Building Finishing Contractors Market Size, Share, Trends and Forecast by Contractors, Application, Residential, and Region, 2025-2033

Building Finishing Contractors Market Size and Share:

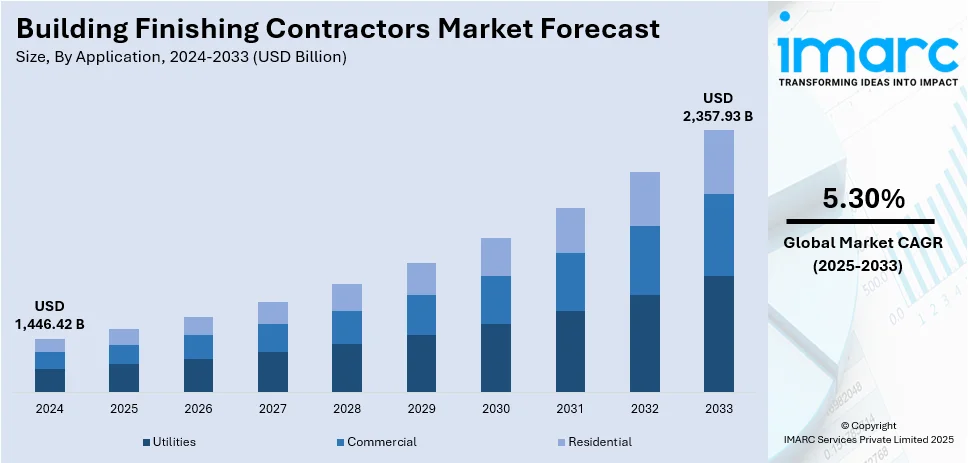

The global building finishing contractors market size was valued at USD 1,446.42 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,357.93 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.6% in 2024. The rising construction and renovation activities in the residential and commercial sectors, the widespread adoption of predictive analytics, and increasing the number of firms and contractors offering professional building finishing services represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,446.42 Billion |

| Market Forecast in 2033 | USD 2,357.93 Billion |

| Market Growth Rate (2025-2033) |

5.30%

|

The building finishing contractors market growth is influenced by a number of major factors, mainly the increasing demand for residential, commercial, and industrial building projects. With urbanization on the rise across the world, the demand for high-quality interior and exterior finishes is on the rise. This involves the installation of flooring, wall coverings, ceilings, and decorative finishes that add functionality and beauty to buildings. In addition, the push toward sustainable building practices is further affecting market expansion, with more emphasis placed on green materials, energy-efficient products, and green building certification. The growth in remodeling and renovation projects, driven by a need to update outdated infrastructure, further increases demand for professional finishing services.

In the United States, the building finishing contractors market is particularly strong, driven by a robust construction industry and an expanding housing sector. For instance, as per industry reports, it is estimated that the total annual value of construction in the United States reached USD 2,148,444 in 2024, reflecting the growth in the construction sector. The need for residential and commercial space, as well as the emphasis on superior quality, long-lasting finishes, continues to drive the growth of the market, representing one of the key building finishing contractors market trends. In addition, the development of construction materials and methods through technology also heavily influences the direction of the industry, enabling more effective and economical answers. Furthermore, growing concern for sustainability and energy efficiency in new construction and remodels helps drive the market forward, presenting opportunities for contractors experienced in green finishes.

Building Finishing Contractors Market Trends:

Aging Population and Urbanization Driving Construction and Renovation Demand

The expanding global population, rapid urbanization, and aging infrastructure are driving a rise in construction and renovation activities across the globe. This, coupled with the shifting focus toward making houses, surroundings, and public transport facilities more elderly-friendly due to the growing geriatric population, represents the primary factor driving the market growth. According to the WHO, the global population aged 60 and over will rise from 1 billion in 2020 to 1.4 billion by 2030. By 2050, this demographic is projected to double, reaching 2.1 billion.

Surge in Predictive Analytics Adoption for Enhanced Project Management

There is a surge in the adoption of predictive analytics as it aids project managers in predicting and avoiding delays in labor availability and equipment shortages. Predictive analytics also collects weather data to help companies take preventive actions against weather conditions, preventing the loss of materials and labor costs. Consequently, the rising use of predictive analytics by building finishing contractors to simplify risk management, manage finances and resources, and allocate budgets has catalyzed building finishing contractors market growth. The global predictive analytics market size reached USD 18.9 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 104.7 billion by 2033, exhibiting a growth rate (CAGR) of 19.9% during 2025-2033.

Government Investments and Consumer Preferences Supporting Market Growth

Governments of various nations, in both emerging and developed economies, are making heavy investments in infrastructure development and improvement. For instance, in July 2024, India’s federal government announced plans to invest a record ₹11.11 trillion (USD 132.85 billion) in infrastructure for the financial year ending March 2025, aiming to boost economic growth and generate employment in the world’s most populous country. In line with this, the increasing consumer preferences for wood, laminate, and vinyl flooring owing to their enhanced aesthetic appeal and durability have propelled the market growth. Other factors, including the increasing residential and commercial construction activities, such as new construction, repair, and remodeling, coupled with the rising number of building finishing firms and contractors, improving consumer living standards, elevating income levels, and technological advancements, are also anticipated to create a favorable building finishing contractors market outlook.

Building Finishing Contractors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global building finishing contractors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on contractors, application, and residential.

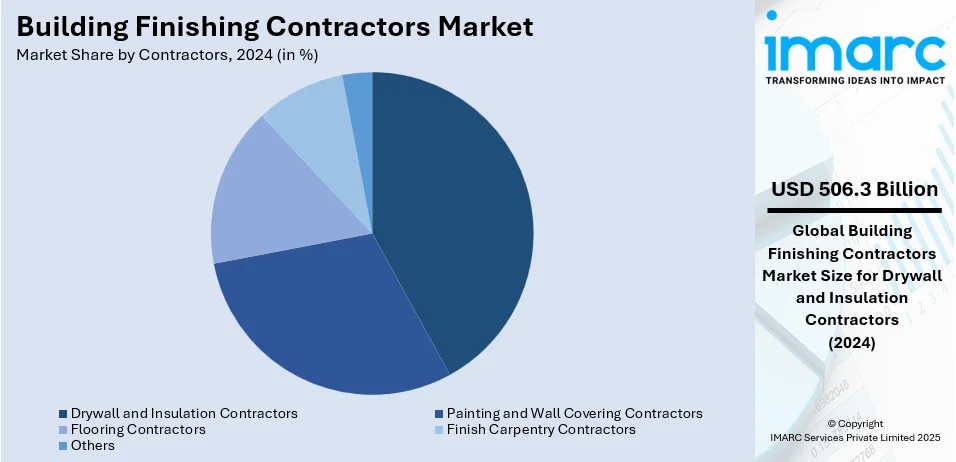

Analysis by Contractors:

- Drywall and Insulation Contractors

- Painting and Wall Covering Contractors

- Flooring Contractors

- Finish Carpentry Contractors

- Others

Drywall and insulation contractors stand as the largest component in 2024, holding around 35.0% of the market, due to their essential role in construction projects. These contractors specialize in installing drywall systems and insulating materials that contribute to a building's structural integrity, energy efficiency, and aesthetic appeal. The growing demand for energy-efficient buildings and the increasing focus on sustainable construction practices have driven the rise of drywall and insulation contractors. Additionally, the robust construction industry, particularly in emerging economies, is expected to further boost the growth of this segment. As a result, drywall and insulation contractors remain critical to the market’s overall expansion.

Analysis by Application:

- Utilities

- Commercial

- Residential

Commercial leads the market in 2024, driven by the substantial demand for office buildings, retail spaces, and other commercial infrastructures. This sector requires specialized finishing services, including drywall installation, painting, flooring, and insulation, to meet the functional and aesthetic requirements of businesses. Rapid urbanization, increasing commercial real estate developments, and growing investments in infrastructure projects contribute significantly to the market's growth. Furthermore, the demand for modern, energy-efficient commercial spaces further propels the need for high-quality finishing contractors, ensuring the commercial segment remains dominant in the global market.

Analysis by Residential:

- Large Chain Companies

- Individual Contractors

Large chain companies in the residential segment of the building finishing contractors market play a significant role in providing standardized, high-quality services to residential construction projects. These companies benefit from economies of scale, allowing them to offer competitive pricing while maintaining consistent service quality. They often work on large-scale developments, such as multi-family housing, providing a wide range of finishing services, including drywall, insulation, flooring, and painting, catering to both private homeowners and developers alike.

Individual contractors in the residential segment focus on personalized services tailored to the specific needs of homeowners. These contractors often specialize in smaller-scale projects such as renovations or custom builds. They offer flexibility and a higher level of customer engagement, providing more direct communication with clients. While typically smaller in scope compared to large chain companies, individual contractors build strong local reputations through their craftsmanship and attention to detail, making them an essential part of the residential building finishing contractors market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest building finishing contractors market share of over 35.6%, bolstered by rapid urbanization, significant economic growth, and extensive infrastructure investments. Government initiatives promoting green construction and modern design further stimulate demand, while technological innovations enhance project efficiency and quality. Moreover, diverse local markets provide attractive opportunities for both large multinational companies and specialized regional players. Competitive pricing, skilled labor, and streamlined supply chains reinforce the region’s advantage. Furthermore, strategic collaborations and market consolidation drive efficiency and cost-effectiveness, positioning Asia Pacific as a critical growth engine within the global building finishing contractors industry.

Key Regional Takeaways:

United States Building Finishing Contractors Market Analysis

The building finishing contractors market in the United States is experiencing strong growth, driven by the demand for residential, commercial, and infrastructure construction. In 2023, the U.S. construction equipment market size reached USD 43.53 Billion, highlighting the increasing scale of construction activities across the country. Factors such as government infrastructure investments, economic expansion, and urbanization continue to fuel market demand. Renovation and remodeling projects, particularly in aging infrastructure, also contribute to growth. Moreover, a shift toward sustainable building practices, with an emphasis on eco-friendly materials and energy-efficient solutions, further drives the need for specialized contractors. The integration of advanced technologies like BIM (Building Information Modeling) is improving efficiency and cost management in construction, offering new opportunities for contractors. Additionally, the growing commercial real estate sector, particularly in office spaces, retail, and hospitality, enhances market demand. The focus on high-quality, durable, and aesthetically pleasing finishes further supports the expansion of building finishing contractors in the United States.

North America Building Finishing Contractors Market Analysis

The North America building finishing contractors market exhibits steady growth driven by robust construction activity and increasing renovation projects. Advanced technologies, evolving design trends, and sustainable practices contribute to enhanced project efficiency and quality. Both established enterprises and local specialists compete vigorously, leveraging cost-effective materials and innovative service offerings. Additionally, regulatory frameworks and consumer preferences influence market strategies, fostering collaborations and strategic mergers. The sector’s resilience is further supported by diverse project portfolios spanning commercial, residential, and industrial segments. For instance, in October 2024, U.S. government allocated over USD 4.2 billion funding in America agenda. This funding will be distributed through the National Infrastructure Project Assistance (Mega) and Infrastructure for Rebuilding America (INFRA) grant programs, supported by the Bipartisan Infrastructure Law to support infrastructure development and improving transportation systems across the nation. Furthermore, market analysis indicates strong potential for future expansion in building finishing contractors market demand amid competitive pressures and evolving industry standards across the region.

Europe Building Finishing Contractors Market Analysis

The building finishing contractors market in Europe is seeing robust growth driven by infrastructure development, urbanization, and sustainability initiatives. A key factor influencing market demand is the rapid growth of smart cities, with the European smart cities market projected to grow at a CAGR of 13.95% during 2024-2032. This growth is expected to spur demand for advanced building finishes, as smart city projects require cutting-edge construction technologies and sustainable, energy-efficient solutions. Additionally, the focus on green building practices and stringent sustainability regulations across European countries boosts the demand for eco-friendly materials and finishes. Renovation and retrofitting of older buildings, along with new commercial and residential developments, further fuel the need for specialized contractors. Urban regeneration projects and the increasing desire for aesthetically appealing, functional spaces contribute to the expansion of the building finishing contractors market in Europe. The ongoing investment in public infrastructure, coupled with the rising popularity of smart buildings, offers significant growth opportunities for contractors specializing in high-quality, modern finishes.

Asia Pacific Building Finishing Contractors Market Analysis

The building finishing contractors market in the Asia-Pacific region is driven by rapid urbanization, industrialization, and infrastructure development. For instance, Australia’s construction market size was valued at USD 403.2 billion in 2024 and is expected to reach USD 588 billion by 2033, growing at a CAGR of 4.30% from 2025-2033, as per IMARC Group. This growth highlights the increasing demand for building finishing services in both residential and commercial sectors. Government initiatives, such as smart city developments and affordable housing projects, further support market expansion. Additionally, rising disposable incomes in urban areas are boosting the demand for high-quality finishes in modern living spaces, while the adoption of sustainable building practices provides new opportunities for contractors in the region.

Latin America Building Finishing Contractors Market Analysis

The building finishing contractors market in Latin America is expanding due to rapid urbanization and infrastructure development. With urbanization now around 80%, as reported, the region outpaces most others in this regard, creating significant growth opportunities in the construction sector. The rising middle class, especially in urban areas, drives demand for high-quality finishes in both residential and commercial buildings. Additionally, government investments in public infrastructure and a growing emphasis on sustainable building practices encourage contractors to adopt eco-friendly materials and energy-efficient solutions, fueling further market growth.

Middle East and Africa Building Finishing Contractors Market Analysis

The building finishing contractors market in the Middle East and North Africa (MENA) is experiencing growth due to rapid urbanization and large-scale construction projects. With urbanization already at 64%, as noted by the World Bank, this demographic shift significantly drives demand for residential, commercial, and infrastructure development. Major cities like Dubai, Riyadh, and Cairo are central to this expansion, creating substantial opportunities for contractors. Furthermore, the increasing focus on sustainability and energy-efficient construction solutions offers contractors the opportunity to integrate green materials and modern finishes, driving further market development.

Competitive Landscape:

The market for building finishing contractors is dominated by a combination of large multinational companies and small specialist firms. Competitors compete for contracts on the basis of cost competitiveness, quality of work, and new technologies. Moreover, regional differences in demand and regulatory settings determine strategic positioning and building finishing contractors market share. Companies emphasize efficiency, sustainability, and customer service to stand out. Consolidation patterns are manifest in the form of mergers and acquisitions, whereas niche operators prosper by servicing specialized niches. For instance, in November 2024, Shawmut Design and Construction acquired First Finish, a hotel renovation contractor. This partnership combines Shawmut’s large-scale project expertise with First Finish’s fast-track, luxury interior renovation skills for efficient hotel upgrades. Furthermore, competitive forces are fluid with changing design trends and advances in technology altering effective service delivery and operational efficiency in a highly segmented global marketplace.

The report provides a comprehensive analysis of the competitive landscape in the building finishing contractors market with detailed profiles of all major companies, including:

- APi Group Inc.

- Cleveland Construction Inc.

- Fletcher Building

- JGC Holdings Corporation

- Obayashi Corporation

- Performance Contracting Group Inc.

- Takenaka Corporation

Latest News and Developments:

- January 2025: Tata Projects announced that the construction of Micron Technology’s semiconductor assembly and test facility in Sanand, near Ahmedabad, is expected to be completed by December 2025. With 60% of the work already finished, the remaining construction is set to be completed by the end of 2025. The facility, covering nearly 50 acres in the Sanand industrial area, began construction in July last year.

- December 2024: The National Company Law Appellate Tribunal has appointed the government’s construction arm, NBCC, as the project management consultant to oversee the completion of 16 delayed projects by Supertech Ltd. These projects, affecting nearly 50,000 buyers, are located in Uttar Pradesh, Uttarakhand, Haryana, and Karnataka.

- October 2024: Saudi Arabia has initiated the USD 50 Billion 'Mukaab' project in Riyadh, a monumental skyscraper that will be the world’s largest building. The cubical structure will reach 1,300 feet in height and 1,200 feet in width. Construction is now underway, with the project aiming to reshape the urban landscape of the capital city.

- April 2024: Intel continued its global expansion in 2023, using 145,000 tons of steel and over 2 Million cubic yards of concrete. Key projects include two new chip factories in Chandler, Arizona, where a USD 32 Billion investment is underway. The concrete pour for Fab 52 was completed in December 2023, and teams are now installing an automated material handling system.

Building Finishing Contractors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Contractors Covered | Drywall and Insulation Contractors, Painting and Wall Covering Contractors, Flooring Contractors, Finish Carpentry Contractors, Others |

| Applications Covered | Utilities, Commercial, Residential |

| Residentials Covered | Large Chain Companies, Individual Contractors |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | APi Group Inc., Cleveland Construction Inc., Fletcher Building, JGC Holdings Corporation, Obayashi Corporation, Performance Contracting Group Inc., Takenaka Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the building finishing contractors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global building finishing contractors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the building finishing contractors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building finishing contractors market was valued at USD 1,446.42 Billion in 2024.

IMARC estimates the global building finishing contractors market to reach USD 2,357.93 Billion in 2033, exhibiting a CAGR of 5.30% during 2025-2033.

The building finishing contractors market is driven by strong construction activity, increasing renovation projects, and rising demand for high-quality interior finishes. Advances in sustainable materials, smart building technologies, and energy-efficient solutions are reshaping industry standards. Additionally, government infrastructure investments and growing urbanization continue to fuel market expansion.

Asia Pacific currently dominates the market, holding a market share of over 35.6% in 2024. This leadership is propelled by rapid urbanization, large-scale infrastructure projects, and expanding residential and commercial construction. Moreover, increasing government investments, rising disposable incomes, and growing demand for energy-efficient and sustainable building materials further support market growth across China, India, and Southeast Asia.

Some of the major players in the building finishing contractors market include APi Group Inc., Cleveland Construction Inc., Fletcher Building, JGC Holdings Corporation, Obayashi Corporation, Performance Contracting Group Inc., Takenaka Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)