Calcium Carbide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Calcium Carbide Price Trend, Index and Forecast

Track real-time and historical calcium carbide prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Calcium Carbide Prices October 2025

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 0.38 | 0.10% ↑ Up |

| Europe | 1.29 | -1.4% ↓ Down |

| South America | 1.21 | 10.4% ↑ Up |

| North America | 1.69 | 2.3% ↑ Up |

Calcium Carbide Price Index (USD/KG):

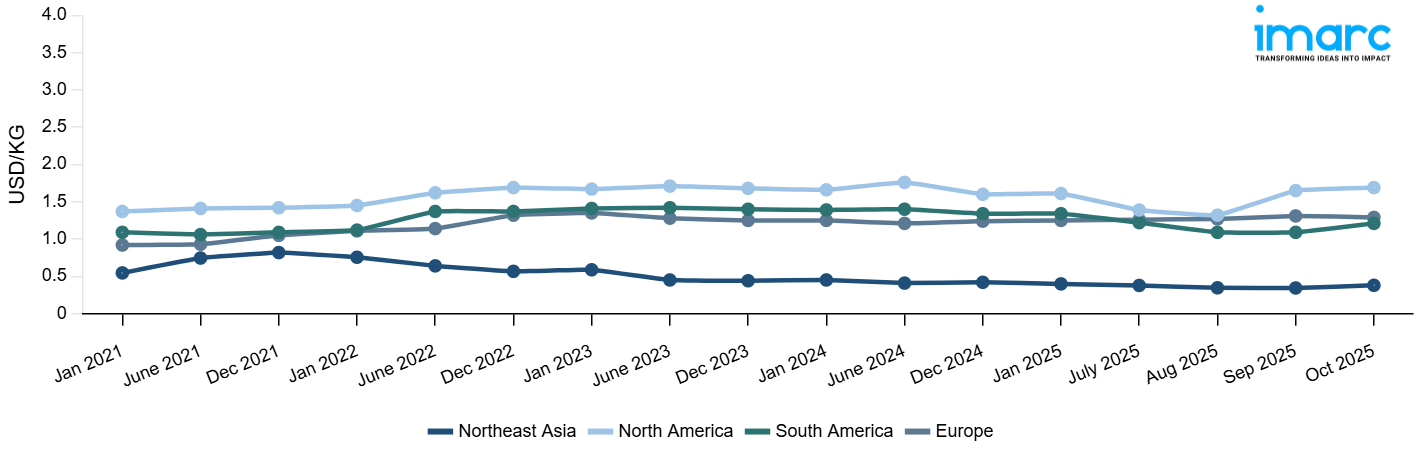

The chart below highlights monthly calcium carbide prices across different regions.

Get Access to Monthly/Quaterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: The price reduction was primarily driven by a temporary easing of domestic supply constraints following an increase in production capacity across key facilities in China and Japan. Lower demand from the steel and chemical sectors also contributed to the price dip. Additional cost determinants included fluctuations in local electricity tariffs, port handling fees, and inland logistics expenses. International shipping costs remained stable, but currency fluctuations against the US dollar slightly affected import parity prices in countries relying on imported raw materials. Regulatory compliance costs for environmental and safety certifications were largely unchanged but continued to factor into overall production economics. Overall, the market in Northeast Asia reflected a moderate oversupply situation combined with stable demand, leading to softened pricing for calcium carbide.

Europe: In Europe, calcium carbide prices increased. This upward movement was influenced by higher energy costs, particularly natural gas and electricity, which form a significant portion of production expenses. Demand from downstream acetylene production and the steel industry remained robust, supporting price growth. Supply-side constraints, including ongoing maintenance shutdowns at certain European plants, also contributed to tighter availability. Additional factors affecting prices included port handling charges, customs duties on imports, and regional logistics costs. Currency fluctuations, especially against the Euro, affected imported raw material pricing, while compliance with environmental regulations and safety standards added incremental cost. The combination of sustained demand, energy cost pressures, and limited short-term supply availability drove the positive pricing trend in Europe.

South America: In South America, calcium carbide prices remained flat. Market stability was largely due to balanced supply and demand conditions. Key producers in Brazil and Argentina maintained steady production, while consumption from the steel and chemical sectors was consistent with prior quarters. Logistics and domestic transportation costs were stable, and no significant disruptions were reported at ports or customs. Currency fluctuations had minimal impact on local pricing, as most raw materials were sourced domestically. Compliance costs related to environmental regulations were maintained at existing levels. Overall, the South American market experienced equilibrium, with prices reflecting a steady operational environment without major volatility.

North America: Calcium carbide prices in North America rose sharply. This increase was driven by high demand from the construction and steel sectors, coinciding with limited domestic production due to maintenance shutdowns and capacity constraints. Rising electricity and natural gas prices further amplified production costs, while increased port handling and inland logistics expenses added to overall pricing pressure. Import-dependent regions faced additional costs from currency fluctuations and international freight charges. Environmental and safety compliance costs, although stable, also contributed to the higher price base. The cumulative effect of strong demand, tight supply, and elevated operational costs resulted in a significant upward movement in North American calcium carbide prices.

Calcium Carbide Price Trend, Market Analysis, and News

IMARC's latest publication, “Calcium Carbide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the calcium carbide market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of calcium carbide at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed calcium carbide prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting calcium carbide pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Calcium Carbide Industry Analysis

The global calcium carbide industry size reached USD 18.05 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 28.98 Billion, at a projected CAGR of 5.40% during 2026-2034. The market is driven by the rising demand from the steel and chemical industries, increasing applications in acetylene and synthetic chemical production, and expanding construction activity.

Latest developments in the Calcium Carbide Industry:

- March 2025: Ghani Chemical Industries Limited announced plans to transfer the full scope of its Calcium Carbide Project operations to its subsidiary, Ghani ChemWorld Limited (GCWL). According to the company’s filing with the Pakistan Stock Exchange, the restructuring involves a share swap arrangement in which GCWL will issue 500 shares for every 1,000 GCIL shares held by existing GCIL shareholders.

- January 2024: DCM Shriram inked a 12000 crore rupees MoU with the Gujrat Government during the Vibrant Gujrat Summit 2024 to manufacture chemical and petrochemical products in Bharuch, Gujarat, by 2028. DCM Shriram is a diversified conglomerate that produces PVC resins, aluminum chloride, calcium carbide, caustic soda, and many other products.

- December 2023: Ghani Chemical Industries Limited (GCIL) announced its intention to establish a calcium carbide manufacturing project at Hattar Special Economic Zone. This comes along with the company’s plan to construct a 275 ton per day air separation unit (ASU) plant in the zone.

- May 2023: Xinjiang Tianye Co., Ltd. announced the acquisition of 100% equity of Tianchen Chemical, making it a wholly-owned subsidiary. Following the acquisition, Xinjiang Tianye's production capacities will significantly increase, including calcium carbide production capacity of 2.13 million tons/year and calcium carbide slag cement production of 5.35 million tons/year.

Product Description

Calcium carbide (CaC2), also known as calcium acetylide, is a chemical compound produced when coke and calcium oxide (lime) react at high temperatures. It possesses a grey to reddish-brown appearance and occurs in a crystalline solid form. Some of the unique characteristics of CaC2 are its strong heat conductivity, solubility in a wide range of solvents, and capacity to combine explosively with air. It is employed in metallurgy, agricultural activities, fruit ripening, chemical production, and iron desulfurization. CaC2 guarantees effective energy production, boosts crop yields, and improves industrial processes. It is also highly praised for its adaptability, affordability, and dependability. Calcium carbide itself appears as a grayish-black solid with a distinctive garlic-like odor. Its most notable property is its reaction with water, producing acetylene gas and calcium hydroxide.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Calcium Carbide |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Calcium Carbide Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of calcium carbide pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting calcium carbide price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The calcium carbide price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The calcium carbide prices in October 2025 were 0.38 USD/Kg in Northeast Asia, 1.29 USD/Kg in Europe, 1.21 USD/Kg in South America, and 1.69 USD/Kg in North America.

The calcium carbide pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for calcium carbide prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)