Butterfly Valve Market Size, Share, Trends and Forecast by Product Type, Material Type, Design, Function, End-Use Industry, and Region, 2025-2033

Butterfly Valve Market Size and Share:

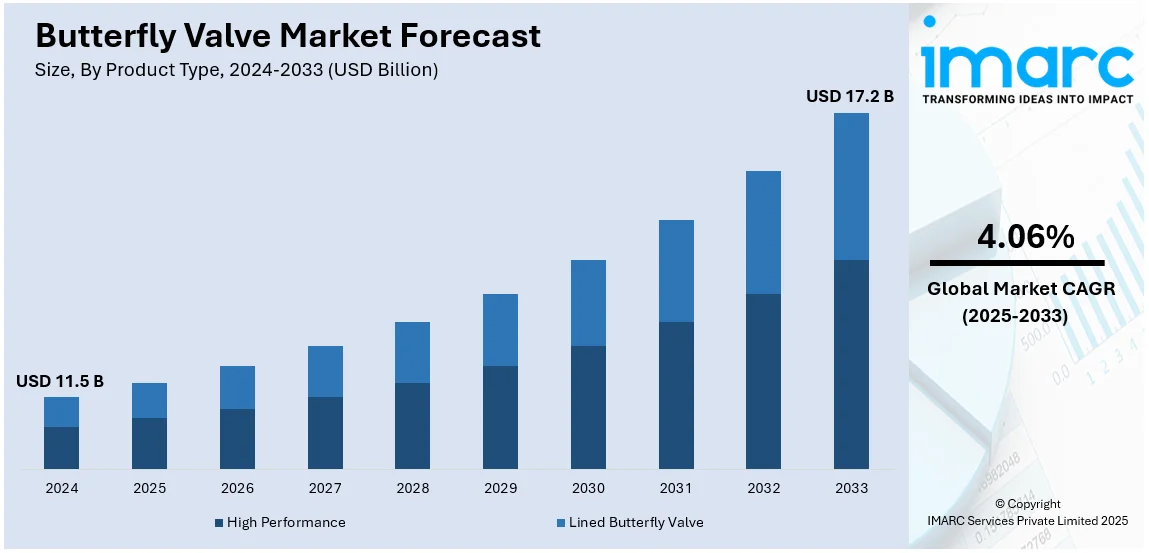

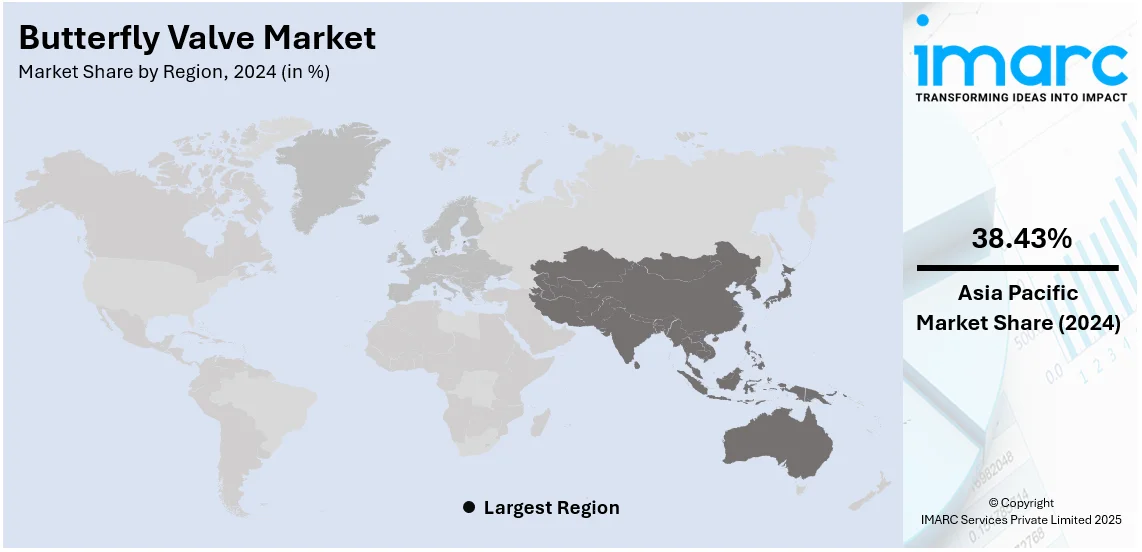

The global butterfly valve market size was valued at USD 11.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.2 Billion by 2033, exhibiting a CAGR of 4.06% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 38.43% in 2024. This regional market is chiefly impacted by amplifying investments in water and energy management industries, bolstering industrialization, and proliferating infrastructure ventures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.5 Billion |

|

Market Forecast in 2033

|

USD 17.2 Billion |

| Market Growth Rate 2025-2033 | 4.06% |

The global butterfly valve market is majorly propelled by accelerating requirement for effective flow control systems in crucial sectors, mainly power generation, oil and gas, or water treatment. Revolutionary innovations in valve technology, encompassing improved longevity and sealing, are boosting utilization across crucial operations. Moreover, the fueling emphasis on automation in industrial setting and the notable incorporation of smart valves to enhance operational efficacy further bolster market expansion. In addition, elevating investments in energy segments and proliferating infrastructure ventures also foster the fueled need for butterfly valves. Furthermore, their versatility and cost-efficiency across varied environments position them as an ideal option in modern industrial functions.

The United States plays a significant role in the global butterfly valve market, driven by its advanced industrial infrastructure and robust demand across key sectors such as oil and gas, water treatment, and power generation. The market heavily benefits from the adoption of high-performance valves tailored for stringent regulatory and operational standards. Besides this, innovations in materials and smart valve technologies further bolster growth. In addition to this, the rising focus on sustainability and efficient fluid control systems supports the adoption of butterfly valves in modern applications, reinforcing the United States' position as a critical market in the global landscape. For instance, in January 2024, Emerson, a U.S.-based prominent butterfly valves manufacturer, launched Fisher easy-Drive 200R Electric Actuator, compatible with butterfly valves. The actuator delivers reliable and accurate performance, even in challenging conditions often faced in sectors such as oil and gas, especially in cold, isolated regions. When integrated with such valves, it enhances performance, maximizes uptime, and minimizes emission risks typically associated with gas-powered systems.

Butterfly Valve Market Trends:

Growing industrialization, along with the rising trend of automation in the oil and gas industry, is one of the primary factors fueling the market's growth. Butterfly valves are extensively used in the extraction of crude oil and gas from refineries, oil terminals and depots. They are also utilized to enhance the operational efficiency of the industrial production process. Furthermore, increasing investments for power generation in developing nations are also expected to catalyze the market growth. According to reports, India's Electricity Generation sector, with an installed capacity of 410,339.23 MW, offers 831 investment opportunities valued at USD 342.21 Billion. As non-fossil fuel electricity is set to reach 64% by 2029-30, this growth boosts demand for critical infrastructure, including butterfly valves. The rise of smart cities, characterized by high energy efficiency, is boosting the adoption of butterfly valves. Simultaneously, the demand for stainless steel models is increasing due to their ability to endure high pressures while requiring minimal maintenance. These valves are lightweight, compact, and cost-effective to operate, making them ideal for applications such as pulp and paper manufacturing, fuel systems, and HVAC systems like refrigeration and air conditioning. Additionally, advancements like 3D printing in valve production and the integration of Industrial Internet of Things (IIoT) technologies to enhance operational performance are expected to further propel the butterfly valve market growth further.

Butterfly Valve Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global butterfly valve market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, material type, design, function, and end-use industry.

Analysis by Product Type:

- High Performance

- Lined Butterfly Valve

- Rubber Lined Butterfly Valve

- Plastic Lined Butterfly Valve

High performance valve stands as the largest product type in 2024, holding around 64.5% of the market. This is attributed to their preeminent ability to operate under elevated temperature and pressure conditions. Such valves are comprehensively leveraged in applications demanding dependable sealing and accurate flow control, especially in industries like energy production, chemical manufacturing, and oil and gas. Moreover, their cutting-edge design facilitates reduced leakage, even in challenging parameters, establishing them as vital component for crucial operations. Furthermore, with rapid increase in industrialization and requirement for efficacy-driven solutions, producers are emphasizing on improving both the performance and durability of such valves through advanced technologies. The amplifying focus on operational dependability and safety further strengthens high-performance valves as the key product type in the global market.

Analysis by Material Type:

- Stainless Steel

- Cast Iron

- Aluminium

- Others

Stainless steel leads the market with around 36.8% of market share in 2024. This is owned to its superior longevity, robustness, and resistance against corrosion. It is especially preferred in sectors dealing with and demanding operational ecosystems, aggressive or corrosive chemicals, and elevated temperatures. Furthermore, the material's resilience and capability to endure vigorous conditions make it preferable option for utilization in chemical processing or oil and gas industries. In addition, stainless steel valves provide compatibility with both low-pressure and high-pressure systems, facilitating flexibility across wide range of applications. Moreover, heavy investments in industrial and infrastructure ventures worldwide are significantly bolstering the deployment of stainless steel butterfly valves, as they offer a cost-efficient solution with reduced maintenance requirements, sustaining their position as an ideal material in the market.

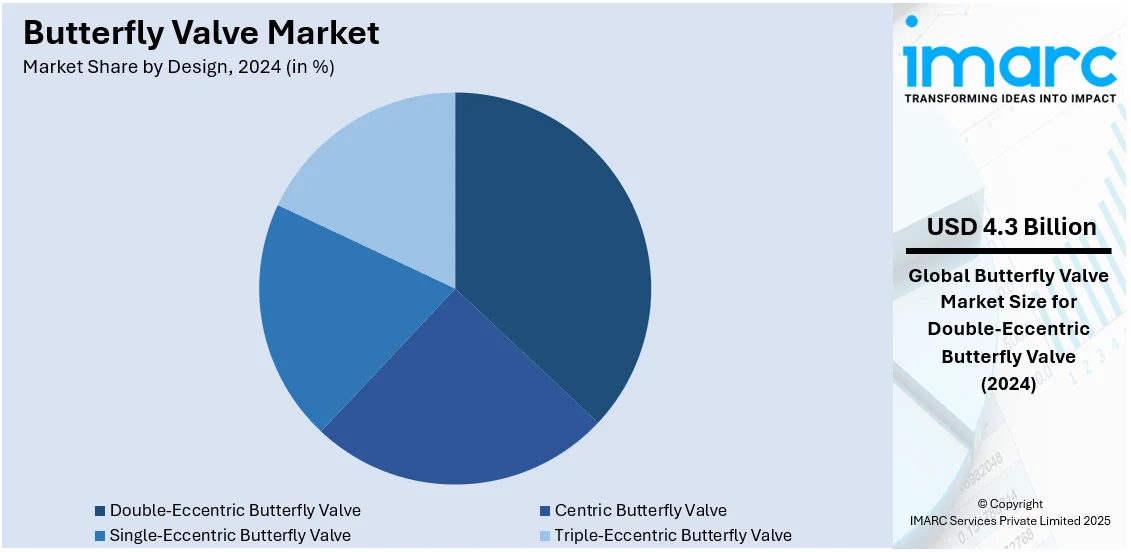

Analysis by Design:

- Centric Butterfly Valve

- Single-Eccentric Butterfly Valve

- Double-Eccentric Butterfly Valve

- Triple-Eccentric Butterfly Valve

Double-eccentric butterfly valve leads the market with around 37.1% of market share in 2024. These valves offer enhanced sealing performance and reduced wear and tear due to their unique offset design, which minimizes contact between the disc and seat. This makes them suitable for demanding applications where reliability and operational efficiency are paramount like in power generation plants, water purification facilities, and petroleum refineries. Moreover, the double-eccentric design also enables quick and easy operation, reducing downtime and improving process efficiency. Furthermore, as industries prioritize sustainability and operational precision, the demand for these valves continues to grow, reinforcing their leadership within the design segment of the global butterfly valve market.

Analysis by Function:

- On/Off Valve

- Control Valve

On/Off valve stand as the largest component in 2024, holding around 62.48% of the market. This domination pertains to their high dependability and less complexity. These valves are designed to either completely stop or allow flow, making them essential in applications requiring straightforward flow control. Furthermore, industries such as water treatment, HVAC, and chemical processing heavily rely on these valves for their ease of use and low maintenance. Their compatibility with automation systems further enhances their efficiency in modern industrial settings. In addition to this, the growing need for cost-effective and dependable solutions for flow management across multiple industries solidifies on/off valves as the dominant functional segment within the butterfly valve market.

Analysis by End-Use Industry:

- Oil and Gas Industry

- Water and Wastewater Industry

- Power Generation Industry

- Chemical Industry

- Others

Oil and gas industry leads the market with around 25.82% of market share in 2024. This is due to its extensive need for flow control solutions in upstream, midstream, and downstream operations. Butterfly valves are widely used in pipeline systems, refining processes, and storage facilities for their capability to manage high pressure and temperature fluctuations effectively. Moreover, the industry's continuous expansion, driven by rising energy demand and investments in exploration and production activities, significantly contributes to the growth of this segment. Additionally, stringent safety regulations and the necessity for reliable equipment in hazardous environments make butterfly valves a preferred choice in the oil and gas sector, ensuring their dominance in the end-use industry segment.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 38.43%. In the Asia-Pacific region, economic growth is a key driving factor for the butterfly valve market, particularly in emerging economies like China and India. The expanding industrial sector, including manufacturing, chemical processing, and power generation, drives the demand for fluid control solutions such as butterfly valves. The rapid urbanization and industrialization in these countries result in increased investments in infrastructure projects, particularly in water and wastewater management systems, where reliable valve systems are crucial. Additionally, the rising demand for energy, particularly in renewable energy sectors like solar and wind, has led to increased demand for high-performance valves in power plants. According to ITA, India, the third-largest energy consumer, aims to achieve 500 GW of non-fossil energy capacity by 2030, with renewable energy comprising 50% of its energy mix. This transition to renewables enhances the need for reliable components, such as butterfly valves, to support energy systems, ensuring efficient fluid and gas flow management in renewable energy plants. Technological advancements in valve materials, such as corrosion-resistant alloys and durable elastomers, also play a role in expanding the market. Government initiatives and regulations aimed at enhancing energy efficiency and environmental protection further boost the adoption of butterfly valves. Additionally, the increasing focus on industrial automation, with the integration of smart valves and control systems, is set to drive the market in the region, as industries seek to improve efficiency and reduce operational costs.

Key Regional Takeaways:

United States Butterfly Valve Market Analysis

In 2024, United States accounted for the 82.50% of the market share in North America. The growth of the butterfly valve market in the United States is driven by the growing need for energy-saving solutions in sectors like oil and gas, chemical processing, and water treatment. The country’s extensive infrastructure development, along with a push for modernization in utilities and industrial applications, fuels the need for advanced valve systems. For instance, in September 2023, the USD 25 Trillion U.S. economy, supported by aging infrastructure, is benefiting from the largest federal investment in decades through the bipartisan infrastructure law, boosting sectors like butterfly valves essential for modernizing water systems, electrical grids, and transportation networks. Regulatory standards and safety protocols also contribute to market expansion, as companies adopt high-quality butterfly valves to ensure compliance with environmental and operational standards. Moreover, the demand for automation in manufacturing plants and pipelines enhances the market’s growth, as butterfly valves offer quick, reliable control of fluid flow. The rising focus on sustainable practices and energy conservation within industries encourages the adoption of energy-efficient valve technologies. Technological advancements in valve design and materials also play a pivotal role, as manufacturers introduce corrosion-resistant and high-performance valves, further boosting their application in various sectors. The country’s robust industrial sector, along with increased investments in water infrastructure and waste management systems, is expected to continue driving the growth of the butterfly valve market in the United States.

Europe Butterfly Valve Market Analysis

In Europe, the adoption of butterfly valves is primarily driven by stringent environmental regulations and the industrial focus on sustainability. The chemical and pharmaceutical sectors demand high-performance valves for managing hazardous and high-purity substances under controlled conditions. European manufacturers butterfly valves for their compact design and operational efficiency, which align with space and energy-saving objectives. The pulp and paper industry is another significant user, as these valves are ideal for handling slurry and fibrous materials with minimal wear and maintenance. The increasing investment in desalination plants to address water scarcity concerns has further boosted demand for corrosion-resistant butterfly valves capable of withstanding saline environments. Moreover, the food processing sector has a strong requirement for sanitary butterfly valves, designed to ensure compliance with hygiene standards and facilitate easy cleaning. The focus on transitioning to advanced manufacturing technologies has led to the integration of smart valve systems that support data-driven operational optimization in European facilities. The adoption of butterfly valves in power generation, particularly in hydropower and thermal plants, is supported by their efficiency in controlling high-capacity fluid flow. According to EU, In 2022, the EU's net electricity generation dropped by 3.1% to 2,701 TWh, 5.0% below its 2008 peak of 2,844 TWh, emphasizing efficiency needs where butterfly valves enhance power plant performance by optimizing flow control and reducing energy losses. With a strong emphasis on operational longevity and reduced environmental impact, butterfly valves remain a critical component in Europe’s industrial landscape.

Latin America Butterfly Valve Market Analysis

Latin America’s demand for butterfly valves is propelled by its flourishing industrial processing sectors. The mining industry relies on these valves for handling abrasive and slurry applications in ore processing. For instance, in May 2024, Latin America, holding 58.4% of global lithium reserves, remains a mining hotspot despite economic and social challenges, with USD 19.3 Million tons of lithium resources in Argentina alone. Butterfly valves benefit significantly from the mining boom by enabling precise flow control in lithium extraction processes, aligning with rising demands and energy transition goals. The rise of beverage and food industries has also increased the need for hygienic and corrosion-resistant valve options to maintain operational compliance. Furthermore, pulp and paper manufacturing industries require robust flow control solutions for high-capacity applications, making butterfly valves an optimal choice. The focus on improving industrial productivity and reducing maintenance costs has driven manufacturers to adopt reliable and lightweight valves. These factors collectively drive the utilization of butterfly valves across key sectors in Latin America.

Middle East and Africa Butterfly Valve Market Analysis

In the Middle East and Africa, butterfly valve adoption is fuelled by the region’s emphasis on efficient fluid control across various industrial applications. The oil and gas sectors prioritize these valves for their ability to operate under extreme conditions while minimizing leakage risks in pipelines. For instance, in January 2024, Saudi Arabia's vast oil and gas sector, holding 17% of global petroleum reserves and producing 13.6 mmbpd in 2022, highlights robust investment in cleaner energy and technologies like CCUS. This environment drives demand for butterfly valves, essential for efficient fluid control in oil, gas, and petrochemical processes, aligning with Saudi Aramco's USD 161.1 Billion net income and ambitious capital programs. Agricultural irrigation systems, crucial for water conservation efforts, also rely on durable butterfly valves for precise flow regulation. The industrial manufacturing landscape demands cost-effective and adaptable solutions, further enhancing the appeal of butterfly valves in production lines. Additionally, the growing focus on localized industrialization has prompted the adoption of versatile valve technologies that can be integrated into diverse systems. By addressing the needs of high-temperature and large-scale operations, butterfly valves remain an essential tool in the region’s industrial advancements.

Competitive Landscape:

The competitive landscape is represented by the robust establishment of key players actively emphasizing on tactical collaborations, advancements, and product augmentation to fortify their market position. For instance, in November 2024, Heap & Partners Ltd unveiled its latest Phase Butterfly Valve Range. This proud line envelops high performance triple offset butterfly valves, concentric butterfly valves, and double offset butterfly valves. Besides, several companies are utilizing innovations in valve materials and technology to improve accuracy, effectiveness and durability. Furthermore, industry leaders are rapidly utilizing digital monitoring systems and automation to cater to the trends of industrial modernization. Regional players also elevate competition significantly by aligning with the local needs and providing cost-competitive services. In addition, partnerships, mergers, and acquisitions remain crucial tactics to proliferate product portfolio and geographical foothold. Moreover, with magnifying need across key industries, such as power generation, oil and gas, and water treatment, the market portrays optimistic competition boosted by technological revolution and end-user demands.

The report provides a comprehensive analysis of the competitive landscape in the butterfly valve market with detailed profiles of all major companies, including:

- Alfa Laval Corporate AB

- Curtiss-Wright Corporation

- Flowserve Corporation

- Emerson Electric Co.

- Pentair PLC

- Weir Group PLC

- AVK Group A/S

- Crane Company

- Schlumberger Limited

- Velan, Inc.

- KSB SE & Co. KGaA

- Honeywell International Inc.

Latest News and Developments:

- September 2024: Flomatic has expanded its Sylax® 3 Butterfly Valve line with the introduction of a new 1 1/2” lug style size. This compact valve maintains high-quality performance with a ductile iron body, 316SS disc, and stainless-steel stem, offering efficient flow control. It is NSF/ANSI 61 certified and suitable for applications requiring bi-directional and dead-end capabilities.

- February 2024: GF Piping Systems has expanded its Butterfly Valve 565 portfolio with the introduction of the Lug-Style model, designed for water applications in industries like water treatment, marine, and cooling. The new valve features a lightweight, corrosion-free construction with customizable plug-in inserts, enhancing flexibility and ease of maintenance. Its innovative design facilitates one-sided disassembly, improving operation and service life in piping systems.

- April 2023: JA Moody and Lexair supplied K-LOK valves to the United States Navy. This product line is managed by a small company known for its strong customer service, engineering, and manufacturing. The Navy can expect improved performance and reliability from this collaboration.

- June 2023: Francis Ward and Aliaxis collaborated to tackle food contamination. Together, they developed an industry-first plastic opening valve with FDA and WRAS approvals. Their partnership created a unique solution that effectively reduces contamination risks for their clients.

- July 2022: Valworx introduced a new range of all-stainless air-actuated sanitary butterfly valves. These valves are designed with Tri-Clamp ends for secure hygienic connections. All materials used in the valves meet USDA, FDA, and 3-A standards. The valves are ideal for industries such as pharmaceuticals, food, beverage, personal care, and pet care. This new product enhances efficiency in sanitary applications across multiple sectors.

Butterfly Valve Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product types Covered |

|

| Material Types Covered | Stainless Steel, Cast Iron, Aluminium, Others |

| Designs Covered | Centric Butterfly Valve, Single-Eccentric Butterfly Valve, Double-Eccentric Butterfly Valve, Triple-Eccentric Butterfly Valve |

| Functions Covered | On/Off Valve, Control Valve |

| End-Use Industries Covered | Oil and Gas Industry, Water and Wastewater Industry, Power Generation Industry, Chemical Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Alfa Laval Corporate AB, Curtiss-Wright Corporation, Flowserve Corporation, Emerson Electric Co., Pentair PLC, Weir Group PLC, AVK Group A/S, Crane Company, Schlumberger Limited, Velan, Inc., KSB SE & Co. KGaA and Honeywell International Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the butterfly valve market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global butterfly valve market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the butterfly valve industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The butterfly valve market was valued at USD 11.5 Billion in 2024.

The butterfly valve market is projected to exhibit a CAGR of 4.06% during 2025-2033, reaching a value of USD 17.2 Billion by 2033.

The butterfly valve market is majorly driven by increasing demand for efficient flow control in industries such as oil and gas, water treatment, and power generation, ongoing advancements in valve technologies, rising infrastructure development, and the growing emphasis on energy efficiency.

Asia Pacific currently dominates the market, accounting for a share of around 38.43%. The dominance is driven by rapid industrialization, increasing demand for energy-efficient solutions, expanding oil and gas sector, growing water treatment projects, and rising investments in infrastructure development.

Some of the major players in the butterfly valve market include Alfa Laval Corporate AB, Curtiss-Wright Corporation, Flowserve Corporation, Emerson Electric Co., Pentair PLC, Weir Group PLC, AVK Group A/S, Crane Company, Schlumberger Limited, Velan, Inc., KSB SE & Co. KGaA and Honeywell International Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)