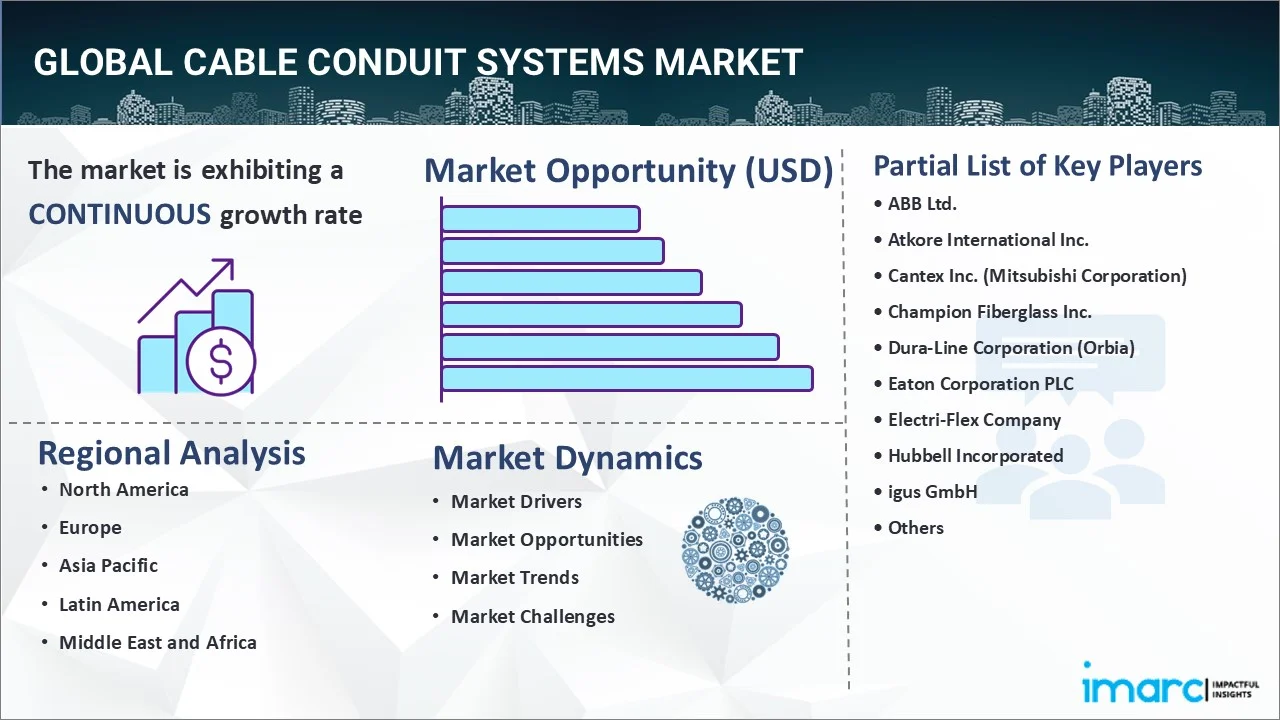

Cable Conduit Systems Market Report by Type (Rigid Cable Conduit Systems, Flexible Cable Conduit Systems), End User (Manufacturing, Commercial Construction, IT and Telecommunication, Healthcare, Energy, and Others), and Region 2025-2033

Global Cable Conduit Systems Market:

The global cable conduit systems market size reached USD 7.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. An increase in the number of housing projects as a result of rapid development and rising incomes is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.8 Billion |

|

Market Forecast in 2033

|

USD 12.5 Billion |

| Market Growth Rate 2025-2033 | 5.04% |

Cable Conduit Systems Market Analysis:

- Major Market Drivers: The elevating adoption of a convenient mode of transportation due to the rising population of working professionals and shifting lifestyle choices is propelling the market.

- Key Market Trends: The growing usage of smart protection systems for improving vehicle mobility and safety is one of the factors contributing to the cable conduit systems market growth.

- Competitive Landscape: Some of the major market companies include ABB Ltd., Atkore International Inc., Cantex Inc. (Mitsubishi Corporation), Champion Fiberglass Inc., Dura-Line Corporation (Orbia), Eaton Corporation PLC, Electri-Flex Company, Hubbell Incorporated, igus GmbH, Legrand, and Schneider Electric SE, among many others.

- Geographical Trends: North America is currently dominating the market due to its emphasis on replacing aging infrastructure, along with stringent compliance rules, notably in commercial and residential construction projects.

- Challenges and Opportunities: The high installation cost is hampering the market. However, adopting cost-effective manufacturing procedures while spreading awareness of the long-term benefits of durability, safety, and lower maintenance costs will continue to catalyze the market over the forecast period.

Cable Conduit Systems Market Trends:

Technological Advancements in Materials

The development of new supplies such as flexible, lightweight, and corrosion-resistant conduits is increasing the usage of cable conduit systems in extreme conditions, enhancing efficiency, installation ease, and durability. In April 2024, ABB Installation Products introduced the PMA EcoGuard PA6, one of the industry’s first sustainable cable protection systems made from recycled fishing nets, helping to safeguard electrical cables, wires, and marine life.

Rising Demand in the Manufacturing Sector

As manufacturing facilities automate and modernize, they require durable conduit systems to protect wires from machinery and environmental damage, ensuring continuous equipment functioning and avoiding costly downtime. In August 2024, Malé Water and Sewerage Company (MWSC) produced and launched conduit pipes designed to protect electrical wires from damage. This largely contributes to the cable conduit systems market share.

Growth in Renewable Energy Projects

The advent of renewable energy sources, such as solar and wind, is creating a demand for dependable and long-lasting conduit systems to safeguard wire in hostile conditions, boosting market growth in sectors focusing on sustainable energy. In July 2024, Tekmar Group completed its role in the Dogger Bank A offshore wind farm by supplying essential cable protection systems (CPS) for the project’s inter-array cables.

Global Cable Conduit Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and end user.

Breakup by Type:

- Rigid Cable Conduit Systems

- Metallic

- Non-metallic

- Flexible Cable Conduit Systems

- Metallic

- Non-metallic

Currently, rigid cable conduit systems hold the largest cable conduit systems market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes rigid cable conduit systems (metallic and non-metallic) and flexible cable conduit systems (metallic and non-metallic). According to the report, rigid cable conduit systems represented the largest market segmentation.

Rigid cable conduit systems provide increased safety for electrical wire, particularly in industrial and commercial situations. These systems are well-known for their durability and impact resistance, making them ideal for areas that require high safety standards and mechanical damage protection.

Breakup by End User:

- Manufacturing

- Commercial Construction

- IT and Telecommunication

- Healthcare

- Energy

- Others

Among these, manufacturing holds the largest cable conduit systems market size

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturing, commercial construction, IT and telecommunication, healthcare, energy, and others. According to the report, manufacturing represented the largest market segmentation.

The manufacturing industry is a major user of cable conduit systems as they protect electrical wires in industrial environments. These devices ensure safe and efficient operations, protecting cables in high-activity and machinery-intensive workplaces.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads in the cable conduit systems market growth

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest cable conduit systems market share.

North America exhibits a clear dominance in the market driven by consumer preference for higher electrical safety regulations, infrastructure modernization, and rising industrial sectors such as energy, telecommunications, and transportation. Furthermore, the expansion of smart cities and the advent of renewable energy projects drive up demand for efficient and long-lasting conduit systems.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Atkore International Inc.

- Cantex Inc. (Mitsubishi Corporation)

- Champion Fiberglass Inc.

- Dura-Line Corporation (Orbia)

- Eaton Corporation PLC

- Electri-Flex Company

- Hubbell Incorporated

- igus GmbH

- Legrand

- Schneider Electric SE

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Cable Conduit Systems Market Recent Developments:

- August 2024: Malé Water and Sewerage Company (MWSC) produced and launched conduit pipes designed to protect electrical wires from damage.

- July 2024: Tekmar Group completed its role in the Dogger Bank A offshore wind farm by supplying essential cable protection systems (CPS) for the project’s inter-array cables.

- April 2024: ABB Installation Products introduced the PMA EcoGuard PA6, one of the industry’s first sustainable cable protection systems made from recycled fishing nets, helping to safeguard electrical cables, wires, and marine life.

Cable Conduit Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Manufacturing, Commercial Construction, IT and Telecommunication, Healthcare, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Atkore International Inc., Cantex Inc. (Mitsubishi Corporation), Champion Fiberglass Inc., Dura-Line Corporation (Orbia), Eaton Corporation PLC, Electri-Flex Company, Hubbell Incorporated, igus GmbH, Legrand, Schneider Electric SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cable conduit systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cable conduit systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cable conduit systems industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cable conduit systems market was valued at USD 7.8 Billion in 2024.

We expect the global cable conduit systems market to exhibit a CAGR of 5.04% during 2025-2033.

The emerging trend of smart protection systems for enhancing the mobility and safety of vehicles, along with the introduction of corrugated conduits and protective hoses to protect valuable cables against unfavorable external influences in vehicles, is primarily driving the global cable conduit systems market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for cable conduit systems.

Based on the type, the global cable conduit systems market has been divided into rigid cable conduit systems and flexible cable conduit systems. Currently, rigid cable conduit systems hold the majority of the total market share.

Based on the end user, the global cable conduit systems market can be bifurcated into manufacturing, commercial construction, IT and telecommunication, healthcare, energy, and others. Among these, manufacturing exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global cable conduit systems market include ABB Ltd., Atkore International Inc., Cantex Inc. (Mitsubishi Corporation), Champion Fiberglass Inc., Dura-Line Corporation (Orbia), Eaton Corporation PLC, Electri-Flex Company, Hubbell Incorporated, igus GmbH, Legrand, and Schneider Electric SE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)