C-Arms Market Size, Share, Trends and Forecast by Type, Technology, Application, End User, and Region, 2025-2033

C-Arms Market Size and Share:

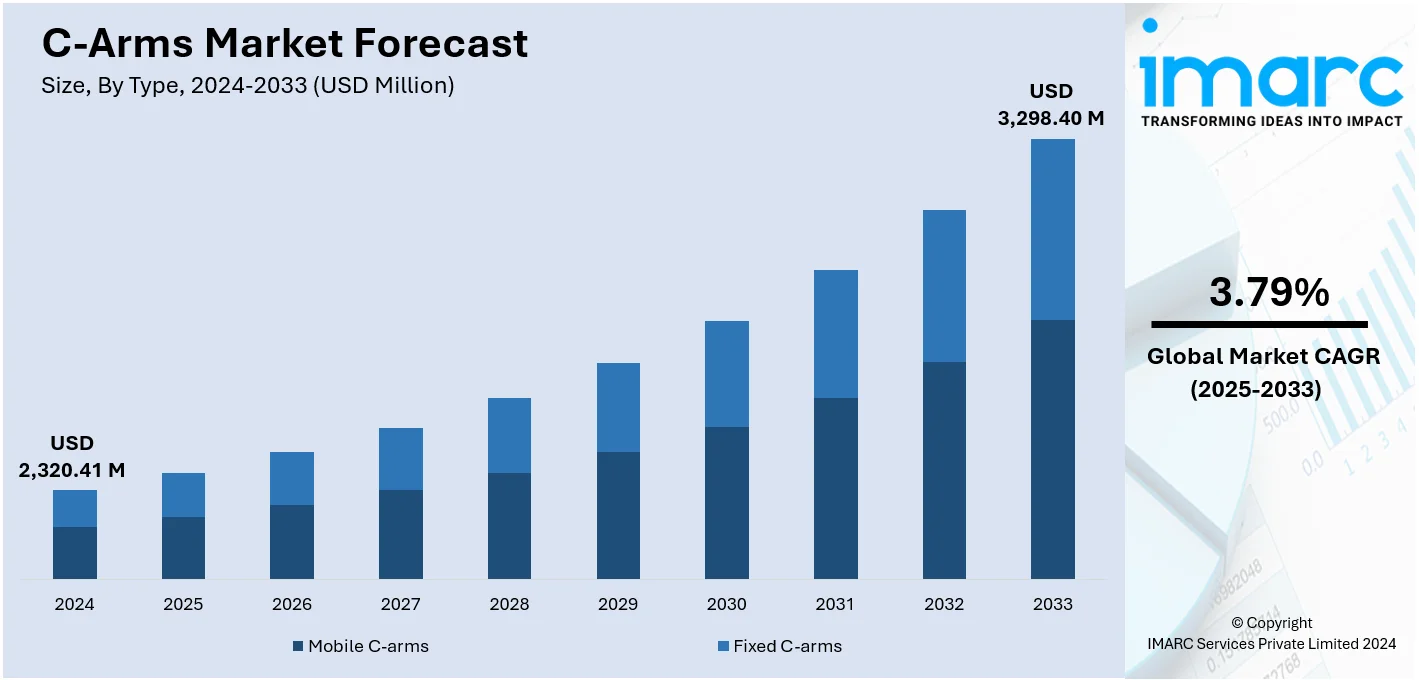

The global C-arms market size was valued at USD 2,320.41 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,298.40 Million by 2033, exhibiting a CAGR of 3.79% from 2025-2033. North America currently dominates the market, holding a market share of over 35.5% in 2024. The market is propelling due to the escalating demand for advanced imaging technologies in minimally invasive surgeries, orthopedics, and cardiovascular procedures. Innovations like 3D imaging and portable systems enhance precision and flexibility, contributing to the growing C-arms market share. Moreover, increasing healthcare investments and the shift toward outpatient care drive global adoption across hospitals and surgical centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,320.41 Million |

|

Market Forecast in 2033

|

USD 3,298.40 Million |

| Market Growth Rate 2025-2033 | 3.79% |

The market is defined by the growing demand for minimally invasive surgical solutions, driven by the need for precise imaging among individuals with chronic diseases. Technological improvements, which include 3D imaging, flat-panel detectors, and digital radiography, are improving diagnostic accuracy and operational efficiency, thereby favoring the market growth. Medical professionals increasingly prefer moveable and compact C-arms due to their enhanced flexibility and adaptability in operating rooms and emergency settings. Additionally, the rising awareness of advanced medical imaging technologies has driven greater adoption of C-arms, particularly among the growing elderly population, who frequently require diagnostic and interventional procedures. Investments in healthcare infrastructure in emerging economies further bolster this trend, as these regions seek to address unmet medical needs. Such investments provide significant opportunities for market expansion, particularly in underserved areas with high demand for modern imaging solutions.

To get more information on this market, Request Sample

In the United States, the C-arms market is propelled by the country’s well-established healthcare infrastructure and high prevalence of orthopedic and cardiovascular conditions. The emphasis on outpatient care and ambulatory surgical centers is increasing the demand for mobile C-arms, which provide cost-effective and efficient imaging solutions. For instance, in November 2024, GE HealthCare, a U.S. based company, announced advanced clinical applications for the OEC 3D mobile CBCT C-arm, enhancing visualization and navigation during endoscopic bronchoscopy, with verified interfaces for robotic and navigation systems to improve procedural accuracy and efficiency. In addition, the integration of artificial intelligence and real-time imaging technologies further supports market growth, catering to the growing need for precise surgical guidance. Furthermore, government initiatives promoting healthcare innovation, coupled with favorable reimbursement policies, are fostering the widespread adoption of advanced C-arm systems, positioning the U.S. as a leader in the global market.

C-Arms Market Trends:

Rising Prevalence of Chronic Diseases and Demand for Minimally Invasive Procedures

Increasing incidences of chronic diseases including cardiovascular disorders, musculoskeletal illnesses, and cancers are creating increasing needs for modern diagnostic and interventional surgical treatment that are fostering growth in the C-arms market across the globe. A primary advantage is that these C-arms will allow real-time imaging, without which the less-invasive interventional procedures become virtually impossible; accuracy and clinical results thus improve immensely. The rising aging population fuels this demand as elderly people are more prone to chronic conditions and often require more advanced diagnostic imaging and precision-based surgeries. According to the WHO, by 2030, 1 in 6 people will be aged 60 years or older, with the share of this population increasing from 1 billion in 2020 to 1.4 billion. Apart from this, the FAO has estimated that by 2020, chronic diseases will take almost 75% of total deaths globally. Furthermore, 71% of total deaths due to IHD, 70% due to diabetes, and 75% attributed to stroke will be accounted for in developing countries. This gives a clue on how C-arms can become crucial in health care as healthcare needs grow in areas of the world where such is happening in an ever-increasing burden of chronic diseases.

Technological Advancements in Imaging Systems

Innovations in C-arm technology such as the use of flat-panel detectors, 3D imaging, and mobile C-arms are driving growth in the global C-arms market. Such technology has greatly improved the quality of images, as well as the efficiency and precision of operations, leading to accurate diagnostics and better surgical outcomes. Therefore, they have been in great demand globally by hospitals, clinics, and ambulatory surgical centers. Moreover, the market dynamics are being redefined with advanced image processing by AI and machine learning. For instance, in April 2022, Omega Medical Imaging, LLC introduced Soteria.AI, a dedicated modality for cardiology labs that has been proven to decrease the dosage of radiation by 84% with high-quality imaging. In the same way, in November 2021, Canon Medical Systems Corporation unveiled its High-Definition (Hi-Def) imaging detector as part of its C-arm systems, including the Alphenix Sky. Such detectors resolve the images, allowing clinicians to perform better treatment of patients. The constant improvement of C-arms highlights its importance in medical imaging and surgery.

Expansion of Healthcare Infrastructure in Emerging Markets

There has been a heavy investment in health infrastructure by the government and private bodies in developing nations, which improves the access of citizens to state-of-the-art medical technology. It is further pushing the demand for multispecialty hospitals and diagnostic centers as their demand has become very high due to healthcare service expansion across areas like Asia-Pacific, Latin America, and the Middle East. In all these areas, such expansions have drastically increased the requirement for C-arms that find significant usage in diagnostic imaging and minimally invasive procedures. In addition, refurbished C-arms have become widely available, making it easier for small healthcare facilities to afford these systems and thus contributing further to market growth. For example, in India, health-related government spending went up by 16.6% between the years 2019-20 and 2020-21, according to the Press Information Bureau (PIB). This hike in healthcare budgeting is seen as a stepping stone toward better medical infrastructure, which fosters an amiable environment for adopting C-arm systems in developing countries.

C-Arms Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global C-arms market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, application, and end user.

Analysis by Type:

- Mobile C-arms

- Fixed C-arms

Mobile C-arms are the dominant segment in the global C-arms market, typically impacted by their versatile attributes and escalating need across several critical medical purposes. Such portable, compact built imaging systems provide substantial benefits in diagnostic as well as surgical procedures, facilitating imaging in real-time in the outpatient room, operating setting, or intensive care units. In addition to this, their exceptional capability to offer clear, premium quality images while exhibiting convenient manoeuvrable abilities significantly improves their preferences amongst healthcare professionals. Besides this, with emerging procedural volumes and increasing efforts to invest extensively in healthcare infrastructure upgrading, especially pain management, orthopedics, and cardiology, mobile C-arms are established to sustain their domination in the industry throughout the forecast period.

Analysis by Technology:

- Image Intensifiers

- Flat Panel

Image intensifiers are the leading technology segment in the global C-arms market, owing to their ability to enhance image quality and improve diagnostic precision. These devices convert low-intensity X-rays into bright, clear images, enabling real-time visualization during medical procedures. Image intensifiers are used in a number of different specialties such as orthopedics, cardiology, or trauma care needing high-resolution imaging for diagnostics. Their cost-effectiveness, reliability, and wide adoption in both mobile and stationary C-arm systems, contributing to the market dominance. As the demand for healthcare product and services particularly in advance imaging continues to grow, image intensifiers will therefore remain relevant within the C-arms technology market.

Analysis by Application:

- Cardiology

- Gastroenterology

- Neurology

- Orthopedics and Trauma

- Oncology

- Others

Orthopedics and trauma lead the market with around 32.7% of market share in 2024. This is primarily due to the high demand for real-time imaging during surgical procedures. C-arms provide critical support in orthopedic surgeries, such as fracture fixation, joint replacement, and spinal surgery, by offering clear, detailed images that guide surgeons. In trauma care, C-arms enable rapid, precise imaging for injury assessment and intervention. The increasing incidence of orthopedic conditions and trauma-related injuries, coupled with advancements in C-arm technology, ensures the continued dominance of this segment. Moreover, the increasing preference for minimally invasive procedures continues to fuel the rising demand for C-arms in such applications.

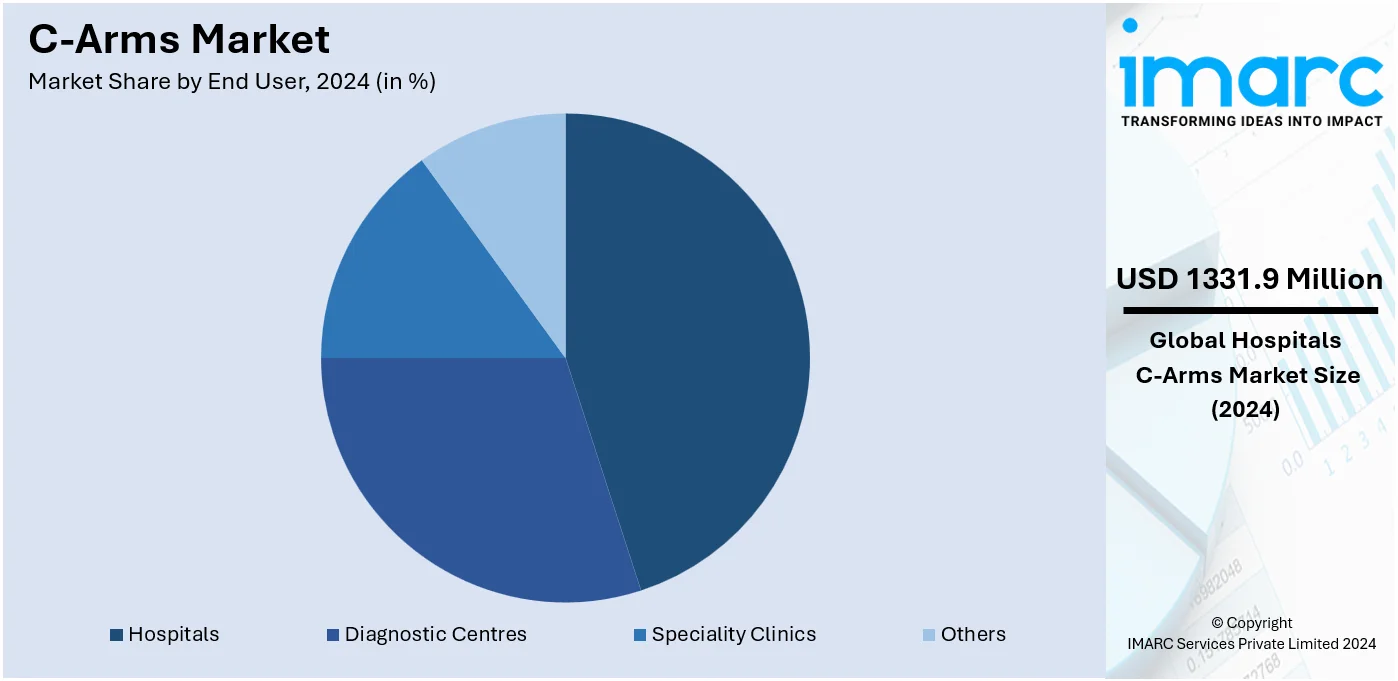

Analysis by End User:

- Hospitals

- Diagnostic Centres

- Speciality Clinics

- Others

Hospitals leads the market with around 57.4% of market share in 2024. The segment is driven by their essential role in providing advanced diagnostic and surgical care. C-arm facilities are used in various departments in the hospital institution like orthopedics, cardiology, neurology, and emergency medicine for real-time imaging of complex procedures. The increasing demand for minimally invasive surgeries and more precise diagnostic tools continues to emphasize the dependence on having C-arms within hospitals. Hospitals' adoption of advanced medical technologies and improved healthcare infrastructure ensures sustained market growth.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.5%. This stems from the presence of sophisticated healthcare systems, widespread implementation of state-of-the-art medical innovations, and a growing preference for procedures that are minimally invasive. The area gains significant advantages from the active involvement of leading industry players who are dedicating resources to research and development, aiming to launch cutting-edge imaging technologies. Favorable reimbursement policies and a growing geriatric population with higher incidences of orthopedic and cardiovascular conditions further driving the C-arms market growth. The region leads with significant investments in healthcare, while Canada follows with increasing adoption of portable and compact C-arms. Furthermore, North America’s robust focus on outpatient care and precision imaging solidifies its market leadership.

Key Regional Takeaways:

United States C-arms Market Analysis

In 2024, United States accounted for 84.30% of the market share in North America. The upward trend of outpatient surgeries for the last two decades in the United States has been a significant growth driver for the demand for advanced medical imaging technologies, such as C-arms. This upward trend has been driven by gains in surgical technology advancements, improved anesthetic techniques, and changing patient preferences for less invasive procedures with quicker recovery times. More than 60% of all surgical procedures performed in the United States are now performed on an outpatient basis, a fact which further underlines increasing reliance on portable and efficient imaging solutions. More importantly, the increasing statistics of chronic diseases like heart diseases have increased the demand for high-precision imaging systems, and one of them is C-arms. In this regard, as reported by the CDC, heart diseases led to 702,880 deaths in 2022, making it a cause for 1 in every 5 deaths in the country. So, this raises the need for better diagnostic and surgical imaging tools in treating seriously fatal conditions, which further gives a boost to the market of C-arms in the United States.

Europe C-arms Market Analysis

Cardiovascular disease is one of the biggest challenges in health across Europe, and significantly influences the requirement for advanced medical imaging solutions, such as C-arms. According to an industrial reports, in European countries, about 4.1 million deaths occur each year due to CVD, pointing out the need for accurate diagnosis and surgical interventions. In the United Kingdom alone, 7.6 million people have CVD, leading to around 163,000 annual deaths, which is approximately one death each three minutes.

Lifestyle factors, including smoking, are an important contributor to the burden of CVD. According to a recent 2021 report by Action on Smoking and Health, approximately 20,000 of these deaths are directly attributed to smoking as well as 1 in 8 of these deaths. The growing burden of CVD requires adequate and time-effective imaging systems to guide minimally invasive surgeries and improving patient outcomes. This booming demand, along with the growth in healthcare facilities all around Europe, sets up the C-arms market to experience significant expansion in the region.

Asia Pacific C-arms Market Analysis

Growth in the healthcare sector, Asia-Pacific region, is currently robust and drives quite high demand for C-arms. The healthcare industry, across the region especially in countries like India, China, Japan, and South Korea, has observed considerable public and private investments. According to an industrial report, India's healthcare industry has grown to reach USD 372 Billion in 2023. In the country, government spending on healthcare also saw a growth of 16.6% between 2019 and 2021. This reflects a growing focus in the region on developing healthcare infrastructure. This rise in healthcare investments is accompanied by a growth in multispecialty hospitals, diagnostic centers, and ambulatory surgical centers that need advanced imaging technologies like C-arms. Furthermore, the increasing incidence of chronic diseases and the aging population in the region also enhance the demand for high-quality, real-time imaging solutions, and this bodes well for the future of the C-arms market in the Asia-Pacific region.

Latin America C-arms Market Analysis

The growth and development of the healthcare industry in Latin America are contributing to a significant growth trend in the C-arms market. Brazil, Mexico, and Argentina have increased the attention on building their healthcare infrastructure along with more advanced medical devices. This has led Brazil's health sector to observe steady growth in surgical procedures. The Brazilian Hip Society estimated that in 2020, 70,000 hip arthroplasties were performed yearly, with a growing proportion being done in private healthcare settings. This shift to private healthcare is driving demand for advanced imaging technologies such as C-arms, especially for orthopedic and minimally invasive surgeries.

Nevertheless, the growing incidence of chronic diseases in addition to an aging population and broader access to health services will create a higher demand for precision imaging solutions from hospitals, surgical centers, and diagnostic clinics. This is likely to further propel the use of C-arms in Latin America's health care sector.

Middle East and Africa C-arms Market Analysis

The Middle East and Africa region is experiencing growth in health infrastructure, driven by massive investments and increased demand for the latest medical technologies. In the GCC countries, the health sector is going to experience tremendous growth, as health expenditure is expected to reach USD 135.5 billion by 2027, according to the World Economic Forum. These include prevention care, technology, and incorporation of new concepts into health service delivery. To that end, Saudi Arabia also includes over $65 billion into the budget it has to dedicate to its plan Vision 2030 for renovating health services infrastructure. Its increase will surely drive up demands for good image solutions like the C-arm systems. The aging population in the region, along with the growing prevalence of chronic diseases, drives the demand for precise diagnostic and surgical interventions. This is forcing greater adoption of C-arms across hospitals, clinics, and surgical centers in the MEA region.

Competitive Landscape:

The competitive landscape of the C-arms market is established by the presence of key players and emerging manufacturers, driving innovation and technological advancements. Companies focus on developing compact, portable systems and advanced features like 3D imaging to cater to the increasing need for less invasive surgical techniques. Moreover, strategic initiatives, including partnerships, acquisitions, and extensive R&D investments, enable businesses to strengthen their market presence and meet evolving healthcare needs. For instance, in December 2024, Philips expanded its partnership with Sim&Cure to integrate Sim&Size software into the Azurion platform, enhancing precision, efficiency, and workflow in neurovascular procedures, particularly for brain aneurysm treatments using C-arms. Besides this, the widespread employment of AI and machine learning in imaging systems enhances diagnostic accuracy and operational efficiency, intensifying competition. Expanding applications in orthopedics, cardiology, and outpatient care further shaping the C-arms market outlook.

The report provides a comprehensive analysis of the competitive landscape in the C-arms market with detailed profiles of all major companies, including:

- AADCO Medical Inc.

- Allengers

- BPL Medical Technologies

- Canon Medical Systems Corporation

- Ecotron co., Ltd.

- FUJIFILM Corporation

- GE HealthCare

- Hologic, Inc.

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Siemens Healthineers AG

- SternMed GmbH

- Ziehm Imaging GmbH

Latest News and Developments:

- March 2024: Siemens Healthineers released a new high-end automated, self-driving C-arm system intended to improve intraoperative imaging during surgical interventions.

- February 2024: Koninklijke Philips N.V. launched the Zenition 90 Motorized, a mobile C-arm system designed to enhance surgical imaging and improve patient care. This advanced system supports complex vascular procedures, cardiac interventions, and pain management, offering high-quality imaging and user-friendly controls for surgeons. It features automated workflows and a Touch Screen Module for efficient operation. Sustainability is prioritized, with a 25% increase in product life and 13% better energy efficiency compared to its predecessor.

- September 2023: Koninklijke Philips N.V. has announced the launch of its new addition to the family of mobile C-arm systems with the Zenition 30.

- May 2023: Koninklijke Philips N.V. announced the Zenition 10 as its newest addition to the company's mobile C-arm systems, said to offer higher versatility and performance.

C-Arms Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mobile C-arms, Fixed C-arms |

| Technologies Covered | Image Intensifiers, Flat Panel |

| Applications Covered | Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, Oncology, Others |

| End Users Covered | Hospitals, Diagnostic Centres, Speciality Clinics, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AADCO Medical Inc., Allengers, BPL Medical Technologies, Canon Medical Systems Corporation, Ecotron co., Ltd., FUJIFILM Corporation, GE HealthCare, Hologic, Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers AG, SternMed GmbH, Ziehm Imaging GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the C-arms market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global C-arms market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the C-arms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The C-arms market was valued at USD 2,320.41 Million in 2024.

IMARC estimates the C-arms market to exhibit a CAGR of 3.79% during 2025-2033.

The market is primarily driven by the increasing demand for minimally invasive procedures, advancements in imaging technology, and rising healthcare investments. Additionally, the growing prevalence of orthopedic, cardiovascular, and trauma-related conditions, along with the need for real-time imaging in surgeries, further contributes to the market's expansion globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the C-arms market include AADCO Medical Inc., Allengers, BPL Medical Technologies, Canon Medical Systems Corporation, Ecotron co., Ltd., FUJIFILM Corporation, GE HealthCare, Hologic, Inc., Koninklijke Philips N.V., Shimadzu Corporation, Siemens Healthineers AG, SternMed GmbH, Ziehm Imaging GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)