Calcium Propionate Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

Calcium Propionate Market Size and Share:

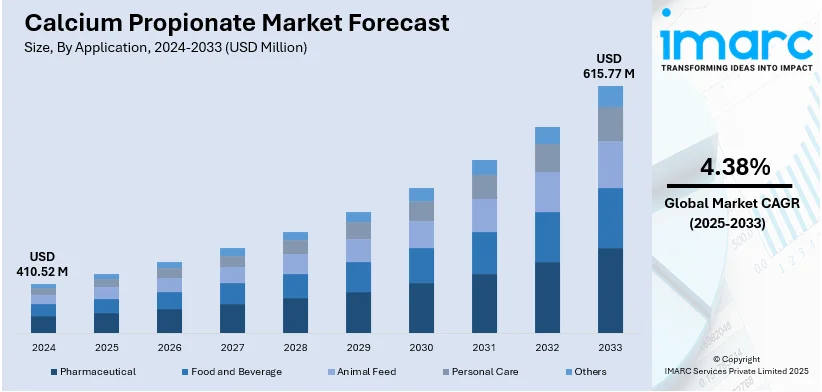

The global calcium propionate market size was valued at USD 410.52 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 615.77 Million by 2033, exhibiting a CAGR of 4.38% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.8% in 2024. The increasing consumption of processed food products, rising farming activities, and the growing demand for organic food represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 410.52 Million |

| Market Forecast in 2033 | USD 615.77 Million |

| Market Growth Rate (2025-2033) | 4.38% |

The global calcium propionate market is majorly impacted by the elevating need for food preservatives in critical sectors, encompassing processed food, bakery, or dairy, to significantly improve shelf life and mitigate spoilage issues. The proliferating food and beverage segment, combined with escalating urbanization and a notable increase in population worldwide, further bolsters market expansion. In addition to this, the accelerating requirement for animal feed preservatives to avoid or limit fungus-based contamination aids industry growth globally. The rapid increase in purchasing of energy as well as sports drinks, coupled with the heightening utilization of calcium propionate in personal care products, also facilitates the global market growth. Regulatory certifications and rapid innovations in food safety policies further fortify market demand.

The United States is a key market for calcium propionate, driven by strong demand from the food and beverage industry, particularly in bakery and dairy products. The country’s well-developed processed food sector relies on preservatives to enhance shelf life and maintain quality. Bedsides this, the growing consumption of ready-to-eat meals and increasing awareness of food safety standards contribute to market expansion. For instance, as per industry reports, 31% of the people in the U.S. consume packaged food more than fresh one. In line with this, ready meals industry in the nation is expected to elevate by around 4% during the years 2020 to 2025. In addition, the rising use of calcium propionate in animal feed, coupled with the expanding agricultural and livestock sectors, further supports demand. Moreover, the presence of major industry players and stringent food regulations enhance the market's growth in the United States.

Calcium Propionate Market Trends:

Growing Consumption of Processed Food and Beverages:

The increasing consumption of processed food products, including bread, bagels, tortillas, cakes, donuts, cheese, yogurt, chips, and sauces, is a key driver for the demand for calcium propionate. For instance, industry reports revealed that Turkey consumed 199.6 kg of bread per capita per year, reflecting the rising demand for preservative solutions in bakery products. This trend, coupled with the flourishing food and beverage (F&B) industry, is driving significant market growth. In addition to this, rapid urbanization, the rising global population, and the expansion of food service restaurants and catering chains further bolster the demand for calcium propionate as a preservative in packaged food. For instance, the United Nations (UN) states that the 68% of the world population is projected to live in urban areas by 2050.

Increasing Participation in Sports and Fitness

The growing participation in recreational sports and fitness activities is another factor fueling calcium propionate market growth. The demand for sports and energy drinks is surging due to the increasing number of individuals engaging in athletic activities. In 2023, 242 Million people in the United States took part in sports and fitness activities, according to the 15th annual State of the Industry Report from the Sports & Fitness Industry Association and Sports Marketing Surveys USA. This trend is contributing to the growing consumption of sports drinks, which often use calcium propionate as a preservative, thus strengthening the market's outlook in this segment.

Expanding Use in Animal Feed and Personal Care Products

Calcium propionate’s use as a preservative in animal feed is playing a significant role in the market's growth. It helps prevent mold and fungal growth in animal feed for poultry, swine, cattle, and pets. This is increasingly important as farming activities grow and the agriculture sector expands globally. For instance, industry reports indicate that global agriculture sector depicted a 15.7% year-on-year increase, reaching USD 94.3 Billion in 2024. Additionally, calcium propionate’s rising use in personal care products, including shampoos and conditioners, is further propelling market growth. The demand for preservatives in personal care products is increasing due to growing consumer awareness of product safety and quality.

Calcium Propionate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global calcium propionate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form and application.

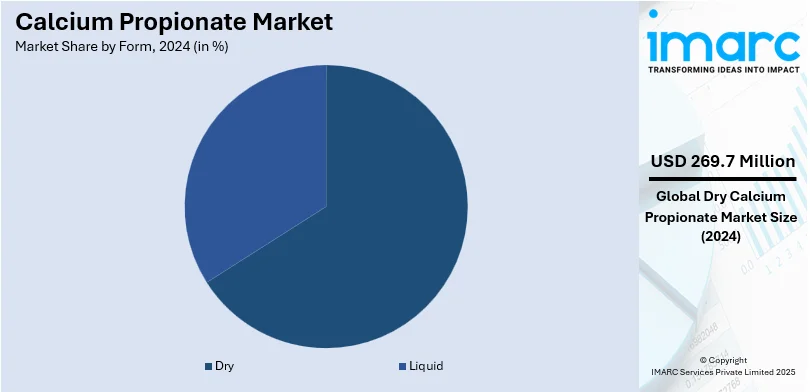

Analysis by Form:

- Dry

- Liquid

Dry stand as the largest form in 2024, holding around 65.7% of the market, due to its widespread use in food preservation, particularly in bakery products. The dry form of calcium propionate provides better handling properties along with excellent longevity while ensuring homogeneous combination with dry mixture components. Besides this, the addition of dry calcium propionate to baked goods stops bacteria from growing while also preventing mold formation, thus it lengthens shelf life without refrigeration requirements. In addition to this, the increasing consumer need for preserved food items with lengthy shelf stability drives the dominance of dry form product sales in the global market. Furthermore, the food market continues to give dry calcium propionate positions of influence because of consumers rapidly preferring convenient products.

Analysis by Application:

- Pharmaceutical

- Food and Beverage

- Animal Feed

- Personal Care

- Others

The food and beverage sector requires calcium propionate as a preservative primarily, thus creating it the biggest market share as the application segment. As a result of its antimicrobial effectiveness, calcium propionate protects food products from mold growth and spoilage thereby providing vital food preservation functionality to the food sector. Furthermore, manufacturers apply calcium propionate especially for bakery products, including bread and cakes along with other baked goods, to protect their quality during longer storage periods. In addition, the widespread use of calcium propionate results from its non-toxic properties, together with its approval status across multiple regions. Moreover, the market expansion of calcium propionate in food and beverage applications continues because of expanding global requirements for packed foods alongside consumer demands for longer product durability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%, influenced by strong demand across the pharmaceutical, food and beverage, and animal feed segments. The region’s well-structured food processing industry relies heavily on calcium propionate for its mold-inhibiting properties in bakery products and other shelf-stable foods. In addition to this, the growing trend of convenient and ready meals further boosts market growth. For instance, as per industry reports, ready meals industry across North America is anticipated to reach valuation of USD 66.70 Billion by 2028. Moreover, the animal feed industry in North America also contributes significantly to the demand for calcium propionate as a preservative. Furthermore, the presence of key market players and advanced manufacturing facilities in the U.S. and Canada enhances the region's market leadership. Regulatory support and stringent quality standards further facilitate market expansion in North America.

Key Regional Takeaways:

United States Calcium Propionate Market Analysis

The United States market for calcium propionate is being driven by the rising demand for food preservation solutions amidst increasing concerns over food waste. Consumers are showing a growing preference for baked goods, dairy products, and ready-to-eat (RTE) meals that maintain freshness and shelf stability. The shift toward clean-label products with reduced chemical additives further positions calcium propionate as an attractive choice due to its recognized safety and efficacy. In addition, the rising number of health-conscious consumers is leading to higher demand for bakery products with natural preservatives, which aligns with the regulatory approvals granted for calcium propionate in food applications. As per reports, 50% of Americans claim to actively try to eat healthy. Besides this, in the animal feed sector, there is a significant push toward adopting calcium propionate as a mold inhibitor, particularly in livestock nutrition. This adoption is driven by its dual benefits of prolonging feed quality and reducing livestock diseases linked to mold contamination. Furthermore, the robust infrastructure of food processing industries in the United States supports the consistent uptake of calcium propionate, bolstered by advancements in manufacturing technologies for food-grade preservatives. Additionally, stringent government regulations on food safety and efforts to minimize mycotoxin levels in food supply chains are creating favorable conditions for market expansion.

Asia Pacific Calcium Propionate Market Analysis

The Asia Pacific region's calcium propionate market is primarily fueled by the rapid expansion of the bakery and confectionery industries in emerging economies such as India and China. Urbanization and changing dietary habits are propelling the demand for convenience foods, necessitating efficient preservative solutions like calcium propionate. The CIA reports that the urban population in China was 64.6% of total population in 2023. Moreover, inflating income levels and evolving consumer preferences for fresh and packaged foods have resulted in significant investments by food manufacturers in advanced preservation techniques. In line with this, calcium propionate's ability to combat spoilage and microbial contamination is highly valued, especially in tropical climates where humidity accelerates food deterioration. Besides this, in the agriculture sector, there is a rise in the awareness regarding the use of preservatives in animal feed. Calcium propionate’s role in extending feed shelf life and its compatibility with stringent feed safety standards are particularly significant in regions heavily reliant on livestock industries. Furthermore, government policies supporting domestic food production and a focus on reducing post-harvest losses are fostering the use of preservatives. Moreover, expanding regional trade agreements and the establishment of food processing zones across the region are expected to amplify the market growth.

Europe Calcium Propionate Market Analysis

In Europe, the calcium propionate market benefits from a well-established food and beverage industry characterized by a strong focus on quality and safety. Growing concerns about food spoilage and the increasing incidence of mycotoxin contamination in cereals and grains are driving demand for calcium propionate in both food and feed applications. In line with this, regulations promoting clean-label food products are encouraging manufacturers to adopt natural and safe preservatives, positioning calcium propionate as a key solution. The demand for bakery items, especially in Western Europe, is particularly robust, with calcium propionate serving as a critical ingredient to prevent mold formation and extend shelf life. The livestock sector, integral to the region's agricultural economy, is another prominent driver. According to reports, in the year 2023, Spain was responsible for around one-quarter of the sheep (23.6%) and (25.4%) populations across the European Union, while Greece share was equivalent to European Union's population of goat (25.8%), meanwhile France had a lesser share of the bovine population, that was 22.8%. Calcium propionate is widely used in animal feed formulations to combat mold and improve feed hygiene, which aligns with strict European Union standards on feed safety and quality. Furthermore, emerging trends in organic and sustainable farming are prompting the exploration of calcium propionate as an effective yet eco-friendly preservative. Additionally, investments in research and development by European companies for innovative applications in cosmetics and pharmaceuticals further contribute to the market expansion.

Latin America Calcium Propionate Market Analysis

Latin America's calcium propionate market is witnessing growth on account of rising demand for bread and other baked goods, a staple in regional diets. Economic improvements and urbanization have driven the expansion of the packaged food sector, increasing the need for effective preservatives like calcium propionate to maintain product freshness. The agriculture-driven economies of Latin America also utilize calcium propionate in animal feed to counteract the humid climate’s impact on feed quality. This preservative helps address mold-related feed spoilage and aligns with regional efforts to enhance livestock productivity. Furthermore, supportive government policies to minimize post-harvest losses and boost food safety standards are further encouraging the adoption of calcium propionate. The increasing export of food products to global markets, necessitating compliance with international safety regulations, has also positively influenced the market. According to reports, Brazilian agribusiness exports hit a record in 2023, reaching USD 166.55 Billion.

Middle East and Africa Calcium Propionate Market Analysis

The magnifying need for preserved baked goods and dairy products is offering a favorable market outlook. Urbanization and changing consumption patterns are boosting the packaged food sector, where calcium propionate plays a vital role in preventing spoilage caused by mold and bacterial growth. Additionally, rising food security concerns and government initiatives aimed at reducing post-harvest losses are increasing the adoption of food-grade preservatives. The development of the food processing sector, supported by foreign investments and trade agreements, is further amplifying the demand for calcium propionate in the region. Furthermore, the thriving pharmaceutical industry in the region is catalying the demand for calcium propionate as it is used to stabilize medications and prevent microbial contamination. In the Middle East and Africa pharmaceutical sector, 16 M&A deals were inked during the third quarter of 2024, with overall evaluation of USD 1.8 Billion, as per the GlobalData’s Deals Database.

Competitive Landscape:

The market is intensely competitive, with leading industry players actively emphasizing on augmenting their manufacturing abilities, product advancements, and tactical alliances. Major manufacturers, such as Kemin Industries, Inc, with robust global footprint spanning over 120 nations with estimated revenue of USD 100 Million to 1 Billion, are currently leveraging their comprehensive distribution networks and established market presence to maintain a robust foothold. In addition, competition is majorly driven by factors such as pricing strategies, product quality, and supply chain efficiencies. Various firms are increasingly making investments for research and development projects to enhance the functionality of calcium propionate in various applications, such as food preservation and animal feed. Besides this, regional players are emerging in response to local demand, further intensifying market competition.

The report provides a comprehensive analysis of the competitive landscape in the calcium propionate market with detailed profiles of all major companies, including:

- A.M Food Chemical Co. Ltd

- AB Mauri Malaysia (Associated British Foods Plc)

- Addcon GmbH

- Impextraco NV

- Kemin Industries, Inc

- Perstorp Holding AB

- Pestell Nutrition Inc. (Barentz International)

- Puratos Group

- Titan Biotech

Latest News and Developments:

- November 2024: A study published in the peer-reviewed Journal of Equine Veterinary Science confirms what some horsemen already believed that calcium propionate is a successful alkalizing agent in horses. The study's authors cite communications with the New York Equine Drug Testing and Research Lab indicating that the substance has been given in liquid form to harness horses to enhance performance. The researchers note that calcium propionate is also utilized as a food preservative in both equine and human food products.

- April 2022: Perstorp planned to expand its production capacity by approximately 70,000 tons per year for carboxylic acids onstream in the year 2024. The firm is experiencing robust growth ProSid as well as Profina demand. Resultantly, the firm has planned to substantially elevate calcium propionate production capacity, which, as of now, is located in Italy.

- June 2021: Kerry Group agreed to acquire the food preservative maker Niacet for about USD 1 Billion from the private equity firm SK Capital Partners. Based in Niagara Falls, New York, Niacet calls itself North America’s largest producer of organic acid salts, including sodium acetate and calcium propionate, used in preservation and other food applications.

- April 2021: Kemin Industries unveiled its new ingredient library for its Kemin Food Technologies website in North America. This leading-edge tool is developed to aid consumers select optimum safety, freshness, and color solutions for food products, including oils and fats, meat and poultry, snack, and baked goods. The ingredient library depicts the company’s ingredient solutions, enveloping acerola, green tea, rosemary, propionic, dry calcium propionate, and buffered vinegar.

Calcium Propionate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Dry, Liquid |

| Applications Covered | Pharmaceutical, Food and Beverage, Animal Feed, Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.M Food Chemical Co. Ltd, AB Mauri Malaysia (Associated British Foods Plc), Addcon GmbH, Impextraco NV, Kemin Industries, Inc, Perstorp Holding AB, Pestell Nutrition Inc. (Barentz International), Puratos Group, Titan Biotech, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the calcium propionate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global calcium propionate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the calcium propionate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The calcium propionate market was valued at USD 410.52 Million in 2024.

IMARC estimates the calcium propionate market to reach USD 615.77 Million by 2033, exhibiting a CAGR of 4.38% during 2025-2033.

Key factors driving the market encompass its comprehensive utilization as a preservative in bakery products, propelling requirement demand for shelf-stable food, increase in awareness of food safety, heightening need in animal feed to mitigate mold growth, and its usefulness in the pharmaceutical sector for preservation as well as stability.

North America currently dominates the calcium propionate market, accounting for a share exceeding 37.8%. This dominance is fueled by robust need from the animal feed, food preservation, and bakery sectors, combined with established production abilities.

Some of the major players in the keyword market include A.M Food Chemical Co. Ltd, AB Mauri Malaysia (Associated British Foods Plc), Addcon GmbH, Impextraco NV, Kemin Industries, Inc, Perstorp Holding AB, Pestell Nutrition Inc. (Barentz International), Puratos Group, Titan Biotech, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)