Business Information Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Business Information Market Size and Share:

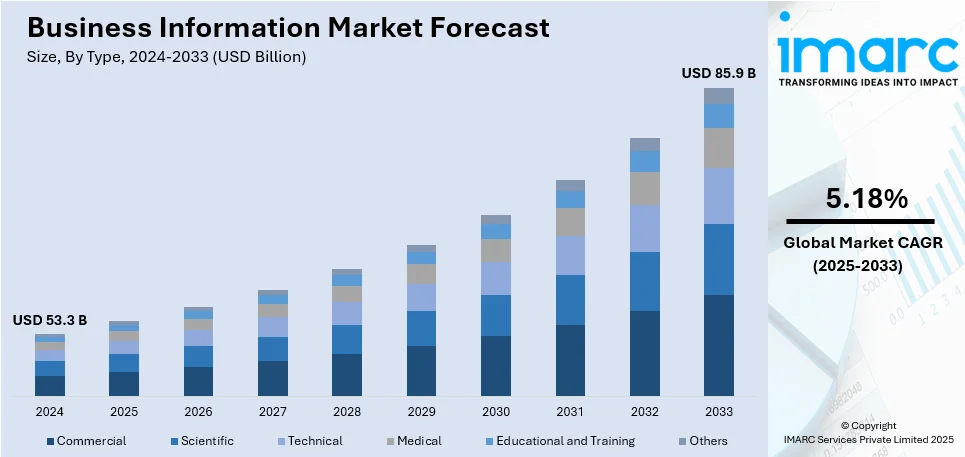

The global business information market size reached USD 53.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 85.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. North America currently dominates the market, holding a market share of over 38.4% in 2024. The market is experiencing steady growth driven by the increasing need to manage, store, and process data effectively, rising adoption of advanced data analytics, machine learning (ML), and artificial intelligence (AI) tools, and the growing focus on protecting digital assets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.3 Billion |

|

Market Forecast in 2033

|

USD 85.9 Billion |

| Market Growth Rate 2025-2033 | 5.18% |

The global business information market is principally impacted by the escalating dependency on data-driven decision-making across various segments. The deployment of leading-edge technologies, like ML, AI, and big data analytics has substantially improved the capability of companies to attain feasible insights from huge datasets. Fueling need for sector-specific data and real-time market intelligence is further extending the business information market share. In addition to this, magnifying necessity of regulatory adherence and proliferating digitalization across key industries have boosted the requirement for dependable business information services. Such factors collectively establish the market for steady growth as various enterprises gravitate towards competitive intelligence and tactical strategic planning.

The United States plays a critical role in the global business information industry, chiefly propelled by robust presence of dominant market players and its upgraded technological infrastructure. For instance, Bloomberg LP is a major business information company that is based in the U.S. and has annual revenue of around USD 984.4 million. The nation’s intensely diversified economy develops significant requirement for data-based insights across critical industries, encompassing retail, healthcare, and finance. Furthermore, numerous organizations in the United States utilize innovative analytics tools and business intelligence services to upgrade operations, aid decision-making, and attain a competitive edge. In addition to this, the deployment of cutting-edge technologies like cloud-based platforms and AI further boots the requirement for reliable, real-time business information services, establishing the U.S. as a major market contributor worldwide.

Business Information Market Trends:

Technological Advancements

The rising adoption of advanced data analytics, machine learning (ML), and artificial intelligence (AI) tools is supporting the growth of the market. According to studies, 70% of company executives think generative AI would drastically alter how they do business. In addition, these tools allow companies to extract valuable insights from vast datasets. These technologies enable organizations to analyze the behavior of individuals, market trends, and competitor strategies with unprecedented accuracy and speed. Additionally, cloud computing and big data solutions are making it easier to store and access large volumes of information in real-time. Apart from this, technology allows for the collection and analysis of real-time data, providing companies with up-to-the-minute information on market conditions and competitive activities. This real-time capability is critical in fast-paced industries. Furthermore, visualization tools and dashboards are making it easier for business professionals to understand complex data. Visual representations of data enable more accessible and actionable insights. Besides this, AI and predictive analytics can identify trends, predict future outcomes, and automate data analysis, saving time and resources, thereby elevating the business information market demand globally.

Rising Need to Manage Data Effectively

Organizations are generating and collecting massive amounts of data daily due to rapid digitalization. According to reports, 149 zettabytes of data would be created, recorded, duplicated, and consumed worldwide in 2024. The amount of data worldwide is expected to increase even more by 2025, reaching 181 zettabytes by the end of the year. Real-time data processing, cloud-based storage, and the growing use of IoT devices are the main drivers of this expansion. This data includes information of individuals, sales data, and online interactions. Besides this, the growing demand for business information services due to the rising need to manage, store, and process data effectively is offering a positive market outlook. In addition, companies require solutions that can help them extract meaningful insights and convert raw data into actionable intelligence. Moreover, organizations are increasingly relying on data-driven decision-making to optimize their operations, identify growth opportunities, and enhance the experiences of individuals. Accurate and up-to-date data is essential for informed choices in areas like marketing, product development, and resource allocation. Furthermore, stringent data protection and privacy regulations compel companies to manage data securely and in compliance with legal requirements. Non-compliance can lead to severe penalties and reputational damage. In line with this, effective data management ensures data resilience and availability, safeguarding against data loss due to unforeseen events, such as hardware failures, cyberattacks, or natural disasters. This influences the business information market growth significantly by bolstering its adoption.

Increasing Focus on Protecting Digital Assets

The increasing number of cyber threats and security risks is contributing to the growth of the market. The 2022 SonicWall Cyber Threat Report states that ransomware attacks worldwide rose by 98% in the U.S. alone last year, with a 105% year-over-year increase in 2021 and a staggering 232% growth since 2019. Over 623 million ransomware infections have been documented globally, according to researchers. These threats can range from data breaches and malware attacks to phishing attempts and ransomware incidents. In line with this, organizations need timely and accurate information about potential vulnerabilities and security risks to effectively protect their digital assets. Furthermore, business information services gather data and intelligence and monitor hacker forums, dark web activities, and other sources to identify potential risks and vulnerabilities before they can be exploited. Besides this, these services provide organizations with information about known vulnerabilities in their software, systems, and infrastructure. This allows companies to proactively patch or mitigate these vulnerabilities to reduce the risk of exploitation. Moreover, business information providers offer security assessments and penetration testing services that help organizations understand their vulnerabilities and prioritize security improvements. Apart from this, business information services can provide real-time information about the incident, including the nature of the attack, affected systems, and recommended response actions. This is beneficial for organizations in mitigating the risks of damage.

Business Information Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global business information market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Commercial

- Scientific

- Technical

- Medical

- Educational and Training

- Others

Educational and training leads the market with around 33.8% of market share in 2024. Educational and training include business information services aimed at educational institutions, training centers, and e-learning platforms. These services provide data and insights for educational research, curriculum development, and training program enhancement. They also provide access to a wide range of research papers, reports, and industry-specific data that can be incorporated into training materials and educational resources. In addition to this, educational institutions often use business information to offer career guidance to their students. They provide insights into job market trends, salary expectations, and in-demand skills to help students make informed career choices. Besides, the rapid incorporation of business information in e-learning platforms has also fostered personalized learning experiences, magnifying engagement and knowledge retention. This trend further reinforces the sector’s dominance in the market.

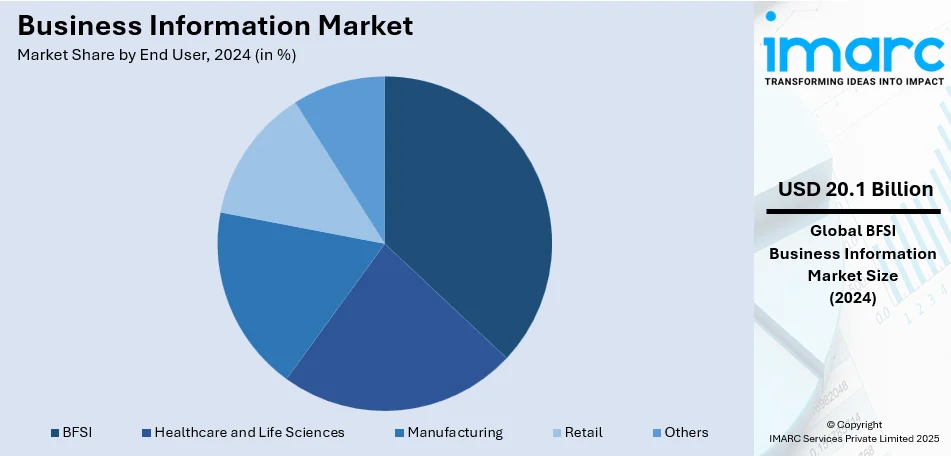

Analysis by End User:

- BFSI

- Healthcare and Life Sciences

- Manufacturing

- Retail

- Others

BFSI leads the market with around 37.8% of market share in 2024. The banking, financial services, and insurance (BFSI) sector uses data for risk assessment, market analysis, investment strategies, compliance, and fraud detection. This sector requires real-time financial data and market insights to prevent financial losses. Business information helps banks evaluate creditworthiness, insurers underwrite policies, and financial institutions monitor market trends. It also aids in fraud detection, customer relationship management (CRM), and optimizing financial operations. In addition to this, upgraded analytics and artificial intelligence have significantly improved the BFSI sector’s capability to identify emerging market opportunities and mitigate risks. Business intelligence also plays a critical role in regulatory compliance by providing tools to monitor and manage adherence to complex global financial regulations.

Regional Analysis

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.4%. North America has established itself as the leading regional market, majorly impacted by resilient deployment of analytics tools across key sectors and its well-established technological landscape. The region heavily profits from the strong establishment of leading industry players providing extensive data solutions, addressing the escalating need feasible insights. Several businesses in North America are currently leveraging artificial intelligence (AI) and leading-edge analytics to improve decision-making, further bolstering the utilization of business information services. In addition to this, North America’s exceptionally built retail, financial, and healthcare industries heavily depend on real-time data and intelligence to sustain competitive benefits. With constant investment in advancements and technology, this region remains a major hub for the development and utilization of advanced solutions, thus creating a positive business information market outlook.

Key Regional Takeaways:

United States Business Information Market Analysis

In 2024, United States accounted for 85.80% of the market share in North America. The main drivers of the business information market in the country are the sophisticated digital infrastructure of the United States and the increasing reliance on data-driven decision-making across industries. According to reports, the use of big data analytics by more than 90% of Fortune 500 organizations in 2023 increased demand for corporate information services. The financial services sector, which, according to the data by International Trade Administration, accounts for more than 7% of the US GDP, invests heavily in business information systems for risk assessment and market intelligence. The increasing use of machine learning (ML) and artificial intelligence (AI) enhances the use of predictive analytics, which fuels the need for real-time corporate data.

According to Office of Advocacy, US Government data, there are more than 33 million small and medium-sized businesses that operate in the United States. Most of these companies rely on business information providers for consumer profiling and competitive insights. Further, the use of digital innovations by programs such as Science Act and CHIPS also increases the adoption of new technologies. This need pushes forward the incorporation of sophisticated business information solutions in industries such as manufacturing, technology, and healthcare.

Europe Business Information Market Analysis

The rapid scale of digital transformation of sectors and the openness that regulations need to achieve increases corporate information demands in Europe. This has been further supported by the General Data Protection Regulation, which mandates companies to spend on compliant data solutions. Moreover, demand for ESG data has also seen a significant upsurge because of the growing focus on sustainability in the region, particularly in countries like Germany, France, and the UK. A considerable amount of business data is utilized by the financial services industry in Europe, as it reportedly forms more than 25% of the GDP in the continent. In addition to this, with a funding amount of €7.6 billion (USD 7.79 Billion), the Digital Europe Programme initiated by the European Union fosters digital innovation and data use in various sectors according to the statistics of the European Commission. More than 20% of Europe's GDP is manufactured, which depends more and more on business intelligence to boost competitiveness and optimize supply networks.

Asia Pacific Business Information Market Analysis

The Asia-Pacific market for business information is expanding rapidly as a result of the region's economic growth and increased use of digital technology. Markets for such information for business expansion among nations with an aggregate population in excess of 3 billion-including China and India-are witnessing a growth in demand rapidly, as per reports. Consumer understanding and market tendencies based on data are now important because of this e-commerce that is growing inside these countries-places like Alibaba and Flipkart are spearheading it. The two technological innovation leaders South Korea and Japan greatly ease the use of AI-powered business intelligence solutions. Digital transformation programs that are supported by the government such as the Indian Digital India campaign and Chinese Internet Plus policy encourage business information services. On the other hand, the increase in the number of global companies in the region creates a necessity for regional market intelligence and competitive analysis.

Latin America Business Information Market Analysis

The market for business information is growing in Latin America due to the region's increasing digital transformation and the increasing use of business intelligence solutions. Brazil and Mexico, the two largest economies in the region, dominate the market with more than 75% of metropolitan areas having internet, as per reports. In order to improve their competitiveness in the market, SMEs—which make up almost 99 percent of all firms in the area—are increasingly using business information services. The need for real-time business intelligence to manage risks and enhance customer experience is driven by the fintech industry, especially in nations like Argentina and Colombia. In addition, cross-border business intelligence solutions are becoming more accessible with regional trade agreements such as Mercosur, which enhance decision-making and market analysis skills.

Middle East and Africa Business Information Market Analysis

The business information market in the Middle East and Africa (MEA) region is driven by rapid digitalisation and the growing emphasis on economic diversification. The UAE's Smart Dubai 2021 objective and Saudi Arabia's Vision 2030 have motivated the adoption of data-driven business tools to enhance decision-making and efficiency. Businesses in Africa can now access market knowledge through initiatives such as the African Union's Digital Transformation Strategy, which are improving internet connectivity. The need for business information is largely driven by the industries in the major cities such as fintech, retail, and oil & gas, particularly in the region of Dubai, Lagos, and Nairobi. Growing e-commerce and mobile payments also demand data-driven insights that fuel the demand for corporate information in the market.

Competitive Landscape:

Key players are collecting and aggregating data from various sources, including public records, financial statements, government databases, surveys, and online sources. They are using advanced analytics and data processing tools to analyze the collected data and generate reports, dashboards, and insights. In line with this, companies are offering financial data services, including credit reports, financial risk assessments, and investment analysis, to support financial institutions and organizations in managing financial risks. Furthermore, business information providers specialize in specific industries, offering tailored data and insights for sectors like healthcare, finance, and manufacturing. They assist clients in staying compliant with relevant regulations by providing data and solutions that meet legal and ethical standards, especially in areas like data privacy and anti-money laundering. In addition, leading companies, such as Deloitte Touche Tohmatsu Limited, are dominating by offering customized solutions to meet the specific needs of clients. For instance, as per industry reports, Deloitte reported global revenue of USD 67.2 billion for FY2024, reflecting a 3.1% growth in local currency and 3.6% in USD compared to FY2023, for the fiscal year ending May 2024.

The report provides a comprehensive analysis of the competitive landscape in the business information market with detailed profiles of all major companies, including:

- Bloomberg L.P.

- Deloitte Touche Tohmatsu Limited

- Equifax Inc.

- Ernst & Young Global Limited

- Experian PLC

- KPMG International Limited

- PricewaterhouseCoopers LLP

- RELX plc

- Thomson Reuters Corporation

- Wolters Kluwer N.V.

Latest News and Developments:

- January 2025: SafeSend, a tax automation technology aimed at streamlining professional tax operations, has been purchased by Thomson Reuters. In line with its overarching goal of developing innovative tax and accounting solutions, this acquisition attempts to increase Thomson Reuters' capacity to automate and streamline the tax preparation, review, and client communication process. Customers will benefit from increased accuracy and efficiency in tax procedures thanks to SafeSend's capabilities, which will supplement Thomson Reuters' current services.

- January 2024: Bloomberg L.P. announced the release of Data Access, an extension of Bloomberg Transaction Cost Analysis solution (BTCA), which enables clients to access data more easily through an Application Programming Interface (API).

Business Information Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Commercial, Scientific, Technical, Medical, Educational and Training, Others |

| End Users Covered | BFSI, Healthcare and Life Sciences, Manufacturing, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bloomberg L.P., Deloitte Touche Tohmatsu Limited, Equifax Inc., Ernst & Young Global Limited, Experian PLC, KPMG International Limited, PricewaterhouseCoopers LLP, RELX plc, Thomson Reuters Corporation, Wolters Kluwer N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the business information market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global business information market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the business information industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business information market was valued at USD 53.3 Billion in 2024.

IMARC expects the market to reach USD 85.9 Billion by2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033.

Major factors driving the market encompass the amplifying need for data-based decision-making, enhancements in digital technologies, elevated utilization of AI and analytics tools, and the demand for real-time insights. Moreover, proliferating sectors and globalization further bolster the need for feasible and dependable business intelligence.

North America currently dominates the business information market, accounting for a share exceeding 38.4%. This dominance is fueled by innovative technological infrastructure, comprehensive implementation of analytics tools, and robust establishment of crucial market players.

Some of the major players in the business information market include Bloomberg L.P., Deloitte Touche Tohmatsu Limited, Equifax Inc., Ernst & Young Global Limited, Experian PLC, KPMG International Limited, PricewaterhouseCoopers LLP, RELX plc, Thomson Reuters Corporation, Wolters Kluwer N.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)