Bubble Tea Market Size, Share, Trends and Forecast by Base Ingredients, Flavor, Component, and Region, 2026-2034

Bubble Tea Market Size and Share:

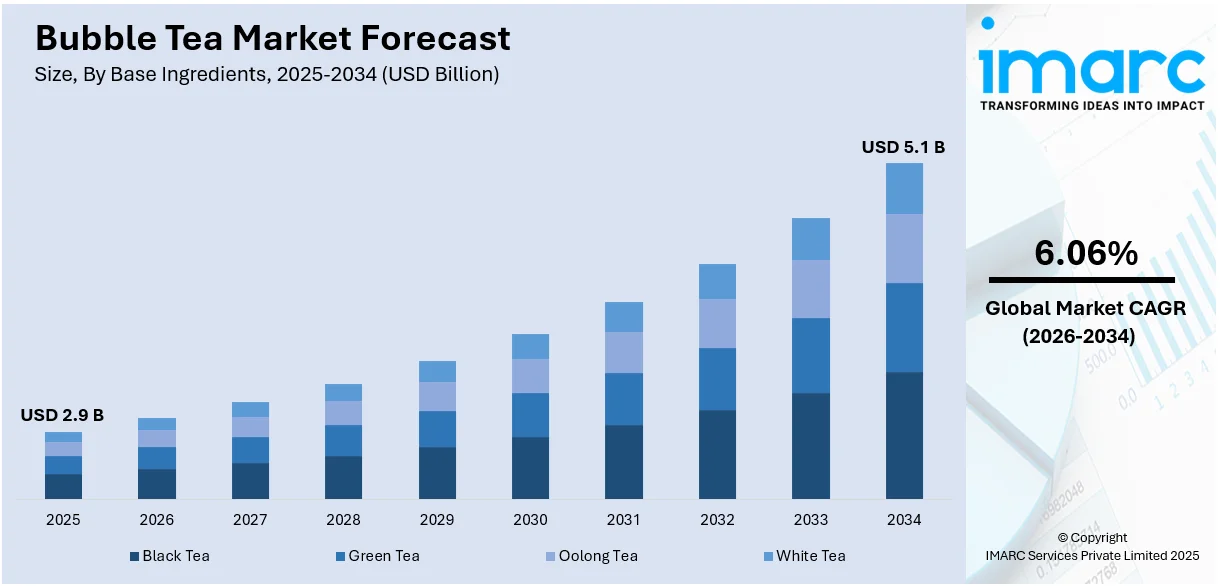

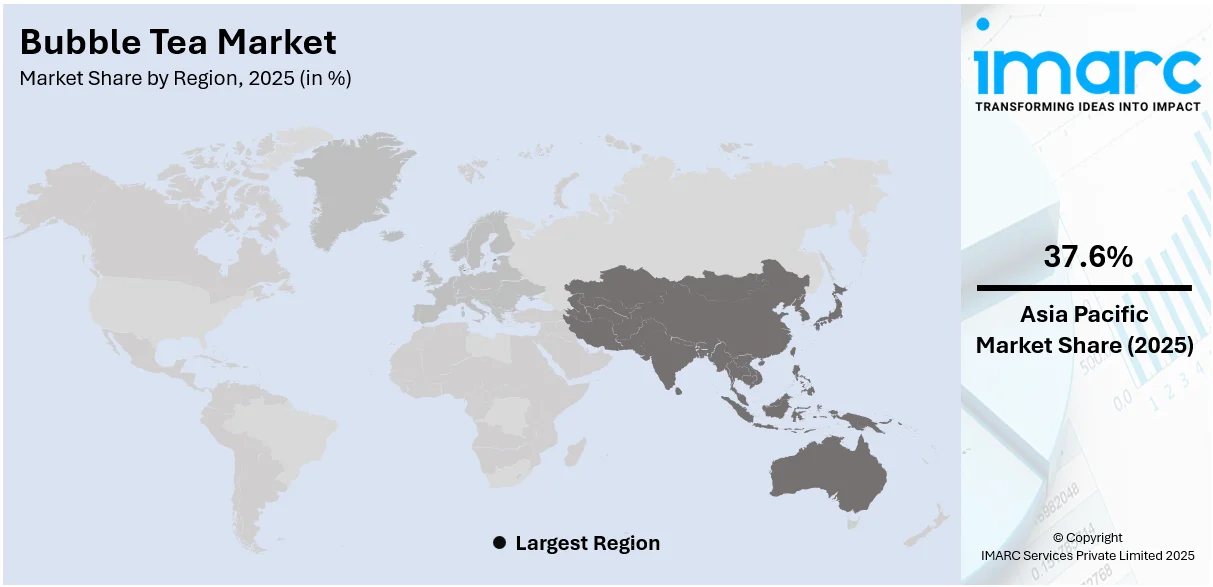

The global bubble tea market size was valued at USD 2.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.1 Billion by 2034, exhibiting a CAGR of 6.06% from 2026-2034. Asia Pacific currently dominates the market in 2025. Rising global popularity, increase in disposable incomes and the rapid urbanization is creating a positive outlook for the market. Health-conscious consumers nowadays favor natural ingredients, while innovative flavors and attractive packaging attract younger demographics. Expanding franchises, cafe culture and social media influence also contribute significantly to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.9 Billion |

|

Market Forecast in 2034

|

USD 5.1 Billion |

| Market Growth Rate (2026-2034) | 6.06% |

The expansion of retail chains has significantly boosted the global bubble tea market. In China, the tea industry has experienced substantial growth, with provinces like Sichuan reporting a comprehensive output value exceeding 120 billion yuan in 2023, marking a year-on-year increase of over 10%. Similarly, Guizhou's tea output reached 469,000 metric tons, contributing to an output value of 64.38 billion yuan. This growth is mirrored in the United States, where tea imports were valued at $508 million in 2022, nearly quadrupling from $131 million three decades earlier. The proliferation of bubble tea outlets and franchises has made the beverage more accessible, catering to diverse consumer preferences and driving market expansion. This trend is further supported by the increasing number of tea-related events and expos, such as the 15th Hunan Tea Industry Expo, which showcases the industry's growth and innovation.

To get more information on this market Request Sample

The U.S. bubble tea market is expanding due to several factors. Tea consumption remains high, with over 159 million Americans drinking tea daily. In 2021, Americans consumed nearly 3.9 billion gallons of tea, with black tea accounting for 84% of this consumption. Retail and food services sales have also been on the rise. In November 2024, sales reached $724.6 billion, a 0.7% increase from the previous month and a 3.8% increase from November 2023. Additionally, U.S. food imports have been growing. In 2023, the United States imported $508 million worth of tea, nearly quadrupling the value imported three decades earlier. These trends indicate a growing consumer base and increased accessibility to diverse tea products, contributing to the expansion of the bubble tea market in the United States.

Bubble Tea Market Trends:

Rise in Collaboration and Social Media Influence

Social media platforms and influencer collaborations are significantly boosting the market growth. Eye-catching photos and videos showcasing colorful degradations attract a wide audience mainly the younger demographic. Influencer promoting bubble tea on platforms like Instagram, tik-tok and YouTube create trends and drive consumer interest. In October 2023, CoCo Fresh Tea & Juice and Blizzard Entertainment collaborated to bring an exhilarating experience to Diablo IV fans in several countries. This unprecedented collaboration offers themed drinks, exclusive merchandise, and in-game benefits. CoCo introduced two new flavors inspired by Diablo IV: Frozen Orb and Lilith Advocate. These collaborations increase the brand visibility and engagement turning bubble tea into a clamping and shareable experience, which, in turn, is contributing significantly to the market growth across the globe.

Shift Towards Healthier Options

Consumers nowadays are increasingly health conscious which drives the demand for bubble tea made with reduced sugar and organic ingredients. This trend reflects broader shift in beverage industry where natural and health-oriented products are favored. For instance, BUBLUV, Inc., a New York based start-up, has launched BUBLUV Bubble Tea, the first ready to drink, served as a boba alternative. It offers less than 1g of sugar and 50 calories per 9.5oz bottle. The tapioca pearls are made of tapioca starch and konjac with no added sugar. The tea is brewed with loose leaf tea and sweetened with all natural sweeteners which results in a lightly sweet and refreshing taste. Bubble tea shops are further offering low calorie sweeteners, fresh fruits and organic teas to cater to this market segment. This shift not only appeals to health-conscious consumers but also helps position bubble tea as a viable alternative to other sugary drinks further expanding its market base.

Rise of DIY Bubble Tea Kits

The rising front towards DIY bubble tea kits and home delivery services is growing as consumers nowadays seek convenience and personalized experiences. DIY kits allow enthusiasts to recreate their favourite bubble tea drinks at home catering to those who enjoy hands-on activities or prefer customization. For instance, New Zealand-based DIY bubble tea by Avalanche introduced their at-home bubble tea kits, which is gaining immense traction among the masses. The kits, featuring flavors like taro, brown sugar, and strawberry, have gained popularity thanks to social media, particularly a viral TikTok video. Avalanche plans to release the kits in New Zealand supermarkets soon, prompting anticipation among fans. The affordable and Instagrammable nature of the kits has contributed to their rapid success. Meanwhile, home delivery services provide easy access to bubble tea without the need to visit a physical store. This trend has been particularly amplified by the COVID-19 pandemic, as more people look for convenient and safe ways to enjoy their favorite beverages.

Bubble Tea Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bubble tea market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on base ingredients, flavor, and component.

Analysis by Base Ingredients:

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

According to the report, black tea represented the largest segment. Black tea dominates the market accounting for the majority of market share mainly due to its rich flavor, widespread availability and versatility. Black tea's robust taste pairs well with various toppings and flavorings which makes it a popular base for classic and innovative bubble tea recipes. Black tea’s health benefits like antioxidants and moderate caffeine content further enhances its appeal. As consumers nowadays continues to seek familiar yet customizable beverages black to remains a staple driving significant market demand and growth in the bubble tea industry.

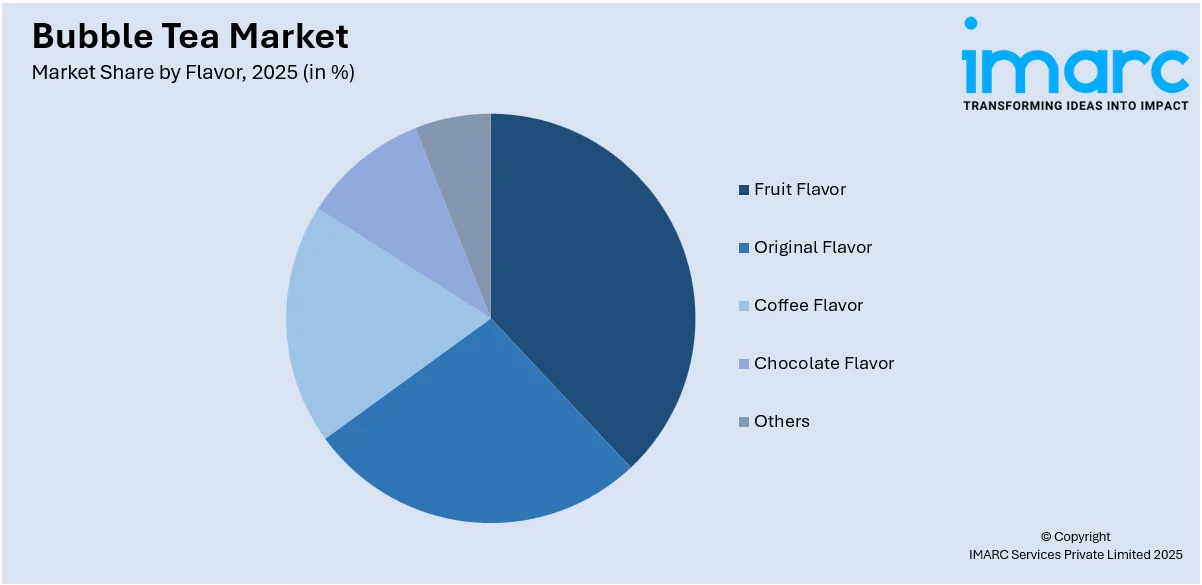

Analysis by Flavor:

Access the comprehensive market breakdown Request Sample

- Original Flavor

- Coffee Flavor

- Fruit Flavor

- Chocolate Flavor

- Others

According to the report, fruit flavor accounted for the largest market share. Fruit flavors command the largest share of the bubble tea market, reflecting consumers' preference for refreshing and vibrant taste experiences. With a wide array of options including strawberry, mango, passion fruit, and lychee, fruit flavors offer a spectrum of sweetness and tanginess to suit diverse palates. Their natural appeal aligns with the growing demand for healthier beverage choices, as fruit flavors often contain less sugar and artificial additives compared to other options. Additionally, fruit-flavored bubble teas are versatile, easily complementing various types of tea bases and toppings, making them a staple in the bubble tea industry's offerings.

Analysis by Component:

- Flavor

- Creamer

- Sweetener

- Liquid

- Tapioca Pearls

- Others

According to the report, liquid represented the largest segment. The liquid segment stands as the leading category in the bubble tea market, encompassing a diverse range of tea bases, fruit juices, and milk options. This segment's dominance is attributed to its foundational role in creating the beverage's flavor profile and consistency. Tea bases like black, green, or oolong tea provide the beverage's primary flavor, while fruit juices and milk add depth and creaminess. As consumers seek customized and flavorful options, the liquid segment continues to drive innovation and growth in the bubble tea industry.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Netherlands

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the report, Asia Pacific represents the largest regional market for bubble tea. Asia Pacific asserts dominance in bubble tea market commanding the largest share due to its cultural roots and widespread popularity. Originating in Taiwan, bubble tea has a deep-seated tradition in the region fostering a strong consumer base and thriving market ecosystems. Countries like Taiwan, China, South Korea and Japan exhibit robust demand for bubble tea driven by blend of tradition, innovation and evolving consumer preferences. Due to the rising preference of bubble tea across the region companies are opening their franchisees across the region in order to expand their consumer base. For instance, CoCo Fresh Tea & Juice plans to expand its franchise model across the Asia Pacific region following increasing demand for bubble tea in the area. The company, which currently operates over 5,000 stores globally, aims to use its successful Filipino franchise model as a template for further expansion. With strong demand observed in countries like Singapore, CoCo Fresh Tea & Juice is looking to capitalize on the growing popularity of bubble tea in the region. With a rich tapestry of flavors, textures, and experiences, Asia Pacific continues to set the pace for the global bubble tea industry's growth and expansion.

Key Regional Takeaways:

North America Keyword Market Analysis

The bubble tea market in North America is experiencing significant growth, driven by several key factors. A notable increase in consumer demand for tea and coffee-based beverages, particularly among the working population, has been observed. This trend is supported by the availability of various flavors tailored to changing consumer preferences, as well as the introduction of low-calorie and zero-fat options by innovative manufacturers. The market's growth is also driven by the growing popularity of Asian food and beverage culture, especially among younger consumers seeking customizable and authentic drink experiences. The diversification of product offerings, including innovative flavors and toppings, has enhanced consumer interest. Besides this, the expansion of specialty beverage and cafes has bolstered the market reach for bubble tea.

United States Bubble Tea Market Analysis

Growing cultural influence, changing consumer preference, and rising demand for functional beverages have propelled the business of bubble tea in the US. According to an industrial report, the drink's popularity has grown particularly among the young age group of 18-34 years old, who accounted for over 60% of sales in the United States. This trend has been significantly facilitated by Asian-Americans, who now comprise about 7% of the population, introducing and bringing local chains and family-owned businesses into the popular culture of bubble tea. Its flexibility enables a customer to select from a diverse menu of teas, flavors, tapioca pearl toppings, and sweetness levels. Other trends of consumption in order to reduce weight, in line with being healthy, encourage the selection of low-calorie and fruit-flavored bubble teas and favor sugar-free and plant-based formulations. Retail operations, such as Boba Guys, Gong Cha, and Kung Fu Tea, have expanded substantially; Kung Fu Tea has now expanded to over 300 US stores. Social media platforms play a great role in the increase in the demand for bubble tea; one can see hashtags such as #BubbleTea reaching millions of entries. Convenience and accessibility in the increased availability of RTD in retail stores boost more market growth.

Europe Bubble Tea Market Analysis

Multicultural metropolitan centers have increased in numbers; consumers are increasingly aware of Asian drinks and the healthy indulgence culture, which contribute to the expansion of the bubble tea market in Europe. The young population of this region is accepting the beverage quickly. According to the European Commission for the year 2020, some 73.6 million persons of the total population of the EU, stood at 447.3 million, between the age bracket of 15 and 29. Bubble tea shops and kiosks have sprouted everywhere in big cities: London, Paris, Berlin. Europe's demand for unique and personalized food experiences is well met by the appeal of exotic flavors such as matcha, taro, and lychee, and customizability. The vegan and plant-based movement has also influenced the market as consumers increasingly opt for oat and almond milk versions. Independent cafes are still performing well, but major chains like Bubbleology and Mooboo are expanding rapidly. More health-conscious Europeans are demanding fruit-based bubble teas and organic ingredients, which is further expanding the range of products. With its introduction at festivals and pop-up events, visibility and acceptance of bubble tea have increased, and thus growth in the region has been steady.

Asia Pacific Bubble Tea Market Analysis

Owing to drivers such as increased urbanization, innovation, and cultural appropriateness, the market remains largely led by Asia-Pacific, where the origin of bubble tea was found. Owing to exports of its tapioca pearls and tea extracts into many countries, Taiwan, where bubble tea was invented, remains at the forefront in flavor and preparation techniques. Thanks to the fast-growing Chinese middle class and their fondness for modern drinks, there are reportedly more than 50,000 tea stalls across the country selling famous brands such as Hey Tea and Nayuki. In addition, 1.5 billion cups of bubble tea are sold in Taiwan each year, as per an industry report. Other factors contributing to the rapid growth of this drink are its affordability and reach into Southeast Asia, mainly to Thailand, Malaysia, and Indonesia. With regards to regional flavors, the availability of its region flavor like gula melaka and pandan helps boost its regional appeal further. Meanwhile, with improved delivery services provided through entities like GrabFood and Foodpanda, constant demand on its supply is also kept at bay by making sure bubble tea becomes more reachable to busy streets.

Latin America Bubble Tea Market Analysis

The bubble tea business in Latin America is driven by the rising disposable incomes, the impact of Asian culture, and a growing taste for novel beverages. Nations such as Brazil and Mexico, with their huge metropolitan populations, are major contributors to the regional demand, accounting for about 70%, as per industry report. The younger generation finds the unique texture and flavor options particularly appealing. Data from the Pan American Health Organisation indicate that there are more young people than ever before in the Americas, numbering about 237 million, aged between 10 and 24 years old. The figure is estimated to decline to 230 million by 2030. Partnerships with regional ingredients, like tropical fruits, for instance, guava and passionfruit, assist the market by complying with local tastes. In addition, bubble tea is made more widely known and consumed due to the increasing number of Asian eateries and cafes.

Middle East and Africa Bubble Tea Market Analysis

The market for bubble tea in the Middle East and Africa is driven by tourism, urbanisation, and the uptake of international culinary trends. The UAE is the region leader, accounting for more than half of demand because of its vibrant café culture and diversified expatriate community. Gen Z and millennials are especially fond of bubble tea because of its uniqueness and Instagram-friendly appeal. To accommodate local tastes, the Middle Eastern flavors like rose and saffron feature in the bubble tea offers. The influx of international bubble tea firms, such as Dubai and Riyadh, has increased availability and contributed to increased growth in the industry.

Competitive Landscape:

The competitive landscape of the bubble tea market is characterized by a mix of established brands and emerging players vying for market share. Leading global chains such as Fanale Drinks, Fokus Inc, Huey-Yuhe Enterprise Co. Ltd., Kung Fu Tea, Lollicup USA Inc., Quickly Chapel Hill, Sharetea, Troika J C Inc and Kung Fu Tea compete alongside regional favorites and local tea shops. Intense competition drives innovation in flavor offerings, packaging, and customer experience, with brands constantly seeking to differentiate themselves through unique selling propositions and marketing strategies. For instance, in 2022, Kung Fu Tea launched a new app to make ordering bubble tea easier than ever. The app features a redesigned menu that allows users to customize their drinks, an order ahead option, and a loyalty program. Users can also receive product recommendations and exclusive deals. The app, created with Blue Label Labs, aims to provide a seamless user experience and is the first step in Kung Fu Tea's digital transformation. Kung Fu Tea is known for its made-to-order beverages and currently has over 300 locations in the U.S. and abroad. This dynamic environment fosters creativity and diversity, enriching the bubble tea market with a wide range of options to cater to diverse consumer preferences and tastes.

The report provides a comprehensive analysis of the competitive landscape in the bubble tea market with detailed profiles of all major companies, including:

- Boba Loca USA Inc.

- Bubble Tea Supply

- CoCo Fresh Tea & Juice

- Fanale Drinks

- Fokus Inc

- Huey-Yuhe Enterprise Co. Ltd.

- Kung Fu Tea

- Lollicup USA Inc.

- Quickly Chapel Hill

- Sharetea

- Troika J C Inc.

Latest News and Developments:

- September 2024: The well-known bubble tea company Gong Cha has entered the African market with the opening of its first location in Mauritius. The company's growth strategy is in line with this expansion, which highlights the rising demand for bubble tea around the world. Leveraging the brand's fame and reputation for premium tea goods, the new store seeks to promote Gong Cha's unique beverages to the Mauritius market.

- May 2024: In an effort to attract Gen Z customers, Starbucks has added boba-inspired drinks and bubble tea to its summer menu for 2024. This is the company's attempt to adapt to changing consumer tastes by adding trendy beverages to its range. By combining tapioca pearls, inventive flavour combinations, and Starbucks' classic offerings, the menu offers fresh variations on the bubble tea trend.

- July 2023: Kung Fu Tea and Nintendo teamed up to launch a summer partnership, celebrating the release of Pikmin 4 on the Nintendo Switch. The collaboration will introduce a new limited-time drink inspired by the beloved Pikmin characters alongside themed cups and exclusive straw caps.

- May 2023: CoCo Fresh Tea & Juice teamed up with the popular game Honkai Impact 3rd to create an immersive experience for Gen Z. This collaboration has brought themed merchandise and cosplayers dressed as game characters to CoCo stores in London and Paris, captivating fans and gamers alike. This partnership aims to enhance CoCo's brand awareness and "fun" value by bridging the gap between gaming and bubble tea, with plans to explore similar opportunities in the future.

Bubble Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Base Ingredients Covered | Black Tea, Green Tea, Oolong Tea, White Tea |

| Flavors Covered | Original Flavor, Coffee Flavor, Fruit Flavor, Chocolate Flavor, Others |

| Components Covered | Flavor, Creamer, Sweetener, Liquid, Tapioca Pearls, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boba Loca USA Inc., Bubble Tea Supply, CoCo Fresh Tea & Juice, Fanale Drinks, Fokus Inc, Huey-Yuhe Enterprise Co. Ltd., Kung Fu Tea, Lollicup USA Inc., Quickly Chapel Hill, Sharetea, Troika J C Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bubble tea market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bubble tea market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bubble tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global bubble tea market was valued at USD 2.9 Billion in 2025.

IMARC Group estimates the market to reach USD 5.1 Billion by 2034, exhibiting a CAGR of 6.06% from 2026-2034.

Rising global popularity, increase in disposable incomes and the rapid urbanization is creating a positive outlook for the market. Health-conscious consumers nowadays favor natural ingredients, while innovative flavors and attractive packaging attract younger demographics. Expanding franchises, cafe culture and social media influence also contribute significantly to the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global bubble tea market include Boba Loca USA Inc., Bubble Tea Supply, CoCo Fresh Tea & Juice, Fanale Drinks, Fokus Inc, Huey-Yuhe Enterprise Co. Ltd., Kung Fu Tea, Lollicup USA Inc., Quickly Chapel Hill, Sharetea, Troika J C Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)