Calcium Carbonate Market Report by Type (Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC)), Application (Paper, Paints and Coatings, Plastics, Adhesives and Sealants, and Others), and Region 2025-2033

Calcium Carbonate Market Size:

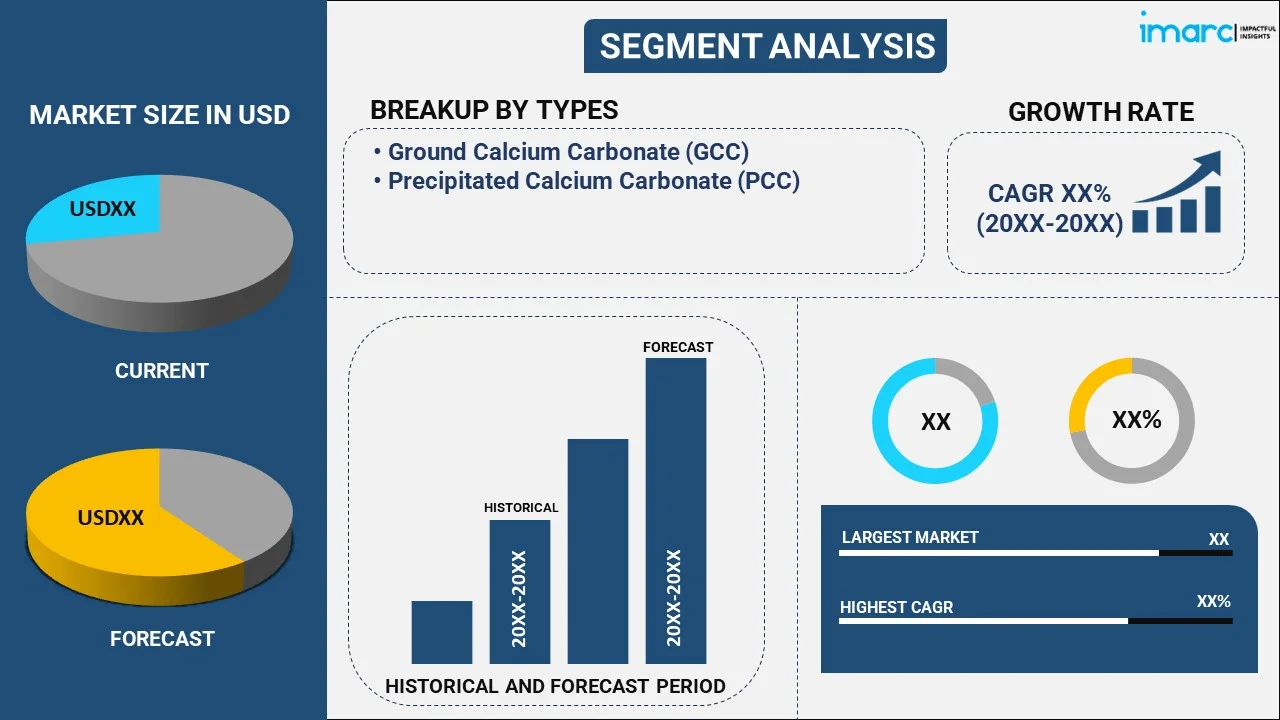

The global calcium carbonate market size reached 9.8 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 15.6 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. Asia Pacific leads the market because of its strong manufacturing base, diverse application sectors, and a growing demand for construction materials, plastics, and automotive products in the expanding economies of the region. The market is experiencing moderate growth owing to the growing utilization of paper in various industries to create eco-friendly packaging, rising investments in novel drug formulation, and increasing construction of several residential and commercial buildings.

Market Size & Forecasts:

- Calcium carbonate market was valued at 9.8 Million Tons in 2024.

- The market is projected to reach 15.6 Million Tons by 2033, at a CAGR of 4.8% from 2025-2033.

Dominant Segments:

- Type: Ground calcium carbonate (GCC) leads the calcium carbonate market owing to its excellent performance across diverse applications, such as paper, plastics, and paints. Its affordability, accessibility, and capability to improve product characteristics render it the preferred option for many sectors, reinforcing its dominant market position.

- Application: Paper represents the largest segment because it plays a crucial role in improving the quality and cost-effectiveness of paper manufacturing. The requirement for enhanced brightness, opacity, and better printability in paper products creates a constant demand for calcium carbonate, reinforcing its leading role in this segment.

- Region: Asia Pacific leads the calcium carbonate market attributed to its strong production capabilities, high demand from multiple industries, and vigorous economic expansion. The area gains from a strong supply chain, growing infrastructure, and ongoing technological progress, which enhances its market leadership.

Key Players:

- The leading companies in calcium carbonate market include Blue Mountain Minerals, Carmeuse (Carmeuse Lime Inc.), GCCP Resources, GLC Minerals LLC (Hurlbut Holdings Inc.), Greer Limestone Company, Gulshan Polyols Ltd., Imerys (Belgian Securities B.V.), J.M. Huber Corporation, LafargeHolcim, Minerals Technologies Inc., Mississippi Lime Company, Omya AG, Parchem Fine & Specialty Chemicals, and United States Lime & Minerals Inc. (Inberdon Enterprises Ltd.).

Key Drivers of Market Growth:

- Advancements in the Paper and Pulp Industry: The pulp and paper industry is utilizing calcium carbonate to improve paper quality and reduce costs. Calcium carbonate enhances brightness, opacity, and smoothness while lowering material expenses. The increasing need for premium paper products and eco-friendly production techniques is bolstering the market growth.

- Carbon Capture and Utilization (CCU) Technologies: CCU technologies are boosting the calcium carbonate market by transforming CO2 emissions into useful byproducts. As sectors aim to minimize their carbon footprints, calcium carbonate generated via CCU presents a viable, eco-friendly option.

- Rise of Sustainable Packaging Solutions: Sustainability in packaging is driving the need for calcium carbonate, as it improves material strength and longevity while preserving an environment-friendly profile. With rising user awareness and regulatory demands, sectors are adopting calcium carbonate-based packaging options to comply to mandates and appeal to discerning buyers.

- Use in Pharmaceutical Industry: Calcium carbonate is becoming popular in the pharmaceutical sector, especially for making tablets and capsules. It functions as a calcium supplement and excipient, enhancing formulation stability. The increasing health awareness and growing geriatric population is driving the need for calcium carbonate in pharmaceuticals production.

- Demand from Construction and Infrastructure Sectors: The growing need for calcium carbonate in materials, such as concrete and cement, is positively influencing the market. Calcium carbonate improves the strength, durability, and cost-effectiveness of materials. With global infrastructure growth, calcium carbonate's contribution to enhancing construction material performance guarantees its persistent market demand.

- Preference for Eco-Friendly Cosmetic Ingredients: The move towards natural and eco-friendly cosmetics is catalyzing the demand for calcium carbonate in products like mattifying agents and powders. With individuals increasingly looking for non-toxic, eco-friendly products, calcium carbonate is gaining popularity, leading to a rise in its demand and an increase in its market presence within the cosmetics sector.

Future Outlook:

- Strong Growth Outlook: The calcium carbonate market is poised for strong growth, attributed to increasing demand across diverse industries. Its versatile applications, cost-effectiveness, and essential role in enhancing product performance position it for sustained expansion, offering significant opportunities for market participants and fostering long-term development.

- Market Evolution: The calcium carbonate market is evolving with continuous innovation and the development of new applications. Advances in processing techniques and increasing environmental awareness are driving the demand for sustainable solutions, ensuring the market adapts to changing industry needs and remains resilient in a dynamic economic environment.

The growing employment of calcium carbonate market in the construction industry for the creation of cement, concrete, and various other construction materials, is offering a favorable market outlook. The capability of calcium carbonate to enhance durability, strength, and workability makes it crucial for the development of infrastructure and urban growth. The rising need for infrastructure and increasing renovation of aging building is catalyzing the demand for calcium carbonate products. Furthermore, calcium carbonate is utilized in carbon capture technologies because of its capacity to absorb carbon dioxide (CO2) emissions. With industries and governments concentrating on lessening carbon footprints and addressing climate change, the need for calcium carbonate in carbon capture and sustainable technologies is steadily increasing, supporting the market growth in ecological applications. Additionally, calcium carbonate act as a filler and coating pigment in paper production, enhancing brightness and opacity. The expansion of the global paper and pulp industry, driven by increasing usage of printed materials and packaging, is driving the demand for calcium carbonate as a cost-effective solution.

To get more information on this market, Request Sample

Calcium Carbonate Market Trends:

Advancements in the Paper and Pulp Industry

The rising use of calcium carbonate in paper and pulp sector for enhancing the quality and cost-effectiveness of paper manufacturing is bolstering the market growth. Calcium carbonate is extensively utilized as a filler and coating agent to improve brightness, opacity, and surface smoothness, thereby minimizing the requirement for costly raw materials. With the growing demand for premium paper products, especially in packaging and printing uses, the need for calcium carbonate is increasing. The rise of digital printing technologies, along with ongoing demand for paper products, especially in developing markets, is contributing to the market growth. The continuous advancement of sustainable and economical paper manufacturing techniques, incorporating calcium carbonate, is further impelling the market growth. According to the calcium carbonate market report, the increasing adoption of calcium carbonate in the paper and pulp industry is expected to strengthen the market growth.

Advancements in Carbon Capture and Utilization (CCU) Technologies

Carbon capture and utilization (CCU) enables industries to capture CO2 emissions and transform them into useful byproducts, such as calcium carbonate. With industries and governing bodies prioritizing the reduction of carbon footprints and achieving sustainability targets, the need for calcium carbonate produced from CO2 is rising. This advancement not only reduces environmental harm but also opens a new path for leveraging CO2 emissions in a profitable way. The advancement of CCU technologies is driving the need for calcium carbonate, aiding its increasing market presence in environmental and industrial uses. In 2024, CarbonFree announced a $150 million carbon capture project at US Steel's Gary Works in Indiana. The initiative aimed to capture 50,000 metric tons of CO2 annually and convert it into valuable calcium carbonate using CarbonFree's SkyCycle technology. This marked a shift towards profitable carbon capture and utilization (CCU) rather than traditional storage methods.

Rise of Sustainable Packaging Solutions

As industries strive to reduce their environmental impact, calcium carbonate is becoming a key material in the development of recyclable and reusable packaging. Calcium carbonate’s ability to enhance the strength, durability, and performance of packaging materials while maintaining an eco-friendly profile makes it an attractive choice for manufacturers. With rising user awareness and stricter environmental regulations, industries such as food and beverage (F&B), and retail are adopting calcium carbonate-based packaging solutions. This growing emphasis on reducing plastic waste and adopting circular economy practices ensures the continuous rise in the demand for calcium carbonate in packaging applications. In 2024, North Coast Seafoods, based in Boston, launched 100% recyclable and reusable packaging made from up to 70% calcium carbonate, in collaboration with Disruptive Packaging. The new packaging, called Unicor, was durable, waterproof, and leakproof, passing all necessary strength tests. This initiative aimed to promote sustainability in the seafood industry with fully closed-loop recyclability.

Calcium Carbonate Market Growth Drivers:

Growing Use in Pharmaceutical Industry

The rising employment of calcium carbonate in manufacturing tablets and capsules as both a calcium supplement and an excipient are positively influencing the market. As health awareness rises and the global population increases, particularly among the elderly, the need for calcium supplements keeps growing. The World Health Organization (WHO) states that by 2030, one out of every six individuals worldwide will be 60 years or older, and this figure is expected to climb to 2.1 billion by 2050. This changing demographic, which is more susceptible to age-related health issues require various supplements. Calcium carbonate acts not just as a dietary supplement but also significantly contributes to enhancing the stability of various pharmaceutical formulations. With the growing global emphasis on healthcare, wellness, and preventive medicine, calcium carbonate's significance in dietary supplements and pharmaceutical formulations reinforces its market standing.

Increasing Demand from Construction and Infrastructure Sectors

With the expansion of infrastructure and construction sectors, the demand for premium materials like calcium carbonate in cement, concrete, and various construction materials increases. Calcium carbonate improves the strength, longevity, and usability of these materials, making them vital for constructing roads, buildings, and infrastructure initiatives. Moreover, calcium carbonate enhances the efficiency of construction methods by lowering expenses and improving material performance, which further contributes to its market demand. The ongoing development of urban and rural infrastructure in multiple areas is driving the demand for calcium carbonate, establishing it as an essential component in construction uses. Calcium carbonate's critical role in construction is being redefined by innovative solutions by key players. For example, in 2024, Hyperion Global Energy launched a pilot project with Lafarge Canada to capture carbon emissions from cement production and convert them into calcium carbonate for use in concrete.

Growing Preference for Eco-Friendly Cosmetic Ingredients

As individuals shift towards natural and environmentally responsible products, the cosmetics industry is adopting more sustainable alternatives to synthetic ingredients. Calcium carbonate, derived naturally, offers excellent benefits in formulations, such as mattifying agents and powders, providing functionality without compromising environmental standards. Its use in cosmetics, driven by user preferences for natural and non-toxic components, is encouraging its adoption by producers. In line with this trend, in 2024, Imerys introduced ImerCare 400D, a mattifying agent for lipsticks made from natural calcium carbonate and microporous diatomaceous earth, at the in-cosmetics Global show in Paris. The product provided superior absorption, a natural mattifying effect, and thermal stability, serving as an eco-friendly alternative to synthetic silica. Imerys also showcased ImerCare Blur, a calcium carbonate-based ingredient for powders with a soft-focus effect. As demand for these natural alternatives rises, the calcium carbonate market price is expected to increase because of its growing use in high-demand cosmetic formulations.

Calcium Carbonate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

Ground calcium carbonate (GCC)accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes ground calcium carbonate (GCC) and precipitated calcium carbonate (PCC). According to the report, ground calcium carbonate (GCC) represented the largest segment.

The ground calcium carbonate (GCC) exhibits a clear dominance in the market. This growth is driven by its application across various industries, such as plastics, paints, and construction. GCC is used in plastics to enhance mechanical properties and improve the quality. The construction sector employs GCC as a soil treatment agent and in the production of cement. The growing population is driving the demand for food, which requires suitable soil treatment agents to ensure better yield. The Food and Agriculture Organization of the United Nations estimated in 2023 that invasive insects cost the world economy $70 Billion a year and plant illnesses $220 Billion annually.

Breakup by Application:

- Paper

- Paints and Coatings

- Plastics

- Adhesives and Sealants

- Others

Paper holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes paper, paints and coatings, plastics, adhesives and sealants, and others. According to the report, paper accounted for the largest market share.

The rising utilization of calcium carbonate in the paper industry as a cost-effective coating agent and paper filler is propelling the market growth. It enhances the qualities of the paper, such as brightness, opacity, and surface smoothness, which is crucial in high-quality printing and writing materials. Furthermore, calcium carbonate is naturally abundant with lower environmental impact compared to synthetic alternatives, appealing to manufacturing focusing on sustainability and cost reduction. These factors, combined with the steady utilization of paper in packaging, publishing, and advertising, sustain the demand for calcium carbonate in this sector. According to Packaging Distributors of America, the global packaging market is set to grow at a CAGR of 3.94% from 2022 to 2027. In the US, the packaging industry reached USD 184.65 Billion in 2021, projected to hit USD 218.12 Billion by 2027.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest calcium carbonate market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for calcium carbonate.

The demand for calcium carbonate in the Asia Pacific region is attributed to rapid industrialization and economic growth, especially in India and China. According to UNICEF, nearly 55% of the population in Asia is excepted to live in urban areas by 2030. Moreover, the extensive limestone reserve allows for a cheap and easily accessible supply of raw materials. Furthermore, the favorable government policies promoting infrastructure development and sustainable material usage are bolstering the market growth in the region. Apart from this, the rising construction of various residential apartments is driving the demand for calcium carbonate.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the calcium carbonate industry include:

- Blue Mountain Minerals

- Carmeuse (Carmeuse Lime Inc.)

- GCCP Resources

- GLC Minerals LLC (Hurlbut Holdings Inc.)

- Greer Limestone Company

- Gulshan Polyols Ltd.

- Imerys (Belgian Securities B.V.)

- J.M. Huber Corporation

- LafargeHolcim

- Minerals Technologies Inc.

- Mississippi Lime Company

- Omya AG

- Parchem Fine & Specialty Chemicals

- United States Lime & Minerals Inc. (Inberdon Enterprises Ltd.)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Leading companies in the calcium carbonate market are engaging in numerous strategic activities to improve their market presence. These include increasing their production capacity, engaging in mergers and acquisitions (M&A), and investing in research operations to innovate and enhance product quality. Key players are also focusing on the introduction of eco-friendly and sustainable calcium carbonate products to meet the growing demand for green solutions in several industries. For instance, Cimbar Resources, Inc. finalized its acquisition of Imerys Carbonates USA, Inc.'s Sahuarita, Arizona operation, bolstering its portfolio in calcium carbonates manufacturing. This strategic move positions Cimbar to enhance its presence in the market, catering to the increasing demand for calcium carbonate products.

Calcium Carbonate Market News:

- May 2025: MIDROC Investment Group launched Ethiopia's first coated calcium carbonate production plant in Awash 7 Kilo, Afar Region. The facility, with an annual capacity of 18,000 tons, aims to reduce Ethiopia's import dependency and provide raw materials for industries like pharmaceuticals and plastics.

- April 2025: Researchers from the Indian Institute of Science (IISc) developed a bacteria-based method to repair lunar bricks using lunar soil and the bacterium Sporosarcina pasteurii. The bacteria produce calcium carbonate, effectively binding cracks in the bricks, offering a sustainable repair solution for habitats on the moon. This innovation will be tested aboard India's Gaganyaan mission to assess its viability in space.

- March 2025: TotalEnergies ENEOS and Imerys launched their first solar project in Southeast Asia, installing a 1 MWp solar system at Imerys' calcium carbonate plant in Ipoh, Malaysia. This partnership allows Imerys to reduce energy costs without upfront investment, contributing to its sustainability goals.

- December 2024: Izedon Carbonates (IzeCarb) launched Nigeria's first integrated calcium carbonates production plant in Lampese, Edo State. The plant, using locally sourced dolomite, aimed to reduce imports and boost non-oil revenue by producing calcium carbonate for industries like PVC, paints, and oil drilling.

- October 2024: Akums Drugs launched dual-action heartburn relief chewable tablets in India, combining famotidine, calcium carbonate, and magnesium hydroxide. The tablets provided both rapid neutralization of stomach acid and long-lasting relief by reducing acid production. This innovative formulation targeted GERD symptoms, offering fast, effective, and convenient relief for adults and adolescents.

- July 2024: The Saudi Water Authority launched a pioneering project to produce high-purity calcium carbonate (vaterite) using cement plant by-products and desalination wastewater. The project aimed to enhance environmental conservation, reduce carbon emissions, and contribute SAR 1.5 billion annually to Saudi Arabia's GDP by 2030. This initiative aligned with the Saudi Green Initiative, promoting sustainability and economic growth.

- April 2022: Imerys announced investment to expand and optimize its Sylacauga plant, doubling calcium carbonate production capacity and enhancing operational reliability. The initiative aims to support market demand, reduce energy utilization, and promote sustainable products.

- April 2023: Minerals Technologies Inc. had secured three long-term agreements with major paper companies in China and India to supply precipitated calcium carbonate (PCC), expanding its specialty additives product line. The partnerships involve building and operating on-site PCC satellite plants, collectively producing over 180,000 metric tons annually.

- April 2023: Omya invested in 7 onsite plants across China and Indonesia, including 3 ground calcium carbonate (GCC) plants and 4 precipitated calcium carbonate (PCC) plants, expanding its product portfolio for paper manufacturing.

Calcium Carbonate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC) |

| Applications Covered | Paper, Paints and Coatings, Plastics, Adhesives and Sealants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Mountain Minerals, Carmeuse (Carmeuse Lime Inc.), GCCP Resources, GLC Minerals LLC (Hurlbut Holdings Inc.), Greer Limestone Company, Gulshan Polyols Ltd., Imerys (Belgian Securities B.V.), J.M. Huber Corporation, LafargeHolcim, Minerals Technologies Inc., Mississippi Lime Company, Omya AG, Parchem Fine & Specialty Chemicals and United States Lime & Minerals Inc. (Inberdon Enterprises Ltd.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global calcium carbonate market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global calcium carbonate market?

- What is the impact of each driver, restraint, and opportunity on the global calcium carbonate market?

- What are the key regional markets?

- Which countries represent the most attractive calcium carbonate market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the calcium carbonate market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the calcium carbonate market?

- What is the breakup of the market based on the region?

- Which is the most attractive region in the calcium carbonate market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global calcium carbonate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the calcium carbonate market from 2019-2033.

- The calcium carbonate research report provides the latest information on the market drivers, challenges, and opportunities in the global calcium carbonate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the calcium carbonate industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)