Call Center AI Market Report by Component (Solution, Services), Deployment Mode (On-premises, Cloud-based), Mode of Channel (Phone, Social Media, Chat, Email or Text, Website), Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), Application (Predictive Call Routing, Journey Orchestration, Quality Management, Sentiment Analysis, Workforce Management and Advanced Scheduling, and Others), Industry Vertical (BFSI, IT and Telecommunication, Healthcare, Retail and E-Commerce, Energy and Utilities, Travels and Hospitality, and Others), and Region 2025-2033

Call Center AI Market Overview:

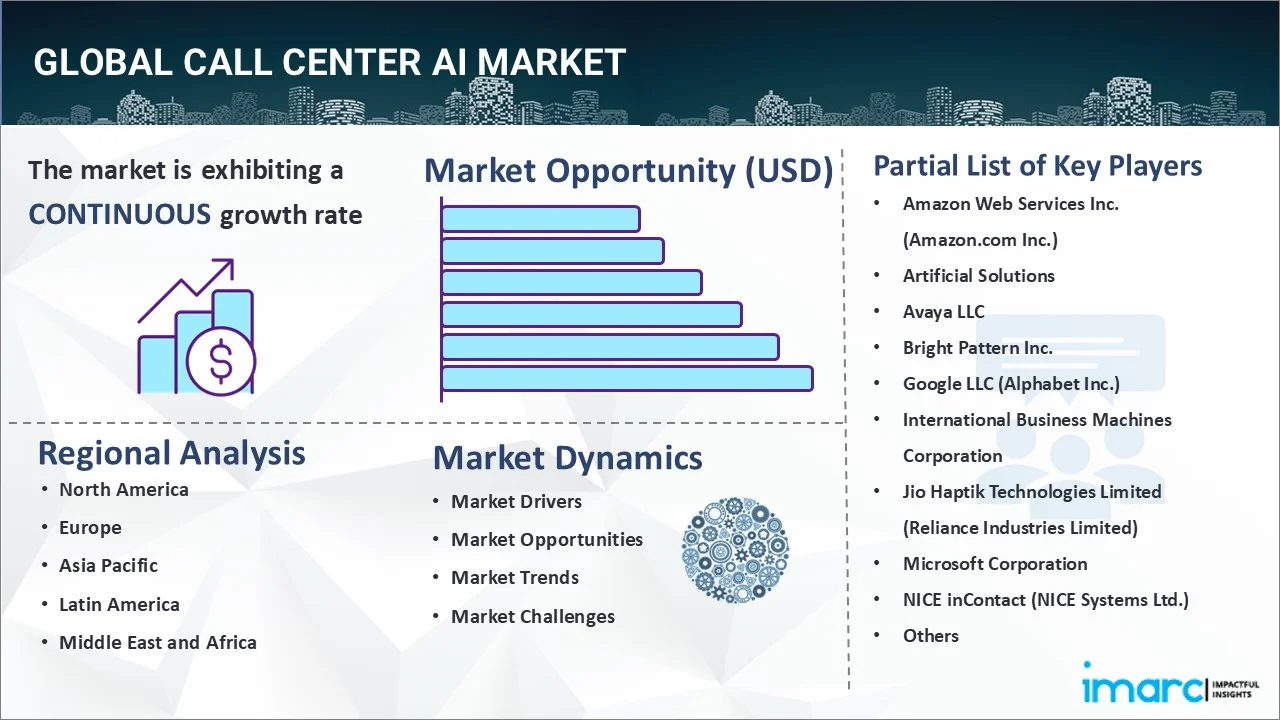

The global call center AI market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.8 Billion by 2033, exhibiting a growth rate (CAGR) of 21.31% during 2025-2033. There are various factors that are driving the market like increasing focus on delivering exceptional user experiences, rising preferences of individuals for quick and personalized interactions, and the growing cases of data breaches and cyber threats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Market Growth Rate (2025-2033) | 21.31% |

Call Center AI Market Analysis:

- Major Market Drivers: One of the key market drivers are the escalating demand for cost-effective solutions. Moreover, the increasing adoption of advanced solutions is acting as a growth-inducing factor.

- Key Market Trends: The market demand is impelled, owing to numerous primary trends, which include the rising focus on enhanced user experience and compliance and data security.

- Geographical Trends: According to the report, North America exhibits a clear dominance, accounting for the largest market share on account of various collaborations among key players.

- Competitive Landscape: Some of the major market players in the call center AI industry are Amazon Web Services Inc. (Amazon.com Inc.), Artificial Solutions, Avaya LLC, Bright Pattern Inc., Google LLC (Alphabet Inc.), International Business Machines Corporation, Jio Haptik Technologies Limited (Reliance Industries Limited), Microsoft Corporation, NICE inContact (NICE Systems Ltd.), Oracle Corporation, SmartAction LLC, Zendesk Inc., among many others.

- Challenges and Opportunities: One of the key challenges hindering the market growth is data privacy concerns. Nonetheless, the increasing focus on sustainable practices, represents recent opportunities.

Call Center AI Market Trends:

Enhanced customer experience and personalization

On 1 March 2023, NICE revealed that LanguageLoop installed NICE's CXone cloud-based platform to safeguard its user experience processes and provide an improved experience to individuals. The rising focus on delivering exceptional user experiences represents one of the key factors propelling the market growth. Additionally, there is a rise in preferences for quick and personalized interactions and support or information among organizations. Call center artificial intelligence (AI), with its AI-powered chatbots and virtual assistants, enables organizations to meet these expectations. These AI-driven systems can provide support all the time, rapid responses, and personalized solutions, thereby leading to heightened user satisfaction. Along with this, the increasing focus on self-service options to resolve the queries of people independently and swiftly is stimulating the call center AI demand.

Compliance and Data Security

There is an increase in the need to maintain compliance with data protection laws and guarantee data security. The constant growth in data production is resulting in a requirement to comply with strict data privacy regulations. AI solutions are widely developed and adopted with a focus on data encryption, secure storage, and compliance management. Besides this, escalating cases of data breaches and cyberattacks. This, coupled with rising concerns about data security is impelling the market growth. AI-powered call center solutions ensure the safety of data of individuals. Furthermore, key players in the market are engaging in collaboration to provide enhanced services and security to individuals. For instance, on 4 May 2023, BT and Five9, a leading provider of the intelligent CX Platform, announced the expansion of their partnership to enhance the choice of contact center services and solutions offered to organizations globally. BT will offer the Five9 Intelligent CX Platform to new and existing users as a managed service to help them fully digitalize their workplace through tighter integration with existing systems.

Omnichannel user engagement

On 14 September 2021, Nuance Communications revealed that Leidos, a Fortune 500® science and technology innovator, integrated Nuance's AI technology into their adaptable digital patient engagement solutions for health systems and federal healthcare agencies. The Nuance conversational AI platform and support team gives the power to deploy enterprise-grade conversational AI and intelligent omnichannel development tools to design and deliver advanced and customized digital patient engagement solutions. Moreover, omnichannel user engagement helps provide seamless and consistent experiences across all communication channels. In addition, rising preferences for seamless interactions across various communication channels, including phone, chat, email, social media, and websites are impelling the market growth. Furthermore, omnichannel engagement allows for a more comprehensive understanding of user behavior, which can inform product development, marketing strategies, and service improvements.

Call Center AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with call center AI forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, deployment mode, mode of channel, enterprise size, application, and industry vertical.

Breakup by Component:

- Solution

- Services

Solution accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services. According to the report, solution represented the largest segment.

Solutions include software and technologies designed to enhance AI capabilities within a call center environment. It benefits in converting spoken communication into written text and allowing for voice-activated interactions. In addition, voice analytics aids in analyzing voice interactions to understand user sentiment as well as agent performance. Furthermore, industry players are forming partnerships to provide enhanced solution to individuals. For example, Bharti Airtel partnered with Nvidia on 23 February 2023 to create an AI-powered solution that aids in improving the overall user experience to its contact centers.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

On-premises hold the largest share of the industry

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based. According to the report, on-premises accounted for the largest market share.

On-premises means hosting the solutions within an organization's data centers or physical infrastructure. It provides more control and personalization options, however, necessitating a substantial initial investment in hardware, software, and upkeep. Businesses with stringent data security needs or specific regulatory compliance often prefer on-premises solutions.

Breakup by Mode of Channel:

- Phone

- Social Media

- Chat

- Email or Text

- Website

Phone represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the mode of channel. This includes phone, social media, chat, email or text, and website. According to the report, phone represented the largest segment.

Phone-based call center AI solutions primarily focus on voice interactions between individuals and AI-driven systems. These solutions include automated voice response systems, virtual agents, and speech recognition technologies. They are changing the way organizations interact with users over the phone while enhancing efficiency and quality of services. AI-driven voice bots can handle numerous service interactions.

Breakup by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises accounted for the largest market share.

Large enterprises have numerous workforces with complex call center operations. They often have multiple call centers serving various regions and user segments. In addition, they are significant players in the market due to their extensive resources. The rising need to efficiently manage high call volumes in large enterprises is bolstering the call center AI market growth.

Breakup by Application:

- Predictive Call Routing

- Journey Orchestration

- Quality Management

- Sentiment Analysis

- Workforce Management and Advanced Scheduling

- Others

Predictive call routing dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes predictive call routing, journey orchestration, quality management, sentiment analysis, workforce management and advanced scheduling, and others. According to the report, predictive call routing represented the largest segment.

Predictive call routing depends on AI algorithms to analyze incoming calls and route them to the suitable agent or department. It relies on various factors like caller history, agent skills, and call urgency to ensure that calls are directed to the right resource. It gathers data from various sources, including previous call logs, individual profiles, purchase history, and interaction records across different platforms like phone, email, and social media.

Breakup by Industry Vertical:

- BFSI

- IT and Telecommunication

- Healthcare

- Retail and E-Commerce

- Energy and Utilities

- Travels and Hospitality

- Others

BFSI is the predominant market segment

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecommunication, healthcare, retail and e-commerce, energy and utilities, travels and hospitality, and others. According to the report, BFSI accounted for the largest market share.

In the BFSI sector, AI-powered chatbots and virtual assistants are employed that benefit in account inquiries, transaction processing, and fraud detection. These technologies improve user service by offering constant assistance, managing everyday tasks, and guaranteeing data protection. Genesys®, a worldwide cloud expert in experience orchestration, revealed on 6 April 2023, that Rabobank, a top cooperative bank in the Netherlands, effectively transitioned into a digital banking powerhouse with the help of the Genesys Cloud CX™ platform. By evolving away from disconnected on-premises solutions and embracing a cloud-first user experience strategy, Rabobank created a novel conversational banking service model.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

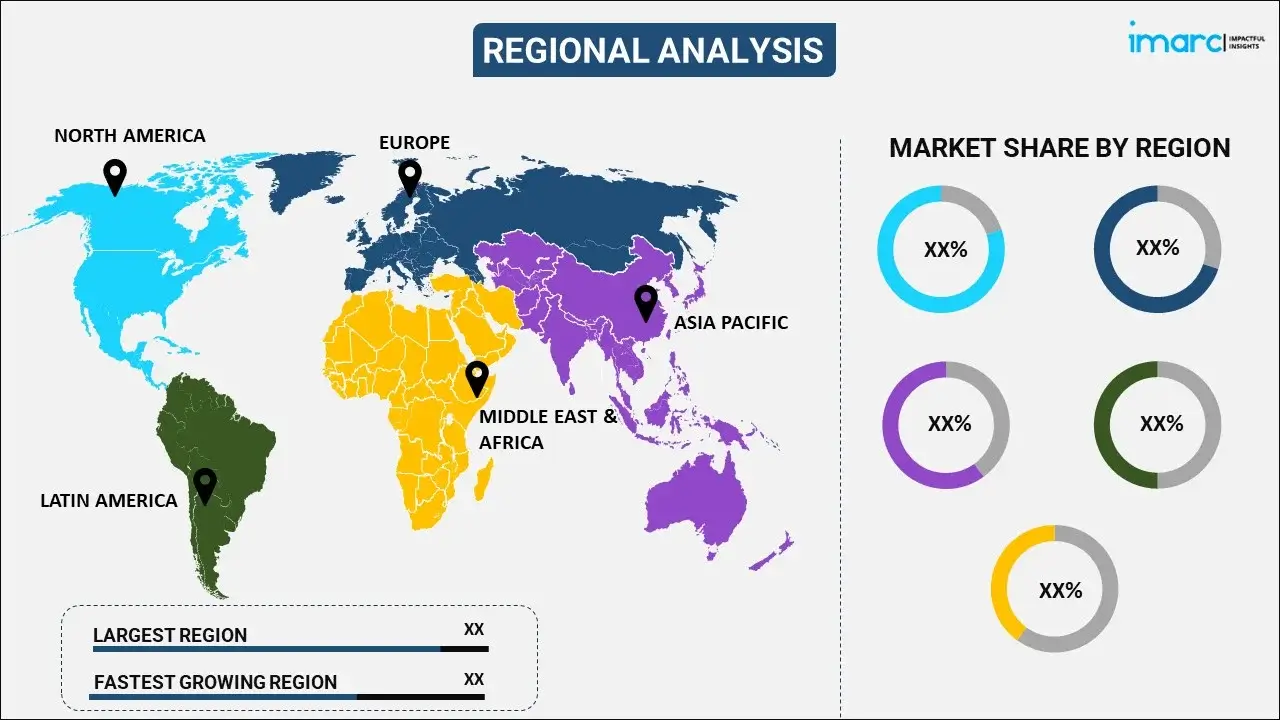

North America leads the market, accounting for the largest call center AI market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for call center AI.

North America dominates the market share because it is known as a center for technological innovation. Moreover, user experience and happiness are becoming top priorities for North American companies, which is impelling the market growth. On March 27, 2023, Cognigy announced a partnership with Foundever, an American supplier of customer experience solutions that will improve the digital transformation of contact centers.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Various major market players in the market are Amazon Web Services Inc. (Amazon.com Inc.), Artificial Solutions, Avaya LLC, Bright Pattern Inc., Google LLC (Alphabet Inc.), International Business Machines Corporation, Jio Haptik Technologies Limited (Reliance Industries Limited), Microsoft Corporation, NICE inContact (NICE Systems Ltd.), Oracle Corporation, SmartAction LLC, and Zendesk Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key industry players are investing in research and development (R&D) activities to improve the capabilities of their AI technologies. They are modernizing their product portfolio to satisfy the changing demands of different types of organizations. They are also developing more advanced chatbots, virtual assistants, and voice recognition systems, that benefits in increasing call center AI market revenue. To increase their market visibility, they are also collaborating with other IT companies and industry players. For instance, NICE and Etisalat Digital collaborated on 9 February 2022 to improve the CXone platform's accessibility in the UAE.

Call Center AI Market Recent Developments:

- 22 January 2022: Sprinklr, the unified customer experience management (Unified-CXM) platform for modern enterprises, partnered with Google Cloud to help enterprises reimagine their user experience management strategies.

- 18 November 2021: NICE announced the collaboration with Google Cloud to address the growing demand for more effective and automated user self-service systems that integrate with traditional contact centers.

- On 13 July 2023, 8x8, Inc., a leading integrated cloud communications platform provider, announced the 8x8 Technology Partner Ecosystem, a new program that allows user-first organizations to enhance individual experience by deeply embedding cutting-edge technologies, including AI capabilities, into the 8x8 platform with persistent data to enhance business intelligence, insights, and analytics. The 8x8 Technology Partner Ecosystem transforms user experience and engagement by democratizing seamless, next-generation, native integrations for organizations of all sizes.

Call Center AI Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Call Center AI Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Mode of Channels Covered | Phone, Social Media, Chat, Email or Text, Website |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Applications Covered | Predictive Call Routing, Journey Orchestration, Quality Management, Sentiment Analysis, Workforce Management and Advanced Scheduling, Others |

| Industry Verticals Covered | BFSI, IT and Telecommunication, Healthcare, Retail and E-Commerce, Energy and Utilities, Travels and Hospitality, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), Artificial Solutions, Avaya LLC, Bright Pattern Inc., Google LLC (Alphabet Inc.), International Business Machines Corporation, Jio Haptik Technologies Limited (Reliance Industries Limited), Microsoft Corporation, NICE inContact (NICE Systems Ltd.), Oracle Corporation, SmartAction LLC, Zendesk Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global call center AI market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global market?

- What is the impact of each driver, restraint, and opportunity on the global market?

- What are the key regional markets?

- Which countries represent the most attractive market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the market?

- What is the breakup of the market based on the deployment mode?

- Which is the most attractive deployment mode in the market?

- What is the breakup of the market based on the mode of channel?

- Which is the most attractive mode of channel in the market?

- What is the breakup of the market based on the enterprise size?

- Which is the most attractive enterprise size in the market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the call center AI market?

- What is the breakup of the market based on the industry vertical?

- Which is the most attractive industry vertical in the call center AI market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global call center AI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and call center AI market recent opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the call center AI industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)