Cable Lugs Market Size, Share, Trends and Forecast by Material Type, End Use Industry, and Region, 2025-2033

Cable Lugs Market Size and Share:

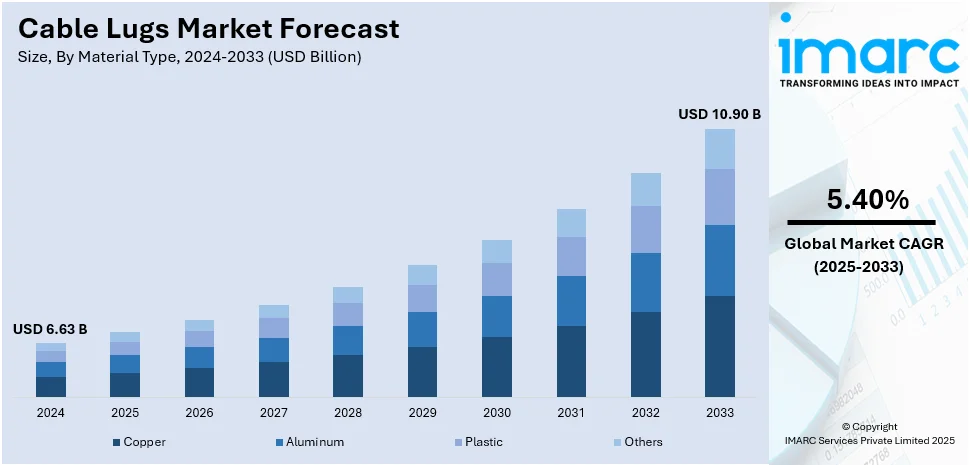

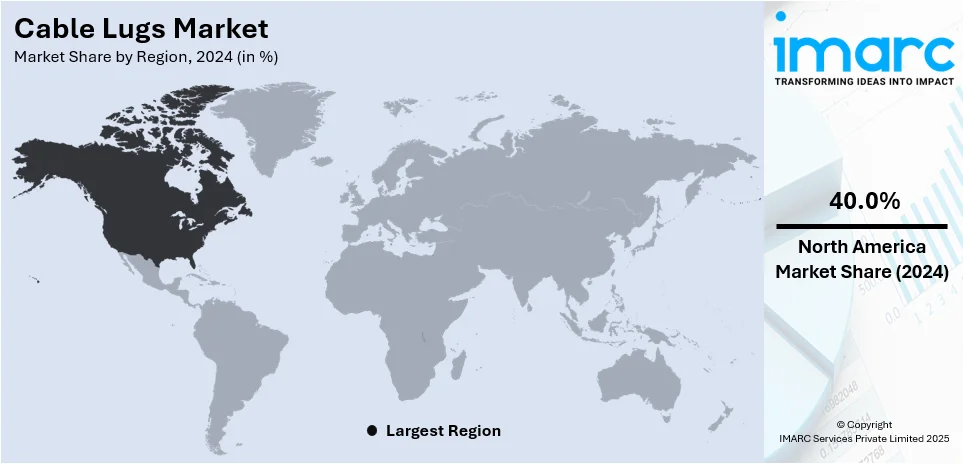

The global cable lugs market size was valued at USD 6.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.90 Billion by 2033, exhibiting a CAGR of 5.40% from 2025-2033. North America currently dominates the cable lugs market share by holding over 40.0% in 2024. The market in the region is driven by extensive investments in power grid modernization, rapid expansion of renewable energy projects, and increasing adoption of electric vehicles (EVs).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.63 Billion |

|

Market Forecast in 2033

|

USD 10.90 Billion |

| Market Growth Rate (2025-2033) | 5.40% |

The global cable lugs market growth is primarily driven by the rising electricity demand due to rapid urbanization and industrialization, as it is increasing the need for efficient power transmission and distribution systems. In addition, the growth in renewable energy (RE) projects is fueling demand for durable electrical connectors in solar, wind, and hydroelectric installations, providing an impetus to the market. Besides this, the expanding EV infrastructure requires high-performance cable lugs for charging stations and battery systems, supporting the market growth. Also, smart city development necessitates advanced electrical components for modern infrastructure, which is driving the market demand. Furthermore, ongoing technological advancements are improving durability and efficiency, thus impelling the market growth.

The United States cable lugs market demand is driven by the aging power infrastructure upgrades, that are increasing the integration of reliable electrical connectors to support grid modernization. The U.S. holds a market share of 85.80%. In line with this, the rising data center expansion is driving the need for advanced cabling solutions in high-power information technology (IT) environments, contributing to the market expansion. Concurrently, the growth in industrial automation is fueling demand for secure electrical connections in smart manufacturing, which is strengthening the cable lugs market share. Besides this, the increasing military and aerospace applications require specialized, high-durability cable lugs, thus fueling the market demand. Furthermore, the expanding offshore wind projects necessitate corrosion-resistant electrical connectors, providing an impetus to the market. Apart from this, strong investments in high-speed rail and metro networks are boosting the demand for efficient power distribution components, thereby propelling the market forward.

Cable Lugs Market Trends:

Rising Energy Demand and Infrastructure Expansion

The increasing demand for electricity and the need for reliable and efficient power transmission and distribution systems due to the rising population, rapid urbanization, and industrialization are influencing the cable lugs market trends. For example, The United Nations predicts that the global population will rise to 9.7 billion by 2050 and reach its maximum of 10.4 billion during the mid-2080s. In line with this, extensive investments in power generation projects and the upgradation of existing energy infrastructure are creating a favorable outlook for the market. Additionally, the expanding infrastructure development and the rise in smart city projects, requiring the installation of cables and cable lugs, are enhancing the cable lugs market outlook.

Shift Towards Renewable Energy and Electric Vehicles (EVs)

The shifting preference for RE sources due to escalating environmental concerns, extensive investments in power generation projects, and the upgradation of existing energy infrastructure is propelling the market growth. For instance, in March 2023, MTM Engineering acquired CET Connect, enhancing its capabilities to provide advanced cable lug solutions and services for industrial clients. The emergence of new markets, such as EVs and RE, is driving the demand for cable lugs that meet specific performance needs. Apart from this, governments and corporations are focusing on solar, wind, and hydroelectric power projects, increasing the requirement for high-quality electrical connectors, thus impelling the market growth.

Technological Advancements and Market Competition

Continuous technological advancements in the manufacturing process, such as the development of more efficient and durable cable lugs, are significantly contributing to the market expansion. The intense market competition and ongoing product innovation have led to the launch of high-quality product variants at a lower price. Additionally, the bolstering growth of the automotive, manufacturing and processing, energy and utilities, and other end-user industries is positively impacting the market. Besides this, standardization efforts are ensuring cable lugs comply with international safety and performance standards, supporting their increased adoption. For instance, the Smart Cities Mission, with 100 cities leading the initiative and nearly USD 1,772.45 million in investment, underscores the need for reliable electrical components like cable lugs in large-scale infrastructure projects, thereby driving the market forward.

Cable Lugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cable lugs market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type and end use industry.

Analysis by Material Type:

- Copper

- Aluminum

- Plastic

- Others

Copper holds the largest market in 2024, holding around 63.7% of the market share. This dominance is driven by the superior electrical conductivity of copper, which ensures minimal power loss and efficient energy transmission. Its high thermal resistance quality leads to its ideal usage in power grids, industrial machinery, and automotive wiring. The increased investments in RE surge the need for copper cable lugs that serve solar and wind energy systems. Moreover, the production of EVs requires advanced copper connectors for building reliable power transfer networks and the development of charging infrastructure. Besides this, the growing construction of data centers creates additional demand because copper lugs provide dependable junctions within these powerful high-power systems. The combination of durability and corrosion resistance properties makes copper lugs appealing to organizations that set safety standards. Furthermore, the standardization initiatives advance the dominance of copper across the energy, automotive sectors, and industrial applications, thereby impelling the market growth.

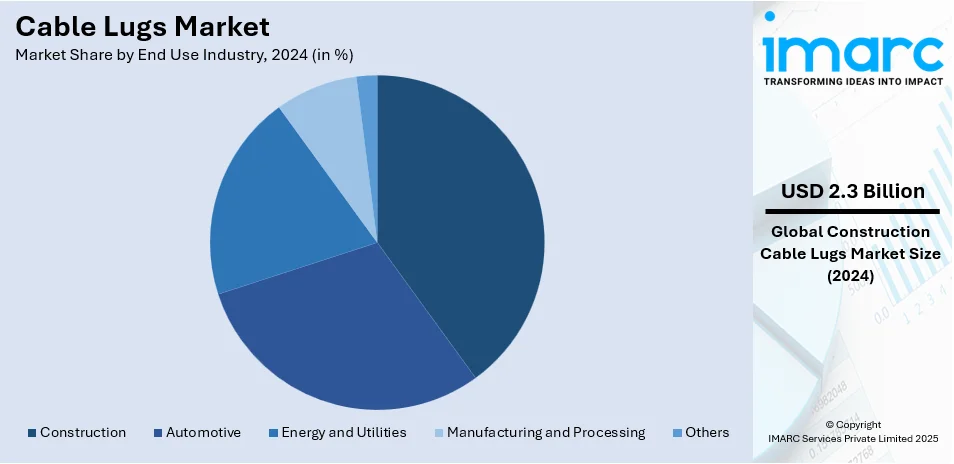

Analysis by End Use Industry:

- Construction

- Automotive

- Energy and Utilities

- Manufacturing and Processing

- Others

Construction leads the market with around 34.8% of the market share in 2024. This dominance is driven due to the fast-growing residential, commercial, and industrial infrastructure, as it increases the need for dependable electrical connections. The implementation of advanced wire solutions for growing smart cities creates an increased need for cable lugs to support secure power distribution systems. Moreover, the investors construct RE facilities into their buildings and developers incorporate solar and wind energy systems into modern construction. Besides this, the electrical safety regulations also enforce compliance standards through their requirement to use high-quality connectors. Additionally, rapid urban growth along with elevated high-rise building development drives the need for extensive electrical infrastructure. Furthermore, modern electrical systems need durable corrosion-resistant connectors to terminate cables. Apart from this, infrastructure initiatives from the government and continuous sector development are significantly contributing to the market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0% in the cable lugs market. In line with this, the increasing government funding for infrastructure projects, including bridges, highways, and smart grids, is driving demand for reliable electrical components. Moreover, the expansion of industrial automation and robotics in manufacturing is boosting the need for secure power connections. Besides this, the growth in residential and commercial construction due to population shifts and urban development is driving the market expansion. Furthermore, the rising defense and aerospace investments require high-durability cable lugs for advanced electrical systems. Also, the surging demand for high-voltage transmission lines to support distributed energy resources is increasing product adoption. Concurrently, ongoing advancements in fire-resistant and corrosion-proof cable lugs are meeting stringent industry standards, driving innovation in the region. As a result, the robust industrial ecosystem of North America, coupled with continuous technological enhancements, continues to solidify its position as the leading regional market.

Key Regional Takeaways:

United States Cable Lugs Market Analysis

In the United States, the adoption of cable lugs cleaning methods depends heavily on the rapid expansion of the automotive industry. For instance, car manufacturers have made public investments totaling more than USD 75 Billion in the U.S. since the beginning of 2021. The expansion of automotive production also encourages manufacturers to maintain proper cable lugs cleaning because efficient electrical systems need functional components for increased durability. Besides this, the advancement of electrically powered vehicles demands high-quality electrical connections for peak performance in the automotive industry. Moreover, automobile electrical systems require cable lugs cleaning as an essential maintenance practice to stop electrical circuit malfunctions which extends their durability and reliability. Furthermore, the increasing automotive production volumes demand efficient cleaning solutions that fulfill high-quality standards while achieving operational efficiency throughout manufacturing lines.

Europe Cable Lugs Market Analysis

In Europe, the growing demand for cable lugs cleaning is largely driven by rapid industrialization and increasing production demands across various sectors. According to reports, industrial production within the EU increased by 8.5% throughout 2021 relative to 2020. The growth rate of cable lugs cleaning increased from 2021 to 2022 at 0.4%. The expansion of production capacity to satisfy growing consumer needs leads industries to require dependable electrical systems that operate efficiently. Additionally, industrialization speeds up the implementation of automated systems that require electrical parts to stay free of pollutants to avoid equipment failures. Moreover, production growth requires extra focus on cable lug cleaning due to its vital role in system performance. Besides this, efficient electrical connections between systems operate smoothly by decreasing equipment breakdowns and increasing operational efficiency, and reducing maintenance interruptions. Furthermore, the necessity for clean electrical connections stands strong across multiple industrial sectors especially manufacturing, energy and automotive because their electrical reliability remains central.

Asia Pacific Cable Lugs Market Analysis

The Asia-Pacific region witnesses an increasing adoption rate of cable lugs cleaning because of the expanding manufacturing and processing industries. In addition, the domestic electronics production in India has expanded from USD 29 Billion in 2014-15 to USD 101 Billion in 2022-23, according to the India Brand Equity Foundation which identifies India as a leading manufacturing destination. The expansion of manufacturing capacity creates a parallel growth in requirements for electrical components which must be free of dirt particles and corrosion while intact from other contaminants. Concurrently, the efficient operations of industries dealing with electronics automotive parts, and heavy machinery depend on reliable electrical connections. Moreover, the growing number of manufacturing plants in developing nations especially requires systematic methods for electrical system maintenance because of their industrial expansion. As a result, the efficiency of electrical systems increases when cable lugs remain clean which decreases maintenance expenses and strengthens machinery and infrastructure reliability.

Latin America Cable Lugs Market Analysis

The market in Latin America is adopting cable lugs cleaning as it needs both enhanced electrical transmission systems and dependable power distribution networks. The increasing energy needs of rapid urbanization require advanced and contaminant-free electrical infrastructure. For instance, the urban population in Latin America represents 85.2 percent of the total which amounts to 565,084,260 people as projected for 2024. Cable lugs form a vital part of power distribution systems which require clean maintenance to deliver their greatest operational potential. The focus on cleaning practices has intensified as an outcome of power transmission and distribution requirements to achieve system reliability through clean cable lugs thus minimizing power outages for the expanding electricity consumption in the region.

Middle East and Africa Cable Lugs Market Analysis

In the Middle East and Africa, the growing construction industry plays a significant role in driving the adoption of cable lugs cleaning. Reports indicate that Saudi Arabian construction activity is expanding rapidly through 5,200 ongoing projects worth USD 819 Billion. The construction sector keeps expanding through residential development together with commercial construction and infrastructure projects thus making reliable electrical systems essential. Besides this, the cleaning of cable lugs produces powerful electrical connections which enhance durability and efficiency thus lowering the risk of equipment failures in newly built facilities. Furthermore, clean electrical components stand as a priority for the thriving construction industry because they guarantee electrical system safety and reliability and extension of service life thereby boosting demand for cable lugs cleaning across the region.

Competitive Landscape:

The cable lugs market is witnessing intensified competition, with manufacturers focusing on product innovation, material enhancements, and cost-effective solutions to gain a competitive edge. Companies are investing in research and development (R&D) to introduce high-durability, corrosion-resistant, and fireproof cable lugs that comply with evolving safety standards. Strategic mergers, acquisitions, and partnerships are expanding market reach and technological capabilities. Market players are also leveraging automation and advanced manufacturing techniques to improve efficiency and reduce costs. Additionally, the rising demand for customized and application-specific cable lugs is pushing manufacturers to enhance their product portfolios, targeting sectors like renewable energy, EV infrastructure, and industrial automation.

The report provides a comprehensive analysis of the competitive landscape in the cable lugs market with detailed profiles of all major companies, including:

- 3M Company

- ABB Ltd.

- Chatsworth Products Inc.

- Emerson Electric Co.

- HELUKABEL GmbH

- Hubbell Incorporated

- Schneider Electric SE

- Weidmüller Interface GmbH & Co. KG

Latest News and Developments:

- May 2024: 3M is expanding its facility in Valley, Nebraska, with a USD 67 Million investment to boost manufacturing capacity. The 90,000-square-foot expansion will include new production lines and equipment. This investment is expected to strengthen 3M's operations and increase local production capabilities.

- April 2024: Prysmian Group revealed plans to acquire Encore for around USD 4.2 Billion. This acquisition is expected to enhance Prysmian's position in the global cable lug market, boost its North American operations, and expand its product offerings, strengthening its overall market reach.

- February 2024: Ensto has introduced a new family of mechanical medium voltage underground cable connectors and lugs, designed to replace the SMJ/SML series. The development, led by Hannele Kenkkilä, involved close cooperation between various experts to refine the product for optimal performance. The new connectors and lugs ensure adaptability to cables, with a screw design that prevents predetermined break points.

- June 2021: Dinkle International launched the DKU series of screw-type terminal blocks. These new terminal blocks are designed for use in power distribution and transmission cabinets, featuring enhanced compatibility with cable lugs, ensuring smoother and more efficient installations.

- February 2021: Weidmüller Interface GmbH & Co. KG announced the development of a new logistics center, set to be completed by 2022. This facility will serve as a global transshipment hub, supporting operations in the Czech Republic, Romania, and Germany, optimizing logistics and supply chain efficiency.

Cable Lugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | Copper, Aluminum, Plastic, Others |

| End Use Industries Covered | Construction, Automotive, Energy and Utilities, Manufacturing and Processing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, ABB Ltd., Chatsworth Products Inc., Emerson Electric Co., HELUKABEL GmbH, Hubbell Incorporated, Schneider Electric SE, Weidmüller Interface GmbH & Co. KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cable lugs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cable lugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cable lugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cable lugs market was valued at USD 6.63 Billion in 2024.

IMARC estimates the cable lugs market to exhibit a CAGR of 5.40% during 2025-2033, expecting to reach USD 10.90 Billion by 2033.

The cable lugs market is driven by rising electricity demand, grid modernization, expanding renewable energy (RE) projects, growth in electric vehicles (EVs) and charging infrastructure, rapid urbanization and smart city developments, and stringent safety regulations requiring high-quality, durable electrical connectors for industrial, commercial, and residential applications.

North America currently dominates the market, accounting for a share exceeding 40.0% in 2024. This dominance is fueled by the expansion of high-speed rail networks, increasing defense and aerospace applications, rising offshore wind projects, strong demand from the telecommunications sector, advancements in fire-resistant electrical components, and government incentives for energy-efficient infrastructure upgrades.

Some of the major players in the cable lugs market include 3M Company, ABB Ltd., Chatsworth Products Inc., Emerson Electric Co., HELUKABEL GmbH, Hubbell Incorporated, Schneider Electric SE, Weidmüller Interface GmbH & Co. KG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)