Cable Accessories Market Size, Share, Trends and Forecast by End User, Voltage, Installation, and Region, 2025-2033

Cable Accessories Market Size and Share:

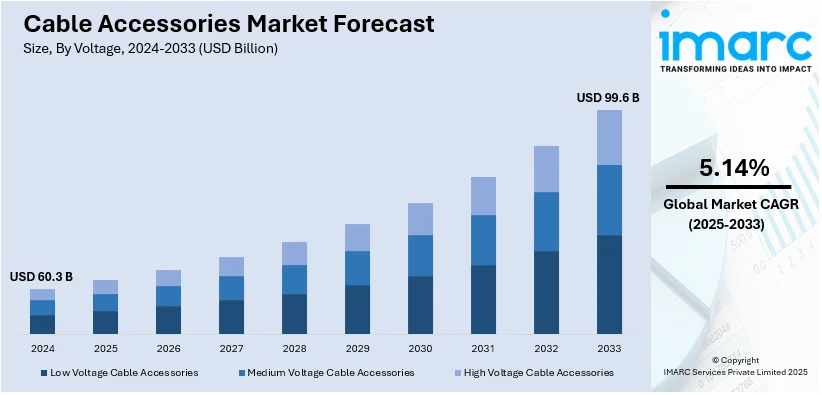

The global cable accessories market size reached USD 60.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 99.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.14% during 2025-2033. Asia Pacific currently dominates the market in 2024, holding a market share of over 40.1% in 2024. The cable accessories market share is propelled by the increasing adoption of smart infrastructure, which heavily depends on advanced cable systems for operation and connectivity, along with the development of smart grids and continuous technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 60.3 Billion |

| Market Forecast in 2033 | USD 99.6 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

One of the primary drivers for the global cable accessories market comes from the rising energy demand, largely due to increasing investment in power generation, transmission, and distribution infrastructure. This is largely influenced by urbanization and industrialization in many emerging economies that would need adequate electrical networks. According to the United Nations, 68% of the population globally is expected to reside in urban areas by the year 2050. Besides this, advances in technology, such as the creation of high-performance and eco-friendly materials for cable accessories, are improving durability and operational efficiency. Expansions of smart grids and renovations of existing electrical networks increase cable accessories market growth. Moreover, growing investment in underground cabling projects, especially in thickly populated areas and environmentally restricted regions, are key factors as well.

The United States stands out as a key market disruptor, driven by huge investments in the upgradation and modernization of aging power infrastructure. There is a significant growth in renewable energy sources like solar and wind, which calls for efficient cable systems and accessories to connect such resources to the grid. Urbanization and further industrial sector expansions also increase demand for advanced cable accessories to provide reliable energy distribution. The development of smart grids and emphasis on energy efficiency necessitate advanced, high-performance cable accessories to withstand various environmental conditions. Increased growth in the telecommunications industry, including the 5G rollout, also creates a demand for specialized cabling solutions. Growth in the electrification of rural and underserved areas and greater emphasis on sustainable underground cabling projects are some other factors. The regulatory standards, which are encouraging safety and green material usage, are further pushing the cable accessories market in the United States.

Cable Accessories Market Trends:

Growing trends of smart infrastructure

According to the IMARC Group’s report, the global smart infrastructure market reached USD 149.2 Billion in 2023. Smart infrastructure development includes the deployment of advanced telecommunications networks, such as 5G, which requires extensive cabling infrastructure with high-performance cable accessories. These accessories must support higher data speeds and bandwidth, requiring precision-engineered connectors, junctions, and shielding accessories. Moreover, smart infrastructure often incorporates energy efficiency measures that rely on sensors and automated systems to control lighting, heating, and cooling based on occupancy and weather conditions. Cable accessories play a critical role in connecting and protecting these sensors and controls, ensuring they operate effectively without interruption, which is increasing the cable accessories market size.

Increasing development of smart grids

Smart grids are highly networked systems that need to coordinate real-time information exchange from several entities like households, buildings, and renewable energy sources. This connectivity requires cable accessories, such as connectors, splices and terminations, that can provide the connection needed for high-speed data and power transmissions. In addition, smart grids incorporate advanced technologies that can efficiently manage electricity supply and demand. Cable accessories in these systems require features like load breaking and fault isolation, which are critical for grid stability and to prevent blackouts. In line with this, the emphasis on grid reliability and the need to minimize downtime in smart grids are strengthening the cable accessories industry. Additionally, accessories that facilitate quick and easy repair or replacement are crucial to maintaining service continuity. The IMARC Group’s report shows that the global smart grid is expected to reach USD 253.5 Billion by 2032.

Ongoing advancements in technology

Technological improvements in the field of material sciences are ensuring that cable accessories are long lasting, dependable and efficient. The application of silicone, ethylene-propylene rubber and cross-linked polyethylene in cable insulation and sheathing improves its performance in adverse environmental conditions, thereby bolstering the cable accessories market growth. Apart from this, advancement in technology is enabling the fabrication of compact and modular cable accessories. These designs facilitate easier installation and maintenance in dense urban environments, such as in data centers or industrial machinery. Furthermore, with growing environmental consciousness, the use of eco-friendly and recycled material in cable accessories is further creating a positive cable accessories market outlook. These innovations are enabling key players to meet these demands without compromising on performance, thus opening new markets and opportunities. For instance, in 2023, Nexans successfully achieved electrical Type Test to develop 525 kV DC SF6 gas free cable terminations with SF6-free accessories including a dry-type Gas Insulated Switchgear (GIS) cable sealing end, and g3 gas filled GIS cable sealing end and an Outdoor Composite (or Air-Insulated Switchgear – AIS) cable sealing end.

Cable Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the cable accessories market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on voltage, installation, and end user.

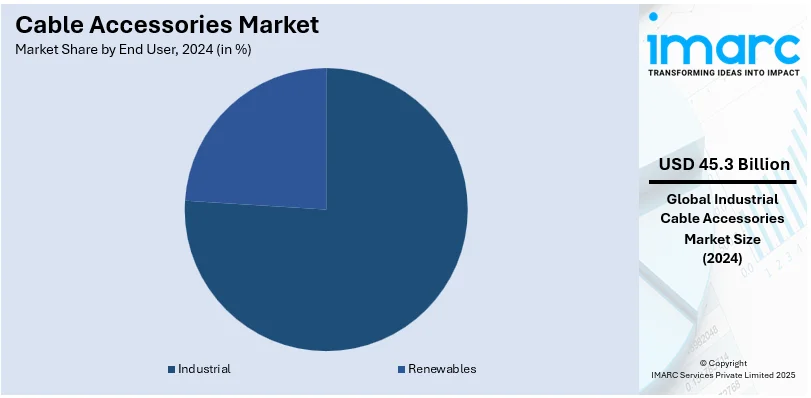

Analysis by End User:

- Industrial

- Renewables

According to the report, industrial represents the largest segment, holding 75.1% of the market share. Industrial hubs require exceptionally robust, reliable, and high-efficiency cable accessories to maintain the safe and seamless flow of electricity and data. This need is driven by the support for intricate machinery, heavy-duty gear, and complex control systems, all relying on cables and their accessories for functionality and safety. In addition, the rise of industrial infrastructure and the increase in automation and smart technology adoption further heighten the need for cable accessories. As industrial sectors are expanding and advancing, the cable accessories market value is increasing significantly.

Analysis by Voltage:

- Low Voltage Cable Accessories

- Medium Voltage Cable Accessories

- High Voltage Cable Accessories

According to the report, low voltage cable accessories account for the largest segment, holding 52.0% of the market share. These accessories include connectors, joints, and terminations that are crucial in ensuring connection and protection of electrical installations. The increased use of low voltage electrical networks in urban infrastructural projects, attributed to trends in urbanization and infrastructural modernization around the world, further expands the cable accessories market demand. Additionally, the preference for renewable sources of energy for powering stationery and transport applications that rely on low voltage solutions is playing a significant role in the growth of this segment of the market.

Analysis by Installation:

- Overhead Cable Accessories

- Underground Cable Accessories

According to the report, overhead cable accessories represent the largest segment, holding 57.9% of the market share in 2024. Overhead lines are generally cheaper compared to their underground counterparts especially in areas that are less populated or sparsely developed where the costs of laying and maintaining underground solutions are prohibitively high, thereby increasing the cable accessories market revenue. Additionally, the accessibility of overhead systems makes them easier and quicker to repair, which is crucial for minimizing downtime during power outages. This logistical advantage is fueling the need for different overhead cable accessories like connectors, clamper, insulator, and protectors as well as other apparatus for constructing, operating, and maintaining this power line.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

According to the report, Asia Pacific represents the largest regional market for cable accessories, holding 40.1% of the market share in 2024. As per the website of the National Bureau of Statistics of China, in 2023, the urbanization rate of permanent residents reached 66.16 percent, 0.94% higher than that at the end of 2022. This huge shift of population from rural to urban areas in China requires the development of new urban centers, housing developments, and commercial facilities, all requires extensive electrical infrastructure. To support this growth, there is a significant demand for cable accessories. Additionally, governing agencies are introducing initiatives in the region to improve rural and urban electrical access and the modernization of aging electrical infrastructure are contributing to the growing adoption of cable accessories.

Key Regional Takeaways:

United States Cable Accessories Market Analysis

In 2024, the United States accounts for over 94.20% of the cable accessories market in North America. It has been observed that the cable accessories market in the United States is being spurred by strong expenditure in renewable energy projects and electrical infrastructure. There has been a tremendous surge in the requirement for high-performance cable accessories, as the increasing reliance on clean energy sources like solar and wind necessitates reliable energy transmission. According to an industry report, in 2023, more than 140 GW of wind power has been installed in the United States, requiring high-tech cable accessories such as terminations, joints, and connections. The second important aspect is smart grid initiatives: investments by the U.S. Department of Energy in grid modernization projects are highly valued, thereby creating a need for reliable and long-lasting cable accessories.

This further increased the need for specialized cable accessories to accommodate high-voltage and fiber-optic cables with the rapid expansion of data centers that is spurred by the rising use of cloud computing and Internet of Things. The telecom industry, according to reports, mainly relies on cable accessories for unbroken connectivity and maintenance with more than 450,000 cell towers.

Europe Cable Accessories Market Analysis

Strict laws that promote the use of renewable energy sources and energy efficiency are driving the cable accessories market in Europe. The European Union's Green Deal, which has set a target of carbon neutrality by 2050, has accelerated the deployment of wind and solar farms, which requires considerable cable infrastructure, as per reports. The 260 GW of offshore wind capacity installed in Europe by 2030 was the fuel behind the need for robust subsea cable accessories. More than 3.5 million charging stations are expected to be installed across the region by 2030, which has increased the demand for cable accessories in EV charging networks, thanks to the electrification of transportation and the growing popularity of electric vehicles. It also requires sophisticated cable accessories due to growing train electrification projects in high-speed rail networks, the Trans-European Transport Network expansion, for example. Countries moving ahead of the league of grid modernisation include Germany, the UK, and France, using advanced cable technologies in supporting smart grid systems.

Asia Pacific Cable Accessories Market Analysis

The market for cable accessories grows rapidly in the Asia-Pacific region due to the factors like industrialization and urbanization along with growing energy demands. In 2023, the world's largest energy consumer, China, reportedly added over 200 GW of renewable capacity, requiring high-quality cable accessories for integration into the grid, as per reports. Cable accessory demand has grown exponentially in India due to government initiatives such as "Power for All" and rapid growth in renewable energy projects. The demand for medium and low-voltage cable accessories in residential and commercial projects is also driven by the region's growing construction industry, which has invested over USD 1.7 Trillion annually till 2030 to sustain its growth momentum, according to Asian Development Bank data. The demand for fiber-optic cable accessories is also driven by the development of 5G technology, with more than 1.2 billion 5G connections expected in the region by 2025, according to reports.

Latin America Cable Accessories Market Analysis

The growth of renewable energy sources and ongoing electrification projects are driving the growth of the cable accessories market in Latin America. The two largest economies in the region, Brazil and Mexico, are leading adopters of solar and wind energy; Brazil produces more than 28 GW of wind energy capacity by 2023, according to an industry report. This modernization of electricity infrastructures by these nations also increases the demand for sophisticated cable accessories. Over 65% of urban areas in major economies are covered by fiber-optic networks, showing the fast expansion of telecommunications infrastructure. Cable accessories are required at an increasing rate to be used inside residential and commercial houses due to growth in urbanisation and government outlays in a smart city.

Middle East and Africa Cable Accessories Market Analysis

MEA region is a region of constantly growing investments for telecom and energy infrastructure. Under their programs such as Saudi Vision 2030, the GCC counties like Saudi, UAE are highly focusing on investment in grid addition and renewable-based projects. As it continues to provide essential energy supplies for its offshore oil and gas operations in the region, mainly in the United Arab Emirates and Qatar, demand for subsea cable accessories in the region will be highly requested. Africa electrification programs have been initiated, that are meant to provide power access to 300 million people under the "Mission 300", according to data from the World Bank. The growth of telecommunications, especially in countries like South Africa and Nigeria, raises the demand for accessories for fiber-optic cables.

Competitive Landscape:

Due to technological advancements, many organizations are enhancing their R&D capacity to develop new and better cable accessories with efficiency, safety, and reliability in terms of performance. They are expanding their manufacturing capability on account of the increased need for higher efficiency of cable accessories. Key players are likely to enter into partnerships, cooperations, and joint venture systems with other firms to diversify product portfolios, gain broader access to the markets and share technological experiences. They include delivering customer services such as technical support, consultancy, and after-sales services that enable organizations to offer a competitive edge. In addition, acquisitions and mergers are common strategies for cable accessories companies looking to quickly expand their product lines or acquire new technologies. For instance, in 2024, ABB signed an agreement to acquire Siemens' Wiring Accessories business in China. The acquisition will deepen ABB's market reach while complementing regional customer offering across smart buildings.

The report provides a comprehensive analysis of the competitive landscape in the cable accessories market with detailed profiles of all major companies, including:

- Nexans SA

- The Prysmian Group

- ABB Group

- NKT A/S

- Taihan Cable & Solution Co., Ltd.

Latest News and Developments:

- April 2024: Encore Wire, a Texas-based producer of electrical building wire and cables, has been acquired by Prysmian Group, a global cable manufacturer. Prysmian's position in North America is strengthened by this action, which also broadens its product line and market penetration. Prysmian's expansion strategy, especially in the commercial, industrial, and residential sectors, is in line with the acquisition. Additionally, it complements current operations and increases output capacities.

- May 2024: ABB and Niedax Group, a leading global supplier of cable management systems, created a joint venture to meet the growing demand for cable tray systems in North America.

Cable Accessories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Users Covered | Industrial, Renewables |

| Voltages Covered | Low Voltage Cable Accessories, Medium Voltage Cable Accessories, High Voltage Cable Accessories |

| Installations Covered | Overhead Cable Accessories, Underground Cable Accessories |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Nexans SA, The Prysmian Group, ABB Group, NKT A/S, Taihan Cable & Solution Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, cable accessories market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cable accessories market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cable accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cable accessories market was valued at USD 60.3 Billion in 2024.

IMARC estimates the cable accessories market to exhibit a CAGR of 5.14% during 2025-2033.

The global cable accessories market is driven by increasing investments in power infrastructure, rapid urbanization, expansion of renewable energy projects, and the growing demand for reliable electricity transmission and distribution systems.

Asia Pacific dominates the market due to rapid urbanization, extensive infrastructure development, and the increasing demand for reliable power transmission in emerging economies like China and India.

Some of the major players in the cable accessories market include Nexans SA, The Prysmian Group, ABB Group, NKT A/S, and Taihan Cable & Solution Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)