Business Continuity Management Market Report by Offering (Solutions, Services), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), Industry (Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, Transportation and Logistics, Energy and Utilities, Manufacturing and Retail, Telecom and IT, and Others), and Region 2025-2033

Business Continuity Management Market Overview:

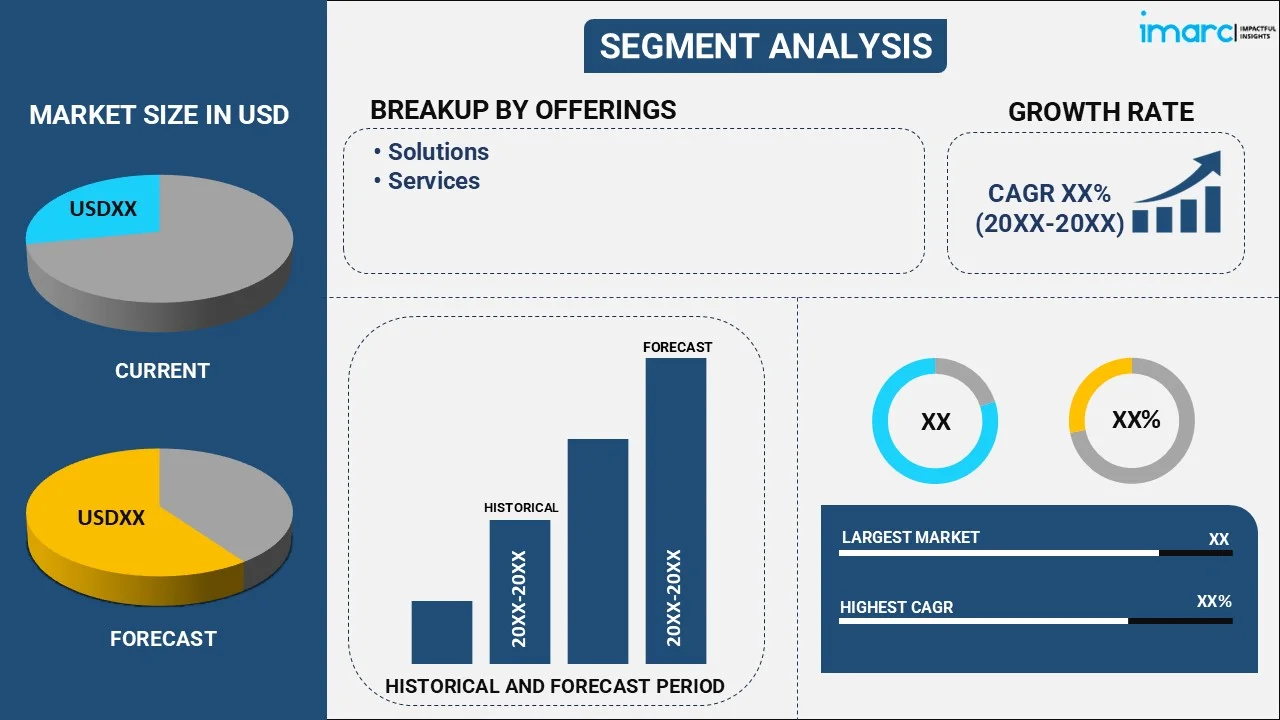

The global business continuity management market size reached USD 754 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,259.1 Million by 2033, exhibiting a growth rate (CAGR) of 13% during 2025-2033. The rising frequency of natural disasters and cyber-attack disruptions in a business, various regulatory frameworks, and increasing awareness about potential risks in business operations are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 754 Million |

| Market Forecast in 2033 | USD 2,259.1 Million |

| Market Growth Rate 2025-2033 | 13% |

Business Continuity Management Market Analysis:

- Major Market Drivers: Business expansion and globalization, coupled with the increasing focus on enhancing user experience, are acting as market drivers.

- Key Market Trends: The rising frequency of disruptions in business processes, along with the increasing regulatory requirements, are stimulating the market growth.

- Geographical Trends: According to the report, North America exhibits a clear dominance, accounting for the largest market share due to the rising focus on protecting crucial data.

- Competitive Landscape: Some of the top market players in the business continuity management industry are Fusion Risk Management Inc., International Business Machines Corporation, Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., Quantivate LLC, Sungard Availability Services (Fidelity National Information Services Inc.), Virtual Corporation, among many others.

- Challenges and Opportunities: One of the key challenges hindering the market growth is data protection and privacy concerns. However, the increasing demand for cloud-based solutions represents business continuity management market recent opportunities.

Business Continuity Management Market Trends:

Rising frequency of disruptions in business processes

There is a rise in the demand for business continuity management due to the high frequency of disruptions in a business, such as natural disasters and cyber-attacks. These disruptions cause a detrimental impact on business operations and financial stability and lower revenue generation while decreasing productivity. Apart from this, there is a rise in the need for advanced solutions in cases of high-profile incidents, such as hurricanes, wildfires, and pandemics. These potential disruptions halt operations, damage infrastructure, and disrupt supply chains. Furthermore, organizations are investing in these business solutions to mitigate the impact of these disruptions, ensure business continuity, and safeguard their operations, reputation, and stakeholder interests. On 9 November 2022, Protera launched an automated disaster recovery framework that enables companies to consistently test, validate, and prove that their processes can effectively respond to cyber-attacks and quickly restore operations with minimal business disruption.

Regulatory requirements

Governing agencies of various countries are encouraging the adoption of business continuity management solutions by implementing stringent regulations and standards. The regulatory frameworks mandate organizations to develop and implement business continuity management plans, conduct risk assessments, and establish robust recovery strategies. These regulations allow organizations to enhance risk management and provide the ability to respond effectively to disruptive incidents. In line with this, organizations are adopting business continuity management strategies as non-compliance can result in penalties, legal ramifications, and reputational damage. On 3 December 2021, LogicManager, a leading provider of leading provider of ERM software solutions (ERM) software solutions, introduced a host of innovative platform features that transform the way their users manage risk and allow organizations to comply with industry standards.

Increasing awareness about potential risks in business operations

The growing awareness about the potential risks and their potential impact on business operations is offering a positive business continuity management market outlook. High-profile incidents, such as major data breaches and supply chain disruptions, cause vulnerabilities for an organization. These disruptions can lead to financial losses, reputational damage, and user dissatisfaction. Executives and decision-makers are increasingly adopting business continuity management to identify and assess risks, develop appropriate mitigation strategies, and establish resilient business processes. Furthermore, organizations are investing in comprehensive risk assessment methodologies, threat intelligence, and business impact analysis to better understand potential risks and build resilience to navigate through uncertainties. Additionally, players in the market are engaging in partnerships to provide enhanced services to various sectors. For instance, Riskonnect announced enhancements to its business continuity and resilience solution through a partnership with OnSolve on 7 February 2023. This partnership will allow Riskonnect to utilize OnSolve’s risk intelligence to offer a new threat intelligence module to provide resilience leaders the ability to monitor global threats in real time and respond faster and more effectively to critical events.

Business Continuity Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with business continuity management market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on offering, organization size, and industry.

Breakup by Offering:

- Solutions

- Crisis Management

- Risk Management

- Audit Management

- Government, Risk, and Compliance (GRC)

- Others

- Services

- Professional

- Managed

Solutions account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solutions [crisis management, risk management, audit management, government, risk, and compliance (GRC), and others] and services (professional and managed). According to the report, solutions represented the largest segment.

Solutions refer to software platforms, tools, and technologies that are designed to support and enable the implementation and management of business continuity practices. They benefit organizations in prioritizing their recovery strategies and allocating resources effectively. They focus on the recovery of information technology (IT) infrastructure, data, and systems in the event of a disruption. Furthermore, companies are introducing solutions that benefit in providing accurate risk detection. On 27 November 2023, Shufti Pro unveiled an enhanced face verification solution that is more precise, accurate, and deters spoofing attempts. This new platform incorporates three-dimensional (3D) depth perception and liveness detection that is powered by the proprietary machine learning (ML) algorithm of the company.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the largest share of the industry

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises represented the largest segment.

Large enterprises need to handle complex business operations and reduce the risk of financial losses, thereby increasing business continuity management demand. In line with this, the increasing employment of business continuity management services to ensure smooth workflow management and optimize efficiency is propelling the growth of the market. On 7 February 2023, Raghnall Insurance Broking launched its new offering ‘Business Cyber Shield’, that offers comprehensive cybersecurity solutions for businesses of all sizes. It provides the latest digital offerings to help clients identify, mitigate, and manage the risks associated with the growing threat of cyberattacks. It is designed to be scalable, so it can be customized to meet the needs of businesses of all sizes, ranging from small and medium enterprises (SMEs) to large corporations.

Breakup by Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- Transportation and Logistics

- Energy and Utilities

- Manufacturing and Retail

- Telecom and IT

- Others

Banking, Financial Services, and Insurance (BFSI)represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the industry. This includes banking, financial services, and insurance (BFSI), government, healthcare, transportation and logistics, energy and utilities, manufacturing and retail, telecom and IT, and others. According to the report, banking, financial services, and insurance (BFSI) represented the largest segment.

Banking, financial services, and insurance (BFSI) companies are highly regulated sectors that handle sensitive user data and financial transactions. The rising adoption of business continuity management in the BFSI sector to reduce the number of various risks, such as cyber threats, natural disasters, and operational disruptions, is contributing to the growth of the market. On 12 December 2023, Ncontracts acquired Quantivate, a growing provider of governance, risk, and compliance (GRC) solutions for banks and credit unions. Ncontracts further enhances its position as the software-as-a-service (SaaS) and knowledge-as-a-service (KaaS) leader.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest business continuity management market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for business continuity management.

North America holds the biggest market share owing to the increasing digitalization across various industries. In line with this, the rising focus on safeguarding operations and protecting critical data is bolstering the business continuity management market growth in the region. Furthermore, there is an increase in the need to mitigate the impact of natural disaster events, along with the focus on regulatory compliance and risk management. On 19 March 2024, Infinite Blue, located in the United States, the leader in total enterprise resilience solutions, acquired Virtual Corporation, LLC., a Colorado-based provider of business continuity management services to respected government agencies and companies worldwide. This acquisition will help clients to achieve the highest levels of enterprise resilience.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major business continuity management companies have also been provided. Some of the major market players in the industry include Fusion Risk Management Inc., International Business Machines Corporation, Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., Quantivate LLC, Sungard Availability Services (Fidelity National Information Services Inc.), Virtual Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the industry are focusing on offering various features, such as risk assessment, business impact analysis, plan development, incident management, and reporting capabilities, to streamline business operations and increase business continuity management market revenue. They are offering training programs, workshops, and certifications to educate organizations and their employees about business continuity management concepts, methodologies, and best practices. In line with this, they are integrating with existing enterprise systems and platforms to ensure seamless data flow, improve situational awareness, and efficient incident response. On 17 February 2023, The BCI launched the BCI Research Foundation, which will fund and support high quality applied research into topics related to organizational resilience, operational resilience, business continuity management, crisis management, and other resilience-related disciplines.

Business Continuity Management Market Recent Developments:

- 8 February 2023: Shufti Pro launched a risk assessment and eIDV services to help global businesses fight identity fraud and financial crimes and meet the ever-evolving regulatory landscape.

- On 28 February 2024, Fusion Risk Management, Inc announced a general availability of its artificial intelligence (AI)-powered assistant Fusion Resilience Copilot™. It is pre-configured to answer critical questions at the click of a button and enables practitioners to automate manual and time-consuming activities, unlock deeper insights into incidents, and quickly respond to disruptions.

Business Continuity Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industries Covered | Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, Transportation and Logistics, Energy and Utilities, Manufacturing and Retail, Telecom and IT, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fusion Risk Management Inc., International Business Machines Corporation, Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., Quantivate LLC, Sungard Availability Services (Fidelity National Information Services Inc.), Virtual Corporation, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the business continuity management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global business continuity management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the business continuity management industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business continuity management market was valued at USD 754 Million in 2024.

The business continuity management market is projected to exhibit a CAGR of 13% during 2025-2033, reaching a value of USD 2,259.1 Million by 2033.

The business continuity management market is driven by the increasing frequency of cyber threats, natural disasters, and geopolitical risks. Organizations are prioritizing risk mitigation, disaster recovery, and ensuring operational resilience. Moreover, regulatory compliance and the need for maintaining continuous service availability further drive the market's growth.

In 2024, North America dominated the business continuity management market driven by rapid digital transformation, rising cybersecurity threats, and the region's expanding infrastructure. The growing demand for risk management solutions across diverse industries, combined with supportive government initiatives, also contributed to Asia Pacific's leading market position.

Some of the major players in the global business continuity management market include Fusion Risk Management Inc., International Business Machines Corporation, Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., Quantivate LLC, Sungard Availability Services (Fidelity National Information Services Inc.), Virtual Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)