Bulletproof Glass Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Bulletproof Glass Market Size and Share:

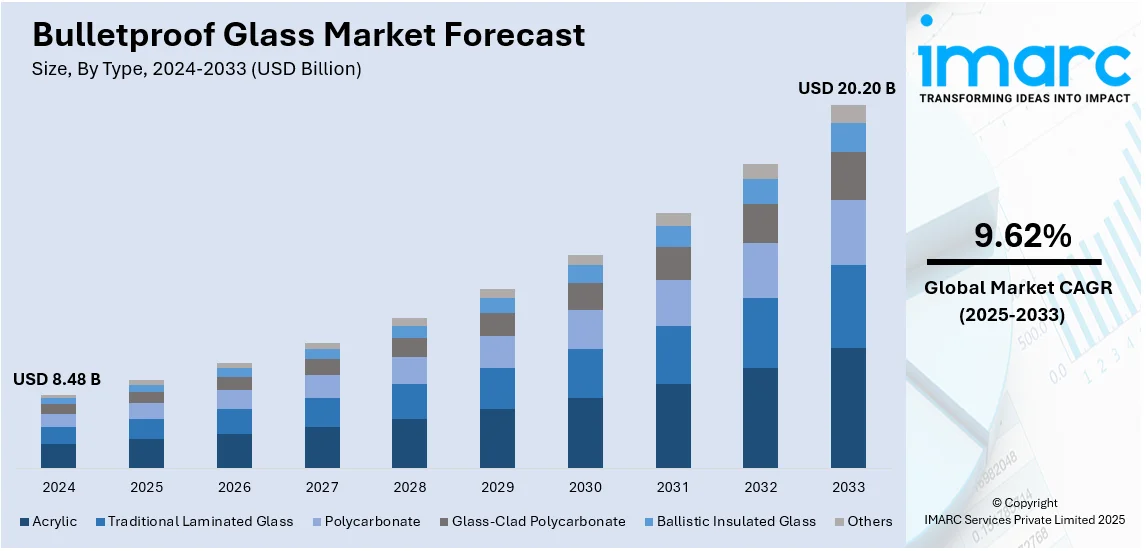

The global bulletproof glass market size was valued at USD 8.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.20 Billion by 2033, exhibiting a CAGR of 9.62% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.67% in 2024. The rising security concerns across military, automotive and commercial sectors, increasing defense budgets and stringent safety regulations and growing adoption in banks, law enforcement and critical infrastructure are some of the factors strengthening the bulletproof glass market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.48 Billion |

|

Market Forecast in 2033

|

USD 20.20 Billion |

| Market Growth Rate (2025-2033) | 9.62% |

The bulletproof glass market is driven by rising security concerns across military, commercial and civilian sectors. Increasing crime rates, geopolitical tensions and terror threats are boosting demand for armored vehicles and secure infrastructure. Growth in high-value assets including banks and luxury vehicles is fueling adoption. Technological advancements such as lightweight composites and multi-layered glass enhance performance. Stringent regulations on safety standards and expanding defense budgets further accelerate market growth. For instance, in March 2025, Germany's political leaders announced their plans to approve unprecedented spending of up to €1 trillion over the next decade aimed at boosting defense and infrastructure. Additionally, demand from automotive and construction industries supports sustained expansion.

The U.S. bulletproof glass market is driven by rising security threats, increasing mass shooting incidents and heightened demand for armored vehicles in law enforcement and military sectors. For instance, in November 2024, the U.S. Army introduced the M1E3 Abrams tank its first hybrid-electric combat vehicle aiming for an operational capability by 2030. This new design reduces fuel consumption and enhances adaptability while incorporating lessons from recent conflicts. The transition supports modernization initiatives including collaboration with General Dynamics and continued production of the M1A2 SEPv3. Government regulations mandating enhanced security for public spaces, banks and embassies are fueling adoption. Growth in high-net-worth individuals investing in secure homes and vehicles further supports demand. Advancements in lightweight, high-strength materials improve efficiency while expanding defense budgets and increasing use in commercial buildings drive sustained market growth across various applications.

Bulletproof Glass Market Trends:

Amplifying Demand in the Automotive Industry

The growth of the global bulletproof glass market is largely driven by the automotive industry, where it is widely used in the production of various vehicles, particularly luxury and government models. As a result, the rising demand for these vehicles contributes significantly to the need for bulletproof glass. Industry reports indicate that the total sales of seven luxury car manufacturers reached 45,311 units in 2024, marking a 20.5% increase compared to the 37,615 units sold in 2023. Furthermore, as security worries become more pronounced, manufacturers are increasingly integrating bulletproof glass into high-end vehicles to enhance safety. This trend is further supported by advancements in glass technology that provide greater durability and transparency while maintaining the vehicle's appearance. Additionally, key consumers such as government entities, corporate executives, and security organizations are driving bulletproof glass market demand, especially in areas experiencing higher levels of crime or targeted attacks.

Increasing Product Application in Banking and Financial Institutions

Banking and financial organizations are increasingly turning to bulletproof glass to enhance security for both clients and staff. This type of glass is being used in ATMs, teller stations, and secure transaction areas to reduce the risks associated with armed robberies and other security threats. According to FBI statistics, U.S. commercial banks experienced 1,112 robbery incidents in 2023. Furthermore, the global financial sector, particularly in areas with high crime rates or strict security regulations, is driving market growth. As financial institutions focus on creating safer environments, the demand for high-quality bulletproof glass continues to rise, contributing to the steady growth of the bulletproof glass market in both emerging and developed economies.

Technological Innovations in Bulletproof Glass Materials

The market for bulletproof glass is currently experiencing significant innovations in material science, which are leading to the creation of lighter, more affordable, and longer-lasting solutions. Developments like polycarbonate and glass-clad polycarbonate are enhancing the overall efficacy of bulletproof glass by increasing strength while reducing weight. According to industry sources, polycarbonate is 250 times stronger than regular glass and can absorb bullet impacts effectively without shattering. These materials are gaining traction in sectors that require heightened security, including aerospace, defense, and law enforcement. Moreover, the shift towards advanced glass technologies is being strengthened by growing environmental concerns, with manufacturers focusing on sustainability through the production of energy-efficient and recyclable products, which encourages wider adoption across various industries. These trends are collectively creating a positive bulletproof glass market outlook across the world.

Bulletproof Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bulletproof glass market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use.

Analysis by Type:

- Acrylic

- Traditional Laminated Glass

- Polycarbonate

- Glass-Clad Polycarbonate

- Ballistic Insulated Glass

- Others

Acrylic dominates the bulletproof glass market due to its lightweight, high impact resistance, and optical clarity. Its superior durability and ease of manufacturing make it a preferred choice for security applications in banks, government buildings, and retail stores. Compared to traditional glass-clad polycarbonate, acrylic offers better UV resistance and cost-effectiveness. Growing adoption in automotive and defense sectors further strengthens its market position. Additionally, advancements in acrylic formulations enhance ballistic protection while maintaining transparency, fueling its widespread use in security infrastructure.

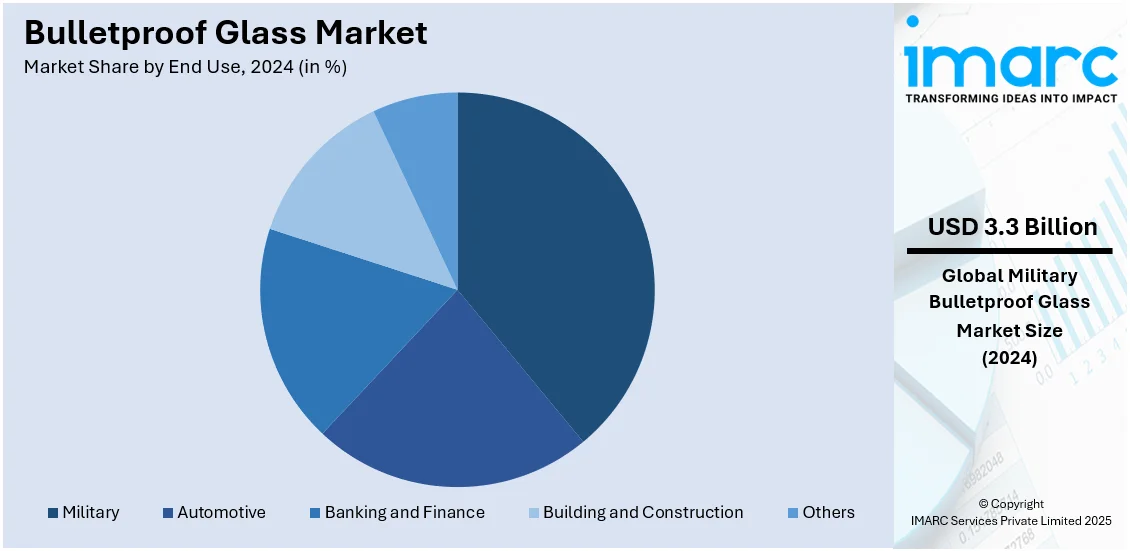

Analysis by End Use:

- Automotive

- Military

- Banking and Finance

- Building and Construction

- Others

Military leads the market with around 38.6% of market share in 2024. The military sector dominates the bulletproof glass market due to rising defense budgets and increasing threats from terrorism and cross-border conflicts. Armored vehicles, military bases, and aircraft require advanced ballistic protection, driving demand for high-strength glass solutions. Technological advancements, including lightweight, multi-layered composites, enhance mobility without compromising security. Governments worldwide prioritize soldier safety, further fueling adoption. Additionally, the growing use of bulletproof glass in naval vessels and combat helicopters strengthens the military's leadership in market share and innovation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.67%. North America leads the bulletproof glass market, driven by high defense spending, increasing security concerns, and stringent safety regulations. The U.S. military, law enforcement agencies, and financial institutions heavily invest in ballistic protection for vehicles, buildings, and personnel. Rising incidents of mass shootings and organized crime further boost demand. Advancements in transparent armor technologies, along with strong adoption in automotive and commercial sectors, support market growth. Additionally, government initiatives to enhance critical infrastructure security reinforce North America’s dominant market position.

Key Regional Takeaways:

United States Bulletproof Glass Market Analysis

In 2024, the United States accounted for over 89.50% of the bulletproof glass market in North America. The growing expansion of defense sectors in the United States is a key driving factor for the increasing adoption of bulletproof glass. The United States Aerospace and Defense industry is currently experiencing significant expansion, with a substantial increase in sales revenue reaching over USD 955 Billion in 2023. The rising need for advanced security solutions to protect both military and civilian infrastructures is prompting higher demand for bulletproof glass in various defense applications. With the growing focus on safeguarding critical assets and enhancing safety measures, bulletproof glass is becoming a preferred material for military vehicles, government buildings, and public spaces. Increased defense budgets and technological advancements are further contributing to the development of high-performance bulletproof glass products that meet stringent safety standards. As defense spending continues to rise, the demand for reliable protection materials such as bulletproof glass is expected to expand, reinforcing its role in the security and defense sectors.

Asia Pacific Bulletproof Glass Market Analysis

In the Asia-Pacific region, the growing adoption of bulletproof glass is driven by increasing investment in the automotive sector. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. The region has seen a surge in vehicle production and demand for safer transportation options, fuelling the need for advanced safety features such as bulletproof glass. With rising concerns over passenger safety and security, both commercial and luxury vehicle manufacturers are incorporating bulletproof glass into their designs. The growing presence of automotive OEMs and the increasing trend of armoured vehicles are also contributing to the adoption of bulletproof glass in this region. This is further supported by government initiatives promoting enhanced safety standards and technological innovations in automotive materials.

Europe Bulletproof Glass Market Analysis

In Europe, the growing adoption of bulletproof glass is largely attributed to the expanding BFSI (Banking, Financial Services, and Insurance) sector. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. As financial institutions continue to face increasing threats such as robberies and violent attacks, the demand for bulletproof glass in branch offices, ATMs, and other facilities has risen significantly. This shift is further fuelled by the need for stronger protection for employees, customers, and assets within these establishments. With banks and financial institutions prioritizing safety and security, bulletproof glass is becoming an essential element in protecting vulnerable areas. The increasing number of financial centres and offices also supports the broader use of bulletproof glass across the BFSI industry, ensuring compliance with stringent security regulations and maintaining public trust.

Latin America Bulletproof Glass Market Analysis

In Latin America, the growing military spending is a significant factor driving the adoption of bulletproof glass. For instance, military spending in Central America and the Caribbean in 2023 was 54% higher than in 2014. As countries in the region invest in modernizing their defense capabilities, the need for secure military vehicles and facilities has led to an increased demand for bulletproof glass. Military budgets are increasingly allocated to enhancing the safety and protection of troops and equipment, leading to more investments in advanced protective materials, including bulletproof glass. As security concerns escalate, both governmental and private sectors are turning to bulletproof glass solutions to meet the rising demand for fortified structures and vehicles.

Middle East and Africa Bulletproof Glass Market Analysis

The growing investment in building and construction projects in the Middle East and Africa is fuelling the adoption of bulletproof glass. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. With the region witnessing rapid infrastructure development, including government buildings, commercial centers, and high-end residential projects, there is an increased need for security measures. Bulletproof glass is becoming a critical element in architectural designs, providing protection against potential threats. The demand for enhanced safety solutions in these construction projects, along with ongoing investments in urban development, is propelling the growth of the bulletproof glass market in the region.

Competitive Landscape:

The bulletproof glass market is highly competitive, with companies focusing on technological advancements, product innovation, and material optimization to enhance ballistic resistance and durability. Manufacturers are investing in lightweight, multi-layered composites to improve transparency and reduce weight for military, automotive, and architectural applications. Strategic partnerships with defense organizations and government agencies drive market expansion. Companies are also strengthening their global footprint through mergers, acquisitions, and production facility expansions. Compliance with stringent safety regulations and growing demand for high-security solutions in banking, law enforcement, and transportation sectors further intensify competition, pushing firms to enhance performance and cost efficiency.

The report provides a comprehensive analysis of the competitive landscape in the bulletproof glass market with detailed profiles of all major companies, including:

- Ada Cam Sanayi ve Ticaret Ltd.

- American Glass Products Company

- Armortex Inc.

- Asahi India Glass Limited

- Centigon Security Group

- Compagnie de Saint-Gobain S.A.

- CSG Holding Limited

- ESG Group Limited

- Guardian Industries LLC (Koch Industries Inc.)

- Schott AG

- Stec Armour Glass (M) Sdn Bhd

- Taiwan Glass Industry Corporation

- Total Security Solution

Latest News and Developments:

- June 2024: Vedanta secured a 46.5% ownership stake in Japan's AvanStrate Inc., a prominent manufacturer of glass substrates. This acquisition enhances Vedanta's presence in the glass sector, particularly in innovations such as bulletproof glass. The transaction was completed in the second quarter of 2024.

- June 2024: Allegion plc, a global provider of security solutions, completed the acquisition of Unicel Architectural Corp., recognized for its advanced glass products. This move enriches Allegion's architectural solutions portfolio, with the potential to broaden offerings such as bulletproof glass. The acquisition aims to strengthen Allegion's capabilities in high-performance building materials.

- May 2024: Safe Haven Defense, a company focused on producing bullet-resistant glass laminate and various safety products, announced a strategic partnership with Dominus Capital. This collaboration seeks to accelerate growth and improve its array of security solutions while maintaining exceptional customer service.

- February 2024: Ballistic Vision Safety Glass, a Minnesota-based company founded in 2021, is working on bullet-resistant door technology designed to enhance safety in schools. Initially focusing on ballistic glass for industrial safety, the company is now developing reinforced window and door kits aimed at strengthening existing school doors and windows against potential active shooter threats.

- February 2024: Tesla applied for a patent for its groundbreaking Armour Glass, which features a bulletproof outer layer with thicknesses ranging from 2mm to 5mm. This development is expected to greatly enhance the safety and durability of vehicle windows.

- January 2024: PGT Innovations plans to showcase a variety of premium products at the 2024 NAHB International Builders' Show in Las Vegas, which will include innovative glass solutions. The company intends to highlight its bullet-resistant glass, smart glass, and thin laminated glass through brands such as Western Window Systems and PGT Custom Windows and Doors. These innovations reflect PGT's dedication to offering high-performance and safety-oriented fenestration products.

Bulletproof Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Acrylic, Traditional Laminated Glass, Polycarbonate, Glass-Clad Polycarbonate, Ballistic Insulated Glass, Others |

| End Uses Covered | Automotive, Military, Banking and Finance, Building and Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ada Cam Sanayi ve Ticaret Ltd., American Glass Products Company, Armortex Inc., Asahi India Glass Limited, Centigon Security Group, Compagnie de Saint-Gobain S.A., CSG Holding Limited, ESG Group Limited, Guardian Industries LLC (Koch Industries Inc.), Schott AG, Stec Armour Glass (M) Sdn Bhd, Taiwan Glass Industry Corporation, Total Security Solution, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bulletproof glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bulletproof glass market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bulletproof glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bulletproof glass market was valued at USD 8.48 Billion in 2024.

IMARC estimates the bulletproof glass market to reach USD 20.20 Billion by 2033, exhibiting a CAGR of 9.62% during 2025-2033.

Rising security concerns, increasing crime rates, and terrorist threats are driving the bulletproof glass market. Growing defense budgets, demand for armored vehicles, and stringent safety regulations boost adoption. Advancements in lightweight, high-strength materials and expanding applications in banking, law enforcement, and commercial buildings further accelerate market growth.

North America holds the largest bulletproof glass market share, driven by high defense spending, stringent security regulations, and increasing demand in military, law enforcement, and banking sectors. Rising crime rates, mass shooting incidents, and investments in advanced security infrastructure further boost adoption, reinforcing the region’s dominance in the global market.

Some of the major players in the bulletproof glass market include Ada Cam Sanayi ve Ticaret Ltd., American Glass Products Company, Armortex Inc., Asahi India Glass Limited, Centigon Security Group, Compagnie de Saint-Gobain S.A., CSG Holding Limited, ESG Group Limited, Guardian Industries LLC (Koch Industries Inc.), Schott AG, Stec Armour Glass (M) Sdn Bhd, Taiwan Glass Industry Corporation, Total Security Solution, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)