Building Automation System Market Size, Share, Trends and Forecast by Offering, Communication Technology, Application, and Region, 2025-2033

Building Automation System Market Size and Share:

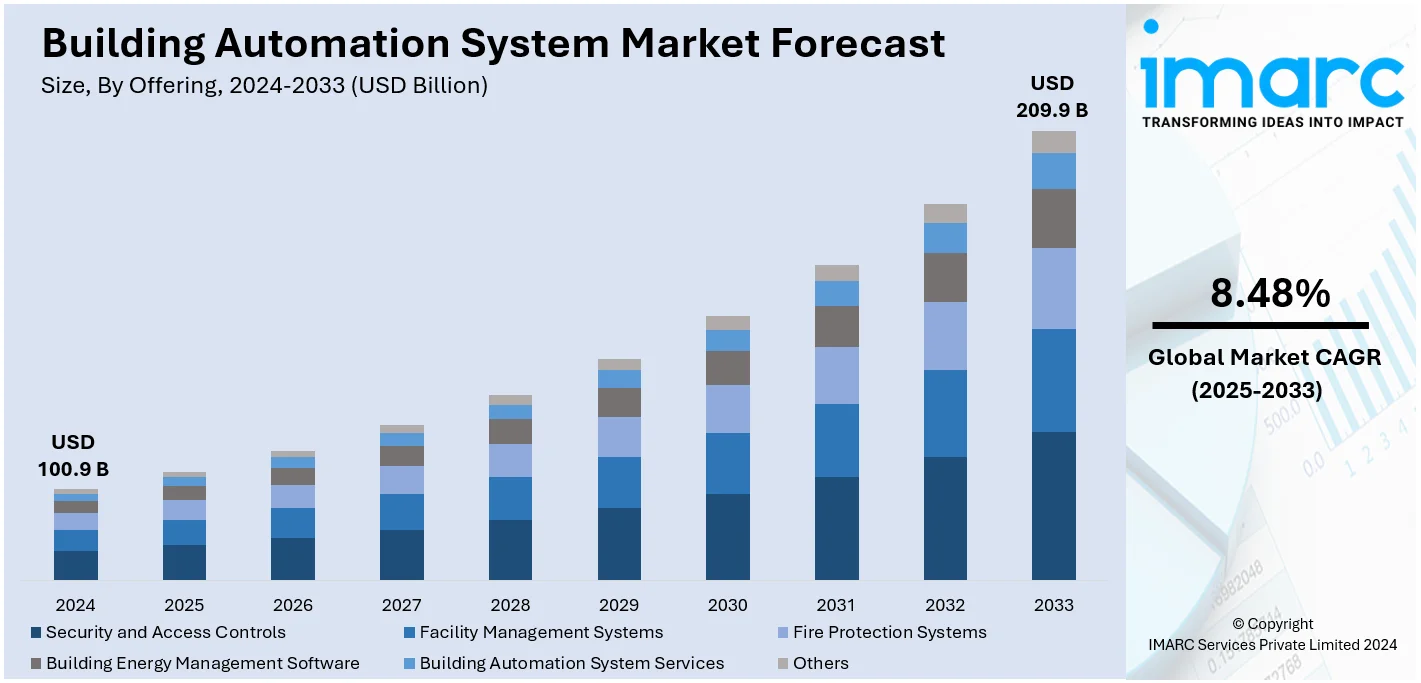

The global building automation system market size was valued at USD 100.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 209.9 Billion by 2033, exhibiting a CAGR of 8.48% from 2025-2033. North America currently dominates the building automation system market share. The rising expenditure capacities of consumers, the increasing demand for integrated security and monitoring solutions, and extensive research and development (R&D) activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 100.9 Billion |

|

Market Forecast in 2033

|

USD 209.9 Billion |

| Market Growth Rate 2025-2033 | 8.48% |

The growth of the global building automation system (BAS) market growth is driven by increasing security concerns and the rising demand for energy-efficient and sustainable solutions. BAS addresses critical needs by protecting sensitive data from cyber threats, optimizing energy consumption, and enhancing building efficiency. The rapid integration of latest technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) further fuels market expansion, enabling real-time monitoring, fault detection, and predictive maintenance. Additionally, the growing adoption of BAS in smart buildings to control HVAC, lighting, and security systems, alongside rising global temperatures and expanding urban populations, contributes to its demand.

The growth of the building automation system market outlook in the United States is rising due to the increasing energy-efficient buildings accounting for 75% of electricity use in the nation and 40% of its overall energy demand. This emphasis on energy efficiency has led to a rise in the adoption of BAS to optimize energy consumption. Additionally, the integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) has enhanced the capabilities of BAS, enabling real-time monitoring and predictive maintenance, which further propels market growth. Furthermore, government initiatives promoting smart buildings and sustainability contribute to the expansion of the country's BAS market.

Building Automation System Market Trends:

Addressing security concerns with integrated solutions

The increasing global emphasis on security and data protection is a significant driver for the building automation system market demand. Organizations are seeking comprehensive solutions to mitigate risks from unauthorized access and cyber threats. BAS effectively addresses these challenges by safeguarding sensitive data and integrating monitoring solutions to enhance security frameworks. The adoption of BAS for corporate and industrial facilities highlights its role in creating safe and controlled environments. Additionally, the ability to seamlessly manage HVAC, lighting, and security systems contributes to its rising demand, particularly in sectors prioritizing robust security measures.

Rising demand for energy-efficient buildings

Energy efficiency has become a critical focus in the construction and planning of modern buildings. BAS is instrumental in reducing energy consumption by optimizing operations such as temperature control, lighting, and ventilation. With increasing global temperatures and the rising adoption of air conditioning systems, BAS offers a sustainable solution by ensuring optimal energy usage. The demand for smart buildings, coupled with government initiatives focused on reducing carbon footprints and improving energy efficiency, is bolstering the market. BAS also enhances indoor comfort and convenience, further driving adoption among the users.

Rapid Growth in Internet of Things (IoT) and Artificial Intelligence (AI) Integration

The integration of the IoT and AI is revolutionizing the BAS market. IoT enables real-time data collection, enhancing the performance and responsiveness of building systems. The global IoT market reached $1,022.6 billion in 2024, underlining its growing influence on BAS adoption. Simultaneously, AI enhances system efficiency by detecting faults, predicting maintenance needs, and minimizing downtime, thus improving operational reliability. With approximately 70,000 AI companies operating globally, AI-driven BAS is becoming a cornerstone of modern building management. These technologies not only optimize energy usage but also cater to the growing demands of smart buildings and cities.

Building Automation System Market Challenges:

Integration with Legacy Systems

The other significant integration challenge is with modern building automation systems, where old legacy infrastructures are integrated. Most old buildings are built with technologies that are decades old and do not support advanced automation solutions. Many such legacy systems do not implement the protocols or standards of communication, which makes integration a pain point during implementation. Upgrades or replacement require high costs, longer project durations, and disruption of operations. Further, some custom integration solutions are required, and it only adds more complexity and cost in modernization efforts. Moreover, building owners can face problems finding professionals who know the legacy systems and understand modern systems in detail so they can integrate them properly. Without proper planning, such projects can lead to inefficiencies or partial automation, undermining the benefits of BAS.

Cybersecurity Risks

As BAS has become highly dependent on IoT devices, cloud computing, and wireless connectivity, cybersecurity risks have started to emerge as a significant issue. BAS can be manipulated through unauthorized access to data breaches, operational disruptions, or even direct physical threats to human safety and property. For example, attackers may use vulnerabilities to take over control of HVAC systems, lighting, and security mechanisms, thus causing a risk of financial loss or safety. Most existing BAS implementations do not have proper security protocols, and thus they are vulnerable to attacks. Ensuring the security of such systems involves deploying end-to-end encryption, employing secure authentication methods, consistently updating software, and actively monitoring for potential threats. However, all these measures increase the complexity and cost of deploying and maintaining a system, especially in smaller buildings with limited budgets.

Building Automation System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global building automation system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, communication technology, and application.

Analysis by Offering:

- Security and Access Controls

- Facility Management Systems

- Fire Protection Systems

- Building Energy Management Software

- Building Automation System Services

- Others

In 2024, security and access controls emerged as the largest component in the building automation system (BAS) market based on offerings. This dominance is driven by the rising need for enhanced safety techniques across commercial, residential and industrial sectors. Advanced security systems, including surveillance cameras, biometric access controls, and intrusion detection systems, are increasingly integrated into BAS to address rising security concerns and protect sensitive assets. The widespread adoption of smart building technologies further fuels demand, as these systems enable seamless monitoring and real-time alerts. Additionally, government regulations mandating robust security measures in critical infrastructure and the increasing prevalence of cyber threats contribute to the growth of this segment, solidifying its leading position in the market.

Analysis by Communication Technology:

- Wireless

- Wired

Wireless communication technology is expected to dominate the BAS market in 2024 due to its flexibility, scalability, and cost-effectiveness. In this regard, wireless solutions would eliminate the need for extensive wiring, making it easier to install while reducing costs, especially in retrofitting older buildings with modern BAS. The increasing number of IoT devices also fuels this segment, since wireless networks ensure control of building systems and real-time monitoring such as HVAC, lighting, and security. Technologies such as Wi-Fi, Zigbee, and Bluetooth is essential in facilitating wireless communication in smart buildings. In addition, the growing acceptance of remote monitoring and the high adoption of energy-efficient solutions augment the demand for wireless BAS and further cements its market dominance.

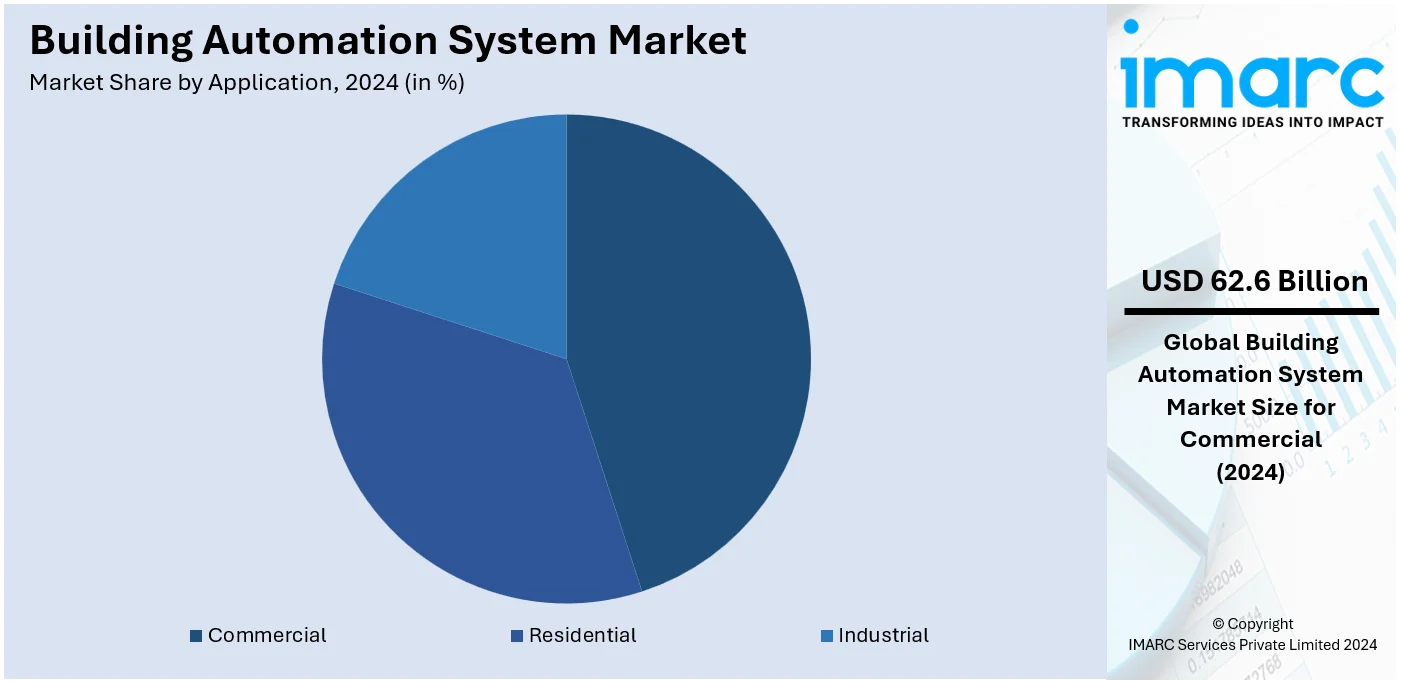

Analysis by Application:

- Commercial

- Residential

- Industrial

In 2024, the commercial sector leads the building automation system (BAS) market, accounting for the majority of the market share. This dominance is driven by the rising adoption of BAS in offices, retail spaces, hospitality, healthcare facilities, and educational institutions to enhance operational efficiency and energy management. Commercial buildings benefit from BAS by optimizing HVAC systems, lighting, and security, ensuring comfort, safety, and cost savings. The increasing focus on smart buildings, driven by sustainability goals and government regulations, further amplifies adoption in this sector. Additionally, the integration of advanced technologies like IoT and AI in commercial BAS enables real-time monitoring, fault detection, and predictive maintenance, making it an indispensable solution for modern building management.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share in the building automation system (BAS) market, driven by the region's advanced infrastructure and widespread adoption of smart technologies. The strong emphasis on energy efficiency, sustainability, and the need to reduce operational costs has led to significant BAS implementation in commercial, industrial, and residential sectors. Government regulations promoting green buildings, such as the U.S. Energy Policy Act and various state-level initiatives, further boost demand for energy-efficient BAS solutions. The integration of advanced technologies like IoT and AI, along with the growing presence of key market players, accelerates adoption in the region. Additionally, retrofitting older buildings with BAS and investments in smart cities contribute to North America's market leadership.

Key Regional Takeaways:

United States Building Automation System Market Analysis

The United States' BAS market is influenced by many factors, which include increasing importance on energy efficiency, sustainability, and operational cost minimization. The United States is the AI innovation incubator, as 4,633 AI startups were founded between 2013 and 2022, with another 524 AI startups in this year itself and attracting non-governmental funding of USD 47 Billion. This increase in AI adoption is contributing to the growing integration of intelligent technologies such as AI and IoT in building management, enhancing the functionality of BAS in areas like energy management, predictive maintenance, and system integration. In addition, government regulations concerning energy consumption and environmental impact have spurred the adoption of BAS across multiple sectors. Growing commercial and residential building sectors are pushing demand for automated systems that improve operational efficiency, security, and comfort. Beyond this, with the rise of COVID-19, the need for smarter and safer workplaces has accelerated the integration of advanced HVAC systems and air quality monitoring. As demand for both new buildings and retrofitting rises, BAS solutions keep changing to be more cost-effective and energy efficient, meeting today's requirements.

Europe Building Automation System Market Analysis

The primary driver for the BAS market in Europe is the region's strong focus on sustainability and energy efficiency, in line with the European Union's strict regulations aimed at reducing carbon emissions and promoting green buildings. In 2023, the European construction market size reached USD 3.38 Billion, contributing to the growing demand for energy-efficient BAS solutions in both new and retrofitted buildings. Technological advances in IoT, AI, and cloud-based solutions improve the functionalities of BAS. Increased adoption of smart cities and urbanization across Germany, France, and the UK further accelerate market growth since most buildings will be required to become automated in improving energy management, occupant comfort, and security. Further, the health and well-being of occupants is becoming a strong focus area, especially in the aftermath of the COVID-19 pandemic, which raises the demand for sophisticated HVAC systems, lighting controls, and air quality monitoring. Building owners and managers are thus adopting integrated BAS solutions to improve energy consumption efficiency, reduce operation costs, and be environmentally compliant with the region's environmental goals. The increasing trend of smart homes and workplace automation remains a driving force for market expansion across Europe.

Asia Pacific Building Automation System Market Analysis

The APAC building automation system market forecast is primarily driven by rapid industrialization, urbanization and rising construction activities across countries like China, India, and Japan. According to the Microsoft IoT Signals report, organizations in Australia report the highest rate of IoT adoption in the region, at 96%, which is fueling the demand for IoT-enabled BAS solutions. Other stringent regulations on improving energy efficiency and reducing carbon emissions from governments are pushing the use of BAS technologies further. The growing trend of smart cities and sustainable buildings contributes to market growth. Demand for better living standards, including enhanced security and comfort, in the context of a rising middle-class population and increased disposable income in APAC countries pushes up the adoption of BAS. As the region modernizes, the demand for advanced automation solutions in residential, commercial and industrial buildings for better energy management and reducing operational costs will be significant.

Latin America Building Automation System Market Analysis

In Latin America, the building automation system market is driven by the region's growing focus on energy efficiency and sustainability, particularly in countries like Brazil and Mexico. According to research, urbanization in Latin America has reached around 80%, contributing to the growing demand for smart buildings and BAS solutions. The implementation of environmental regulations and government initiatives for green building certifications further support this trend. Additionally, the rising need for comfort, security, and energy management in both residential and commercial sectors is fueling BAS adoption, focusing on energy conservation and reducing operational costs.

Middle East and Africa Building Automation System Market Analysis

The building automation system market share in the Middle East and Africa is expected to be highly driven by the rapid urbanization of the area, especially countries like the UAE, Saudi Arabia, and South Africa. Reports from industry state that the MENA region had 0.28 Billion IoT devices by 2023, which will further increase as smart technologies find their way in the region. The emphasis on energy efficiency, sustainable building practices, and smart cities is increasing demand for advanced BAS solutions. Even large-scale projects in infrastructure, like skyscraper buildings and luxury residential complex accommodations, are on the increase and fuel further adoption of integrated BAS solutions to meet modern technological and environmental standards.

Competitive Landscape:

The global building automation system (BAS) market is highly competitive, with several key players that are vying to capture the market share by innovation, strategic partnerships, and regional expansions. Prominent companies dominate the landscape, leveraging advanced technologies like IoT and AI for enhancing product offerings. These firms focus on integrating real-time monitoring, predictive maintenance, and energy efficiency solutions in order to cater to the rising demand for smart buildings. Emerging players, in a quest to provide niche solutions at competitive prices, are entering the market. R&D investments to offer up-to-date, customizable systems further increase the competition. Regional players further diversify the market, trying to adapt the solution to local needs and requirements of different regulatory regimes.

The report provides a comprehensive analysis of the competitive landscape in the building automation system market with detailed profiles of all major companies, including:

- ABB Ltd.

- Convergint Technologies LLC

- Distech Controls Inc. (Acuity Brands Inc.)

- Hitachi Ltd.

- Honeywell International Inc.

- Johnson Controls

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Trane Technologies plc

Latest News and Developments:

- September 2024: Johnson Controls has launched Metasys 14.0, an update to its Building Automation System. The version improves performance, sustainability, and energy management with features like preconfigured energy dashboards and factory-designed applications for better equipment efficiency. It also introduces a continual release model and ensures compatibility with local and cloud systems, adhering to ASHRAE Guideline 36 for HVAC operations.

- May 2024: Airoverse, a new business unit of DMI Companies, will begin offering Building Automation Systems (BAS) and indoor air quality sensors to address the growing demand for intelligent, energy-efficient, and healthier commercial environments. Its cloud-based platform will enable remote and on-site monitoring and control, utilizing sensors, controllers, and algorithms to optimize building performance and reduce costs.

- May 2024: FläktGroup has launched FläktEdge, a centralized building and ventilation control system built on the open FIN Framework platform. It integrates all products into a single system, offering cloud-based access, improved energy efficiency, and faster installation. FläktEdge aims to enhance HVAC automation, reduce energy use, and improve indoor environments. It has been successfully piloted at Trafikverket’s offices in Luleå, Sweden, addressing indoor climate control issues.

- January 2024: Honeywell has launched its Advanced Control for Buildings platform to enhance energy and operational efficiency. The system uses existing wiring to cut installation costs and integrates intelligent edge technology for faster data processing. In collaboration with NXP Semiconductors and Analog Devices Inc., it focuses on machine learning and advanced connectivity for better energy management and industrial applications.

Building Automation System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Security and Access Controls, Facility Management Systems, Fire Protection Systems, Building Energy Management Software, Building Automation System Services, Others |

| Communication Technologies Covered | Wireless, Wired |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Convergint Technologies LLC, Distech Controls Inc. (Acuity Brands Inc.), Hitachi Ltd., Honeywell International Inc., Johnson Controls, Microchip Technology Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Trane Technologies plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the building automation system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global building automation system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the building automation system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Building automation systems (BAS) integrate various building systems like HVAC, lighting, and security to provide centralized control, enhance energy efficiency, improve comfort, and ensure safety in residential, commercial, and industrial buildings.

The building automation system market was valued at USD 100.9 Billion in 2024.

IMARC estimates the global building automation system market to exhibit a CAGR of 8.48% during 2025-2033.

Key drivers include rising energy efficiency demands, increasing integration of IoT and AI for predictive maintenance and monitoring, growing urbanization, government regulations promoting sustainability, and heightened security concerns.

In 2024, security and access controls emerged as the largest segment by offering, driven by increased demand for enhanced safety measures and advanced monitoring technologies.

Wireless communication technology leads the market due to its flexibility, ease of installation, and cost efficiency in retrofitting existing buildings.

The commercial sector is the leading segment, driven by the adoption of BAS in offices, retail spaces, and healthcare facilities to enhance operational efficiency and sustainability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global building automation system market include ABB Ltd., Convergint Technologies LLC, Distech Controls Inc. (Acuity Brands Inc.), Hitachi Ltd., Honeywell International Inc., Johnson Controls, Microchip Technology Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Trane Technologies plc, etc.

A key trend in building automation systems (BAS) is the integration of IoT and AI technologies. This enables real-time data collection, predictive maintenance, and enhanced energy efficiency, offering smarter, more connected, and sustainable building management solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)