Bromelain Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

Bromelain Market Size and Share:

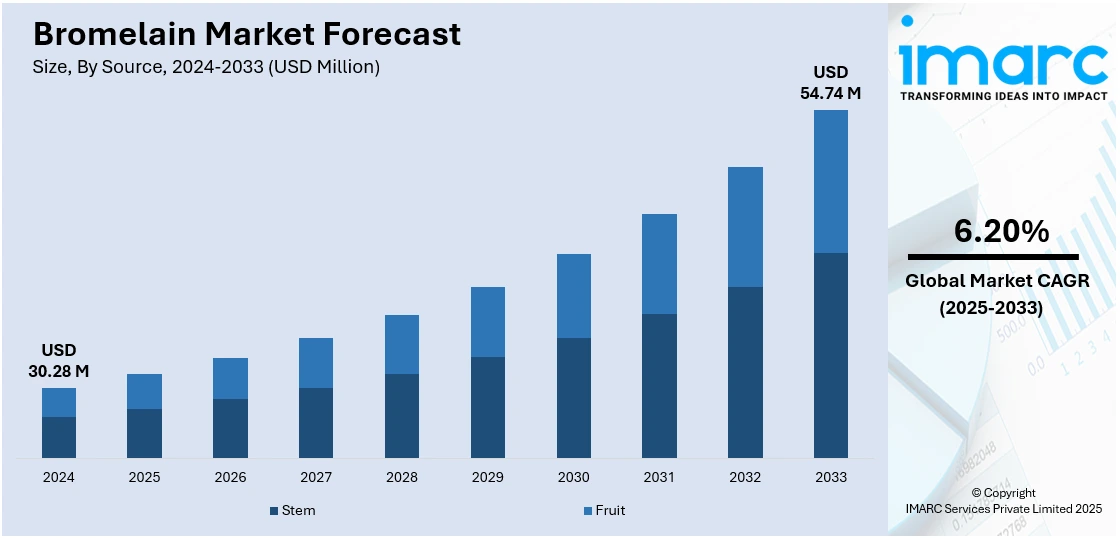

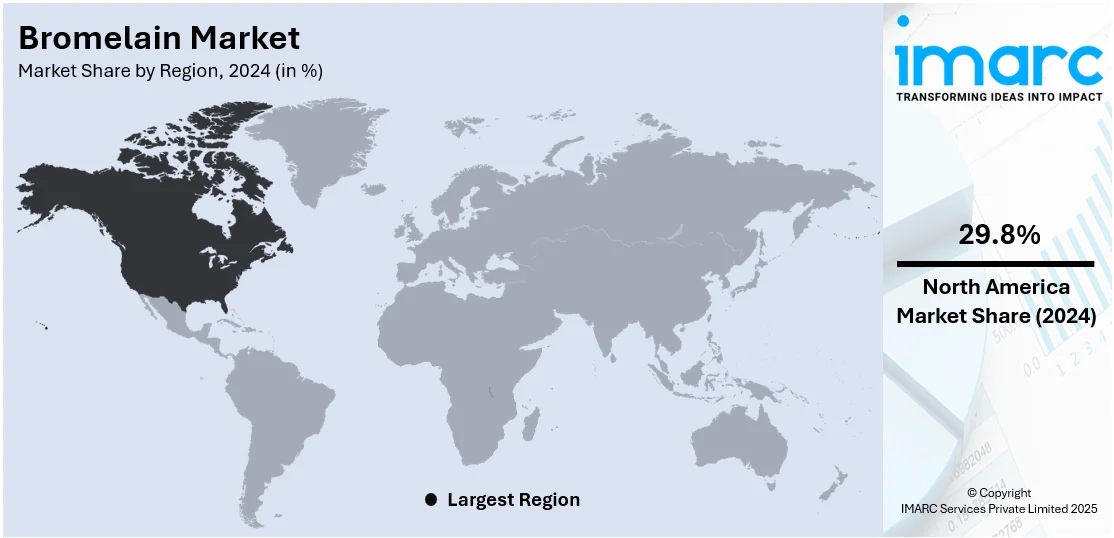

The global bromelain market size was valued at USD 30.28 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.74 Million by 2033, is expected to exhibit a CAGR of 6.20% from 2025-2033. North America currently dominates the market, holding a market share of over 29.8% in 2024. The increasing demand for natural and plant-based supplements among consumers, the increasing awareness about the anti-inflammatory and digestive health benefits of bromelain, and the growing demand for functional foods and dietary supplements drive the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.28 Million |

| Market Forecast in 2033 | USD 54.74 Million |

| Market Growth Rate (2025-2033) | 6.20% |

The global bromelain market is driven by its growing use in the health and wellness industry. Bromelain is a completely natural enzyme with properties concerning anti-inflammatory capabilities, digestion capacity, and aiding in relieving pain. Along with these various applications in different dietary supplements concerning joint health enhancement and better digestion, consumption of bromelain has come to increase market demand with enhanced consumer demand and preference for naturals over chemicals. Rising awareness about the therapeutic benefits of bromelain in treating conditions such as arthritis and sinusitis is also driving adoption. The nutraceuticals and functional foods market is expanding, with food and beverage companies increasingly using bromelain for its digestive and anti-inflammatory properties. The demand for functional foods and natural products is also driving the consumption of bromelain in developed and emerging markets. The cosmetic and pharmaceutical industries are expected to provide further growth opportunities for the market due to the potential applications of bromelain in skin care and wound healing.

The United States has emerged as a key regional market for bromelain due to increased demand for natural health products and dietary supplements. The drug has increased in popularity as more people have become concerned about health issues in a nation where such awareness is crucially important. There has been an uplift in usage due to increased awareness about plant-based and natural ingredients in wellness products. Additionally, with the rising need for bromelain in pharmaceuticals for its curative properties in the healing of wounds and its medicinal use for treating osteoarthritis, growth in the market is likely. The United States also employs many bromelains in cosmetic industry applications for the beauty care that bromelain provides to the skin. Consumer trend combined with industrial application makes the United States the leader in bromelain sales around the globe.

Bromelain Market Trends:

Increasing demand in the pharmaceutical industry

The pharmaceutical sector is the largest contributor to the market, as per the bromelain market report. The injury-recovery, anti-inflammatory, and anti-coagulant properties of bromelain are substantially fueling its utilization in numerous treatments, such as cardiovascular disorders and arthritis. According to recent industry reports, rheumatoid arthritis (RA) cases are expected to rise by 80% over the next 30 years. As of 2024, 18 Million people worldwide are afflicted with RA. This is predicted to reach 31.7 Million by 2050. In addition, this factor is enhanced further through the continued studies about the potential drug use of bromelain. The drug-making aspect enhances the effectiveness of bromelain as a natural enzyme for therapeutic use. Moreover, this product is used as a replacement for synthetic drugs, especially in holistic and natural medicines, which is highly supporting the expansion of this global market.

Rapid product adoption in the food and beverage sector

The market overview of bromelain has shown that it plays an essential role in the food processing industry since it is a natural enzyme and thus is enhancing its demand widely in the food and beverage industry. This enzyme is essentially used as a supplement additive to dietary products and drinks primarily based on its capacity to hydrolyze protein; it is further used in tenderizers of meats. The researchers at the National Institutes of Health concluded in an article published in March 2023 that proteases account for a majority of 60% of enzymes used commercially to process food in the food business, including in bromelain. In addition, bromelain is considered one of the most widely used plant-based proteases for meat tenderization. Furthermore, with increasing customer preference for naturally derived ingredients in food products, bromelain is rapidly emerging as an ideal choice among producers seeking to provide clean-label beverages and food products. Moreover, this trend is expected to further fuel market growth due to escalating customer awareness regarding the benefits of enzyme-based foods.

Expanding Product Use in the Cosmetic Industry

The cosmetics industry makes extensive use of bromelain for its restorative and scrubbing action for the skin. With the market trend of increased demand for non-irritant and natural product ingredients in personal care products, bromelain is gaining strong traction in cosmetics formulations that could help ease anti-inflammatory action and gentle scrubbing. The IMARC Group in its research report states that the global skin care products market has reached USD 166.35 Billion in 2024. According to a research article published in Nutrients in June 2024, bromelain can efficiently be used as an exfoliant in cosmetic products. It can be used softly for removing dead skin cells by its proteolytic activity and improves the texture of the skin or makes the exfoliation process smooth, thereby facilitating the renewal process. Also, it is widely adopted as a gentler, natural alternative to chemical or physical exfoliants. Moreover, bromelain is emerging as an integral ingredient in anti-aging creams, facial masks, and face cleansers. In addition, manufacturers are currently emphasizing effective, natural, clean formulations to address the evolving demands of consumers, which is ultimately contributing to an optimistic bromelain market outlook.

Bromelain Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bromelain market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on source and application.

Analysis by Source:

- Stem

- Fruit

Stem-derived bromelain holds the majority of the bromelain market share as it contains a sufficient level of enzyme concentration in pineapple stems, thus making this the most economical extraction method. A research article published in the journal Foods in February 2024 shows that bromelain powder extracted from basal stem contains the highest level of enzymatic activity of 717 CDU/mg casein digesting units and 2909 GDU/g gelatin digesting units. In addition, the commercially sold bromelain and bromelain-based products are mainly derived from the stems. Furthermore, the high availability of stems as a by-product of pineapple processing enhances its commercial viability. Further, bromelain extracted from the stem is in greater demand across important industries, primarily food processing and pharmaceuticals, where its high purity as well as potency is essential for various uses.

Analysis by Application:

- Healthcare

- Food and Beverages

- Cosmetics

- Others

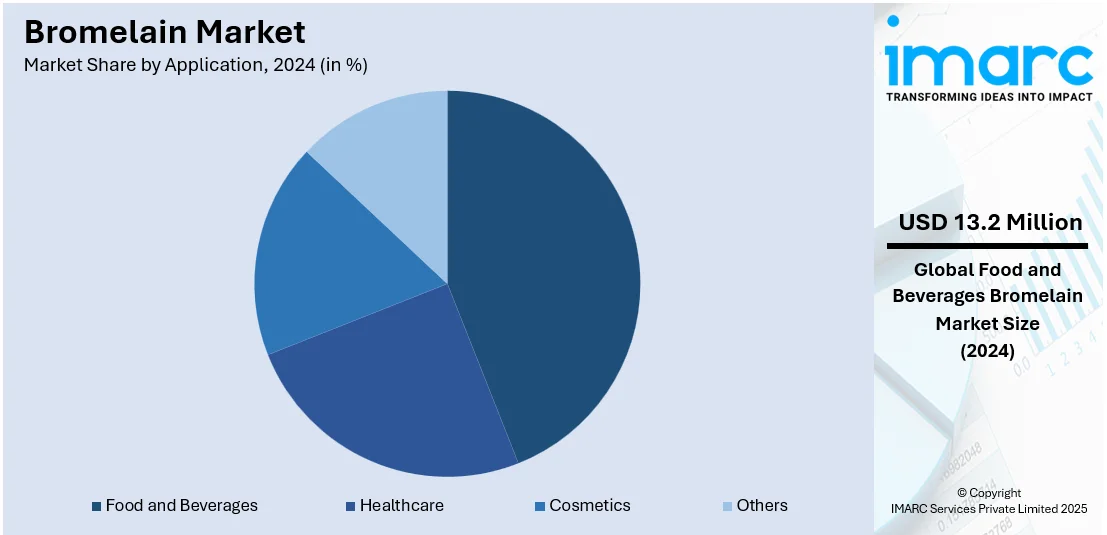

The food and beverages industry has been the leading application segment with a share of 43.6%. It is usually used in food processing, especially as a natural digestive booster and meat tenderizer, which in turn drives its demand. Furthermore, the enzyme is widely used in dietary supplements and beverages primarily due to its health benefits. Moreover, with increasing customer demands for functional and natural ingredients, its applications become stronger in this industry, thus positioning food and beverages as an essential driver in market growth. According to recent reports, natural food sales went up by 4.8% in 2023 at USD 209 Billion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America has become the most significant regional market accounting for 29.8% due to the rise in demand from large-scale industries in cosmetics, food, and pharmaceuticals. The rising adoption of enzyme-based and natural products, coupled with the sophisticated food processing and healthcare industry in North America, is greatly driving the product demand. Also, the continuous research and regulatory certifications of the therapeutic profile of Bromelain enhance its market presence. In addition, the increased propensity for clean-label food products and natural ingredient-based supplements enhances bromelain's use. Moreover, the increasing number of joint disorders, such as arthritis, in the region is also fueling the demand for bromelain since it is used effectively in the treatment of numerous cardiovascular as well as joint diseases. It is reported that by the year 2040, an estimated 78 Million adults in the United States will be suffering from arthritis.

The Asia Pacific market for bromelain is growing due to the increasing demand for natural and herbal remedies in countries like India, China, and Japan. The awareness about the health benefits of bromelain, including anti-inflammatory and digestive properties, has increased its demand in the dietary supplement, food, and pharmaceutical sectors. Besides this, a high-quality agricultural base prevails in this region, particularly in the tropics, with ample pineapples. Hence, local manufacturing increases demand.

Increasing demands in European regions for more natural and herbal-based products are associated with the food, pharmaceutical, and cosmetic sectors. Nowadays, more customers prefer to buy products with bromelain supplements, as most consumers opt for herbal-based items instead of synthetically manufactured medication and ointments to curb inflammation and alleviate pain. Strict regulations in Europe are assuring the quality and safety of bromelain-based products, hence the ingredient has been adopted widely in the wellness sector. Also, clean-label products are in vogue in the food and beverage industry which is boosting the market growth.

Latin America is experiencing a growing demand for bromelain-based products as its tropical climate facilitates the growth of pineapples. Growing demand for natural health supplements and functional foods is boosting demand for bromelain in Brazil and Mexico, among other countries. As knowledge about the value of bromelain for digestive health and for the control of inflammation continues to grow, pharmaceutical and nutraceutical markets expand. Interest in alternative medicine and herbal treatments throughout the region supports market growth.

The expanding demand for bromelain market in the Middle East and Africa is driven by consumers' demands for natural, herbal ingredients for health and wellness. Increasing pharmaceutical formulations of bromelain with pain relief and inflammation are expanding its growth further. Health consciousness in South Africa and the UAE, along with a shift to plant-based diets, is stimulating demand for bromelain supplements and functional foods. In addition, a local supply of pineapples in the tropical regions contributes to the growing markets in those places.

Key Regional Takeaways:

United States Bromelain Market Analysis

In 2024, the United States accounts for 91.10% of bromelain market in North America due to several key factors, reflecting the increasing demand for natural and plant-based products across various industries. One of the prominent growth factors that propel the growth of the market is consumer affinity for natural, organic ingredients. Increasing health and wellness among health-conscious individuals requires the consumption of synthetic-free alternatives. A key trend where the anti-inflammatory, digestive, and therapeutic application of bromelain as an organic enzyme could create an attraction toward the element, which significantly reflects in dietary supplements with improvements in digestion and the reduction in inflammation to have an overall gain in health status. In addition, increasing demand from the F&B sector for bromelain as a natural meat tenderizer in food products and as a clarifying agent in the beverage industry also exhibits a positive market perspective. Food manufacturers include bromelain to satisfy the demand for clean labels. The cosmetic industry also utilizes bromelain due to its exfoliating and skin-soothing properties, which are becoming increasingly popular for use as plant-based skincare solutions. In addition to this, the pharmaceutical industry is also one of the factors contributing to the market's growth. Bromelain is used in the treatment of conditions like sinusitis, arthritis, and wound healing. According to the research report, United States pharmaceutical industry was around USD 574.37 Billion in 2023. This strong figure places the U.S. at the top of the global pharmaceutical map, accounting for about 45% of global pharmaceutical sales. Due to its anti-inflammatory and proteolytic action, bromelain has become one of the potential active ingredients for use in medicines.

Europe Bromelain Market Analysis

Europe's bromelain market is driven by the growing consumer awareness about natural and plant-based ingredients. Bromelain is increasingly in demand due to its various benefits and as it aligns with the trends of sustainability and health. This is attributed to the trend of increasing demand for dietary supplements among Europeans amid growing health consciousness and the elderly population. According to the reports, the EU population was estimated at 448.8 Million people and more than one-fifth (21.3 %) of it was aged 65 years and over on 1 January 2023. Bromelain is widely recognized for its digestive, anti-inflammatory, and immune-boosting properties, making it a favored ingredient in supplements promoting holistic wellness. In addition, in the F&B industry, bromelain is used as a natural tenderizer in meat processing and as a clarifying agent in beverages such as juices and wines. The clean-label trend and natural additives in the European market are supporting the adoption of bromelain, as consumers are increasingly demanding transparency in food production. In the pharmaceutical industry, bromelain is valued for its therapeutic properties, including anti-inflammatory and wound-healing properties. Its application in treating conditions such as sinusitis, arthritis, and post-surgery inflammation drives demand, mainly as natural and complementary medicine. Furthermore, a strict regulatory environment within Europe promotes safe and natural ingredients, making bromelain an appropriate and sustainable option.

Asia Pacific Bromelain Market Analysis

The Asia Pacific bromelain market is witnessing a fast pace of growth, mainly attributed to changing consumer trends, growth in industrial use, and other regional benefits that facilitate easy raw material availability. A major driving factor in the region is the higher demand for natural and organic products due to improved health consciousness from the consumer's side. Bromelain is catching attention in dietary supplements where it finds use for enhancing digestion, an anti-inflammatory component, and helps build immunity levels. Growing consciousness of individuals for health and well-being trends, specifically in countries such as China, India, and Japan, offers a positive outlook in the market. According to the research report of the IMARC Group, the Indian health and wellness market is expected to exhibit a CAGR of 5% during 2024-2032. The F&B sector also plays a pivotal role in the market's expansion. Bromelain is used as a meat tenderizer, a protein-digesting enzyme, and a clarifying agent in beverages. Being driven by the rapid development of the food processing industry as well as demand for clean label products, there is more and more added bromelain content in formulations toward meeting consumer desires for natural ingredient content. It also has support from a substantial agricultural base from which pineapple crop is produced in Thailand, the Philippines, or even India, offering a stable feedstock supply base. This cost advantage, coupled with the continued innovations in extraction technologies, makes Asia Pacific a leader in the global bromelain market.

Latin America Bromelain Market Analysis

The Latin American market for bromelain is driven by the region's large production of pineapples, growing awareness about natural and plant-based products, and expanding applications across various industries, including F&B, pharmaceuticals, and cosmetics. Availability of raw materials is one of the major drivers. Countries like Costa Rica, Brazil, and Mexico are major producers of pineapples in Latin America. This ensures a steady and cost-effective supply of bromelain, making the region a significant contributor to the global market. The growing health and wellness trend in Latin America is another key factor. As consumers increasingly prioritize natural and functional products, bromelain is widely used in dietary supplements for its digestive, anti-inflammatory, and immune-boosting properties. Moreover, the thriving pharmaceutical sector in Brazil is supporting the bromelain market growth. As per a research report, the Brazilian Drug Market Regulation System or CMED has published a report wherein the pharmaceutical market of the country had touched the peak at a turnover of approximately USD 28.49 Billion. Given its perceived therapeutic values, like reducing inflammation, helping in wound healing, and other applications like sinusitis, and arthritis, Bromelain stands valued.

Middle East and Africa Bromelain Market Analysis

The bromelain market in the Middle East and Africa is driven by a rising awareness level among consumers to purchase natural products, increasing demand for functional food items, and changes in healthcare and cosmetics in the region. Another key driver for the market of bromelain in MEA is a rising demand from people for dietary supplements that are natural, and plant based. The increasing focus on preventive healthcare by countries like the UAE, Saudi Arabia, and South Africa also further supports the adoption of bromelain in the nutraceutical sector. On top of this, through ongoing R&D activities and partnerships for local sourcing of pineapples in African countries, the region's production capabilities are being improved. Apart from these, the rapidly increasing adoption of bromelain in the cosmetic and personal care industry for its exfoliation and skin-renovation properties helps the market grow even further. Saudi Arabia's cosmetics industry, according to the IMARC Group, crossed USD 3.9 Bn in the year 2024.

Competitive Landscape:

Market players are expanding their market portfolios and providing quality products while responding to booming consumer demand across the globe for bromelain. The more significant players active in this scenario include Enzybel, Food Chem International Corporation, and Karagen, focusing on sourcing some of the finer bromelains from pineapple extract while ensuring preserved natural properties from the extracts in the process. Many companies are also using more advanced extraction technologies, including enzyme-assisted processes, to make bromelain production more efficient and of greater yield. Furthermore, market players are focusing on R&D to bring new formulations such as bromelain-based dietary supplements, cosmetics, and functional foods into the market. The latter is fast gaining popularity as it provides a range of health benefits including anti-inflammatory, digestive, and skin health. The distribution networks are expanding and finding emergent markets within the Asian-Pacific and Latin America region where there is increasing demand for natural health products. Strategical mergers and acquisitions coupled with other collaboration agreements also continue among leaders, adding value through better market access and portfolio addition of product varieties.

The report provides a comprehensive analysis of the competitive landscape in the bromelain market with detailed profiles of all major companies, including:

- Advanced Enzyme Technologies Limited

- Bio-gen Extracts Private Limited.

- Changsha Natureway Co. Ltd.

- Creative Enzymes

- Enzybel International (Floridienne S.A.)

- Enzyme Development Corporation

- Enzyme Technologies (PTY) Ltd.

- Guangxi Nanning Javely Biological Products Co. Ltd.

- Hong Mao Biochemicals Co. Ltd.

- Mitushi Biopharma

- Xena Bio Herbals Pvt. Ltd.

Latest News and Developments:

- February 2024: Bharat Serums and Vaccines (BSV), an India-based biopharmaceutical company, announced an exclusive distribution deal with MediWound to market NexoBrid, a revolutionary treatment for severe burns, in the Indian subcontinent. Nexobrid (concentrate of proteolytic enzymes enriched in bromelain) is a locally applied biological product that by enzymatic action removes non-viable burn tissue or eschar in patients with deep partial and full-thickness thermal burns as soon as four hours after administration with no harm to the viable tissue.

- April 2024: AstroZhi launched revolutionary nutraceuticals for the treatment of long-term COVID-19 syndrome in the Irish, UK, and European markets. The company includes strong constituents such as Nattokinase, Bromelain, and Curcumin. These nutrients, with leading medical professionals deemed necessary to counteract the spike protein's influence.

Bromelain Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Stem, Fruit |

| Applications Covered | Healthcare, Food and Beverages, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Enzyme Technologies Limited, Bio-gen Extracts Private Limited., Changsha Natureway Co. Ltd., Creative Enzymes, Enzybel International (Floridienne S.A.), Enzyme Development Corporation, Enzyme Technologies (PTY) Ltd., Guangxi Nanning Javely Biological Products Co. Ltd., Hong Mao Biochemicals Co. Ltd., Mitushi Biopharma, Xena Bio Herbals Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bromelain market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bromelain market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bromelain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bromelain market was valued at USD 30.28 Million in 2024.

The bromelain market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 54.74 Million by 2033.

The increasing demand for natural and plant-based supplements among consumers, the rising awareness about the anti-inflammatory and digestive health benefits of bromelain, and the growing demand for functional foods and dietary supplements are some of the factors driving the market for bromelain.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global bromelain market include Advanced Enzyme Technologies Limited, Bio-gen Extracts Private Limited., Changsha Natureway Co. Ltd., Creative Enzymes, Enzybel International (Floridienne S.A.), Enzyme Development Corporation, Enzyme Technologies (PTY) Ltd., Guangxi Nanning Javely Biological Products Co. Ltd., Hong Mao Biochemicals Co. Ltd., Mitushi Biopharma, Xena Bio Herbals Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)