, and Western Mountaineering.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)