Business Analytics Market Report by Software (Query, Reporting and Analysis Tools, Advanced and Predictive Analytics, Location Intelligence, Content Analytics, Data Warehousing Platform, and Others), Deployment Type (Cloud-based, On-Premises), End-User (Large Enterprises, Small and Medium Size Enterprises), Vertical (BFSI, Energy and Power, Manufacturing, Healthcare, Government, Education, Media and Entertainment, Telecom and IT, and Others), and Region 2025-2033

Market Overview:

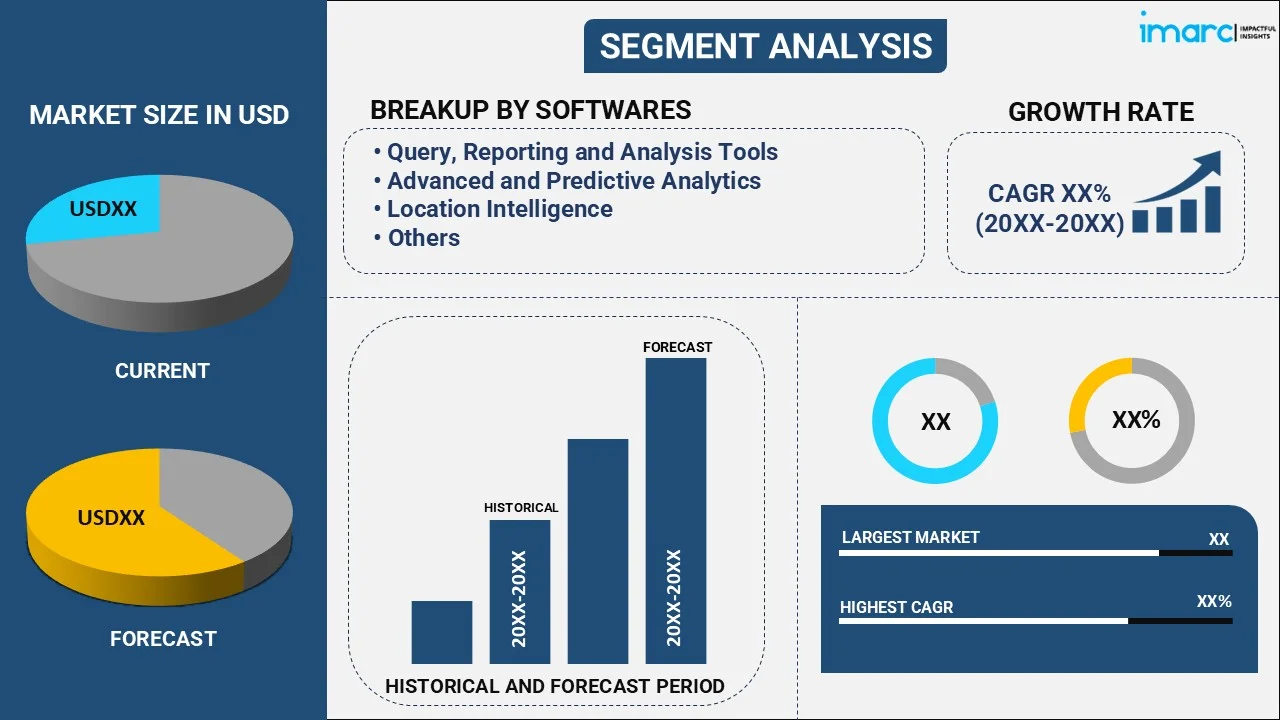

The global business analytics market size reached USD 96.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 196.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. The surging volume and complexity of data, rising demand for optimized supply chain operations, and growing incidences of cybersecurity threats and consequently increasing privacy concerns among businesses are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 96.6 Billion |

| Market Forecast in 2033 | USD 196.5 Billion |

| Market Growth Rate 2025-2033 | 7.8% |

Business analytics is the systematic process of collecting, analyzing, and interpreting data to gain insights and make informed decisions. It leverages various statistical, mathematical, and computational techniques to uncover patterns, trends, and correlations in data that can aid in improving business performance and strategy. It helps identify inefficiencies and areas wherein cost-saving measures can be implemented, leading to improved resource allocation. It assists in identifying and mitigating risks by assessing historical data and predicting potential risks in the future. It is widely used in the healthcare industry for patient outcomes analysis, resource allocation, and disease tracking.

The rising shift to cloud-based analytics solutions offers scalability, flexibility, and cost-efficiency, making analytics more accessible to organizations of all sizes. Apart from this, the widespread use of HR analytics by public and private organizations is offering a favorable market outlook. HR analytics aids in talent acquisition, workforce planning, and employee engagement, contributing to organizational growth and efficiency. Furthermore, the implementation of regulations in the BFSI industry is driving the need for advanced analytics for compliance, risk assessment, and fraud detection. Moreover, the escalating demand for optimized supply chain operations, including demand forecasting, inventory management, and supplier performance analysis is supporting the market growth.

Business Analytics Market Trends/Drivers:

Increasing data volume and complexity

The exponential growth of data represents one of the primary factors positively influencing the market. Additionally, with the expanding use of digital technologies and the Internet of Things (IoT), organizations are generating vast amounts of data, which includes customer interactions, social media, and sensor data. The volume of data generated daily is staggering, making it essential for businesses to harness this data for insights. Apart from this, the rising complexity of data is driving the need for advanced analytics tools, such as natural language processing (NLP), machine learning, and artificial intelligence (AI) to gain valuable insights. Furthermore, the expansion of industries is catalyzing the demand for analytics tools to make informed decisions, personalize customer experiences, optimize operations, and gain a competitive edge.

Evolving AI and ML capabilities

Artificial intelligence (AI) and machine learning (ML) are transforming business analytics. These technologies can analyze data at a scale and depth that was previously unattainable. AI-driven predictive and prescriptive analytics are helping businesses anticipate trends, identify anomalies, and recommend optimal actions. Apart from this, AI and ML are enabling the development of industry-specific analytics solutions. The increasing use of these advanced technologies in the medical sector to help with patient diagnosis is offering a favorable market outlook. Furthermore, the rising utilization of data analytics solutions in the BFSI sector to detect fraudulent transactions is creating a positive outlook for the market.

Regulatory compliance and data privacy concerns

The evolving landscape of regulations and data privacy laws across various countries is another primary factor facilitating the market growth. The governing authorities worldwide are implementing stringent regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations impose strict requirements on how organizations collect, store, and use customer data, and failing to comply can lead to substantial fines and reputational damage. Apart from this, rising incidences of cybersecurity threats and the growing privacy concerns are encouraging businesses to adopt efficient analytics solutions for maintaining trust among customers and partners.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on software, deployment type, end-user and vertical.

Breakup by Software:

- Query, Reporting and Analysis Tools

- Advanced and Predictive Analytics

- Location Intelligence

- Content Analytics

- Data Warehousing Platform

- Others

Data warehousing platform dominates the market

A detailed breakup and analysis of the market based on the software has also been provided in the report. This includes query, reporting and analysis tools; advanced and predictive analytics; location intelligence; content analytics; data warehousing platform; and others. According to the report, data warehousing platform represents the largest market segment as it is a centralized repository that stores vast amounts of structured data from various sources, such as sales, finance, marketing, and customer interactions. This centralized storage simplifies data management, ensuring that analysts and decision-makers have easy access to a unified, consistent source of truth. Additionally, it offers robust security features, including access controls, encryption, and audit trails. It also facilitates data governance by providing mechanisms for data quality management and lineage tracking. Apart from this, it integrates seamlessly with business intelligence (BI) tools and reporting solutions. This integration streamlines the analytics workflow, making it easier for users to create reports, dashboards, and visualizations based on the centralized data.

Breakup by Deployment Type:

- Cloud-based

- On-Premises

On-premises holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises. According to the report, on-premises accounts for the majority of the market share as some organizations have legacy systems that are deeply integrated with on-premises infrastructure, and migrating to the cloud can be complex and costly, making on-premises analytics more viable for these situations. Additionally, on-premises solutions offer greater control over data security and compliance for organizations dealing with highly sensitive data, particularly in sectors like finance, healthcare, and government. Apart from this, in certain regions or industries, data sovereignty regulations mandate that data must be stored within specific geographic boundaries. On-premises deployments allow organizations to comply with such regulations without relying on third-party cloud providers. Moreover, on-premises solutions offer greater customization and control over hardware and software configurations.

Breakup by End-User:

- Large Enterprises

- Small and Medium Size Enterprises

Small and medium size enterprises represent the largest market segment

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes large enterprises and small and medium size enterprises. According to the report, small and medium size enterprises account for the majority of the market share due to the increasing accessibility and affordability of analytics tools and solutions. Many software providers now offer cloud-based analytics services with subscription models, making it cost-effective for SMEs to access powerful analytics capabilities without substantial upfront investments. Additionally, SMEs often rely on focused marketing efforts to reach their target audience efficiently. Analytics helps them analyze customer behavior, preferences, and purchase patterns. This data-driven approach enables more effective marketing campaigns and customer retention strategies. Apart from this, many analytics providers recognize the potential of the SME market and tailor their offerings accordingly. They provide user-friendly interfaces, pre-built templates, and customer support to cater to the specific needs and limited resources of SMEs.

Breakup by Vertical:

- BFSI

- Energy and Power

- Manufacturing

- Healthcare

- Government

- Education

- Media and Entertainment

- Telecom and IT

- Others

BFSI represented the largest market segment

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, energy and power, manufacturing, healthcare, government, education, media and entertainment, telecom and IT, and others. According to the report, BFSI dominates the market due to the increasing security concerns and rising cases of cybersecurity attacks. Analytics is used for intrusion detection, threat assessment, and data encryption, ensuring the safety and integrity of customer information. Additionally, analytics supports financial institutions in conducting stress tests to evaluate their resilience under adverse scenarios. Apart from this, it enables financial institutions to respond swiftly to market fluctuations, execute trades, and process transactions efficiently. Moreover, for asset management and investment banking, analytics aids in portfolio optimization, asset allocation, and investment decision-making. It helps identify attractive investment opportunities and assess the performance of assets in real time.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest business analytics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share since the region has a rich ecosystem of technology companies, startups, and research institutions that drive the development and adoption of cutting-edge analytics tools and techniques. Additionally, North American businesses have a strong culture of data-driven decision-making. They recognize the value of analytics in gaining a competitive edge, optimizing operations, and understanding customer behavior. Apart from this, the region is home to numerous industries, including finance, healthcare, technology, retail, and manufacturing. Moreover, North America boasts a skilled and educated workforce in fields such as data science, statistics, and computer science. This talent pool is essential for developing, implementing, and leveraging analytics solutions effectively.

Competitive Landscape:

Companies are actively engaged in various activities to meet the evolving demands of businesses and industries. They are focusing on advanced data analytics techniques, such as machine learning and artificial intelligence, to extract valuable insights from large datasets. This enables them to provide more accurate predictions and recommendations to their clients. Additionally, they are developing real-time analytics capabilities to provide clients with up-to-the-minute insights. Apart from this, many firms are investing in robust security measures and compliance with data protection regulations like GDPR and CCPA. Furthermore, various business analytics providers are tailoring their services to meet the specific needs of different industries and clients.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Adobe Systems Incorporated

- International Business Machines (IBM) Corporation

- Microsoft Corporation

- Microstrategy Incorporated

- Oracle Corporation

- Salesforce.com Inc.

- SAP SE

- SAS Institute Inc.

- Tableau Software

- Tibco Software Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In March 2023, Tibco Software Inc. announced a series of enhancements to its analytics suite that delivers immersive, smart, and real-time analytics and empowers customers to take action and benefit from faster, smarter insights.

- In September 2023, SAP SE declared the development of the first software-based enterprise resource planning (ERP) system, that has changed the face of business and the ability of our customers to deliver value.

- In October 2022, Tableu Software announced the launch of Tableau 2022.3, a new version of the data visualization and analysis program that allows business users to gain insights into their data by using a data guide to help uncover business intelligence more quickly, and a new advanced analytics and predictions tool called Table Extension.

Business Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Covered | Query, Reporting and Analysis Tools, Advanced and Predictive Analytics, Location Intelligence, Content Analytics, Data Warehousing Platform, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| End-Users Covered | Large Enterprises, Small and Medium Size Enterprises |

| Verticals Covered | BFSI, Energy and Power, Manufacturing, Healthcare, Government, Education, Media and Entertainment, Telecom and IT, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adobe Systems Incorporated, International Business Machines (IBM) Corporation, Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Salesforce.com Inc., SAP SE, SAS Institute Inc., Tableau Software, Tibco Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the business analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global business analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the business analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global business analytics market was valued at USD 96.6 Billion in 2024.

We expect the global business analytics market to exhibit a CAGR of 7.8% during 2025-2033.

The increasing amount of digital data generation from various business platforms, coupled with the widespread applications of business analytics tools to conduct predictive analysis, content analysis, underlying patterns, etc., are primarily driving the global business analytics market.

The sudden outbreak of the COVID-19 pandemic has led to the rising inclination towards business analytics tools across several industrial verticals to remotely manage critical data, enhance data security, and make data-driven decisions to gain a competitive edge.

Based on the software, the global business analytics market has been segmented into query, reporting and analysis tools, advanced and predictive analytics, location intelligence, content analytics, data warehousing platform, and others. Currently, data warehousing platform holds the majority of the total market share.

Based on the deployment type, the global business analytics market can be divided into cloud-based and on-premises, where on-premises deployment currently exhibits a clear dominance in the market.

Based on the end-user, the global business analytics market has been categorized into large enterprises and small and medium size enterprises. Currently, small and medium size enterprises account for the majority of the global market share.

Based on the vertical, the global business analytics market can be segregated into BFSI, energy and power, manufacturing, healthcare, government, education, media and entertainment, telecom and IT, and others. Among these, the BFSI industry holds the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global business analytics market include Adobe Systems Incorporated, International Business Machines (IBM) Corporation, Microsoft Corporation, Microstrategy Incorporated, Oracle Corporation, Salesforce.com Inc., SAP SE, SAS Institute Inc., Tableau Software, Tibco Software Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)