Camera Stabilizer Market Report by Type, Distribution Channel, Application, End-User, and Region 2025-2033

Camera Stabilizer Market Size and Share:

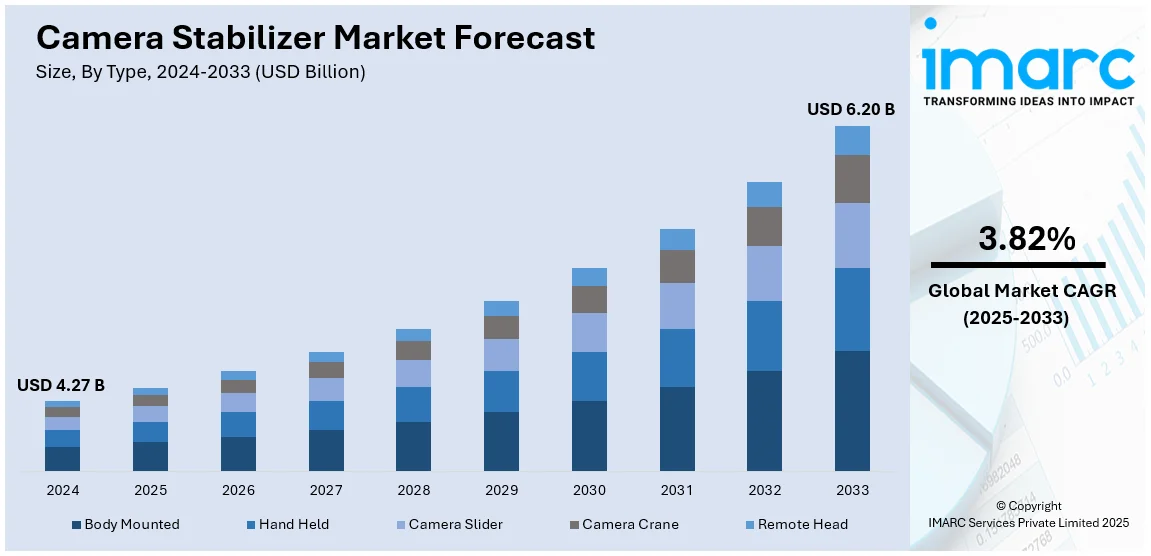

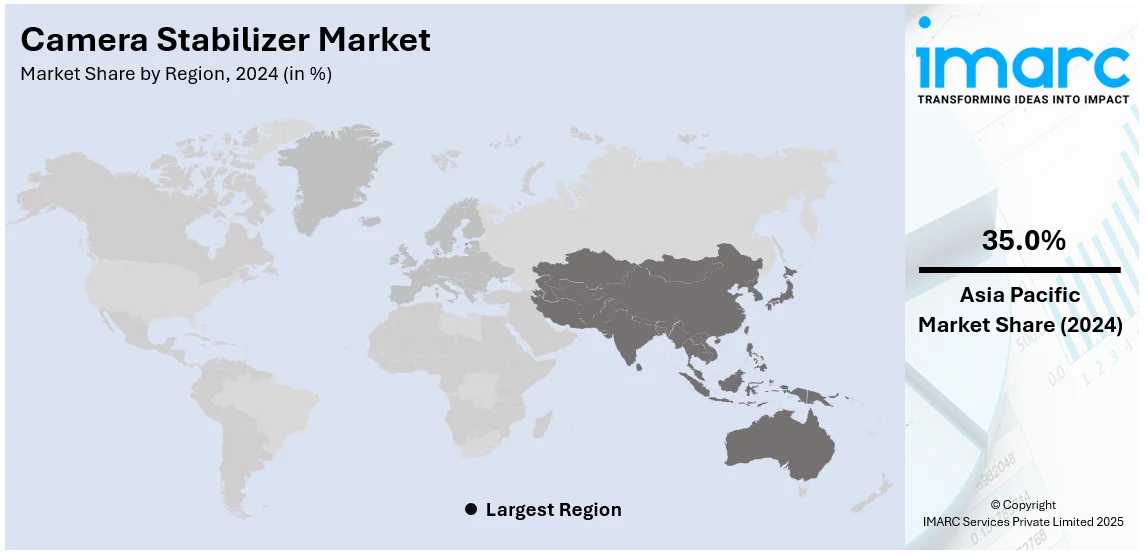

The global camera stabilizer market size reached USD 4.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.20 Billion by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033. Asia Pacific currently dominates the market holding a total of 35.0% of camera stabilizer market share. The market is driven due to the increasing production of numerous types of video content in the media and entertainment industry is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.27 Billion |

|

Market Forecast in 2033

|

USD 6.20 Billion |

| Market Growth Rate (2025-2033) | 3.82% |

The global camera stabilizer market is primarily driven by the increasing demand for high-quality video content across different platforms. Social media, live streaming, and digital content platforms have been gaining popularity lately, and creators and professionals need tools that can provide smooth and professional-looking footage. Camera stabilizers, including gimbals and handheld models, enable users to capture dynamic, stable shots with ease, enhancing production quality. For example, in December 2024, ARRI introduced the ARTEMIS 2 Live, a modular and ergonomic camera stabilizer optimized for live productions, offering advanced adaptability and seamless integration with ARRI’s Camera Stabilizer Systems. Additionally, high definition and advanced smartphone cameras have enhanced the demand for portable and economical stabilizers which are ideal for on-the-go content creation. Furthermore, various technological advancements that include AI tracking, automated stabilization, and compatibility across a wide variety of devices enable the tools to become increasingly versatile and convenient. The expanding scope of content creation into fields such as advertising, sports, and entertainment means the demand for efficient and creative stabilizers remains one of the major growth drivers in this fast-moving and dynamic market.

Growing demands for professional grade video equipment are what fuel the increased use of camera stabilizers in the United States with the share of 82.00%. Increasing popularity of the use of live streaming and video blogging across a range of different industries, from entertainment to social media content creators, has motivated these creators to invest in quality stabilizers to enhance video. In addition, innovative stabilizer designs, such as compact designs and automated focus, and increased smartphone and camera compatibility, make these products more desirable to professionals as well as amateurs. For instance, in September 2024, Tilta introduced the Hydra Alien Mini at IBC, a compact stabilizing arm designed for action cameras and smartphones, supporting up to 1kg. With adjustable tension and versatile compatibility, it enhances stabilization for various filmmaking applications. Furthermore, a high-tech ecosystem of the U.S. enables leading players to introduce newer products that will be in response to changing demands of consumers. With increased adoption in sectors such as sports broadcasting, weddings, and corporate events, it is evident that the versatility of stabilizers makes the U.S. an important player in shaping trends and innovations in the global camera stabilizer market.

Camera Stabilizer Market Trends:

Integration of AI and Automation

Camera stabilizers are increasingly incorporating AI and automation, revolutionizing the way users capture stable and precise shots. Advanced features such as intelligent tracking, automated focus adjustments, and enhanced stabilization reduce manual effort, making them highly user-friendly. In July 2024, Insta360 launched its new AI-powered phone stabilizer, integrated with Apple’s DockKit protocol. This innovation allows seamless connectivity between mobile stabilizers and the iPhone’s native camera app, enhancing usability and performance This integration provides exact control and additional functionality through the camera application without requiring other software. By combining AI-driven stabilization with Apple’s robust ecosystem, this development is a game-changer for professionals and hobbyists alike, setting a new benchmark in mobile filmmaking and photography.

Growing Demand for Smartphone Stabilizers

Camera stabilizer market forecast reports that growing smartphone cameras are increasing demand for smartphone-specific stabilizers. These compact, low-cost stabilizers enable casual users as well as content creators to shoot or record high-quality, professional videos directly from smartphones. In September 2024, the Chinese company Xiaomo launched a pocket camera named Magic 3, which is a lightweight and versatile solution for on the go. Designed to be intuitive, the Magic 3 strikes a balance between portability and stabilization, offering creators the opportunity to shoot high-quality content without bulky gear. This marks the latest movement in the upward trend of small, multi-purpose stabilizers, suited to the increasingly on-the-go, creative audience by underlining an ever-growing demand in the content market for accessible tools.

Expansion of Gimbal Technology

Gimbals, motorized stabilizers are increasingly popular for their ability to provide smooth, high-quality-professional footage. From traditional filmmaking to weddings, sports, and live streaming, their applications are also diversifying. By September 2024, GoPro announced that it had launched its HERO13 Black and HERO action cameras in India along with its new set of accessories to enhance user experience. These cameras come with advanced stabilization features and gimbal compatibility, making them perfect for content creators, adventure enthusiasts, and professionals looking to capture smooth video recording. Increased adoption of gimbals showcases their role in the ever-evolving content creation market as must-have tools that give users added versatility, precision, and the ability to record high-quality stable footage in multiple settings.

Camera Stabilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the camera stabilizer market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, distribution channel, application, and end-user.

Analysis by Type:

- Body Mounted

- Hand Held

- Camera Slider

- Camera Crane

- Remote Head

The most dominant market share of handheld stabilizers is held for their portability, simplicity, and precision. Photographers and videographers use them for dynamic shooting situations, where their light weight and ease of use make it possible to capture smooth, professional-quality footage, and therefore, become a must-have for both casual and professional content creators.

Analysis by Distribution Channel:

- Online Sales

- Offline Sales

Offline leads the market with around 55.9% of market share in 2024. Offline distribution channels for camera stabilizers include sales through physical retail stores, specialized dealers, and distributors. This method provides customers with a hands-on experience allowing personal service, expert advice as well as instant buying options, which increase customer confidence and satisfaction.

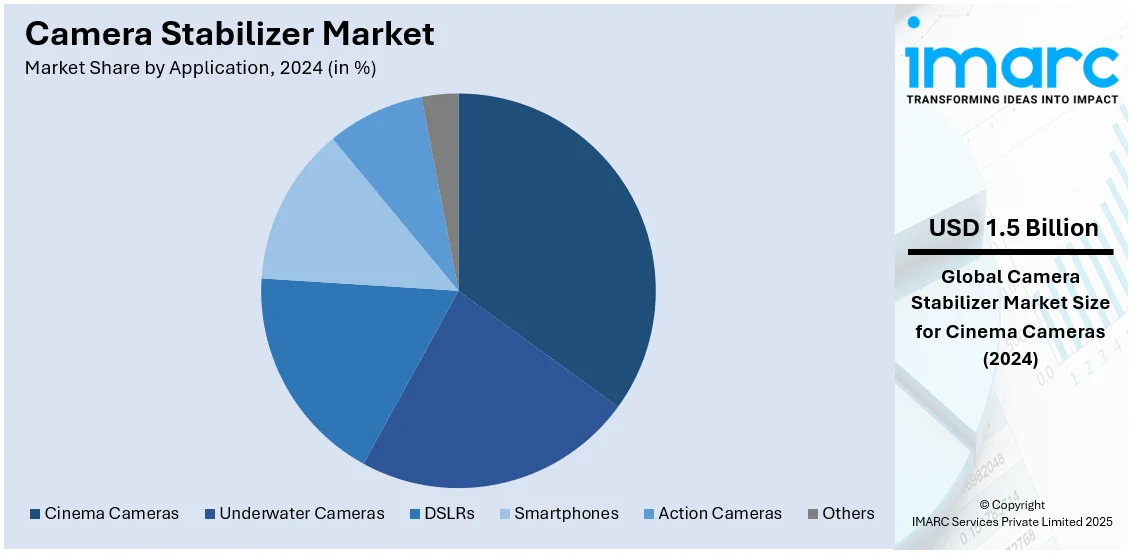

Analysis by Application:

- Cinema Cameras

- Underwater Cameras

- DSLRs

- Smartphones

- Action Cameras

- Others

Cinema Cameras lead the market with around 35.0% of market share in 2024. According to the report, cinema cameras account for the largest market segment, with stabilizers designed to support larger, complex setups. These stabilizers deliver smooth, cinematic shots, enhancing production quality for films, advertisements, and high-end video content. Their precision and stability make them essential tools for professional filmmakers and content creators aiming for superior visual results.

Analysis by End User:

- Professional

- Personal

Professional leads the market with around 63.9% of market share in 2024. According to the report, professional represented the largest market segmentation. Professional photographers and videographers make extensive use of camera stabilizers, which are designed to improve shot precision. These technologies are crucial for high-quality projects such as films, advertisements, and events that require smooth and reliable filming. This represents the camera stabilizer market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

In 2024, Asia Pacific accounted for the largest market share of over 35.0%. The Asia-Pacific camera stabilizer market is growing due to increasing demand for high-quality video production across film, content creation, and live streaming industries. The use of professional and consumer-grade cameras is increasingly adopted, requiring stabilizers to produce smoother and more stable footage. Major players in the region focus on offering advanced, cost-effective stabilizers to professional filmmakers and hobbyists. Growing e-commerce platforms and offline retail networks also play a significant role in expanding the availability of these products. Technological advancements, such as gimbal systems, and the rise of social media-driven content creation also support market growth.

Key Regional Takeaways:

North America Camera stabilizer Market Analysis

North America, which is represented by Hollywood, among other leading entertainment industries and digital content producing industries, is a great market for camera stabilizers. The demand in the market keeps increasing due to the growing demands of professional equipment among filmmakers, vloggers, and other social media influencers. The newer technologies in camera stabilizers have also improved much, such as AI-powered tracking and automated focus adjustments that appeal to hobbyists and pros alike. The increasing trend of live streaming and online video platforms has also increased the adoption of stabilizers for smooth, high-quality footage. Moreover, the availability of advanced smartphones with better cameras has increased demand for portable and user-friendly smartphone stabilizers. North America is a key player in the global camera stabilizer market, with robust distribution networks and the presence of leading technology companies driving innovation and adoption.

United States Camera Stabilizer Market Analysis

The growing media and entertainment sector in the US, along with an increase in video production on websites like YouTube, TikTok, and Instagram, are driving the market for camera stabilisers. Camera stabilisers are in high demand to improve video quality because there are more than 100 million people who identify themselves as content creators in the United States, with nearly 50 million being professional content creators. Hollywood, which is the epicentre of world cinema, is producing more than 700 movies every year and requires sophisticated stabilizers for such complex camera arrangement, as per reports. The stabilizers also find vast use in the sporting broadcasting segment. Sports media rights payments to the US TV and streaming platforms will reach USD 29 Billion by 2024, as per an industry report. The portable, lightweight stabilisers compatible with smartphones and action cameras have gained popularity due to the rise in vlogging and live streaming. Advanced stabilisers with wireless control and AI tracking are gaining more popularity among independent filmmakers and wedding videographers. Government programs encouraging the domestic manufacture of filming equipment also contribute to the growth of the market.

Europe Camera Stabilizer Market Analysis

Thriving film and television production sectors as well as growing material produced for digital platforms are driving the camera stabiliser market in Europe. The combined production of more than 1,000 films and TV shows every year is fueling the demand for professional stabilisers, according to reports by nations including the UK, France, and Germany. The use of stabilisers to shoot cinematic-quality footage has also increased due to the adoption of DSLR and mirrorless cameras in the region. The market is growing due to the rise in tourism-oriented video content, especially in Italy, Spain, and Greece, where travel influencers use stabilisers to shoot immersive footage. Occasions like the Cannes Film Festival increase the demand for cutting-edge filmmaking technology. Government-sponsored cultural initiatives and grants for filmmakers in nations like Sweden and Denmark further boost the demand for expensive stabilisers.

Asia Pacific Camera Stabilizer Market Analysis

The growing entertainment industry and the rise in social media influencers are driving the camera stabiliser market in the Asia-Pacific region. India is the world's largest film producer according to data by Niveshmitra, producing more than 2,000 films every year, hence there is a huge demand for qualified stabilisers. More than 700 million people watch short videos on sites like Douyin in China; that is why smartphone stabilisers are gaining popularity over time in that country, as reported in the media. Technological breakthroughs in South Korea and Japan have resulted in the integration of AI and gimbal technologies into stabilisers. The booming wedding videography business in the region is the other factor for the rising demand for stabilizers. The growing popularity of surfing and skiing in Australia and New Zealand has created a need for durable stabilisers that work with action cameras.

Latin America Camera Stabilizer Market Analysis

Independent filmmaking and social media content creation are now the new growth drivers of the camera stabiliser industry in Latin America. Brazil, a country with more than 187 million internet users, is the number one producer of digital content as reported by industries. This only means that more stabilisers will be needed among vloggers and influencers. Regional film festivals that have expanded across the globe encourage the use of expert stabilizers. For example, Mexico hosts the Guadalajara International Film Festival. In fact, it is sports broadcasting, especially football, that brings about a strong demand for dynamic filmmaking equipment like live-coverage stabilisers. The boom in adventure tourism in countries such as Chile and Argentina has, therefore, made a need for portable stabilisers compatible with action cameras.

Middle East and Africa Camera Stabilizer Market Analysis

The growth in regional film and tourism industries has also led to increasing demand in the camera stabiliser market in the Middle East and Africa. With programs like Vision 2030 promoting local film-making and increasing demand for stabilizers, the United Arab Emirates and Saudi Arabia have emerged as leading filming locations. In Africa, safaris and wildlife photography are examples of adventure tourism that encourages the use of stabilisers to produce high-quality video. The need for small, easy-to-use stabilisers that work with cellphones is also being driven by social media influencers in nations like South Africa and Nigeria. The proliferation of local broadcasting networks contributes to the expansion of the market.

Competitive Landscape:

The camera stabilizer market is competitive, where rapid technological progress and the constant demand for higher quality video across sectors are being met. As such, innovating features with AI-powered stabilization, automated tracking, and further portability into products are gaining acceptance among both content creators and professionals. The market is undergoing huge investments in R&D for improving product functionality and extending their applications beyond conventional filmmaking into live streaming, sports events, and social media content creation. Partnerships and collaborations with smartphone and camera manufacturers are improving the compatibility of these products and market reach. Additionally, the increase in e-commerce platforms has opened up access to these products among consumers across the globe, thus making the competition stiffer between the brands. With a continuously increasing consumer demand for compact, lightweight, and affordable stabilizers, the company is going to emphasize differentiation by the use of high technologies, easy-to-use design, and individualized choices for a wider portion of the highly dynamic and rapidly evolving market.

The report provides a comprehensive analysis of the competitive landscape in the camera stabilizer market with detailed profiles of all major companies, including:

- Camera Motion Research

- Freefly Systems

- FeiyuTech

- Glidecam Industries Inc.

- Glide Gear

- Gudsen Technology Co. Ltd.

- Ikan Corporation

- Movo

- Neewer

- Pilotfly GmbH

- Roxant

- Tiffen Company

- VariZoom

Latest News and Developments:

- September 2024: GoPro announced the introduction of HERO13 Black and HERO action cameras with new accessories in India.

- September 2024: Xiaomo, a Chinese company, launched a new pocket camera called Magic 3, offering a compact and versatile option for content creators and casual users alike.

- July 2024: Insta360’s new AI phone stabilizer was integrated with Apple’s DockKit, which is a game-changing protocol that seamlessly integrates mobile phone stabilizers with the iPhone’s native camera app.

Camera Stabilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Body Mounted, Hand Held, Camera Slider, Camera Crane, Remote Head |

| Distribution Channels Covered | Online Sales, Offline Sales |

| Apllications Covered | Cinema Cameras, Underwater Cameras, DSLRs, Smartphones, Action Cameras, Others |

| End-Users Covered | Professional, Personal |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | Camera Motion Research, Freefly Systems, FeiyuTech, Glidecam Industries Inc., Glide Gear, Gudsen Technology Co. Ltd., Ikan Corporation, Movo, Neewer, Pilotfly GmbH, Roxant, Tiffen Company, VariZoom, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the camera stabilizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global camera stabilizer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the camera stabilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The camera stabilizer market was valued at USD 4.27 Billion in 2024.

IMARC estimates the camera stabilizer market to exhibit a CAGR of 3.82% during 2025-2033.

The camera stabilizer market is driven by rising demand for high-quality video content, advancements in stabilization technology, increased adoption among content creators, and expanding applications in entertainment, sports, and live streaming. Compact designs, AI-powered features, and growing smartphone integration further enhance market growth across professional and consumer segments.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the camera stabilizer market include Camera Motion Research, Freefly Systems, FeiyuTech, Glidecam Industries Inc., Glide Gear, Gudsen Technology Co. Ltd., Ikan Corporation, Movo, Neewer, Pilotfly GmbH, Roxant, Tiffen Company, VariZoom, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)