Bus Market Size, Share, Trends and Forecast by Type, Fuel Type, Seat Capacity, Application, and Region, 2026-2034

Bus Market Size and Share:

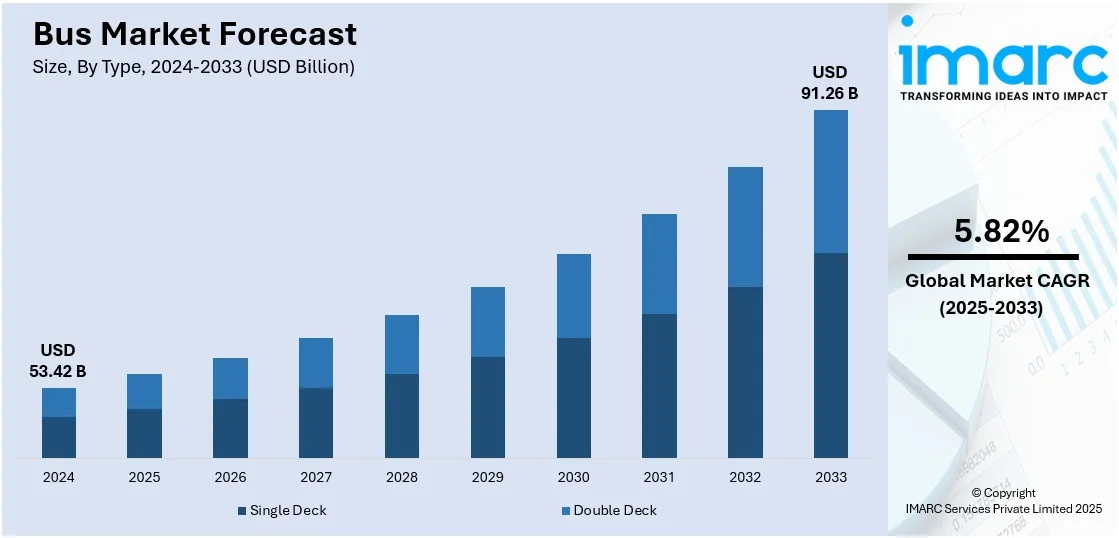

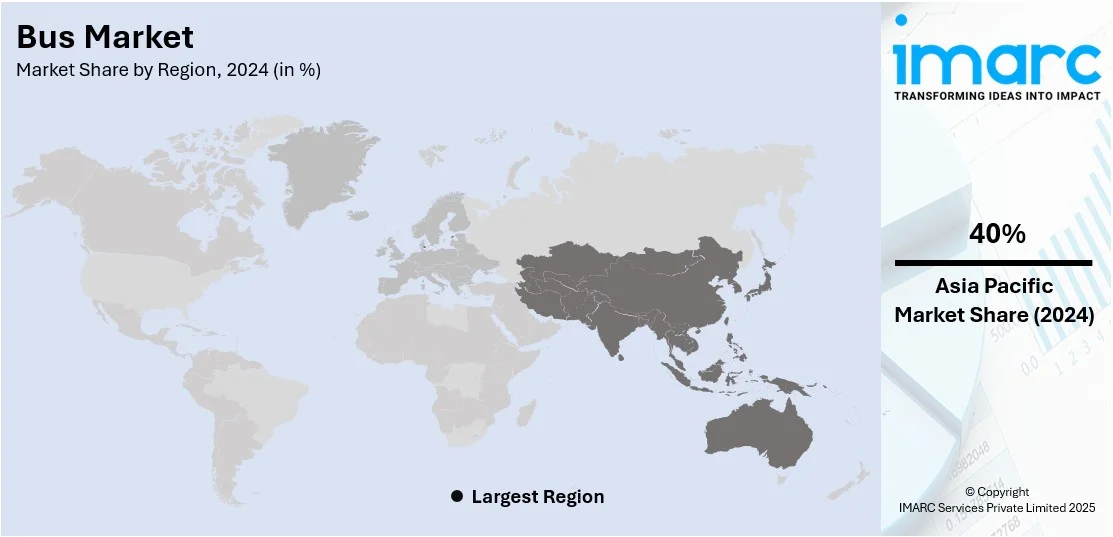

The global bus market size was valued at USD 53.42 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 91.26 Billion by 2034, exhibiting a CAGR of 5.82% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 40% in 2024. The market is driven by rising urbanization, government investments in public transport infrastructure, and increasing demand for electric and fuel-efficient buses due to environmental regulations. Additionally, advancements in autonomous and connected bus technologies, coupled with growing adoption of smart mobility solutions, are enhancing passenger convenience and operational efficiency, further fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 53.42 Billion |

|

Market Forecast in 2034

|

USD 91.26 Billion |

| Market Growth Rate 2026-2034 | 5.82% |

The worldwide move towards sustainable and ecofriendly transportation is the driving force of the bus market. Governments globally are mandating stricter emissions rules, encouraging transit authorities to switch to electric and hydrogen buses. Monies in the form of subsidies, grants, and tax credits are fueling fleet electrification. Furthermore, the pace of urbanization and growing population densities are propelling the need for affordable public transport systems, resulting in wide-scale investments in bus systems. Improvements in battery technology, greater energy efficiency, and charging infrastructure expansion add further strength to the electric bus case. Smart mobility integration, such as artificial intelligence (AI) based fleet management and real-time tracking, is enhancing operational effectiveness and commuter convenience. Public-private partnerships are stimulating innovations in alternative fuel technologies to support long-term market expansion. For instance, in November 2024, Daimler Buses rolled out the near-production Mercedes eIntouro powered by LFP batteries, eCitaro with NMC4 battery, and a fuel-cell bus in H2-only mode at eMobility Days, further strengthening its e-mobility timeline. Moreover, with nations focusing on carbon neutrality and sustainability, the shift towards cleaner and more efficient buses is likely to transform the sector and propel future demand.

To get more information on this market, Request Sample

Building out public transportation networks is a strong impetus of the U.S. bus industry with a market share of 87.30%. For example, in December 2024, Benzie Bus introduced an online trip-planning website under the Advancing Rural Mobility pilot project. Supported by a U.S. Department of Transportation Smart grant, it improves Michigan rural transit accessibility through real-time information and integrated route planning. Further, federal and state governments heavily invest in transit systems to combat traffic congestion, enhance urban mobility, and reduce greenhouse gas emissions. Grant and subsidy programs supporting the purchase of low-emission and electric buses are funding them. Escalating fuel costs and environmental issues further propel transit organizations towards alternative energy technologies, leading to rising demand for battery-electric and hybrid buses. Smart city movement has incorporated advanced technologies, such as contactless ticketing, real-time tracking, and AI-driven fleet management, to advance operational efficiency and commuter experience. Moreover, expanding metropolitan populations require fleet growth and modernization to address growing ridership demands. Private operators and school districts are also modernizing fleets to meet changing environmental and safety standards. As efforts towards sustainability accelerate, government assistance and technology innovations will continue to propel U.S. bus market expansion.

Bus Market Trends:

Growing availability of electric autonomous buses

The accelerating supply of electric autonomous buses is now having a positive effect on the growth of the bus market. Apart from this, the incorporation of electric autonomous buses into urban transport systems is promoting a significant decrease in greenhouse gas emissions. Since these buses run on electricity, they emit little to no emissions, thereby reducing the negative environmental effect of conventional diesel or gasoline-fueled buses. In addition, this shift comes in line with the current worldwide focus on environmental sustainability, so electric autonomous buses become a good choice for cities and transit organizations. Besides that, the implementation of autonomous technology on buses is increasing safety levels. Self-driving buses have onboard sophisticated sensors, artificial intelligence (AI) software, and real-time processing power, which allow them to move through traffic with accuracy, reducing the possibility of accidents resulting from human mistake. The development of autonomous cars is also supported by the accelerated advancement of AI technology, with the global in-vehicle AI robot market amounting to USD 76.4 Million in 2024. As per IMARC Group, the market is expected to boost at a compound annual growth rate (CAGR) of 13.87%, reaching USD 260.4 Million by 2033. This heightened safety factor enhances public trust in bus transportation systems and promotes more ridership.

Rising focus on passenger comfort in public transportation

The increasing emphasis on comfort for passengers in public transport is driving demand for effective seating amenities in public buses. Apart from this, passengers and commuters are highly looking for convenience and comfort during their travel. Consequently, bus manufacturers and operators are constantly investing in enhancing the passenger experience. This encompasses renovating seating configuration, including adding ergonomic design and improving interior luxuries like, air conditioning, Wi-Fi connectivity, and entertainment units. These continuing efforts are contributing to an spurring level of customer satisfaction among commuters, is further enhancing the desirability of bus transport. In addition, the integration of advanced safety elements in new buses is another indispensable factor for coping with increasing commuter comfort demands. The integration of features such as automatic braking systems, lane departure warning, and adaptive cruise control improves safety and helps to create a feeling of security and well-being for passengers.

Increasing popularity of mobility-as-a-service (MaaS)

Currently, the rising popularity of mobility-as-a-service (MaaS) is further supporting bus market growth. Furthermore, MaaS platforms tend to feature public transport modes such as buses as priority elements of their multimodal networks. This emphasis has the effect of further elevating the prominence of buses as safe and efficient means of transportation, prompting greater numbers of consumers to view them as worthy alternatives for daily travel. As per the National Center for Mobility Management, MaaS's prime aim is to make the multi-faceted transport system simple and manageable through the provision of integrated access to public and private mobility services. The project is funded with €40 Million (USD 43.32 Million) under the Italy's National Recovery and Resilience Plan (PNRR) and a further €16.9 Million (USD 18.33 Million) of the complementary fund to facilitate its implementation. Apart from this, the convenience and ease of accessibility provided by MaaS platforms reduce the ease and simplicity with which commuters can schedule and navigate their trips, including bus trips. Moreover, with the provision of real-time schedules, routes, and ticket information about buses on user-friendly applications and platforms, MaaS is eliminating some of the long-held barriers discouraging potential passengers on buses.

Bus Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bus market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, fuel type, seat capacity, and application.

Analysis by Type:

- Single Deck

- Double Deck

Single-deck buses hold a leading 65% market share in 2024, fueled by their widespread use in city and suburban public transportation. They are the best fit for urban transit systems owing to their compact size, fuel efficiency, and affordability. Governments and private fleet operators are replacing single-deck buses with low-emission and electric single-deck models to curb emissions and meet sustainability objectives. These buses find heavy usage as airport and corporate shuttles due to their agility and operation flexibility. Enhanced safety features, digital ticketing, and the integration of real-time tracking have also made them even more in demand. There are high single-deck bus penetration growth rates happening in the Asia-Pacific region and Latin America, supported by governments through the implementation of incentives and infrastructure funding. Additionally, increased demand for smart mobility solutions is driving innovation in electric and hybrid models, assuring constant market growth. With urbanization persisting, the single-deck segment is sure to be the backbone of public transport across the globe.

Analysis by Fuel Type:

- Diesel

- Electric and Hybrid

- Others

The diesel bus has a 70% market share by 2024 and continues to be the best choice because they have an installed fueling base, long operating range, and are cost-saving. Most of the public and private fleet carriers continue to adopt new diesel buses with enhanced fuel efficiency and emission reduction. As electric and hybrids grow, though, diesel buses continue to predominate areas with weak charging infrastructure and greater intercity driving demand. Low-sulfur diesel and particulate filtration systems are improving environmental performance through advanced engine technologies. The Asia-Pacific region and Latin America are still observing high diesel bus penetration, especially in rural and long-haul uses. Hybrid diesel-electric models are being invested in by public transportation authorities to enhance efficiency while ensuring operation reliability. Even with the increase in alternative fuels, diesel buses remain the main form of transport for mass transit in most markets across the globe.

Analysis by Seat Capacity:

- 15-30 Seats

- 31-50 Seats

- More than 50 Seats

Buses with 31-50 seat passengers claim a 55% market share in 2024, as they provide the perfect blend of passenger capacity and operational versatility. They are utilized extensively in urban transit, intercity travel, corporate shuttles, and tourism and are a value-for-money option available for fleet operators. Public transit agencies prefer this segment size because it can maneuver heavy-traffic inner-city environments while maximizing passenger-carrying capacity. Growing tourism and corporate travel are also helping to fuel the market, with travel operators and businesses looking for effective transport solutions. Mid-size hybrid and electric buses are also picking up speed, especially in Europe and Asia-Pacific regions where governments are promoting low-emission transport. The adoption of advanced safety features, smart ticketing, and fleet telematics is also adding to the popularity of the segment. With increasing investments in sustainable mobility, 31-50 seat buses are likely to remain a vital part of public as well as private transport fleets.

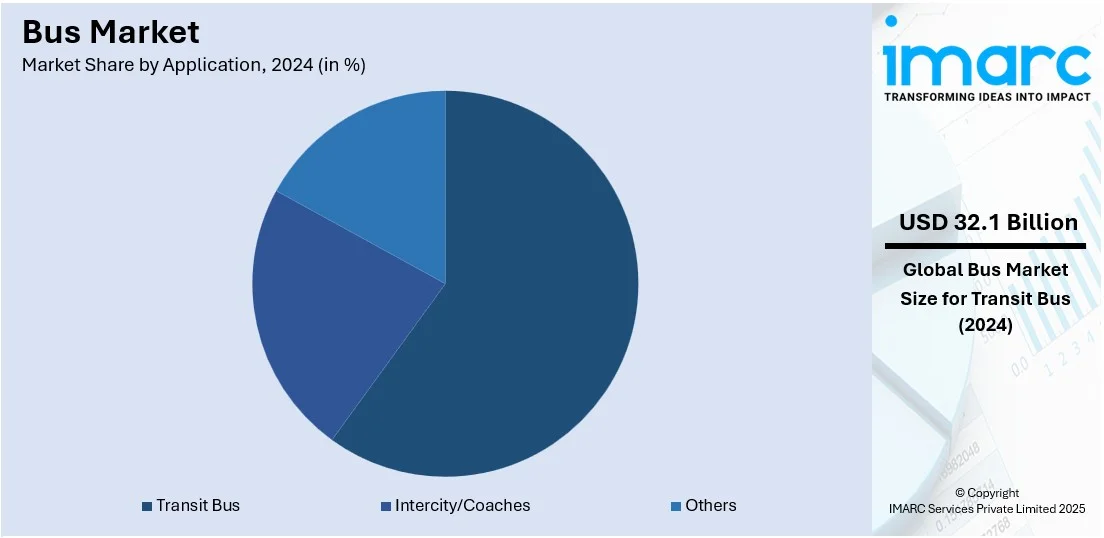

Analysis by Application:

- Transit Bus

- Intercity/Coaches

- Others

Transit bus dominate the market with a 60% market share in 2024 due to increasing investment in public transit to facilitate urban mobility. These buses play a crucial role in easing road traffic congestion and delivering affordable, high-capacity transportation solutions in urban cities. Transit fleets are being increased by governments with new-age, low-emission buses such as electric and hybrid buses. Smart tech integration, including contactless ticketing, GPS tracking, and AI-fleet management, is increasingly making transit bus operations more efficient and reliable. Asia-Pacific and Europe are leading this development, with major fleet modernization programs underpinned by policy support. In the U.S., federal and state finance is assisting transit agencies in fleet upgrade towards sustainability goals. With growing demand for public transport paralleled by increasing urbanization, transit buses should be at the forefront of framing the future for sustainable and effective urban mobility.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific is the leading region in the world bus market, commanding a 40% market share in 2024, driven by increased urbanization, huge government spending, and robust local manufacturing capacity. China, India, and Japan are at the forefront of electric bus takeup, with wide-scale deployment programs that aim to curb emissions and optimize public transport efficiency. Expanding metro networks and growing intercity travel demand are further driving the expansion of bus fleets in the region. Government-supported subsidies and infrastructure investments, especially in networks of electric bus charging points, are driving a shift towards environmentally friendly mobility. The region further enjoys a strong local supply base, making for affordable bus manufacture and uptake. As smart cities continue to grow, the harmonization of AI-based fleet control and real-time passenger information systems is further enhancing public transport performance. With continued infrastructure investment and policy incentives, Asia-Pacific will continue to be the biggest and fastest-expanding bus market in the world.

Key Regional Takeaways:

North America Bus Market Analysis

The bus market in North America is seeing consistent growth due to the growing investments in public transit infrastructure, sustainability, and technology. The region is also witnessing a strong electrification push with federal and state incentives promoting the use of battery-electric and hybrid buses. Large cities are increasing transit systems to support rising urban populations and alleviate traffic congestion. School buses are also being upgraded to include newer safety features and cleaner fuels. Intelligent mobility solutions, such as AI-powered fleet management, real-time tracking, and digital ticketing, are improving operating efficiency. Inter city and interstate bus travel is also high on demand, underpinned by growing travel and tourism. The on-demand shuttle services are also growing in North America to accommodate corporate and airport transportation requirements. Thanks to constant government subsidies, infrastructure building, and new fuel technology, the North American bus market will be poised to keep growing for many years to come.

United States Bus Market Analysis

The US bus industry is facing tremendous change, fuelled by urbanization, environmental issues, and growing demand for mass transit. Based on data from the U.S. Census Bureau, the U.S. population increased by 3,304,757 during 2024 to stand at 340,110,988, further fueling the demand for effective transport options. Buses are seen as an affordable means to solve traffic jams, enhance mobility, and lower carbon emissions in urban areas. The intensifying focus on environmentally friendly means of transport has resulted in electric and hybrid buses gaining prominence and helping bring more sustainable travel onto the scene. The rise in public transportation networks in major urban centers is improving demand for buses, particularly as there is an increased population base to cater to. In addition, incentives provided by the government and financing plans for the introduction of electric cars, along with improvements in batteries, are enabling the switch over to cleaner fleets of buses. The surging demand for long-distance bus services for city travel, as well as the growing demand for chartered bus services for private tours and events, is also influencing the market. The market is distinguished by manufacturers emphasizing product innovation, fuel economy, and safety features.

Europe Bus Market Analysis

The bus market in Europe is observing consistent growth due to the heightened emphasis on sustainable and efficient modes of travel. The growing use of electric and hybrid buses in key European metropolises is revolutionizing public transportation. The green buses assist in shrinking carbon prints, complying with the European Union's strict environmental policies and sustainability objectives. Greenhouse gas emissions due to transport in EU Member States are estimated to decline by around 14% in 2030 and by 37% in 2050, also fuelling the demand for environmentally friendly buses. Furthermore, the accelerating demand for cost-effective, efficient public transport services and the growing quest for alleviating urban congestion are favouring market growth. Urbanization, especially in areas where populations are rapidly growing, is causing amplified dependency on buses as a means of daily commuting. The use of intercity and long-distance bus services, private chartered buses, is also boosting to cater to growing demand for travel.

Asia Pacific Bus Market Analysis

The Asia Pacific bus industry is growing at a fast pace, spurred by the growing urban population, the rising need for public transport, and government schemes to enhance infrastructure. In populous nations, buses are a major mode of transport for daily journeys. The use of electric and hybrid buses is catching up, particularly in cities, as an initiative towards curbing pollution and addressing environmental targets. Further, intercity bus and long-distance travel services demand is increasing. The region's inflating middle class is also escalating demand for private chartered buses for events and tourism. Governments are investing heavily to modernize bus fleets, enhance accessibility, and develop wider transport networks. India Brand Equity Foundation says that Interim Budget 2024-25 provided USD 33.6 Billion to the Ministry of Road Transport and Highways (MoRTH), reflecting a firm focus on infrastructure development. The investment is further fueling growth in the bus market. As smart cities become more popular, the emergence of autonomous and connected buses will fuel the growth of the market even faster, with more safety, efficiency, and convenience.

Latin America Bus Market Analysis

The bus market in Latin America is seeing consistent growth owing to the demand for cost-effective, efficient public transport options driven by high population growth rates and urbanization, and investments by governments in developing public transport infrastructure such as BRTs. The use of electric and hybrid buses is also picking up pace as part of environmental sustainability plans. Demand for intercity buses is also on the rise owing to rises in regional travel. In Brazil, the autonomous vehicle industry, with a value of USD 1.16 Billion in 2024, is shaping the wider transportation industry. With the autonomous vehicle market growing at a CAGR of 21.50% and expected to reach USD 7.78 Billion by 2033, this technology is set to influence the bus industry too, particularly with potential developments in smart and autonomous buses.

Middle East and Africa Bus Market Analysis

The Middle East and Africa bus market is expanding considerably due to growth in urbanization and the ever-growing demand for effective public transportation services. Based on UN-Habitat estimates, urbanization in the area will be up to 97.6% by 2030, while cities such as Riyadh, which is the capital, will be inhabited by an estimated 8.2 million people, with 75% of them being Saudis. This expanding urban community is driving demand for better transportation networks, with governments investing significant funds in public transit infrastructure such as increasing bus networks to improve mobility and combat traffic congestion. Adoption of electric buses is gaining momentum because of the environmental angle and popularity of regional travel. Incentives from governments and funds are further propelling growth in the bus market for sustainable public transport systems.

Competitive Landscape:

The bus industry is extremely competitive, with several global and regional players competing for market share through innovation, strategic alliances, and expansion. Players work to design fuel-efficient, electric, and autonomous buses to address strict emission standards and sustainability considerations. Governments across the globe are developing public transportation infrastructure, and this presents opportunities for producers to win big contracts. Smart connectivity, AI-powered fleet management, and sophisticated safety features are differentiators. Brand preference is also influenced by cost efficiency, after-sales support, and durability of vehicles. Competition has been strengthened with the growing popularity of electric buses, and firms have made significant investments in battery technology and charging systems.

Mergers, acquisitions, and partnerships with technology companies are also defining the market. Regional competitors vie on the basis of low-cost solutions customized to local requirements, while international manufacturers concentrate on expanding production and reaching out to developing markets. This competitive environment creates ongoing innovation and price competition.

The report provides a comprehensive analysis of the competitive landscape in the bus market with detailed profiles of all major companies, including:

- AB Volvo

- Anhui Ankai Automobile Co. Ltd.

- Ashok Leyland (Hinduja Group)

- BYD Company Ltd.

- IVECO S.p.A

- Mercedes-Benz Group AG

- NFI Group

- Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.)

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd

- Tata Motors Limited

- Traton Group (Volkswagen AG)

- Xiamen King Long United Automotive Industry Co. Ltd.

- Zhengzhou Yutong Bus Co. Ltd.

Latest News and Developments:

- October 2025: Beginning in 2026, Daimler Buses will deploy its own public charging stations for electric buses and coaches, targeting heavily trafficked tourist spots in Europe—like bus parking areas at amusement parks or in urban centers. The company intends to promote the growth of high-performance charging infrastructure beyond highways in the upcoming years. This will allow electric buses and coaches to reach even distant travel locations in the future – at present, this is feasible only in a few limited instances. The project will start with a pilot scheme initiated by the regional energy and climate protection agency NRW.Energy4Climate in collaboration with the City of Cologne: Next year, four public fast-charging stations for electric buses and coaches are planned to be set up close to the city center.

- October 2025: VinFast has introduced two new electric bus models at Busworld Europe 2025. The EB 8 and EB 12 signify the firm's debut in the European public transport market. The 12-metre EB 12 has received certification under UNECE and CE regulations and is now ready for order in Europe. The smaller 8-meter EB 8 is poised to follow. Both models will come with an unlimited mileage warranty that spans five years for the vehicle and extends up to eight years for the high-voltage battery and corrosion protection.

- October 2025: Rajasthan Chief Minister Bhajanlal Sharma inaugurated 128 new blue line buses of the Rajasthan State Road Transport Corporation (RSRTC) on Sunday (5 October), signaling a significant enhancement in the state’s public transportation system. The new blue line buses have been allocated to 23 depots throughout Rajasthan, with the project mainly focused on enhancing connections between Jaipur and rural areas.

- September 2025: JBM ECOLIFE Mobility has obtained USD 100 Million in INR equivalent long-term funding from the International Financial Corporation (IFC). The funding will support the rollout of new, air-conditioned electric buses in urban areas of Maharashtra, Assam, and Gujarat.

Bus Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Single Deck, Double Deck |

| Fuel Types Covered | Diesel, Electric and Hybrid, Others |

| Seat Capacities Covered | 15-30 Seats, 31-50 Seats, More than 50 Seats |

| Applications Covered | Transit Bus, Intercity/Coaches, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Anhui Ankai Automobile Co. Ltd., Ashok Leyland (Hinduja Group), BYD Company Ltd., IVECO S.p.A, Mercedes-Benz Group AG, NFI Group, Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.), Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., Tata Motors Limited, Traton Group (Volkswagen AG), Xiamen King Long United Automotive Industry Co. Ltd., Zhengzhou Yutong Bus Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bus market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bus market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bus market was valued at USD 53.42 Billion in 2024.

The bus market is projected to exhibit a CAGR of 5.82% during 2025-2033, reaching a value of USD 91.26 Billion by 2033.

The urbanization, growing demand for public transport, government investments in sustainable mobility, and technology advancement in electric and autonomous buses is driving the market. Increasing emission policies, smart city policies, and growing tourism also boost demand. Cost-effective mass transit options and fuel efficiency issues also drive market growth.

Asia Pacific currently dominates the bus market, accounting for a share of 40%. The market is driven by growing metro networks, increasing population densities, enhanced road infrastructure, and enhancing private sector participation. Rising demand for intercity travel, fleet renewal, and subsidies for environmentally friendly transport add muscle to the region's supremacy.

Some of the major players in the bus market include AB Volvo, Anhui Ankai Automobile Co. Ltd., Ashok Leyland (Hinduja Group), BYD Company Ltd., IVECO S.p.A, Mercedes-Benz Group AG, NFI Group, Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.), Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., Tata Motors Limited, Traton Group (Volkswagen AG), Xiamen King Long United Automotive Industry Co. Ltd., Zhengzhou Yutong Bus Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)