Buttermilk Market in India Size, Share, Trends and Forecast by Sector and State, 2025-2033

Buttermilk Market in India Size Share:

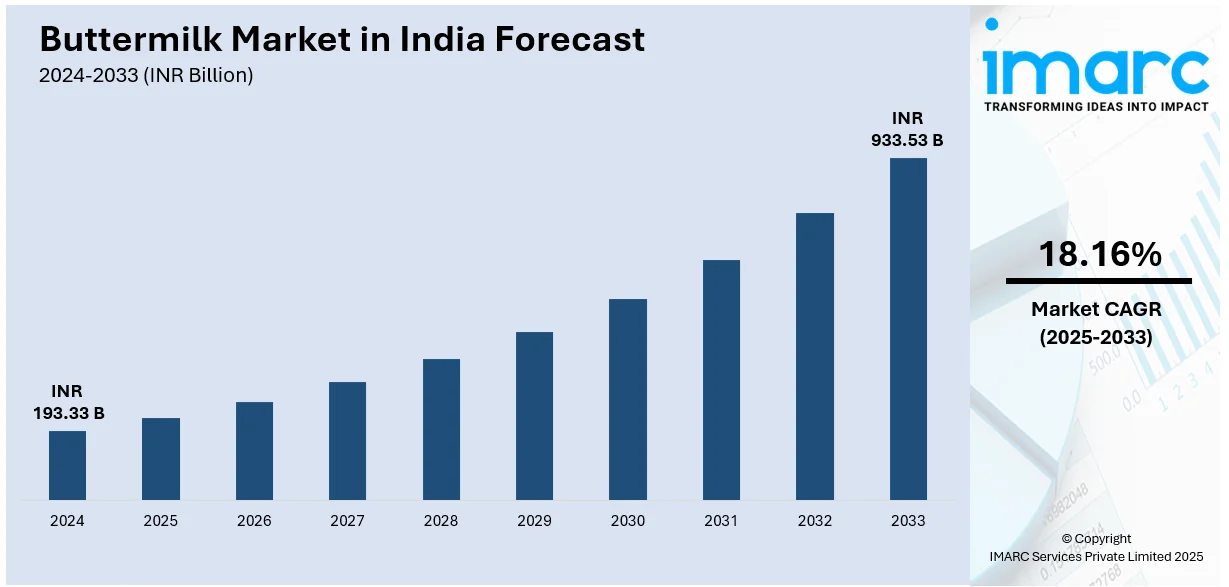

The buttermilk market in India size was valued at INR 193.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 933.53 Billion by 2033, exhibiting a CAGR of 18.16% from 2025-2033. The market is substantially growing due to rising health awareness, increasing demand for probiotic beverages, and the growing preference for convenient, ready-to-drink products. Key drivers include health-conscious urban consumers, product innovations, and broader retail and e-commerce distribution, positioning buttermilk as a popular, nutritious beverage choice.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 193.33 Billion |

|

Market Forecast in 2033

|

INR 933.53 Billion |

| Market Growth Rate (2025-2033) | 18.16% |

A crucial driver of the buttermilk industry across India is the rapidly heightening customer emphasis on health and wellness. As awareness regarding the advantages of gut health as well as probiotics intensifies, buttermilk, prominently acknowledged for its digestive attributes, has attained substantial momentum. For instance, as per industry reports, around 10% of the population in India are affected with digestive conditions, like acid reflux, irritable bowel syndrome, or GERD. As a result, with customers actively navigating nutritious substitutes for sugary beverages, buttermilk has emerged as a functional drink providing both digestive aid and hydration. In addition to this, its low-calorie profile and cost-effectiveness further foster its appeal amongst budget-conscious and health-aware individuals, thereby expanding the buttermilk market in India share.

To get more information on this market, Request Sample

Another key driver is the bolstering requirement for ready-to-drink, convenient beverages. For instance, as per industry reports, ready-to-drink beverage industry across India is exhibited year-on-year elevation of 52% during 2024, reaching around USD 121 Million. Moreover, fueling urbanization and transforming lifestyles have led to the increased acceptance of convenience-based packaged products in India. Buttermilk brands are responding in kind by catering to busy urban lives with a wide range of convenient, grab-and-go, packaged formats. Furthermore, with growing disposable income, especially in major metropolitan areas, there is increased spending on premium, health-oriented products, fueling demand for ready-to-consume buttermilk and boosting the market growth prospects.

Buttermilk Market in India Trends:

Increasing Health and Wellness Focus

A significant trend in the Indian buttermilk market is the growing consumer preference for health-conscious beverages. For instance, as per industry reports, health beverage sector in India has a valuation of USD 10 Billion during 2024 and will further expand to USD 30 Billion by the year 2026, highlighting heightening inclination towards health and wellness trend. Moreover, as awareness of gut health and probiotics increases, buttermilk, recognized for its digestive benefits, has gained popularity. Brands are capitalizing on this by offering probiotic-infused variants, fortified with additional nutrients like calcium and vitamin D. In addition to this, with rising concerns over lifestyle diseases and the shift toward natural, functional beverages, buttermilk is positioned as a nutritious alternative to sugary drinks, driving its demand among urban and health-conscious consumers.

Product Innovation and Flavored Variants

Product diversification is gaining momentum in the Indian buttermilk segment, with flavored buttermilk being its most salient category. Traditionally the drink of choice was buttermilk in its simplest form, but now we see it offered in mint, cumin, and masala flavors. This gives consumers an exciting new taste while keeping the traditional health benefits intact. Another trend is the introduction of premium variants of buttermilk offering organic, low-fat, or high-protein products, which opens new market segments and attracts broader consumer interests toward unique, high-quality drinks. For instance, as per industry reports, in August 2024, Amul launched its new product range with high-protein to cater to the evolving dietary demands. This portfolio also encompasses high-protein buttermilk with 15 grams of protein incorporated in a pack of 200ml.

E-commerce and Retail Expansion

Buttermilk market in India graph illustrates a stable increase in consumer demand due to the rapid growth of e-commerce and retail channels. For instance, as per industry reports, online shopping in India accounts for around 7% of the nation's overall retail industry. In line with this, e-commerce segment in India is anticipated to reach USD 325 Billion by the year 2030. Moreover, online grocery platforms and supermarkets are increasingly stocking ready-to-drink buttermilk to address the customer need for convenience and accessibility. With the rapid adoption of digital shopping, brands are leveraging direct-to-consumer models, ensuring wider reach and better consumer engagement. Additionally, the rise of convenience stores and cold storage networks is enhancing the availability of buttermilk in both urban and semi-urban regions, supporting the sector’s growth and expanding consumer access across the country.

Buttermilk Market in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the buttermilk market in India market, along with forecasts at the country and state levels from 2025-2033. The market has been categorized based on sector.

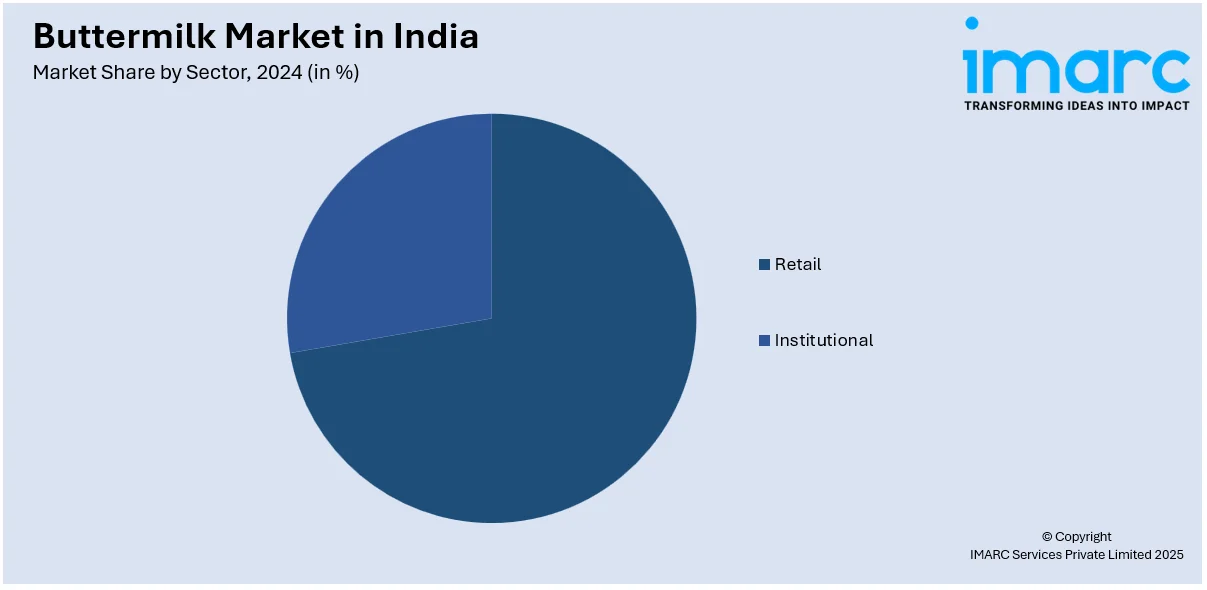

Analysis by Sector:

- Retail

- Institutional

The retail sector holds a dominant share of the buttermilk market in India, driven by rising consumer demand for convenient, ready-to-consume beverages. With the increasing trend of health-consciousness, many consumers prefer packaged buttermilk due to its perceived nutritional benefits, such as probiotics and hydration. Major dairy brands dominate this space through widespread availability in supermarkets, hypermarkets, and online platforms. The retail segment has further expanded with the introduction of various flavor options and packaging sizes, catering to diverse consumer preferences. This sector's growth is also supported by the rising disposable income of urban populations, which fosters greater spending on premium dairy products.

State Analysis:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Tamil Nadu represents a crucial region for the buttermilk market, driven by the state’s deep-rooted dairy culture and preference for refreshing beverages. For instance, IMARC Group states that dairy industry across Tamil Nadu grew to INR 1,380.7 Billion during the year 2024. Buttermilk is widely consumed, especially during the hot summer months. Both local and national brands cater to this demand with various product offerings, including spiced and flavored variants. The market is expanding with increasing customer awareness about health profits, and the rise of organized retail channels is facilitating better distribution of buttermilk products across urban and rural areas.

Competitive Landscape:

The competitive landscape is exhibited by a mix of traditional local producers and large-scale dairy companies. Key players offer ready-to-drink buttermilk products in various packaging formats. Local brands also play a significant role, catering to regional preferences with authentic flavors. Furthermore, the market is witnessing increased product innovation, with variations such as flavored buttermilk and probiotic-enriched options. In addition to this, competitive strategies focus on distribution expansion, product differentiation, and leveraging consumer demand for health-conscious beverages, contributing to the market's growth and fragmentation. For instance, in June 2024, Gujarat Cooperative Milk Marketing Federation, Amul's marketing body, announced plans to strengthen its global footprint by expanding its product portfolio across the United States market. The company will soon launch its variety of products, including buttermilk.

The report provides a comprehensive analysis of the competitive landscape in the buttermilk market in India with detailed profiles of all major companies, including:

- GCMMF

- KMF

- Mother Dairy

- RCDF

- Hatsun

Latest News and Developments:

- In June 2024, Amul unveiled its new variant for buttermilk, Kathiyawadi Chaas. This move is a strategic effort by the company to significantly magnify its sales in buttermilk category.

- In April 2024, Heritage Foods Limited, an India-based buttermilk and other dairy products provider, announced partnership with SIG for aseptic carbon packs packaging for its products. the company also deployed a XSlim 12 Aseptic filling machine, provided by SIG at is production plant in Telangana, India. Post the new packaging launch, the company will unveil new product lines, including spiced buttermilk.

Buttermilk Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Retail, Institutional |

| States Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | GCMMF, KMF, Mother Dairy, RCDF and Hatsun |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the buttermilk market in India market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the buttermilk market in India market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the buttermilk market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The buttermilk market in India was valued at INR 193.33 Billion in 2024.

The market growth is driven by amplifying health awareness, intense need for nutritious beverages, boosting shift towards traditional drinks, increase in popularity of probiotics, and the augmenting urban population. In addition, the convenience of ready-to-drink buttermilk variants is further magnifying market growth.

IMARC estimates the buttermilk market in India to reach INR 933.53 Billion by 2033, exhibiting a CAGR of 18.16% from 2025-2033.

Tamil Nadu currently dominates the buttermilk market in India. This dominance is fueled by its hot climate, strong cultural preference for spiced buttermilk, and well-established dairy industry ensuring consistent supply and distribution.

Major players in the buttermilk market in India include GCMMF, KMF, Mother Dairy, RCDF, Hatsun, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)